Wisp Template For Tax Professionals

Wisp Template For Tax Professionals - Web the summit released a wisp template in august 2022. Free to use and modify to fit your needs. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Download our free template today! Include the name of all information. | natp and data security expert brad messner discuss the irs's newly released security. Web maintaining a wisp a good security plan requires regular maintenance and upkeep. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Publication 5708, creating a written information security plan for your tax & accounting. All tax and accounting firms should do the following:. Ad reliably fast and accurate payroll tax service by adp®. Include the name of all information. Web the irs also has a wisp template in publication 5708. Talk with adp® sales today. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their. Web the summit released a wisp template in august 2022. Publication 5708, creating a written information security plan for your tax & accounting. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Web our free information security plan template, which you can download for free by filling. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web the irs also has a wisp template in publication 5708. Include the name of all information. Web maintaining a wisp a good security plan requires regular maintenance and upkeep. Once completed, tax professionals should keep their. All tax and accounting firms should do the following:. Web creating a written information security plan or wisp is an often overlooked but critical component. Download our free template today! Once completed, tax professionals should keep their. Here are tips to keep a wisp effective: This document is for general distribution and is available to all. Making the wisp available to employees. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. Publication 5708, creating a written information security plan for your tax & accounting.. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. What should be included in the written information security plan (wisp)? Include the name of all information. Publication 5708, creating a written information security plan for your tax & accounting.. Download our free template today! Not only is a wisp essential for your business and a good business. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Web. Once completed, tax professionals should keep their. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Download our free template today! Publication 5708, creating a written information security plan for your tax & accounting. Web the written information security plan (wisp) is a special security plan that helps tax professionals. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Making the wisp available to employees. This document is for general distribution and is available to all. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and. All tax and accounting firms should do the following:. Web the irs also has a wisp template in publication 5708. Here are tips to keep a wisp effective: Written information security plan (wisp) for. Talk with adp® sales today. Web the irs also has a wisp template in publication 5708. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Making the wisp available to employees. All tax and accounting firms should do the following:. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Ad reliably fast and accurate payroll tax service by adp®. Talk to adp® sales about payroll, tax, hr, & more! Download our free template today! Written information security plan (wisp) for. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web creating a written information security plan or wisp is an often overlooked but critical component. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. Not only is a wisp essential for your business and a good business. Once completed, tax professionals should keep their. Making the wisp available to employees. Web creating a plan tax professionals should make sure to do these things when writing and following their data security plans: Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Here are tips to keep a wisp effective: Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Talk with adp® sales today. Talk to adp® sales about payroll, tax, hr, & more! Talk with adp® sales today. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Here are tips to keep a wisp effective: Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web the summit released a wisp template in august 2022. All tax and accounting firms should do the following:. Web creating a plan tax professionals should make sure to do these things when writing and following their data security plans: Web the irs also has a wisp template in publication 5708. Making the wisp available to employees. Once completed, tax professionals should keep their. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Ad reliably fast and accurate payroll tax service by adp®. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information.Tax Preparation Worksheet —

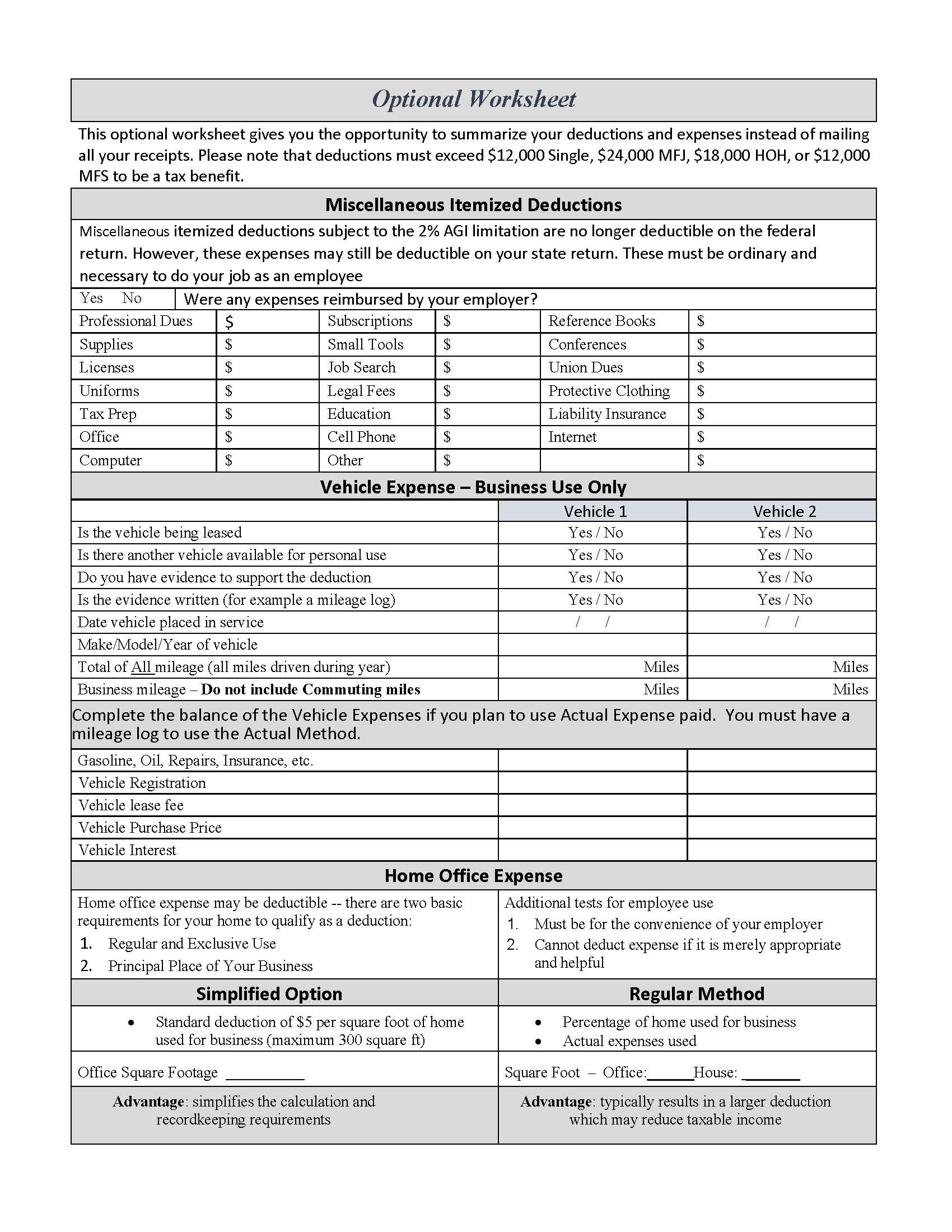

The Tax Preparation Checklist Your Accountant Wants You to Use in 2020

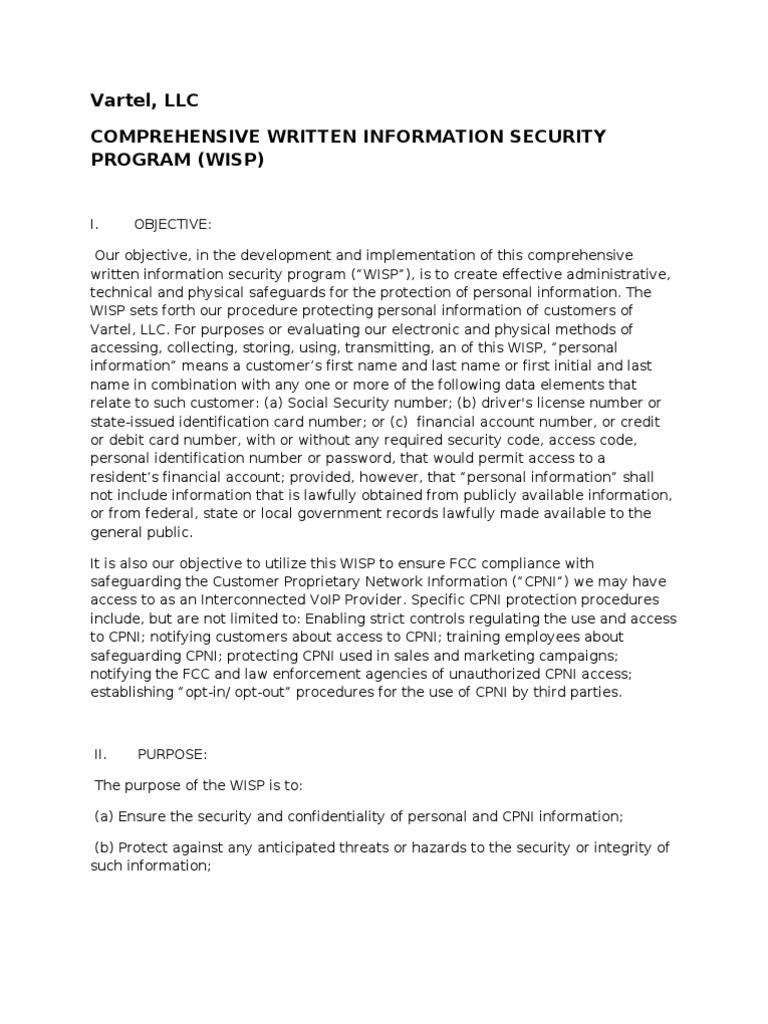

2162012 WISP Document From Vartel,LLC Personally Identifiable

WISP Application Form Student Loan Irs Tax Forms

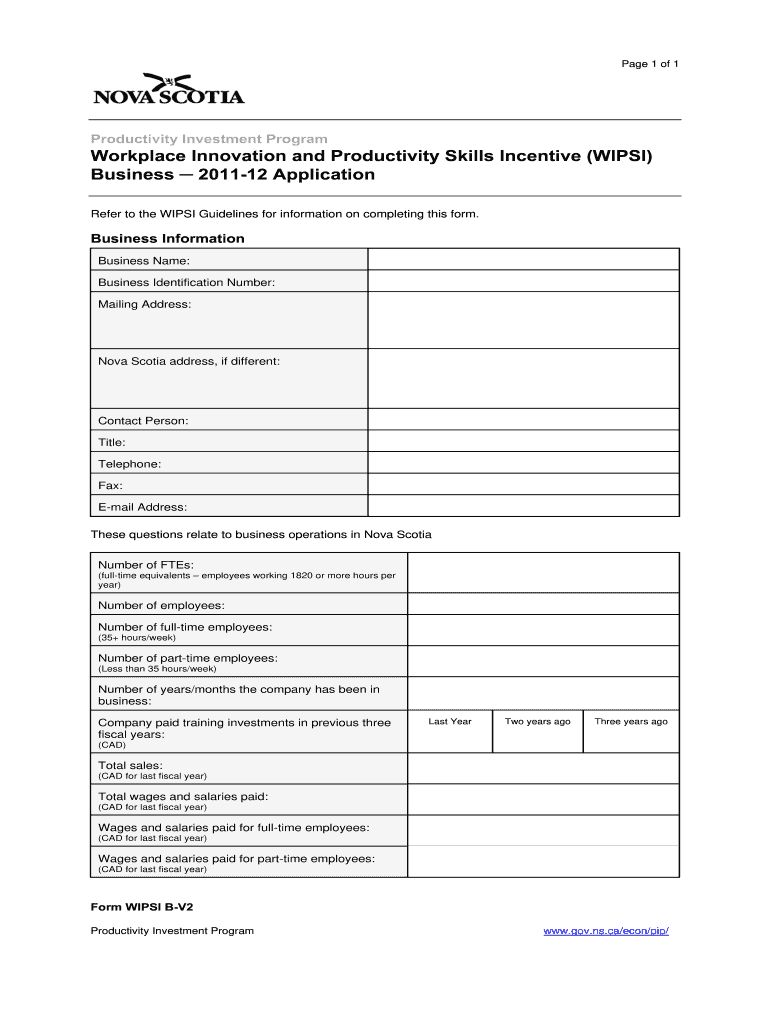

Wipsi Fill Out and Sign Printable PDF Template signNow

Irs Wisp Template

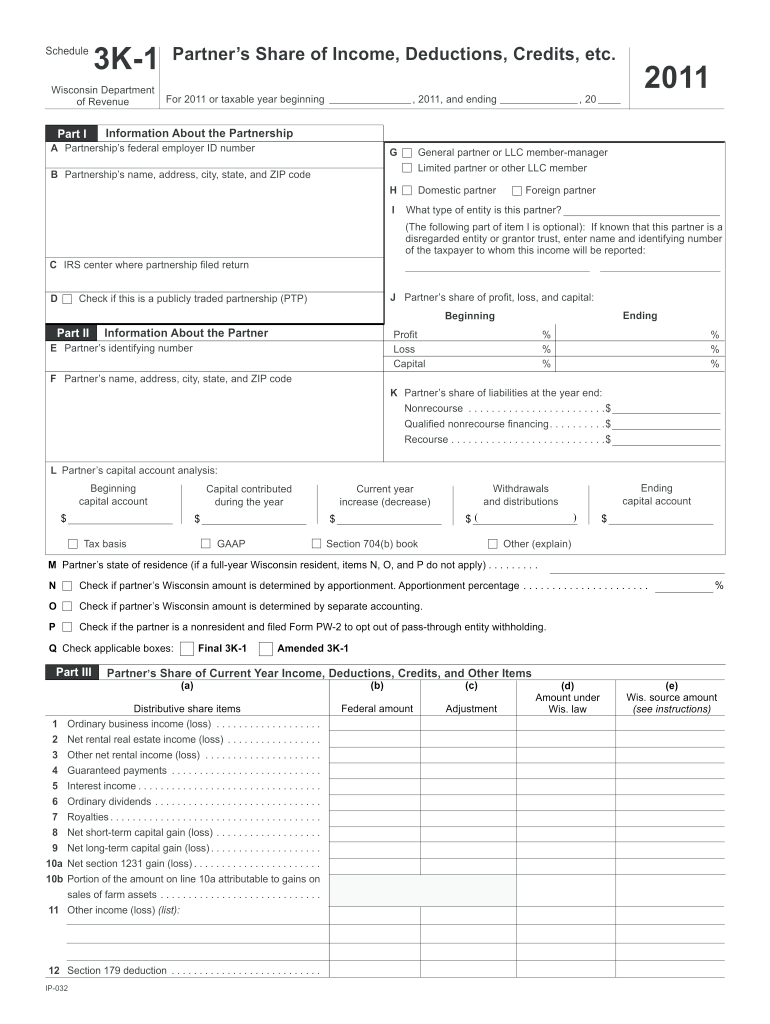

Wis Dept Revenue Partnership Form1065 Fill Out and Sign Printable PDF

Tax Prep Checklist 2022 Printable Printable World Holiday

Employee And Employer Social Security Contributions MPLOYERTA

Tax Preparation Client Intake Form Template Master of

Written Information Security Plan (Wisp) For.

Download Our Free Template Today!

Include The Name Of All Information.

What Should Be Included In The Written Information Security Plan (Wisp)?

Related Post: