Yearly Payroll Report Template

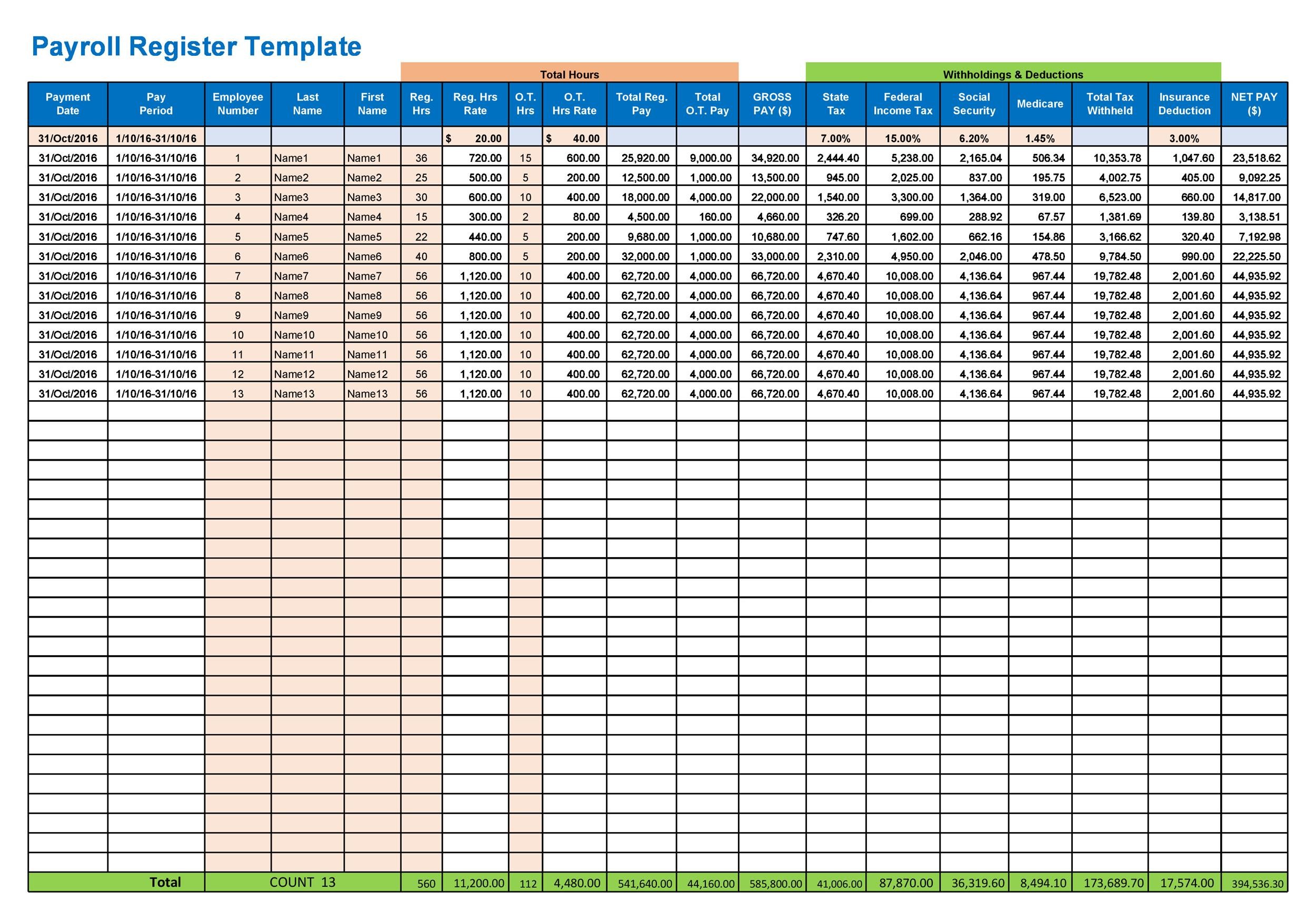

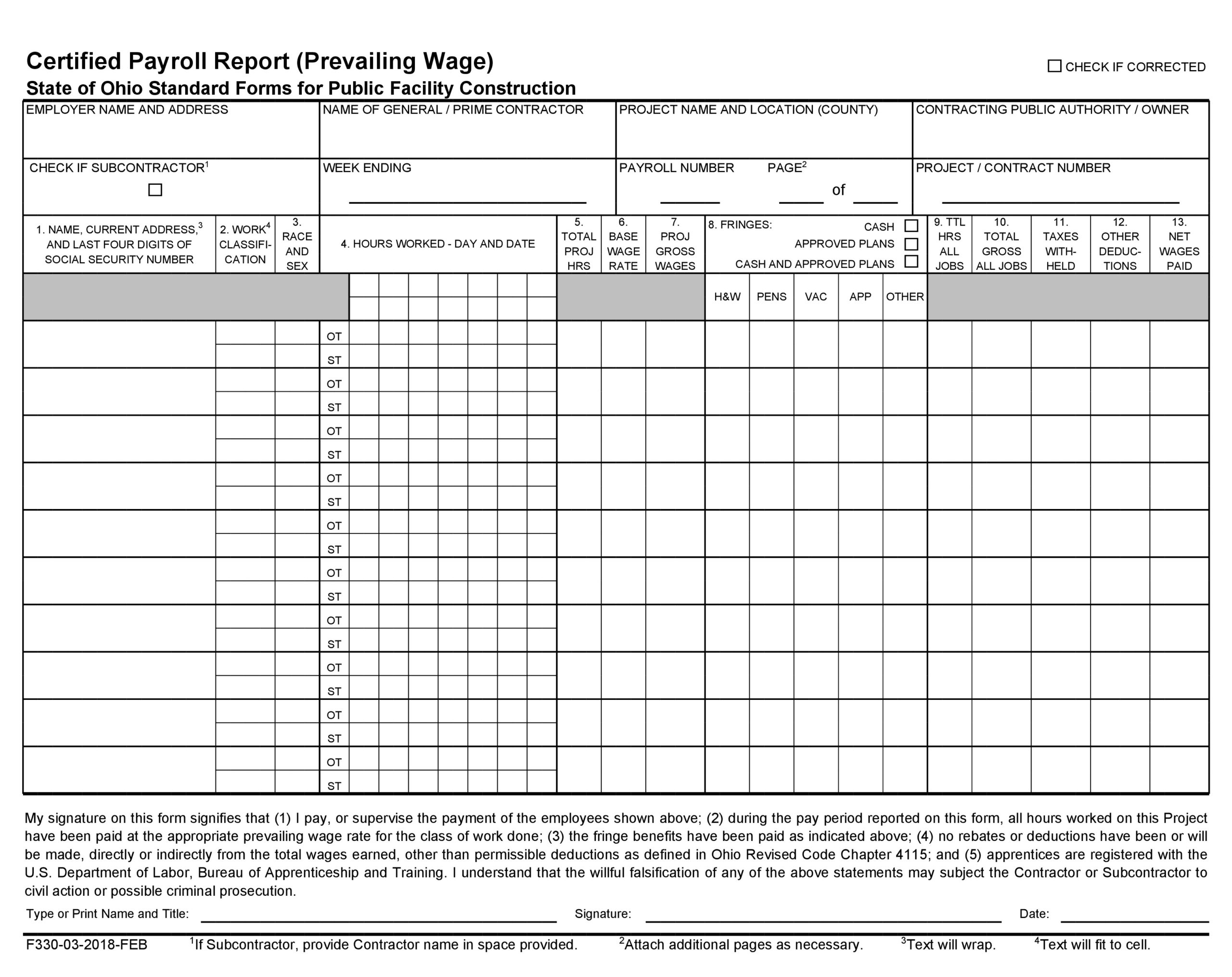

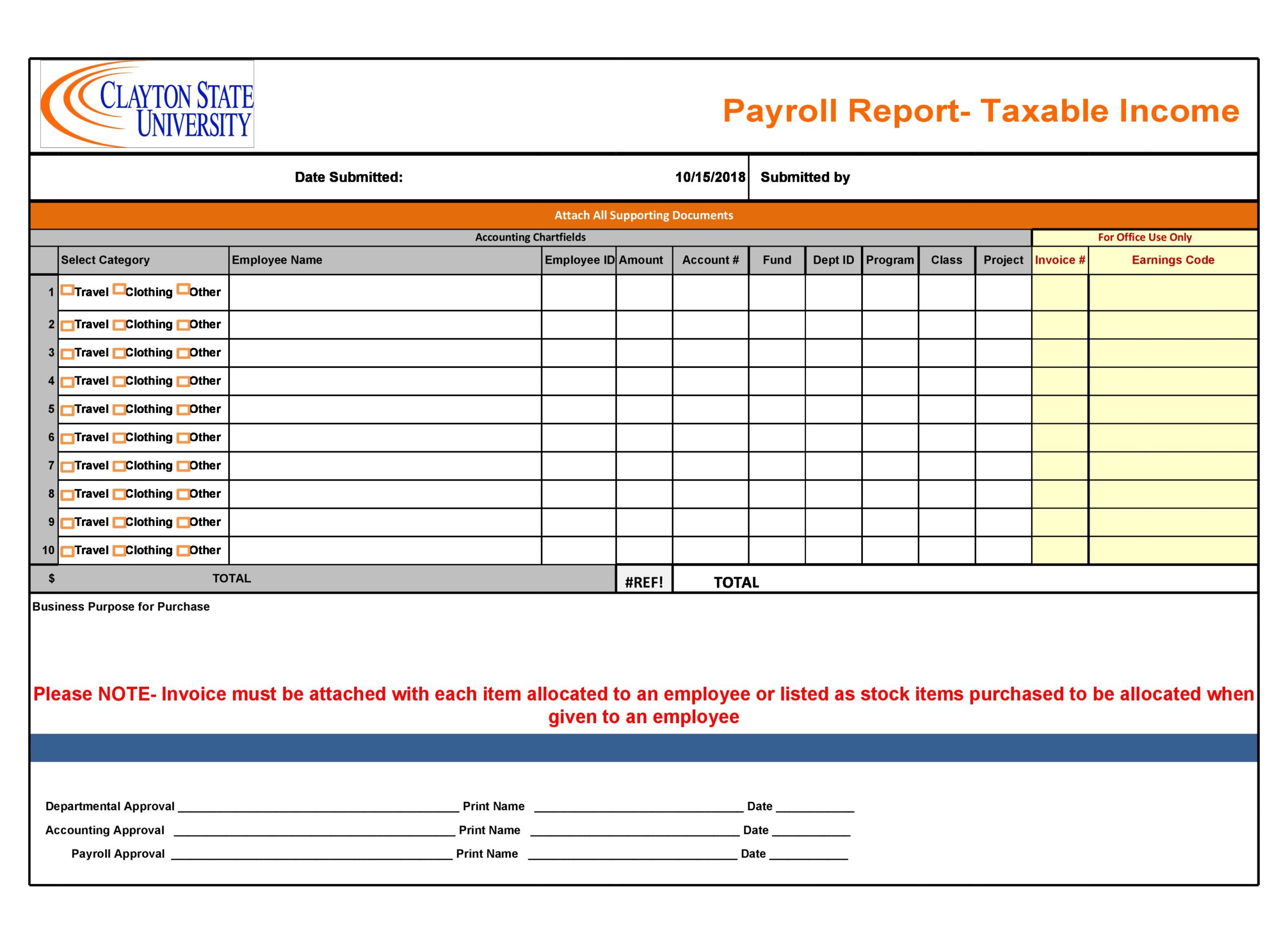

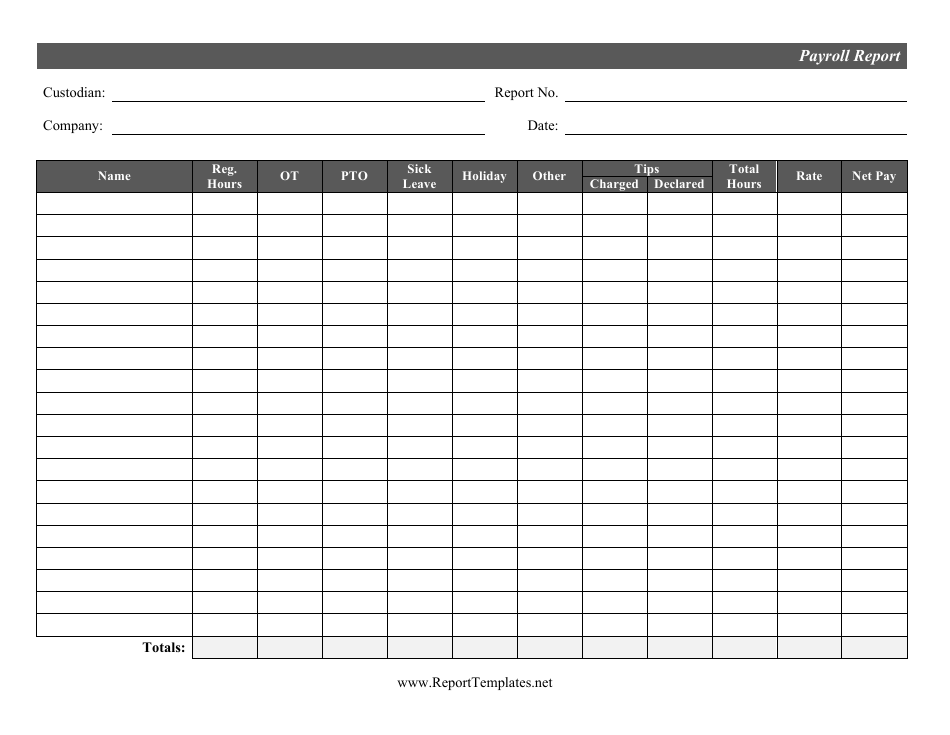

Yearly Payroll Report Template - If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll summary report for any date range, or. You must file annual form 944 instead of filing quarterly forms 941. Gusto supports contractor payments in 120+ countries. Web a payroll report is a document created every pay period that displays specific financial information such as pay rates, hours worked and taxes withheld for the specific pay run. Web here we’ve compiled a list of 10 free payroll templates to streamline the payroll process. Discover the benefits of using these templates and get tips for customizing and maintaining them effectively. Web gather and organize the data you need to generate a payroll report. Only if the irs notified you in writing. Web payroll reports are generated each payroll period, quarterly, and annually. Web select the payroll or tax report to be run; To create a year end payroll report, compile employee identification details (address, position, ssn, etc.), as well as all salary,. Gusto supports contractor payments in 120+ countries. Web the report needs to define all the aspects of the employees’ payment and deducted the number of details. Pay your team and access hr and benefits with the #1 online payroll provider.. From tracking retirement contributions to payroll withholdings, there’s plenty. If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll summary report for any date range, or. Whether you run a small business with a handful of employees or a large firm with multiple departments, there’s an option to make your. Payroll summary reports provide a snapshot of a business’s payroll obligations during a specific time frame. Sign up & make payroll a breeze. Web learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. Web a monthly payroll report template is used to create reports that help you keep track of your. Web select the payroll or tax report to be run; From tracking retirement contributions to payroll withholdings, there’s plenty. Web explore our whole range of payroll and hr services, products, connections and apps for businesses of all sizes and industries. Payroll summary reports provide a snapshot of a business’s payroll obligations during a specific time frame. You can get an. If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll summary report for any date range, or. A quarterly report for fica taxes and federal income tax withholding. Web employer’s annual federal tax return department of the treasury — internal revenue service. Help your business streamline the payroll process with. Web the federal payroll tax reports you need to be aware of are: Gusto supports contractor payments in 120+ countries. Web payroll templates can save businesses time, while also helping to avoid miscalculations and errors. Sign up & make payroll a breeze. You can get an idea of the process by having a look at this employee payroll annual report. Web the payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Fast, lightweight, precision payroll and tax, so you can save time and money. Sign up & make payroll a breeze. Web gather and organize the data you need to generate a. Whether you run a small business with a handful of employees or a large firm with multiple departments, there’s an option to make your payroll processing easier. Web the payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Web year end payroll. Web gather and organize the data you need to generate a payroll report. This page offers a wide variety of free payroll templates that are fully customizable and. Web payroll templates can save businesses time, while also helping to avoid miscalculations and errors. Web select the payroll or tax report to be run; Ad simply the best payroll service for. An annual report for federal unemployment tax act (futa) tax. Ad approve payroll when you're ready, access employee services & manage it all in one place. Gusto supports contractor payments in 120+ countries. Get started with your free payroll template now. Web the federal payroll tax reports you need to be aware of are: To create a year end payroll report, compile employee identification details (address, position, ssn, etc.), as well as all salary,. This page offers a wide variety of free payroll templates that are fully customizable and. Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings statements. Web payroll templates can save businesses time, while also helping to avoid miscalculations and errors. Help your business streamline the payroll process with these customizable templates, and prepare for an. Ad simply the best payroll service for small business. Web year end payroll reports. Web a monthly payroll report template is used to create reports that help you keep track of your employees' salaries, bonuses and other incentives. You must file annual form 944 instead of filing quarterly forms 941. Only if the irs notified you in writing. Get started with your free payroll template now. Web learn how to streamline your payroll process, ensure accuracy, and maintain compliance with payroll report templates. Ad simply the best payroll service for small business. An annual payroll report template is a set of instructions intended to be followed by users in order to create their. Here’s a breakdown of some essential payroll reports to. Whether you run a small business with a handful of employees or a large firm with multiple departments, there’s an option to make your payroll processing easier. Sign up & make payroll a breeze. From tracking retirement contributions to payroll withholdings, there’s plenty. Web the payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Web the federal payroll tax reports you need to be aware of are: Fast, lightweight, precision payroll and tax, so you can save time and money. Only if the irs notified you in writing. Gusto supports contractor payments in 120+ countries. Whether you run a small business with a handful of employees or a large firm with multiple departments, there’s an option to make your payroll processing easier. If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll summary report for any date range, or. Finally an accounting software you want to use, easy, beautiful. Use this annual report template from venngage, everything is customizable! A quarterly report for fica taxes and federal income tax withholding. Payroll summary reports provide a snapshot of a business’s payroll obligations during a specific time frame. Sign up & make payroll a breeze. Sign up & make payroll a breeze. Ad approve payroll when you're ready, access employee services & manage it all in one place. Print or export the report; Web select the payroll or tax report to be run; Web a payroll report is a document created every pay period that displays specific financial information such as pay rates, hours worked and taxes withheld for the specific pay run. Web year end payroll reports.15 Salary Template Download Free Sample Templates

Payroll Tax Forms and Reports in ezPaycheck Software

Uk Payslip Template Excel

Annual Payroll Report Template Venngage Payroll Report ADP

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

Free Printable Payroll Templates Printable World Holiday

Annual Payroll Summary Report Template

Payroll Report Template

10+ Employee Payroll Sheet Template Sample Templates

An Annual Report For Federal Unemployment Tax Act (Futa) Tax.

Use A Year End Payroll Report To Reconcile All The Payroll Information From The Previous Year.

Who Must File Form 944.

Pay Your Team And Access Hr And Benefits With The #1 Online Payroll Provider.

Related Post: