Zero Budget Template

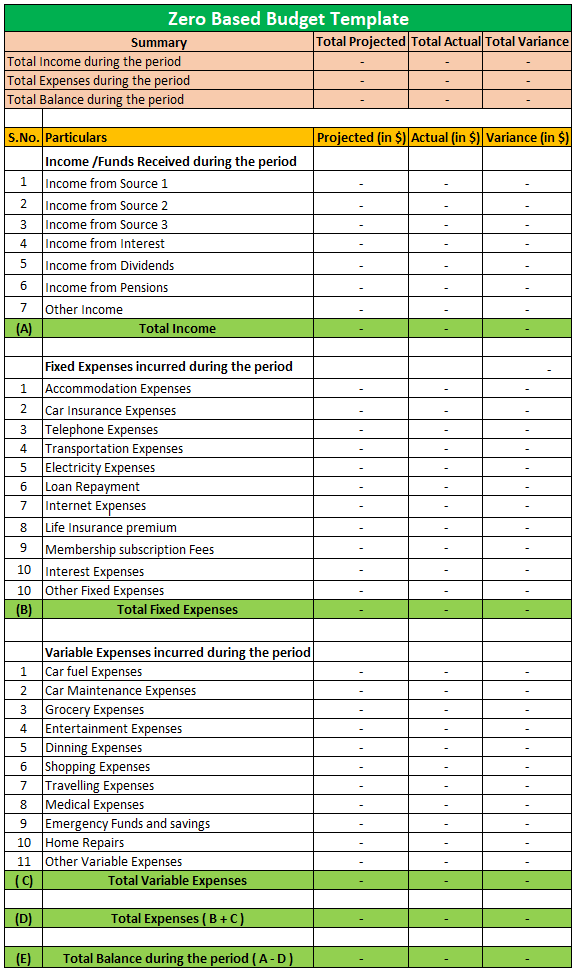

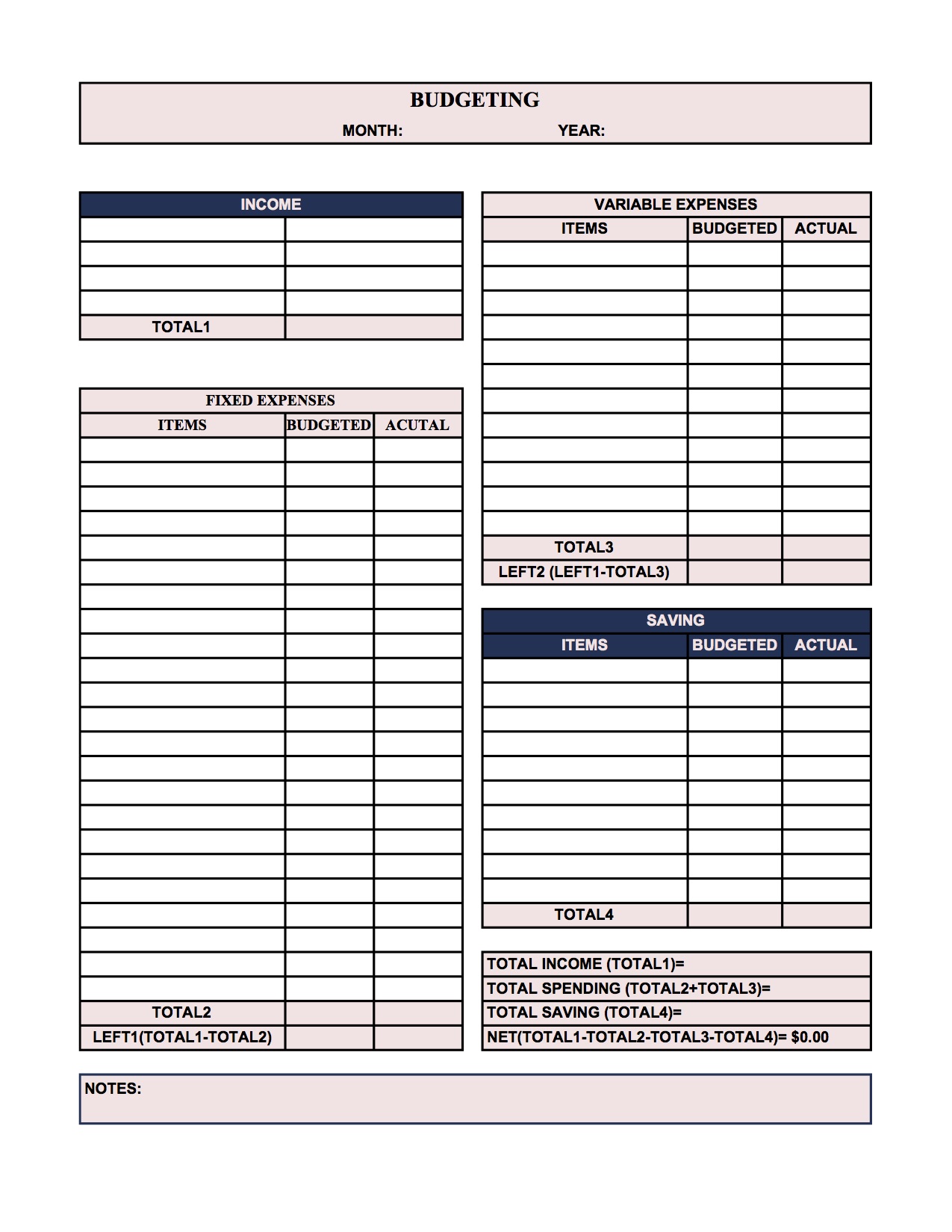

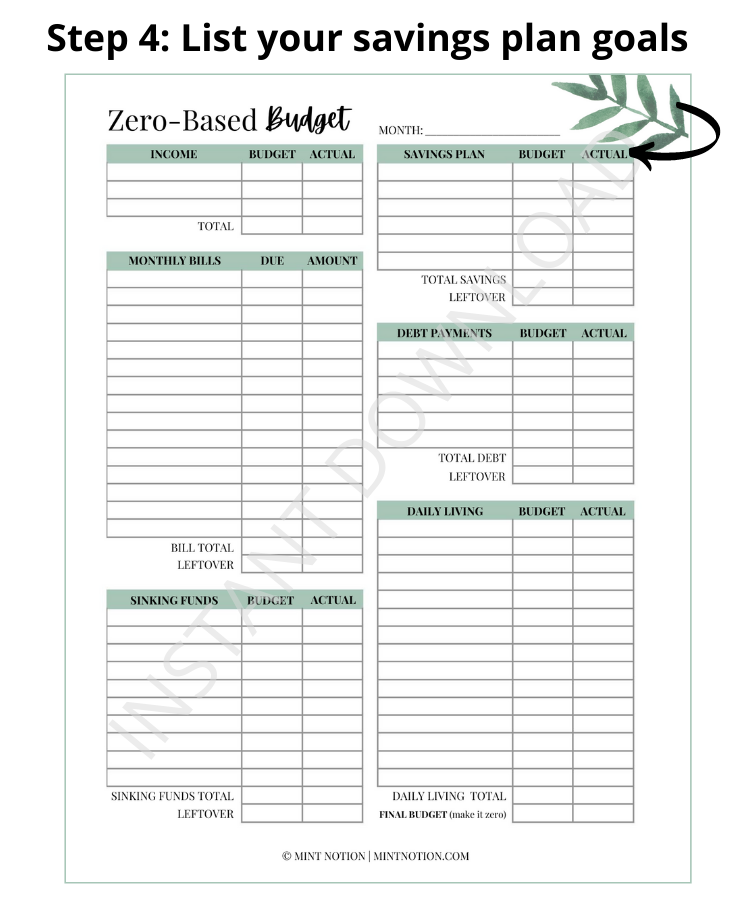

Zero Budget Template - (yes, you are.) steps for using your budget template a budget template (or budget worksheet) is a great way to get everything on paper, right there in front of your eyes. Download allocated spending plan give every dollar a name. Web view larger image. Then, go through the set expenses, debt and adjustable expenses for the month. We’ve got three steps to set up that budget and two more to keep it going—each and every month. Web download consumer equity sheet what's your net worth? Use this form to break down each paycheck and tell your money where to go. Web the total income and the total balances out to zero. This is usually a last resort and is never considered an option in normal situations. By taking a closer look at your budget, you can gain better control over your finances. Use this form to break down each paycheck and tell your money where to go. Begin entering your information in the income area of the template. Google sheets pennies to wealth tiller money (this is the only option that isn't free, but it's also the only automated template that imports. You might like the 50/20/30 method. It is a saving. Every dollar that comes in has a purpose, a job, a goal. Some of your income will be going into savings, some will be going towards expenses, some might. But its popularity remains high because it works! Web download consumer equity sheet what's your net worth? At the end of the worksheet, if your budget is fully balanced, you should. Identify your goals is your primary goal to pay off debt? Begin entering your information in the income area of the template. You might like the 50/20/30 method. Download lump sum payment form Download allocated spending plan give every dollar a name. So, if you make $3,000 a month, everything you give, save or spend should add up to $3,000. Web view larger image. Every dollar that comes in has a purpose, a job, a goal. Some of your income will be going into savings, some will be going towards expenses, some might. Grab the free printable zero based budget free printable. Keep in mind, you might need a. Download lump sum payment form You can update your income in the spreadsheet as your circumstances change. Find out with this form by determining how much you owe versus how much value each asset has. To get started, you can grab my monthly budget template here. To get started, you can grab my monthly budget template here. Find out with this form by determining how much you owe versus how much value each asset has. This is usually a last resort and is never considered an option in normal situations. At the end of the worksheet, if your budget is fully balanced, you should have zero. Grab the free printable zero based budget free printable from the button below. Find out with this form by determining how much you owe versus how much value each asset has. Web this detailed template offers a summary of your income, expenses, and savings goals (both in aggregate and by month) on one sheet with a detailed monthly breakdown by. Download lump sum payment form Some of your income will be going into savings, some will be going towards expenses, some might. Additionally, we’ve provided details on how to choose the right budget for your use case, and steps on how to create one. It is a saving and spending plan where you assign every dollar of your income to. So, if you make $3,000 a month, everything you give, save or spend should add up to $3,000. Your income minus your expenditures should equal zero. Download allocated spending plan give every dollar a name. But its popularity remains high because it works! Every dollar that comes in has a purpose, a job, a goal. Keep in mind, you might need a. Web download consumer equity sheet what's your net worth? Web this detailed template offers a summary of your income, expenses, and savings goals (both in aggregate and by month) on one sheet with a detailed monthly breakdown by category on another. Grab the free printable zero based budget free printable from the button. You can update your income in the spreadsheet as your circumstances change. Web download consumer equity sheet what's your net worth? The idea is that you create a budget, input your total income for the month, and then assign those dollars a. Every dollar that comes in has a purpose, a job, a goal. (yes, you are.) steps for using your budget template a budget template (or budget worksheet) is a great way to get everything on paper, right there in front of your eyes. You might like the 50/20/30 method. Keep in mind, you might need a. Find out with this form by determining how much you owe versus how much value each asset has. It’s simple to get started. But its popularity remains high because it works! Your income minus your expenditures should equal zero. “paycheck income”, “paycheck expenses”, and a “track your purchases here” section. Web when you use a zero based budgeting template, the basic formula is: We'll be using $4,000 for illustrative purposes. It is a saving and spending plan where you assign every dollar of your income to some specific purpose. Identify your goals is your primary goal to pay off debt? Additionally, we’ve provided details on how to choose the right budget for your use case, and steps on how to create one. Download lump sum payment form This is usually a last resort and is never considered an option in normal situations. Download personal budget excel | smartsheet. We’ve got three steps to set up that budget and two more to keep it going—each and every month. At the end of the worksheet, if your budget is fully balanced, you should have zero budget left over. Download personal budget excel | smartsheet. Web download consumer equity sheet what's your net worth? This is usually a last resort and is never considered an option in normal situations. Web the total income and the total balances out to zero. You might like the 50/20/30 method. Web when you use a zero based budgeting template, the basic formula is: Web this detailed template offers a summary of your income, expenses, and savings goals (both in aggregate and by month) on one sheet with a detailed monthly breakdown by category on another. Pro tip looking to pay off your debt faster? You can update your income in the spreadsheet as your circumstances change. For this, firstly, all the sources of income are identified and. The idea is that you create a budget, input your total income for the month, and then assign those dollars a. Additionally, we’ve provided details on how to choose the right budget for your use case, and steps on how to create one. Do you have a stable income and are just trying to organize your finances? Or maybe you’d like to be able to see your entire year in one sheet.How To Make A ZeroBased Budget Budgeting, Free budget printables

Zero Based Budget Template Free Download (Excel, PDF, CSV, ODS)

How To Make A ZeroBased Budget in 2021 Simple budget template

ZeroBased Budget Template Dave Ramsey Inspired Budgeting Method

How To Make A ZeroBased Budget in 2021 Budget planner template

Zero Based Budget Editable PDF Printable Your Frugal Friend Budgeting

Zero Based Budget Monthly Budget Template Detailed Budget Etsy

ZeroBased Budget Printable Paycheck to Paycheck Budget Etsy in 2021

How To Make A ZeroBased Budget Mint Notion

12 Free Budget Templates That'll Help You Save Without Stress

Web View Larger Image.

It’s Simple To Get Started.

Keep In Mind, You Might Need A.

We'll Be Using $4,000 For Illustrative Purposes.

Related Post: