Wage Garnishment Letter Template

Wage Garnishment Letter Template - Web what you need to do your failure to pay your outstanding debts, or entering into a deferred payment plan, has resulted in the garnishment of your wages. Web depending on the garnishment, there may be a form provided for this (i.e., form 668 for a federal levy). Web the best way to complete and sign your example letter to stop wage garnishment. Web the letter must specify the details of the person you are sending the notice of garnishment. This tells who you are addressing and thus, no ambiguity remains. Web phoenix arizona sample letter for writ of garnishment. The case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. Web garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. If you owe a creditor on a debt like a loan, hospital bill, or credit card, it can't automatically garnish. Web type the person's name you are contacting (if you have it), followed by the company name on the next line, the street address on the next, followed by a line that includes the city,. Web garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. Web the best way to complete and sign your example letter to stop wage garnishment. Asa hutchinson of arkansas said sunday that he had met the criteria, which would make eight candidates onstage. Web 2 days agoformer gov. An employer can. It refers to a legal process that instructs a third party to deduct. This requires that you take account of all of your household income and expenses. Wage garnishment letter and important notice to employer; We use cookies to improve security, personalize the user experience, enhance our marketing activities (including. Web type the person's name you are contacting (if you. This requires that you take account of all of your household income and expenses. Determine what are the “disposable earnings” by calculating the gross earnings, then deducting from gross. Web garnishment of earnings for each pay period: The garnishment amount set forth in 15 u.s.c. The employer may use a copy of this worksheet each pay period to calculate the. Determine what are the “disposable earnings” by calculating the gross earnings, then deducting from gross. Save time on document management with signnow and get your example letter to stop wage. Most likely, yyu’ll receive a wage garnishment letter. Pull together any supporting documentation to. If you owe a creditor on a debt like a loan, hospital bill, or credit card,. This tells who you are addressing and thus, no ambiguity remains. Most likely, yyu’ll receive a wage garnishment letter. We've helped 205 clients find attorneys today. Web wage garnishment letter and important notice to employer. Web an official website of the state of north carolina how you know received a notice garnishment release letter garnishment release letter this notice is. Save time on document management with signnow and get your example letter to stop wage. Web garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. Determine what are the “disposable earnings” by calculating the gross earnings, then deducting from gross. Below are instructions and sample calculations for garnishment writs as well. The garnishment amount set forth in 15 u.s.c. The employer may use a copy of this worksheet each pay period to calculate the wage garnishment amount to be deducted from a debtor's disposable. Web an official website of the state of north carolina how you know received a notice garnishment release letter garnishment release letter this notice is sent to. Web the wage garnishment amount for each pay period is the lesser of: Save time on document management with signnow and get your example letter to stop wage. Web step 1 assess your financial situation. Web depending on the garnishment, there may be a form provided for this (i.e., form 668 for a federal levy). Web phoenix arizona sample letter. Web wage garnishment letter and important notice to employer. Pull together any supporting documentation to. If you owe a creditor on a debt like a loan, hospital bill, or credit card, it can't automatically garnish. It refers to a legal process that instructs a third party to deduct. Web the written objection should include: The case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. The employer may use a copy of this worksheet each pay period to calculate the wage garnishment amount to be deducted from a debtor's disposable. If you owe a creditor on a debt like a loan, hospital bill, or credit. It refers to a legal process that instructs a third party to deduct. This tells who you are addressing and thus, no ambiguity remains. Web garnishment of earnings for each pay period: Web garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. Most likely, yyu’ll receive a wage garnishment letter. It refers to a legal process that instructs a third party to deduct. This requires that you take account of all of your household income and expenses. Below are instructions and sample calculations for garnishment writs as well as solutions and sample letters for salary. Determine what are the “disposable earnings” by calculating the gross earnings, then deducting from gross. Asa hutchinson of arkansas said sunday that he had met the criteria, which would make eight candidates onstage. The garnishment amount set forth in 15 u.s.c. Web type the person's name you are contacting (if you have it), followed by the company name on the next line, the street address on the next, followed by a line that includes the city,. Web an official website of the state of north carolina how you know received a notice garnishment release letter garnishment release letter this notice is sent to inform. Web the written objection should include: The employer may use a copy of this worksheet each pay period to calculate the wage garnishment amount to be deducted from a debtor's disposable. Web the wage garnishment amount for each pay period is the lesser of: James, this is to notify that according to. The letter will say that a court or government agency is requiring you to withhold part of. We've helped 205 clients find attorneys today. An employer can also draft a letter detailing the specifics of. % of the employee's disposal pay (not to exceed 15%); Web the best way to complete and sign your example letter to stop wage garnishment. It refers to a legal process that instructs a third party to deduct. Web the letter must specify the details of the person you are sending the notice of garnishment. The employer may use a copy of this worksheet each pay period to calculate the wage garnishment amount to be deducted from a debtor's disposable. Wage garnishments are legally mandated, so you will be notified via a court order (also known as a writ of garnishment) or irs levy if you need to garnish an employee’s wages. Web 2 days agoformer gov. This requires that you take account of all of your household income and expenses. We've helped 205 clients find attorneys today. The case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. Web step 1 assess your financial situation. It also raises the minimum. Web what you need to do your failure to pay your outstanding debts, or entering into a deferred payment plan, has resulted in the garnishment of your wages. Web the written objection should include: Wage garnishment letter and important notice to employer; It refers to a legal process that instructs a third party to deduct.how to write a letter to stop wage garnishment

View How To Write An Objection Letter For Wage Garnishment Cecilprax

Wage Garnishment June 2017

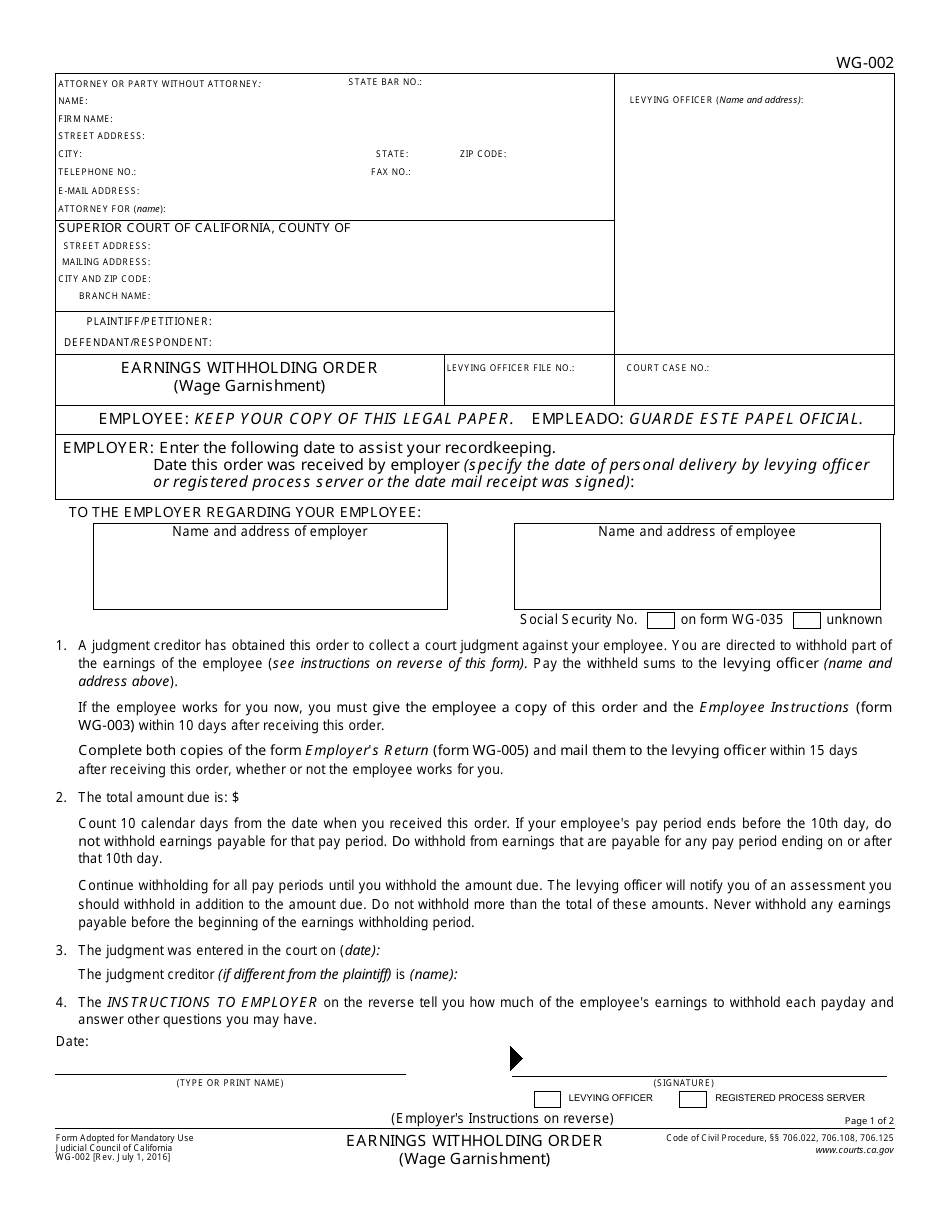

Form WG002 Download Fillable PDF or Fill Online Earnings Withholding

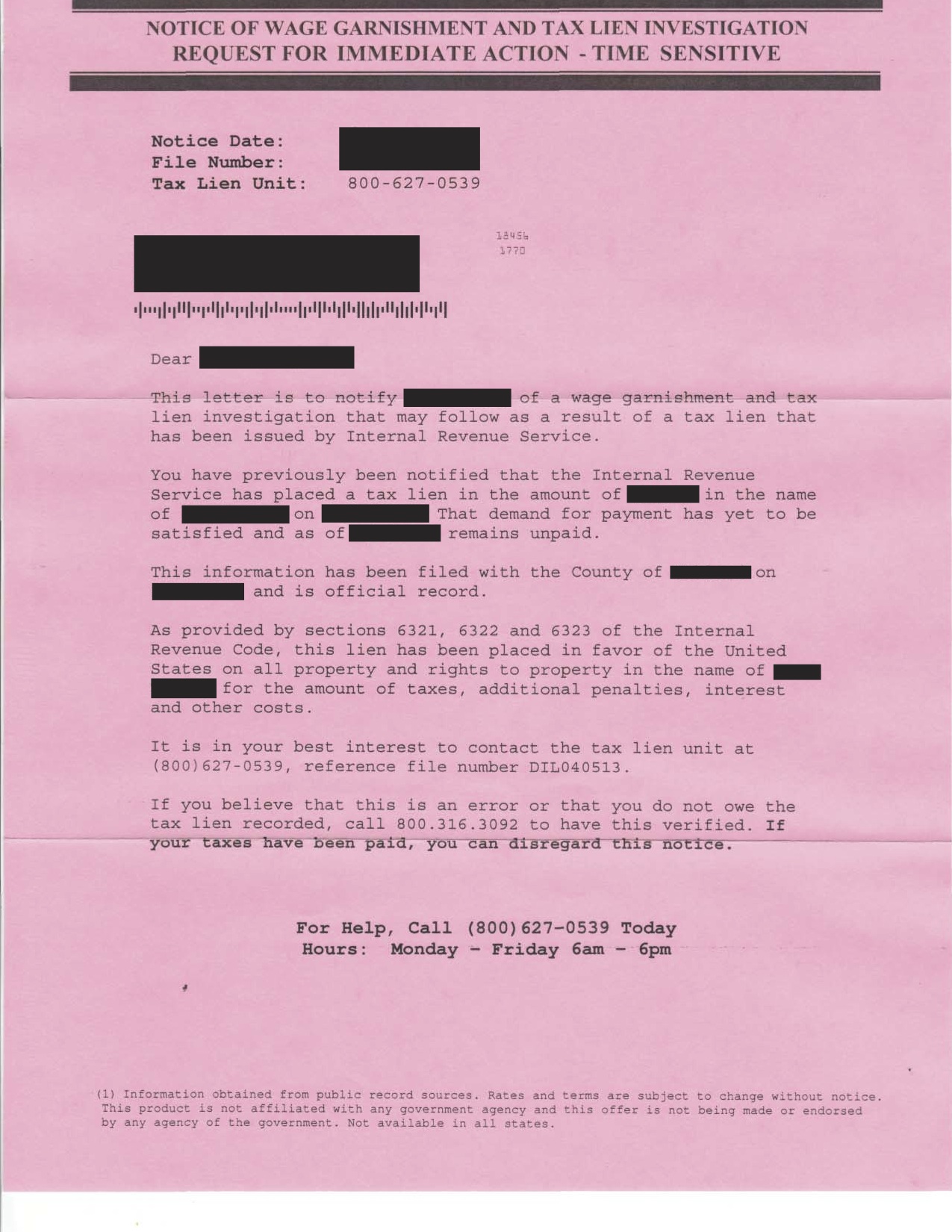

Fake IRS Garnishment Notices ALG Tax Solutions

43+ How To Write A Wage Garnishment Letter Cecilprax

wage garnishment letter template debt validation letter sample

garnishment letter Doc Template pdfFiller

Wage garnishment how to stop them and keep my pay check

Wage Garnishment July 2017

Web An Official Website Of The State Of North Carolina How You Know Received A Notice Garnishment Release Letter Garnishment Release Letter This Notice Is Sent To Inform.

Web Phoenix Arizona Sample Letter For Writ Of Garnishment.

Web The Wage Garnishment Amount For Each Pay Period Is The Lesser Of:

We Use Cookies To Improve Security, Personalize The User Experience, Enhance Our Marketing Activities (Including.

Related Post: