Snowball Debt Template

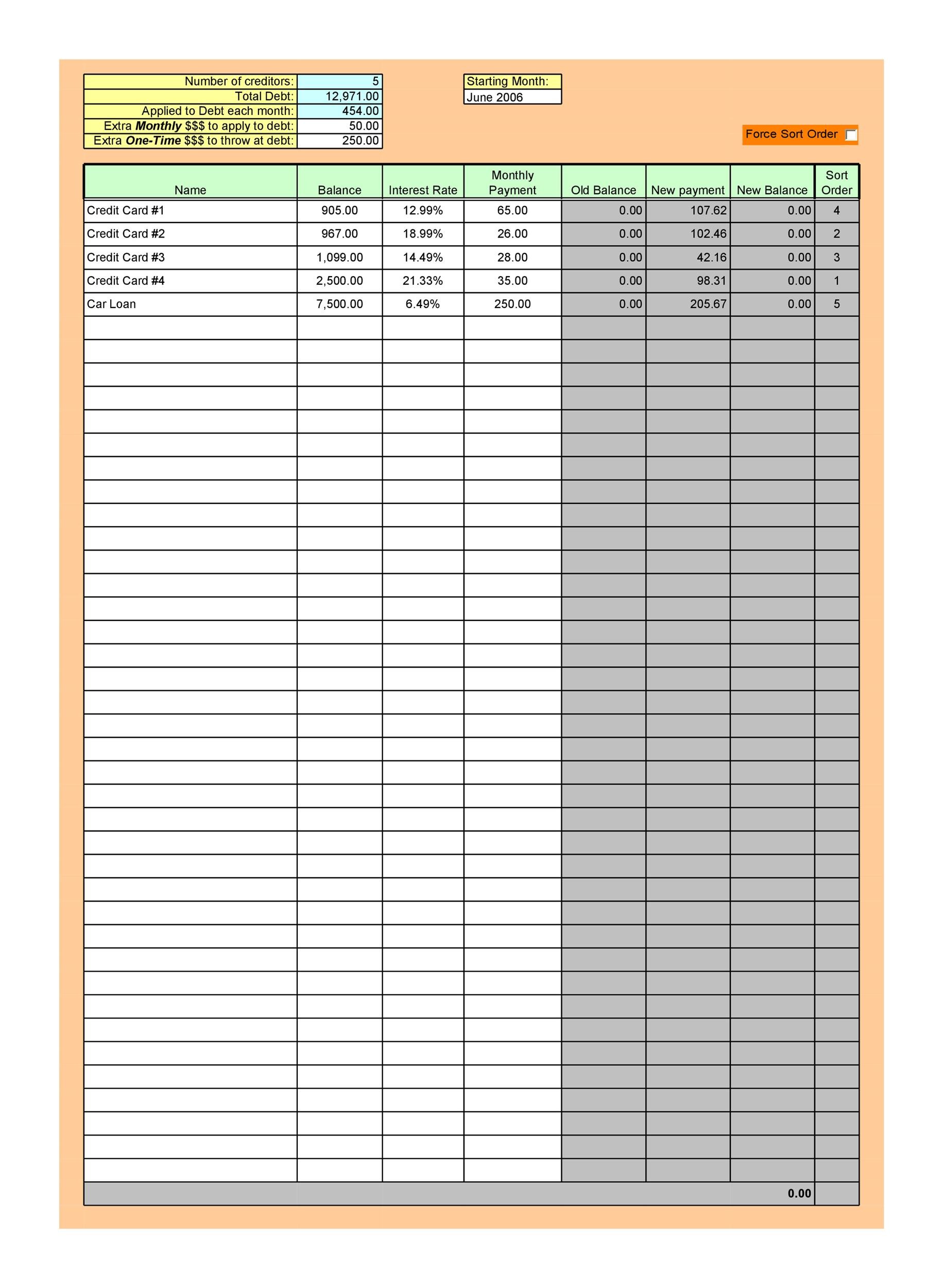

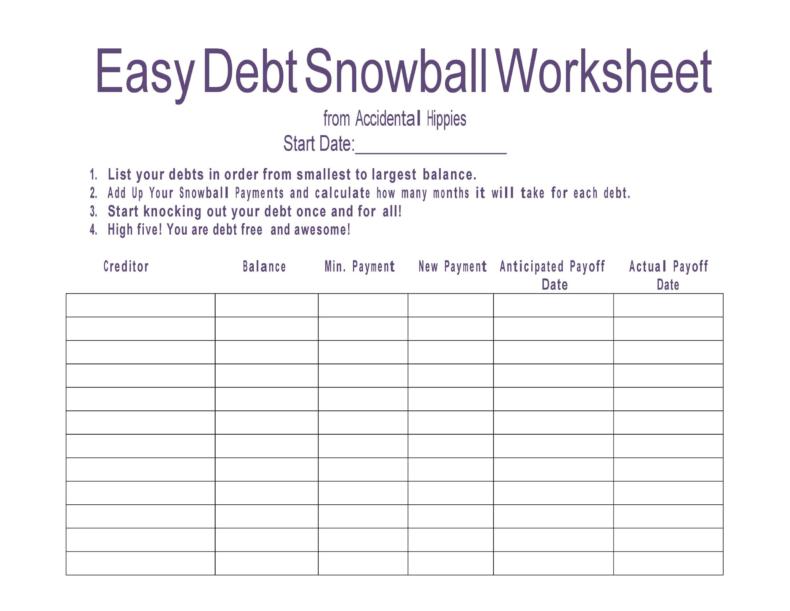

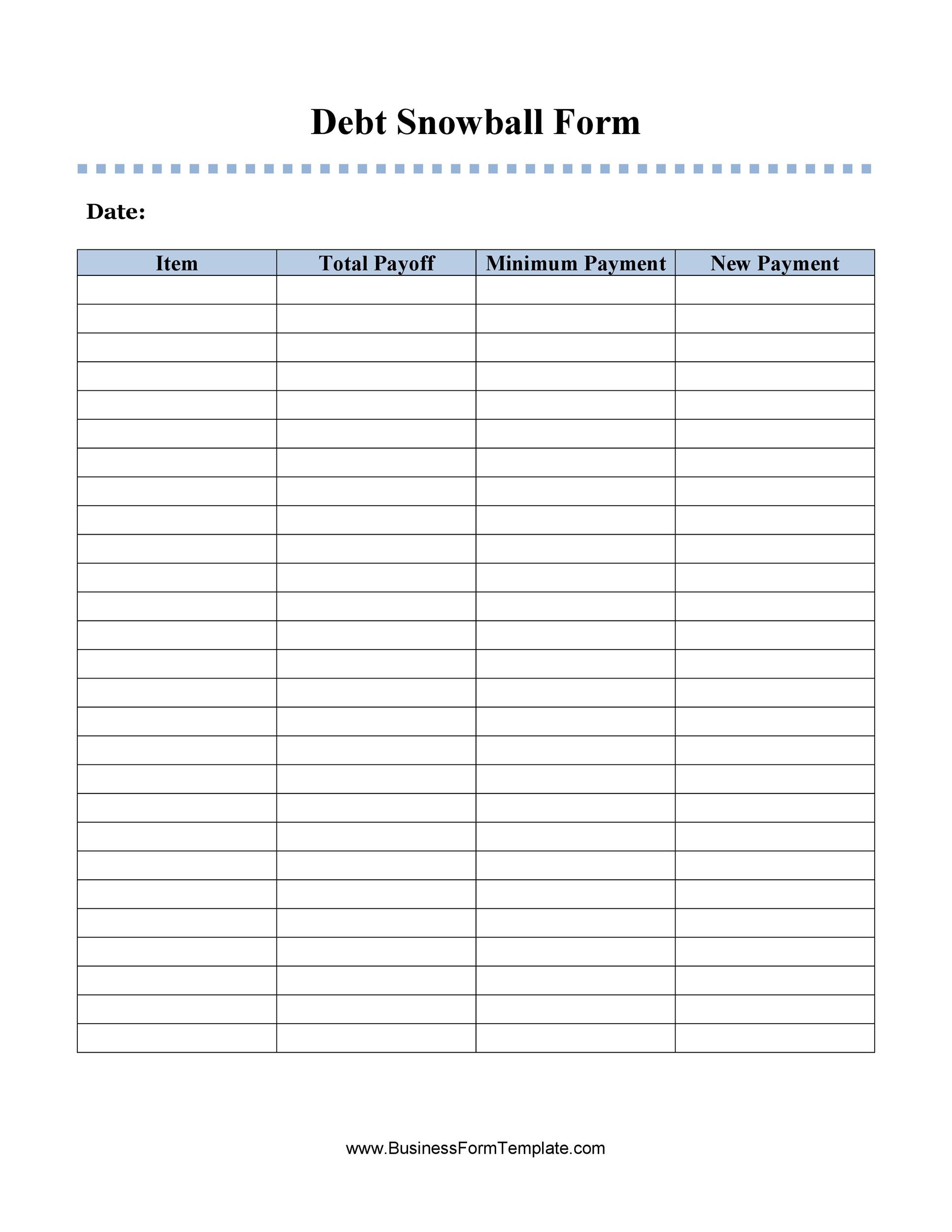

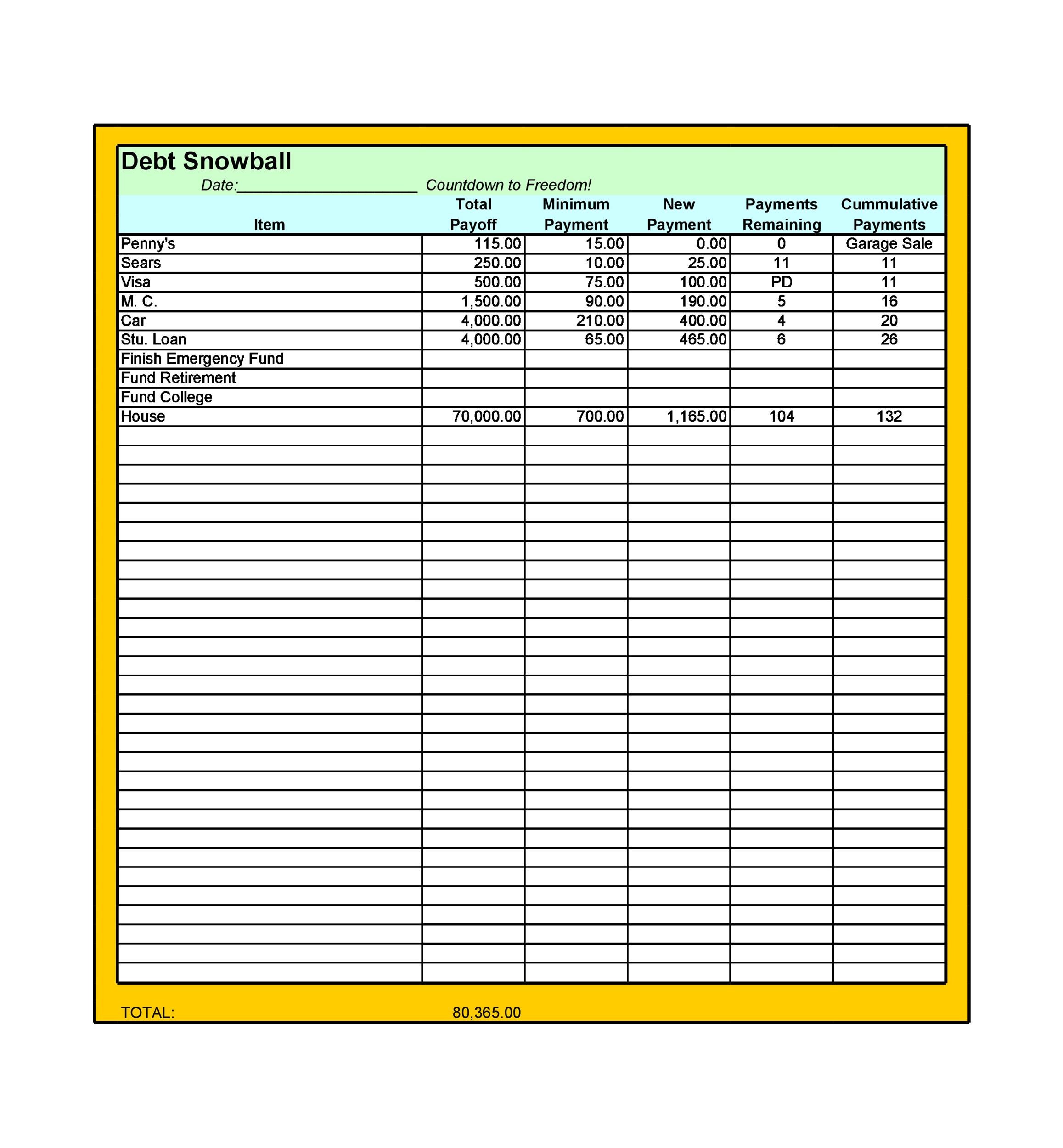

Snowball Debt Template - You can use these forms to list down all. Web how to use this debt snowball excel spreadsheet in excel and google docs. Web debt snowball spreadsheet: Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin employing the. One option on this list. Are you looking for a way to achieve financial. If you want a plan to get out of debt, this is the spreadsheet to use. Web debt snowball worksheet explained. Graphs will help you compare the two strategies side by side. So far, we’ve gone through the basics of the debt snowball excel spreadsheet,. Web download this debt snowball scheduler template design in excel, google sheets format. Web debt snowball spreadsheet: Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin employing the. Web the debt snowball method is a debt reduction strategy where. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. One option on this list. Write each one of your debts. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin employing the. Write each one of your debts down on this form in order from smallest to largest. Web get your copy of my snowball debt spreadsheet. Web debt payoff. One option on this list. Web the debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. If you want a plan to get out of debt, this is the spreadsheet to use. Web the first free printable debt snowball worksheet is a tracking sheet.. Web debt payoff template from medium for google sheets 2. Find out with this form by determining how much you owe versus how much value each asset has. You can get it for free by simply entering your email. Web get your copy of my snowball debt spreadsheet. You can use these forms to list down all. Find out with this form by determining how much you owe versus how much value each asset has. Web how to use this debt snowball excel spreadsheet in excel and google docs. Tiller money tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web debt snowball worksheet explained. Web get your. List your debts from smallest to largest regardless of interest rate. Web get your copy of my snowball debt spreadsheet. Web debt snowball worksheet explained. If you want a plan to get out of debt, this is the spreadsheet to use. Web debt payoff template from medium for google sheets 2. Are you looking for a way to achieve financial. You can use these forms to list down all. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Tiller money offers several types of spreadsheets. If you don’t have a surplus, then you need. The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. Web debt payoff template from medium for google sheets 2. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web get your copy of my snowball debt. One option on this list. Web the debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. You can use these forms to list down all. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create. You can use these forms to list down all. Are you looking for a way to achieve financial. So far, we’ve gone through the basics of the debt snowball excel spreadsheet,. List your debts from smallest to largest regardless of interest rate. Web debt snowball spreadsheet: Find out with this form by determining how much you owe versus how much value each asset has. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Tiller money tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web the first free printable debt snowball worksheet is a tracking sheet. Write each one of your debts down on this form in order from smallest to largest. Web get your copy of my snowball debt spreadsheet. If you want a plan to get out of debt, this is the spreadsheet to use. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin employing the. Web debt payoff template from medium for google sheets 2. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. One option on this list. Web debt snowball worksheet explained. Tiller money offers several types of spreadsheets. You can use this sheet to switch back and forth between the avalanche and debt snowball methods. The tiller community debt snowball spreadsheetallows you to calculate estimated payoff dates and track your progress toward debt freedom. You can get it for free by simply entering your email. You can use this sheet to switch back and forth between the avalanche and debt snowball methods. Web get your copy of my snowball debt spreadsheet. Web how to use this debt snowball excel spreadsheet in excel and google docs. Graphs will help you compare the two strategies side by side. Tiller money tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web researchers say the snowball method is the best way to pay off debt — here's a simple spreadsheet that can make it work for you written by emmie martin employing the. Web debt payoff template from medium for google sheets 2. Web debt snowball worksheet explained. One option on this list. Web debt snowball spreadsheet: List your debts from smallest to largest regardless of interest rate. If you don’t have a surplus, then you need to. Web the debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Web while both the snowball and avalanche methods involve money you actively budget to pay down debt, you can supplement either with “debt snowflakes” — small.Free Debt Snowball Printable Worksheet Track Your Debt Payoff

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Canada

5 Debt Snowball Excel Templates Excel xlts

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy Canada

38 Debt Snowball Spreadsheets, Forms & Calculators

Web In This Article, We’ll Detail What A Debt Snowball Method Is, How It Works, And How To Create A Debt Snowball Spreadsheet In Google Sheets.

Write Each One Of Your Debts Down On This Form In Order From Smallest To Largest.

You Can Use These Forms To List Down All.

So Far, We’ve Gone Through The Basics Of The Debt Snowball Excel Spreadsheet,.

Related Post: