Real Estate Financial Modeling Excel Template

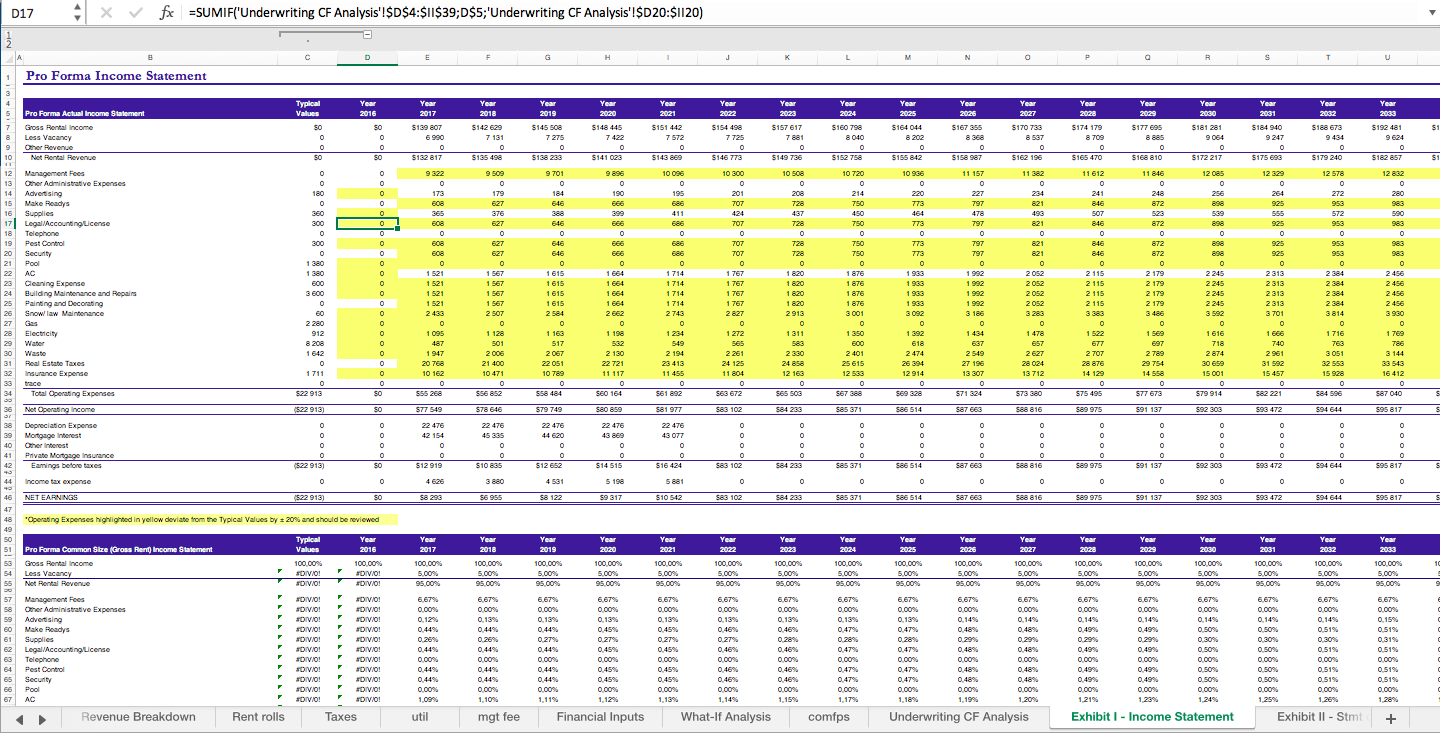

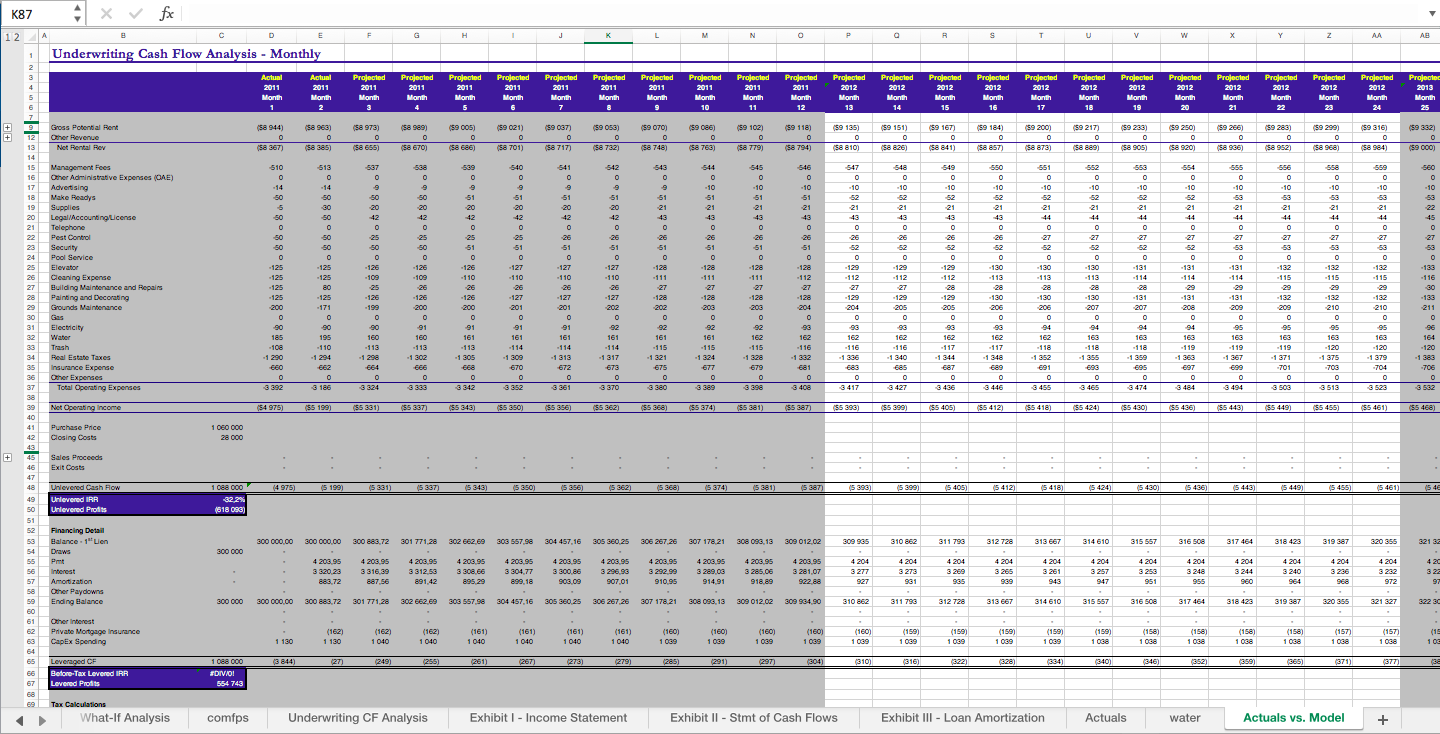

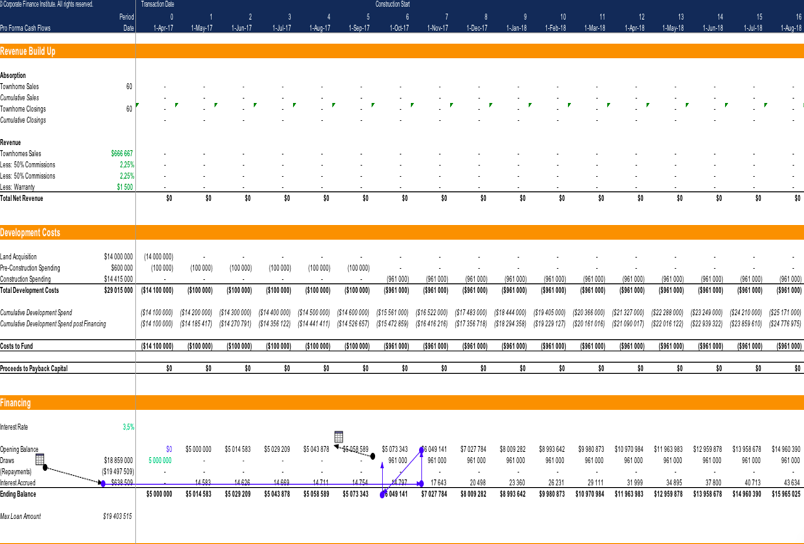

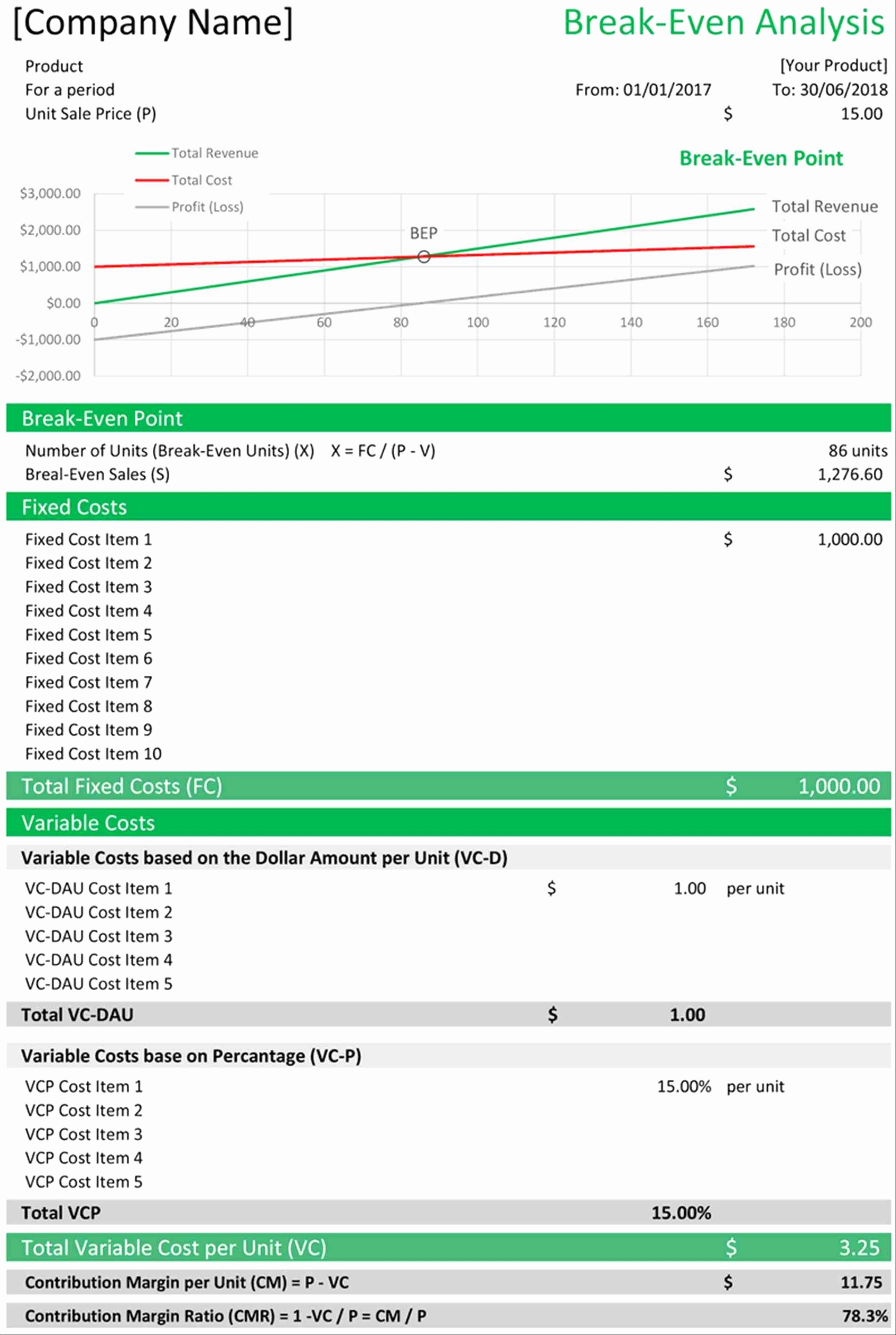

Real Estate Financial Modeling Excel Template - Web real estate financial modeling in excel. Web the formula for calculating the occupancy at a hotel is as follows. How to value a business using the discounted cash flow model. Web spreadsheet in excel to help you calculate residential load. Ad financial model for startups. Includes models covering all properties and investment. Occupancy rate = number of occupied rooms ÷ total number of available rooms. Ad includes fully reusable excel model templates & 20+ hours of video guidance. Web real estate financial modeling: Web all models are built in microsoft excel 2013 or newer. Web published april 13, 2018 updated may 7, 2023 dcf model template this dcf model template provides you with a foundation to build your own discounted cash. Web all models are built in microsoft excel 2013 or newer. Occupancy rate = number of occupied rooms ÷ total number of available rooms. How to value a business using the discounted cash. How to value a business using the discounted cash flow model. Web real estate financial models, excel® templates, and cash flow calculators are essential tools used by investors and consultants to analyze and forecast the financial. Ad financial model for startups. Fully editable & ready to use in ms excel. Web download real estate financial analysis models built in microsoft. Web spreadsheet in excel to help you calculate residential load. Web real estate financial modeling: Here are the sample excel files (both simplified real estate models). We have built models for virtually every real estate property type (e.g. Detailed projections of all project lifetime. We have built models for virtually every real estate property type (e.g. Separate profit and loss budget, balance sheet and cash flow budget. Fully editable & ready to use in ms excel. The multifamily acquisition model case instructions & excel template. Web download real estate financial analysis models built in microsoft excel for office, multifamily residential, single family residential, retail,. Ad financial model for startups. For example, if a hotel. Occupancy rate = number of occupied rooms ÷ total number of available rooms. Web build an interactive financial model to assess a project’s financial viability; Web real estate financial modeling: Web build an interactive financial model to assess a project’s financial viability; Includes models covering all properties and investment. Web all models are built in microsoft excel 2013 or newer. Ad includes fully reusable excel model templates & 20+ hours of video guidance. Understand how to project real estate financing (both debt and equity) flow in and out depending on. Web real estate financial models, excel® templates, and cash flow calculators are essential tools used by investors and consultants to analyze and forecast the financial. Web the formula for calculating the occupancy at a hotel is as follows. Web list of free excel financial model templates. Detailed projections of all project lifetime. Ad financial model for startups. Web all models are built in microsoft excel 2013 or newer. Here are the sample excel files (both simplified real estate models). Fully editable & ready to use in ms excel. Financial ratios analysis and its importance. Web the functionality of the real estate financial plan template: Fully editable & ready to use in ms excel. Web the functionality of the real estate financial plan template: The multifamily acquisition model case instructions & excel template. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform. Detailed projections of all project lifetime. For example, if a hotel. Web real estate financial modeling in excel. Web download real estate financial analysis models built in microsoft excel for office, multifamily residential, single family residential, retail, industrial, and hotel assets. Fully editable & ready to use in ms excel. Web download an excel real estate model from our extensive library of real estate financial pro. Web the formula for calculating the occupancy at a hotel is as follows. Web all models are built in microsoft excel 2013 or newer. Web download an excel real estate model from our extensive library of real estate financial pro formas. Web the cap table template in our real estate agency financial model excel template includes four rounds of financing, and it shows how the shares issued to new investors. Web spreadsheet in excel to help you calculate residential load. Below is a simple multifamily acquisition scenario and a walkthrough of the boe model you. Ad financial model for startups. Web published april 13, 2018 updated may 7, 2023 dcf model template this dcf model template provides you with a foundation to build your own discounted cash. Web this is a fully functional, institutional quality, and dynamic real estate financial model for calculating the return of the acquisition…. How to value a business using the discounted cash flow model. For example, if a hotel. Here are the sample excel files (both simplified real estate models). Web download real estate financial analysis models built in microsoft excel for office, multifamily residential, single family residential, retail, industrial, and hotel assets. Web real estate financial modeling: Fully editable & ready to use in ms excel. Real estate offers one of the most promising returns when it comes to. We have built models for virtually every real estate property type (e.g. Ad financial model for startups. Detailed projections of all project lifetime. Web reit commercial real estate valuation approaches, metrics, and financial model templates. Understand how to project real estate financing (both debt and equity) flow in and out depending on. How to value a business using the discounted cash flow model. Financial ratios analysis and its importance. Detailed projections of all project lifetime. Web all models are built in microsoft excel 2013 or newer. Web real estate financial modeling in excel. Web real estate financial modeling in excel. Web real estate financial models, excel® templates, and cash flow calculators are essential tools used by investors and consultants to analyze and forecast the financial. How to value a business using the discounted cash flow model. Web the functionality of the real estate financial plan template: Web spreadsheet in excel to help you calculate residential load. Occupancy rate = number of occupied rooms ÷ total number of available rooms. Web this is a fully functional, institutional quality, and dynamic real estate financial model for calculating the return of the acquisition…. Web published april 13, 2018 updated may 7, 2023 dcf model template this dcf model template provides you with a foundation to build your own discounted cash. Fully editable & ready to use in ms excel. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform.Real Estate Financial Modeling REFM Course Excel Modeling

Real Estate Financial Model Excel Template for Complete Valuation with

Corporate Finance Institute

Real Estate Financial Model Excel Template for Complete Valuation with

Excel Estate Planning Template Excel Templates

Real Estate Excel Financial Model Template Eloquens

12 Real Estate Excel Templates Excel Templates

Real Estate Excel Templates Gambaran

Real Estate Financial Model Excel Template for Complete Valuation with

Real Estate Financial Model Excel Template for Complete Valuation with

Web Real Estate Financial Modeling:

Web Download An Excel Real Estate Model From Our Extensive Library Of Real Estate Financial Pro Formas.

Web The Formula For Calculating The Occupancy At A Hotel Is As Follows.

Web List Of Free Excel Financial Model Templates.

Related Post: