Calsavers Employee Template

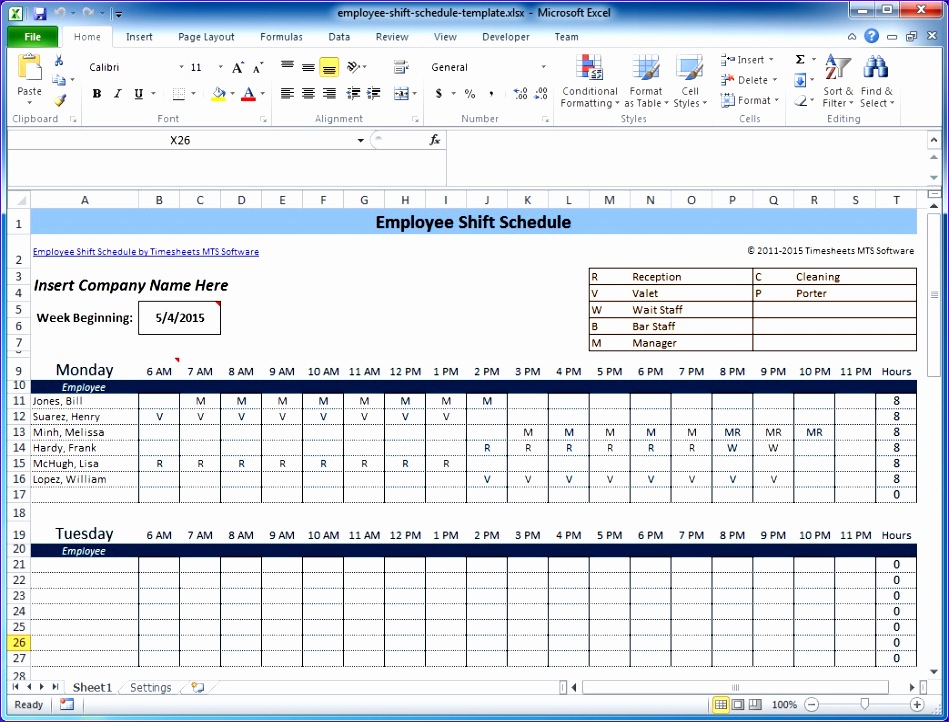

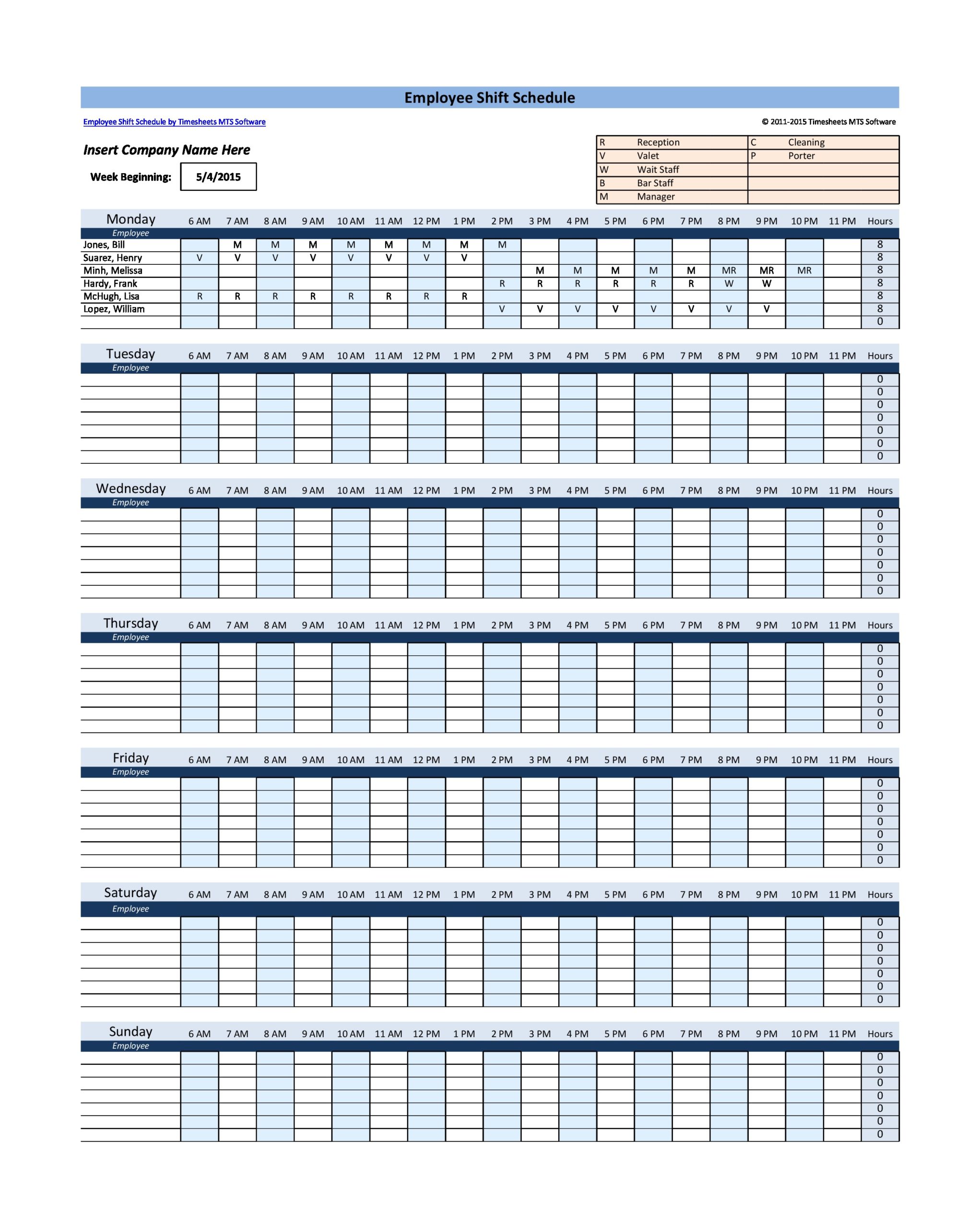

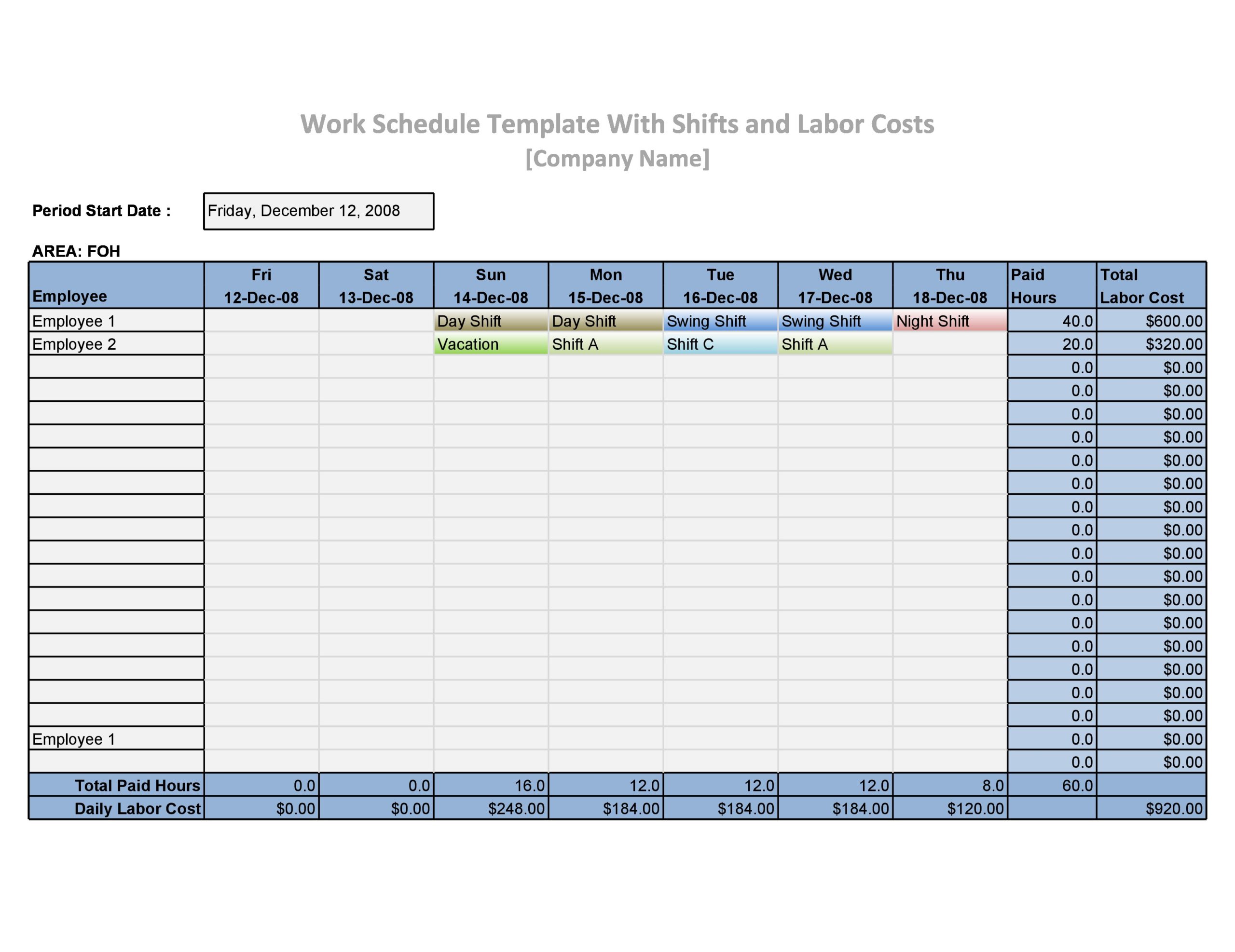

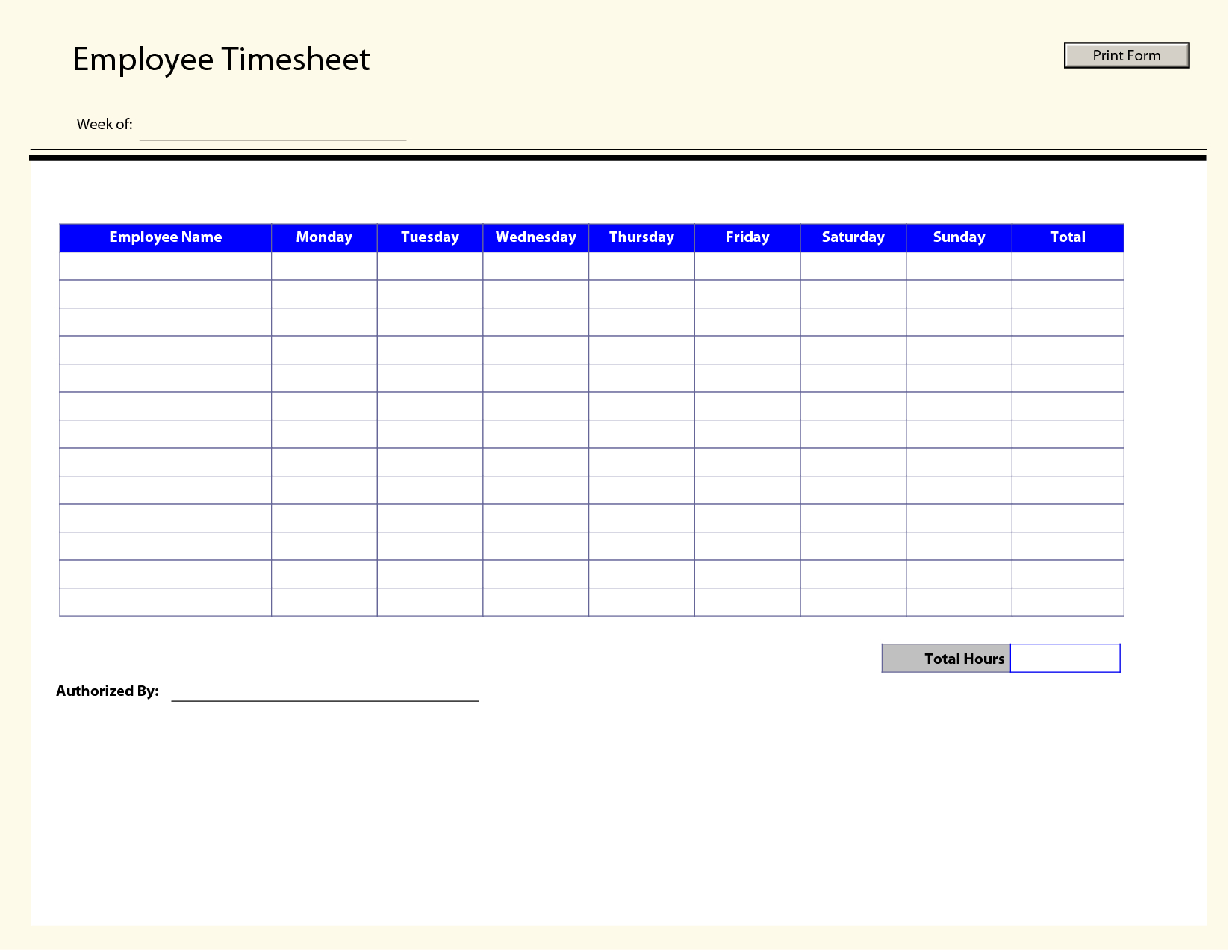

Calsavers Employee Template - Download template what comes next? Web upload your employee information manually (if you only have a few employees) or use our employee information template (if you have many. Use this template communication to inform your employees that your company is facilitating calsavers. Web state law requires eligible employers that do not offer an employer sponsored retirement plan and have at least five employees to register for calsavers and make the program. Web designed to be simple for employees and easy for employers, calsavers is professionally managed by private sector financial firms with oversight from a public board chaired by. You will continue to send employee contributions each pay period. Web employee information template (ms excel file) sending contributions contribution template (ms excel file) provider ftp access payroll providers who use ftp. Web calsavers is california’s retirement savings program for workers who do not have a way to save for retirement at work. Web communication to your employeesyou may use this template communication to inform your employees that your company is facilitating calsavers. Web 7.5 million californians lack a workplace retirement plan.2 15x workers are 15 times more likely to save for retirement if they have access to a payroll deduction savings plan at. Download template what comes next? Social security number (ssn) or individual taxpayer identification number (itin) 2. Create an employee (payroll) list the employee (payroll) list includes all the employees who are eligible to participate in the program. Be allowed to make an employer contribution. Web use this template communication to inform your employees that your company is facilitating calsavers. With calsavers, millions of california workers have the. There are two ways for employees to join: Web your employer is facilitating calsavers, a retirement savings program established by the state of california to make it easier for employees to save for retirement. You can let the standard account options kick in or personalize your account. Be allowed to make an. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web calsavers is california’s retirement savings program for workers who do not have a way to save for retirement at work. Web ensure calsavers works for a dynamic, mobile workforce, savers can keep their account as they move from job to job.. Create an employee (payroll) list the employee (payroll) list includes all the employees who are eligible to participate in the program. Web ensure calsavers works for a dynamic, mobile workforce, savers can keep their account as they move from job to job. Web employee information template (ms excel file) sending contributions contribution template (ms excel file) provider ftp access payroll. Submit employee contributions each pay period incur any program fees. Create an employee (payroll) list the employee (payroll) list includes all the employees who are eligible to participate in the program. You will continue to send employee contributions each pay period. • offer a retirement plan of employers’ choice or • provide access to calsavers for employees 2) automatic. There. Web ensure calsavers works for a dynamic, mobile workforce, savers can keep their account as they move from job to job. Web use this template communication to inform your employees that your company is facilitating calsavers. Web in 2022, california passed legislation to expand the calsavers mandate to employers with at least one employee. There are two ways for employees. Web with the first pay date that occurs 30 days after you upload your employee information, you will need to send your first contributions for participating employees. Web use this template communication to inform your employees that your company is facilitating calsavers. Social security number (ssn) or individual taxpayer identification number (itin) 2. Web upload your employee information manually (if. Web your employer is facilitating calsavers, a retirement savings program established by the state of california to make it easier for employees to save for retirement. Web 7.5 million californians lack a workplace retirement plan.2 15x workers are 15 times more likely to save for retirement if they have access to a payroll deduction savings plan at. Web use this. Web calsavers retirement savings program. Web saving for your future contributions to your account will be made automatically from each paycheck. Social security number (ssn) or individual taxpayer identification number (itin) 2. Download template what comes next? Web upload your employee information manually (if you only have a few employees) or use our employee information template (if you have many. Use this template communication to inform your employees that your company is facilitating calsavers. Web 7.5 million californians lack a workplace retirement plan.2 15x workers are 15 times more likely to save for retirement if they have access to a payroll deduction savings plan at. Submit employee contributions each pay period incur any program fees. Web in 2022, california passed. Web communication to your employees. • offer a retirement plan of employers’ choice or • provide access to calsavers for employees 2) automatic. Web employee information template (ms excel file) sending contributions contribution template (ms excel file) provider ftp access payroll providers who use ftp. Web in 2022, california passed legislation to expand the calsavers mandate to employers with at least one employee. Web use this template communication to inform your employees that your company is facilitating calsavers. Web with the first pay date that occurs 30 days after you upload your employee information, you will need to send your first contributions for participating employees. Download template what comes next? Most employers create one list. Web use this template to upload your employee contribution amounts. Web in 2022, california passed legislation to expand the calsavers mandate to employers with at least one employee. Web saving for your future contributions to your account will be made automatically from each paycheck. Be allowed to make an employer contribution. Web 7.5 million californians lack a workplace retirement plan.2 15x workers are 15 times more likely to save for retirement if they have access to a payroll deduction savings plan at. You can let the standard account options kick in or personalize your account. With calsavers, enrollment is easy, investing is simple, and. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. There are two ways for employees to join: Web ensure calsavers works for a dynamic, mobile workforce, savers can keep their account as they move from job to job. Web communication to your employeesyou may use this template communication to inform your employees that your company is facilitating calsavers. With calsavers, millions of california workers have the. Web communication to your employeesyou may use this template communication to inform your employees that your company is facilitating calsavers. Web designed to be simple for employees and easy for employers, calsavers is professionally managed by private sector financial firms with oversight from a public board chaired by. Web your employer is facilitating calsavers, a retirement savings program established by the state of california to make it easier for employees to save for retirement. Create an employee (payroll) list the employee (payroll) list includes all the employees who are eligible to participate in the program. Web saving for your future contributions to your account will be made automatically from each paycheck. Web in 2022, california passed legislation to expand the calsavers mandate to employers with at least one employee. Web ensure calsavers works for a dynamic, mobile workforce, savers can keep their account as they move from job to job. There are two ways for employees to join: Web use this template to upload your employee contribution amounts. Web 7.5 million californians lack a workplace retirement plan.2 15x workers are 15 times more likely to save for retirement if they have access to a payroll deduction savings plan at. Eligible employees must be employed in the state of california, be age 18 or older, and have a valid social security number or an individual taxpayer identification number. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web employee information template (ms excel file) sending contributions contribution template (ms excel file) provider ftp access payroll providers who use ftp. With calsavers, enrollment is easy, investing is simple, and. Web communication to your employees. Most employers create one list.Employee Sheet Templates at

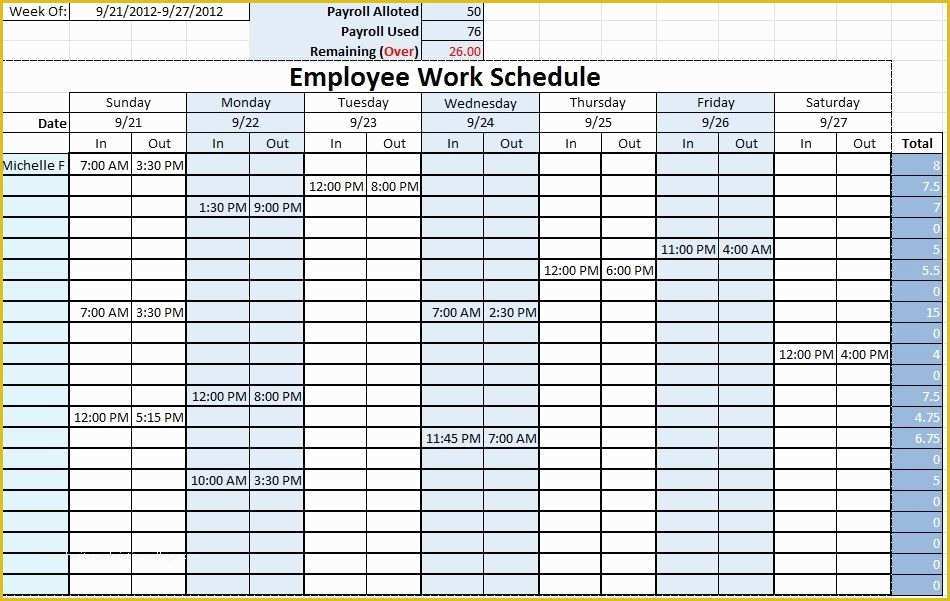

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

Employee Sheet Templates 14+ Free Word, PDF & Excel Format Download

Excel Employee Work Schedule Template SampleTemplatess SampleTemplatess

Employee Work Schedule Template Pdf Pin Employee Weekly Work Schedule

Employee Work Schedule Template Pdf / Free Work Schedule Templates For

Employee Track CalendarFree Printable Example Calendar Printable

Employee Schedule Template Free Download Of Work Schedule Templates

Pay Stub Calculator Templates 13+ Free Docs, Xlsx & PDF Spreadsheet

Web Use This Template Communication To Inform Your Employees That Your Company Is Facilitating Calsavers.

Web All Ca Employers With 5 Or More Employees Must Either:

Web In 2022, California Passed Legislation To Expand The Calsavers Mandate To Employers With At Least One Employee.

Use This Template Communication To Inform Your Employees That Your Company Is Facilitating Calsavers.

Related Post: