Section 105 Plan Template

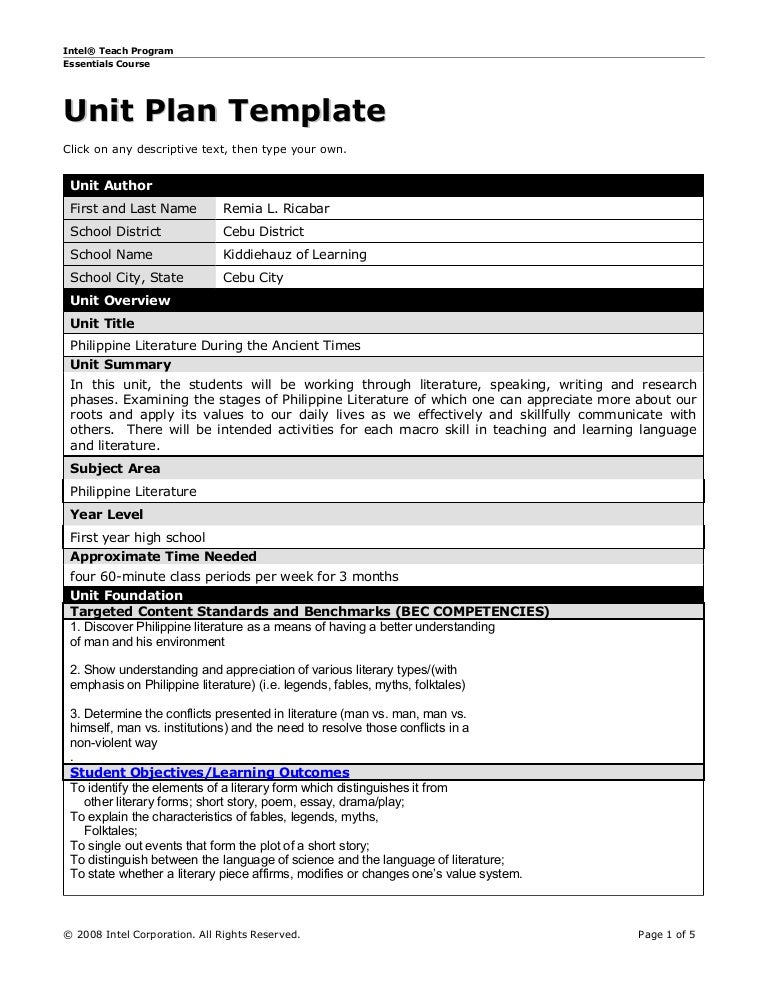

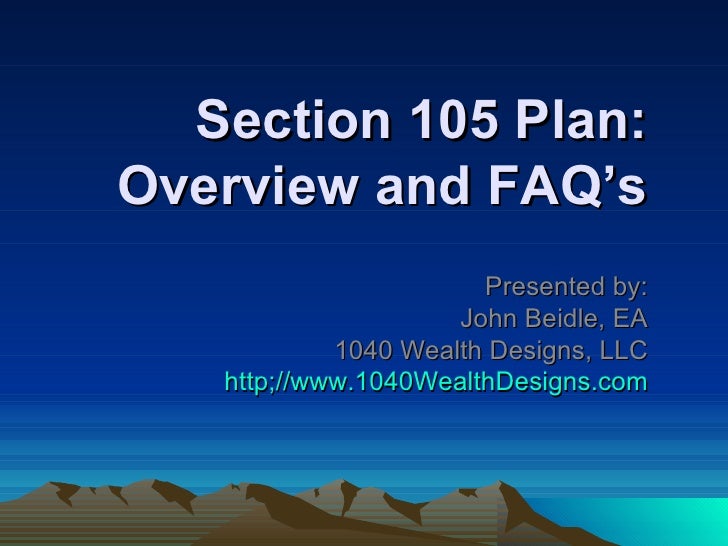

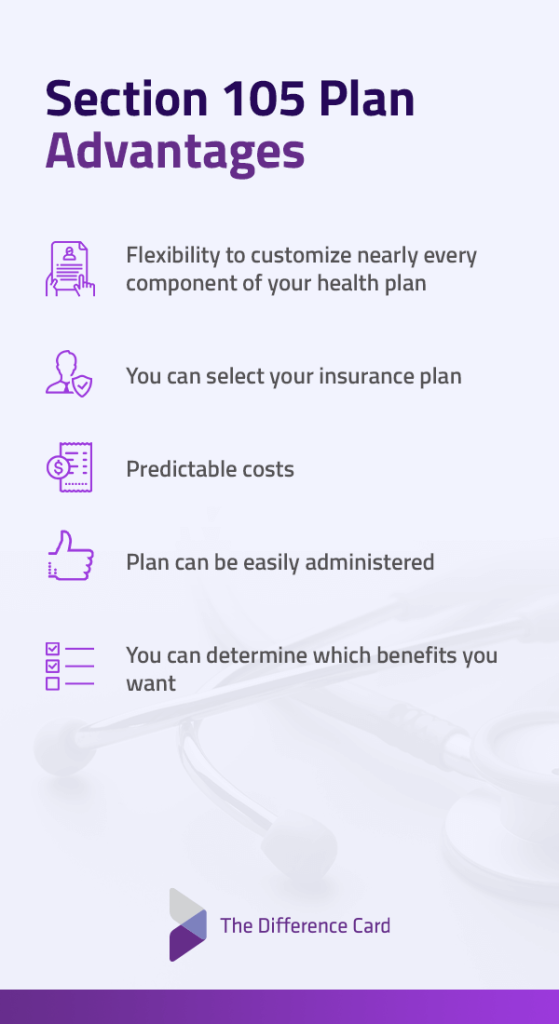

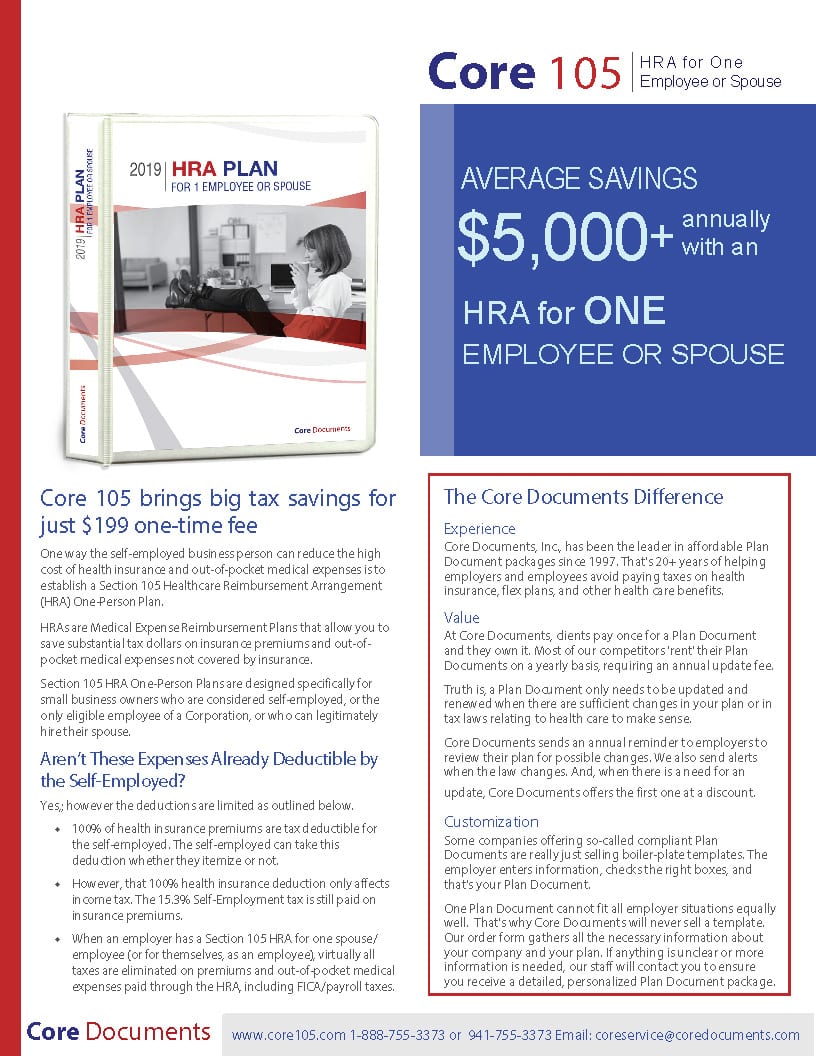

Section 105 Plan Template - There are various types of. Web updated on march 17, 2023. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. The plan is designed and intended to qualify as an accident and. Web originally published on january 9, 2014. Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. Section 105(h) eligibility test.30 c. This is also called an. The employer reimburses the employees for allowable expenses incurred. It is not structured as a salary reduction. Web last updated march 31, 2021. The employer reimburses the employees for allowable expenses incurred. Web updated on march 17, 2023. There are various types of. What is a section 105 plan? For example, qualified health plan benefits are excludable under irc section 105. Section 105 of the internal revenue code. The employer reimburses the employees for allowable expenses incurred. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to.. Web originally published on january 9, 2014. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105. Easy to use, save, & print. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. The purpose of the plan is complete and full medical care for the employees of (name of business). Ad fill out any. Easy to use, save, & print. Web originally published on january 9, 2014. While your employer can’t pay your medicare premiums in the true sense, you’ll be glad to know that they may. Ad fill out any legal form in minutes. For example, qualified health plan benefits are excludable under irc section 105. Easy to use, save, & print. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. It is not structured as a salary reduction. The hra plan can designate the number of hours for an employee to be. A common election is that only full time employees. A section 105 plan is also called a health reimbursement arrangement (or “hra”). The plan is designed and intended to qualify as an accident and. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Implement a section 105 plan alongside a conventional. The employer reimburses the employees for allowable expenses incurred. The purpose of the plan is complete and full medical care for the employees of (name of business). Easy to use, save, & print. The plan is designed and intended to qualify as an accident and. Web benefits provided under this plan are intended to be exempt from taxation under section. Section 105(h) eligibility test.30 c. Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. For example, qualified health plan benefits are excludable under irc section 105. What is a section 105 plan? The plan is designed and intended to qualify as an accident and. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. Health plan” under section 9831 of the. The plan is designed and intended to qualify as an accident and. Web the plan is designed and intended to qualify. The purpose of the plan is complete and full medical care for the employees of (name of business). Section 105(h) eligibility test.30 c. Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. Web last updated march 31, 2021. Easy to use, save, & print. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. For example, qualified health plan benefits are excludable under irc section 105. The plan is designed and intended to qualify as an accident and. The hra plan can designate the number of hours for an employee to be eligible to participate in the hra. The employer reimburses the employees for allowable expenses incurred. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. Web updated on march 17, 2023. Web find out everything you need to know about these medical reimbursement plans below. Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). A common election is that only full time employees. A section 105 plan is also called a health reimbursement arrangement (or “hra”). Health plan” under section 9831 of the. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. Last updated november 9, 2018. Section 105 of the internal revenue code. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Section 105(h) eligibility test.30 c. What is a section 105 plan? The purpose of the plan is complete and full medical care for the employees of (name of business). This is also called an. Section 105 of the internal revenue code. It is not structured as a salary reduction. Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. Section 105(h) benefits test.32 : A common election is that only full time employees. A section 105 plan is also called a health reimbursement arrangement (or “hra”). Web find out everything you need to know about these medical reimbursement plans below. Health plan” under section 9831 of the. For example, qualified health plan benefits are excludable under irc section 105. Web last updated march 31, 2021.Unit plan template

Layout Plan of Noida Sector105 HD Map

Beating high health care costs

AN ORDINANCE TO AMEND SECTION 105 OF THE CITY ZONING

Save Taxes Using The IRS Section 105 Medical Reimbursement Plan

Section 105 OnePerson HRA from 199 fee Core Documents

Section 105 PLEA AGREEMENT IN THE MAGISTRATE COURT FOR THE DISTRICT

Gallery of School Architecture Examples in Plan and Section 105

A Guide to Section 105 Plans PeopleKeep

Section 105 Plan vs Section 125 Cafeteria Plan What's the Doc

Web Originally Published On January 9, 2014.

The Plan Is Designed And Intended To Qualify As An Accident And.

Web Benefits Provided Under This Plan Are Intended To Be Exempt From Taxation Under Section 105 Of The Code, And The Plan Is Intended To Comply With Any Other Code Sections As.

The Employer Reimburses The Employees For Allowable Expenses Incurred.

Related Post: