Printable W 4 Form

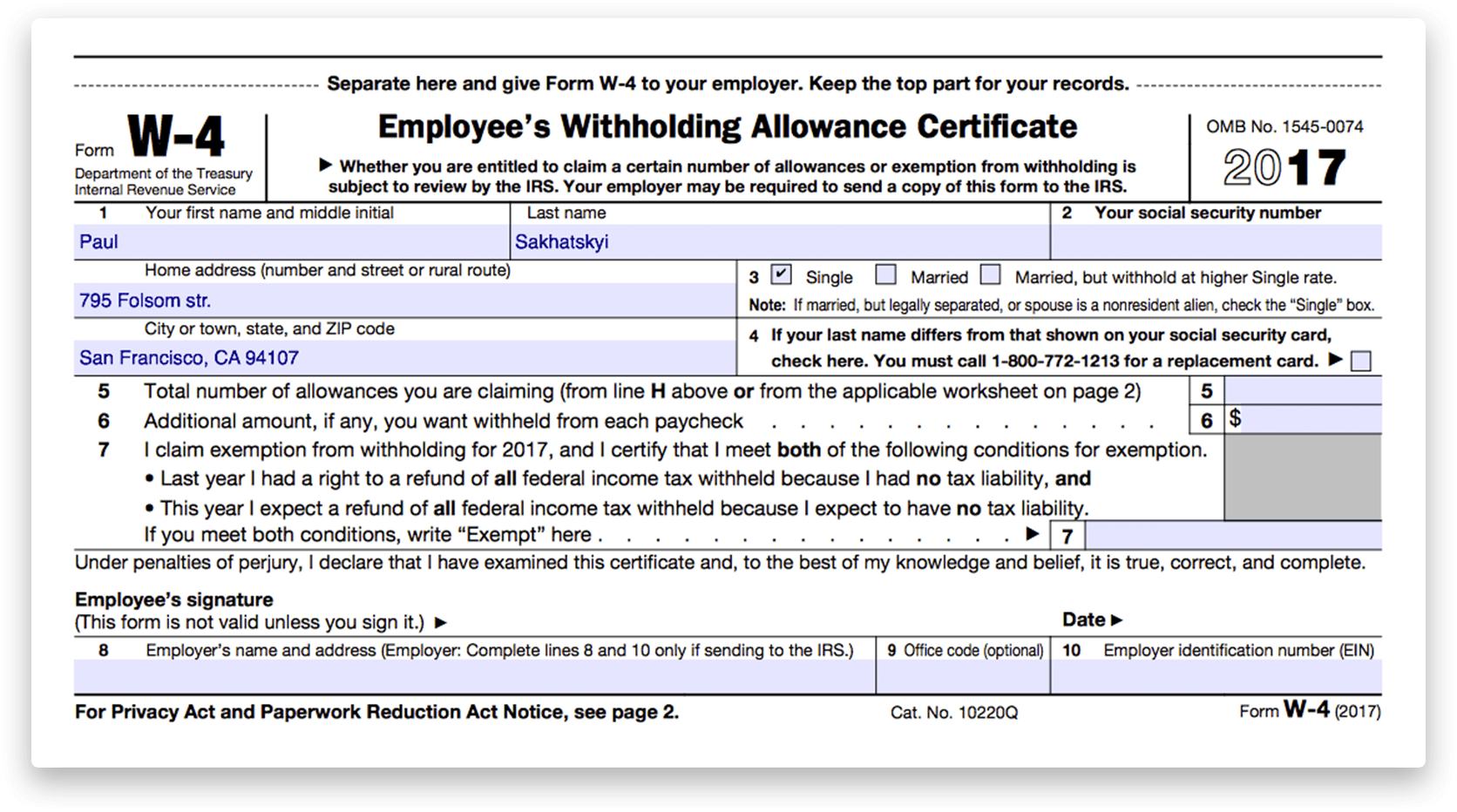

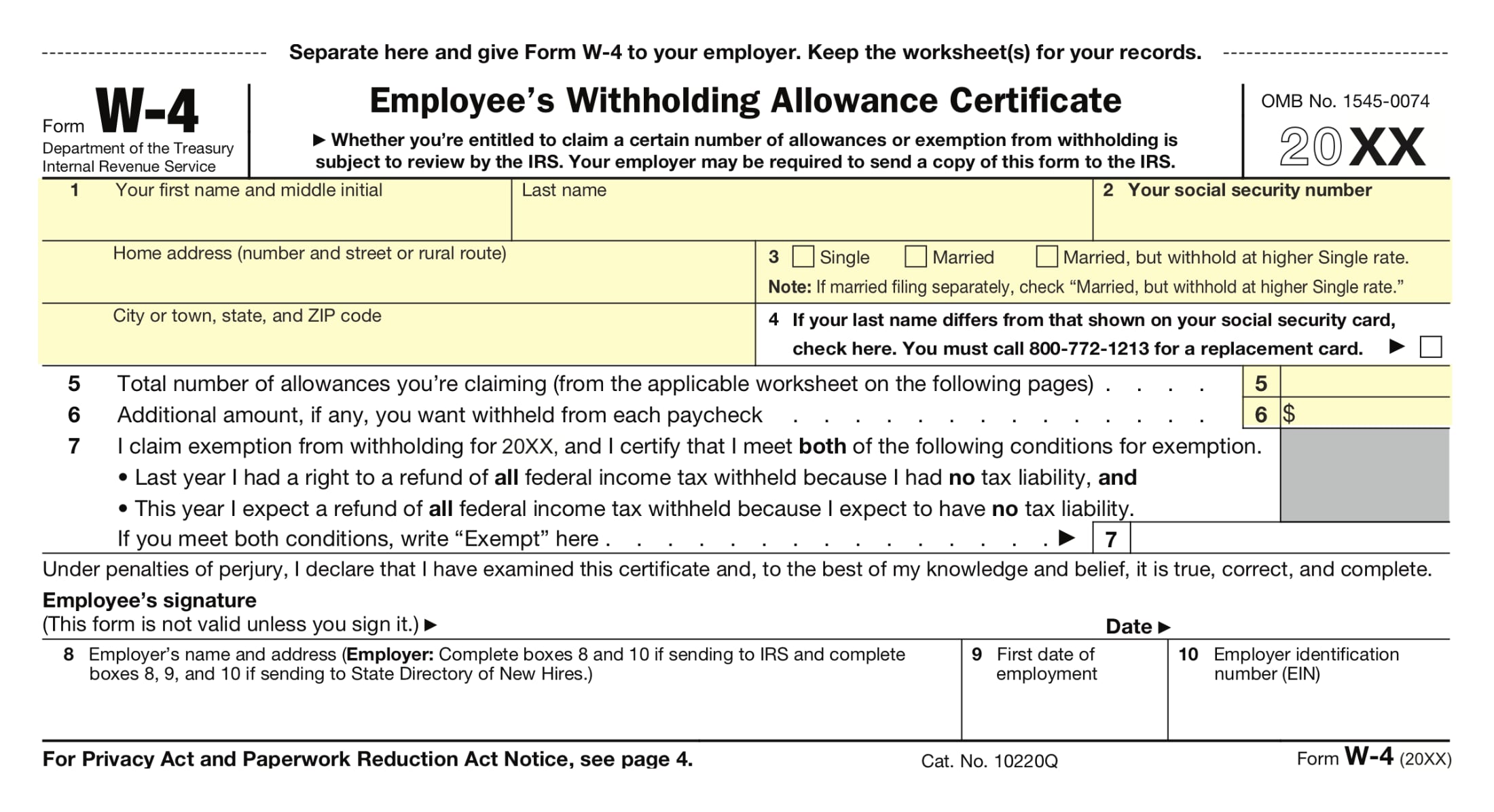

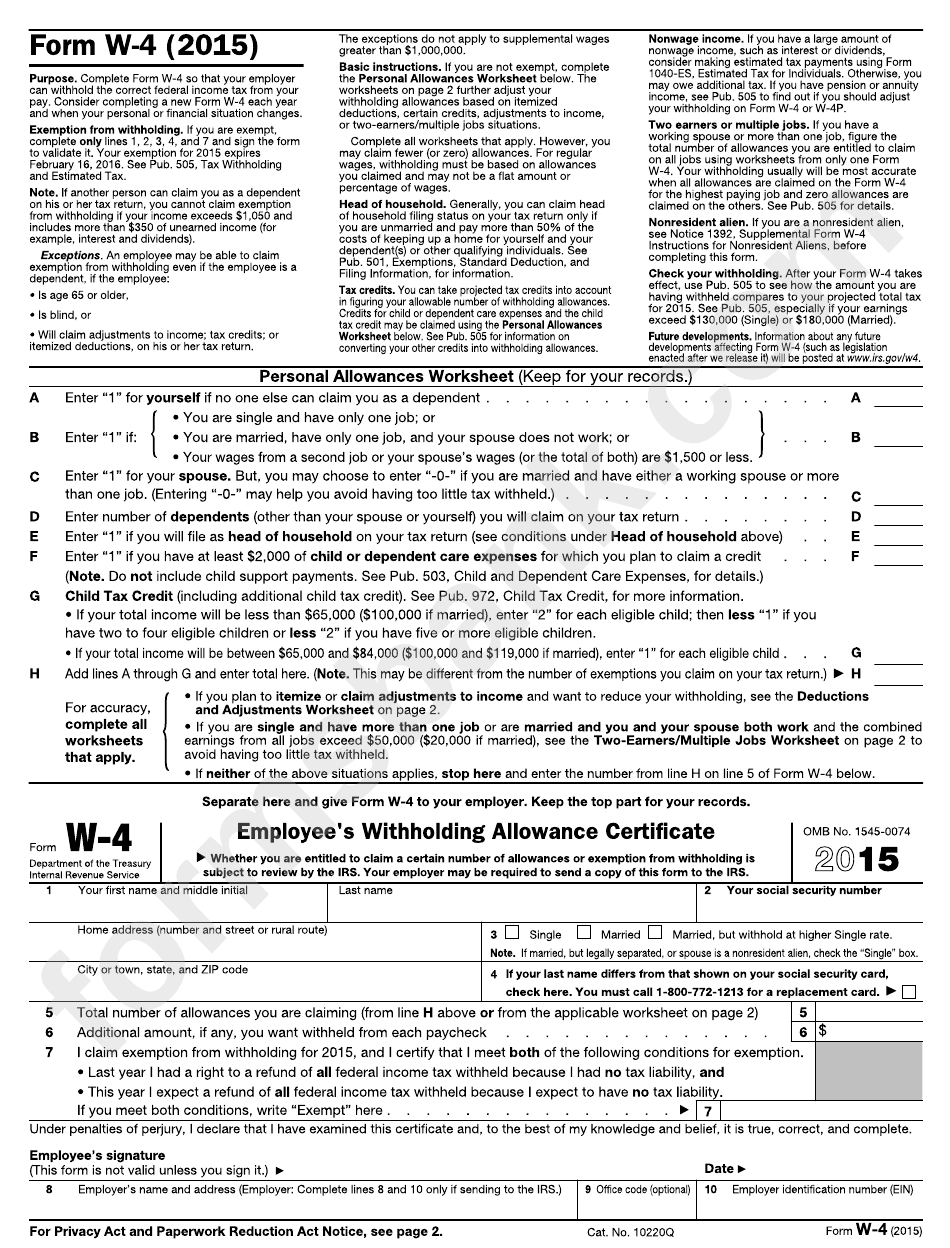

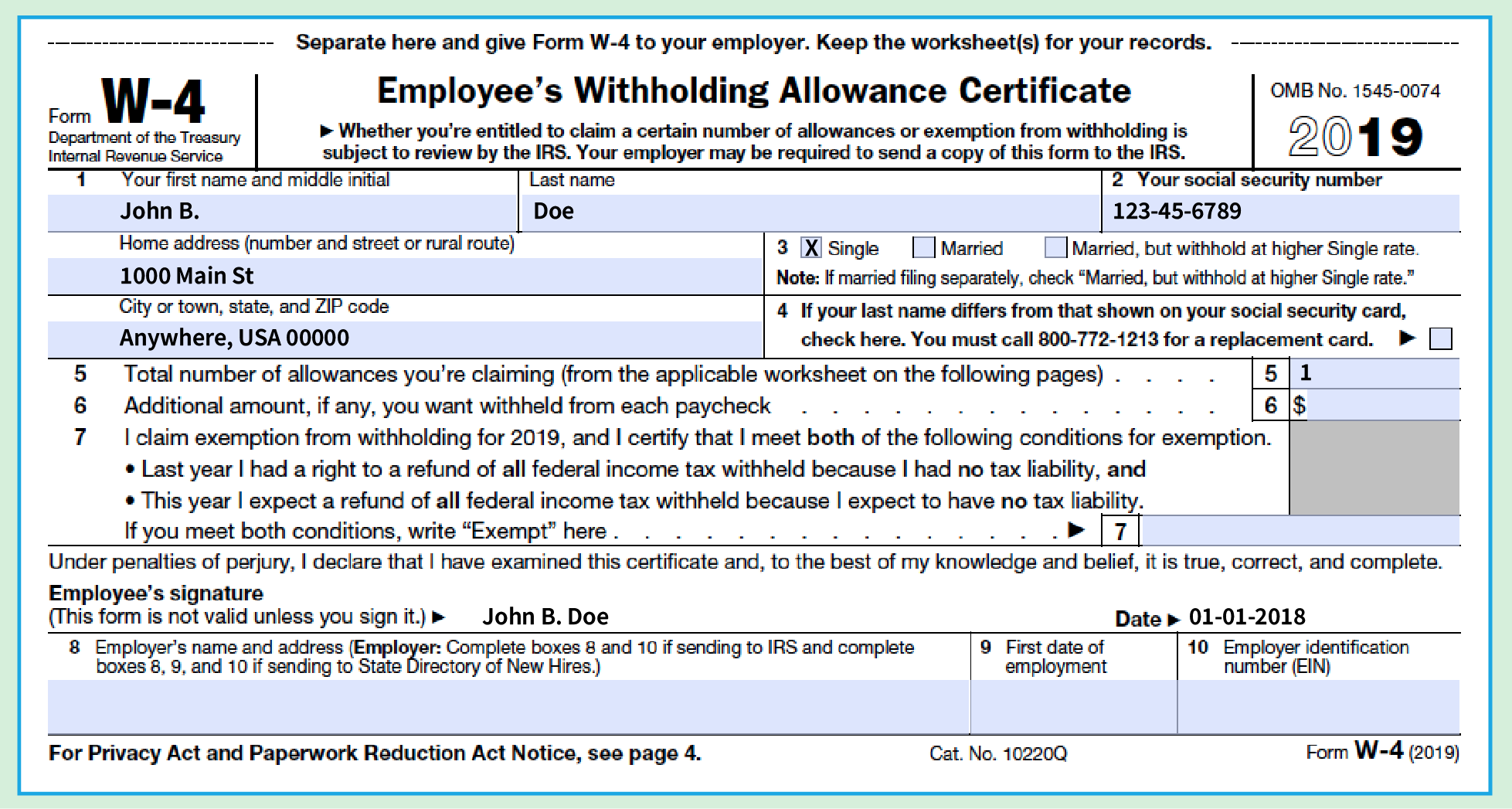

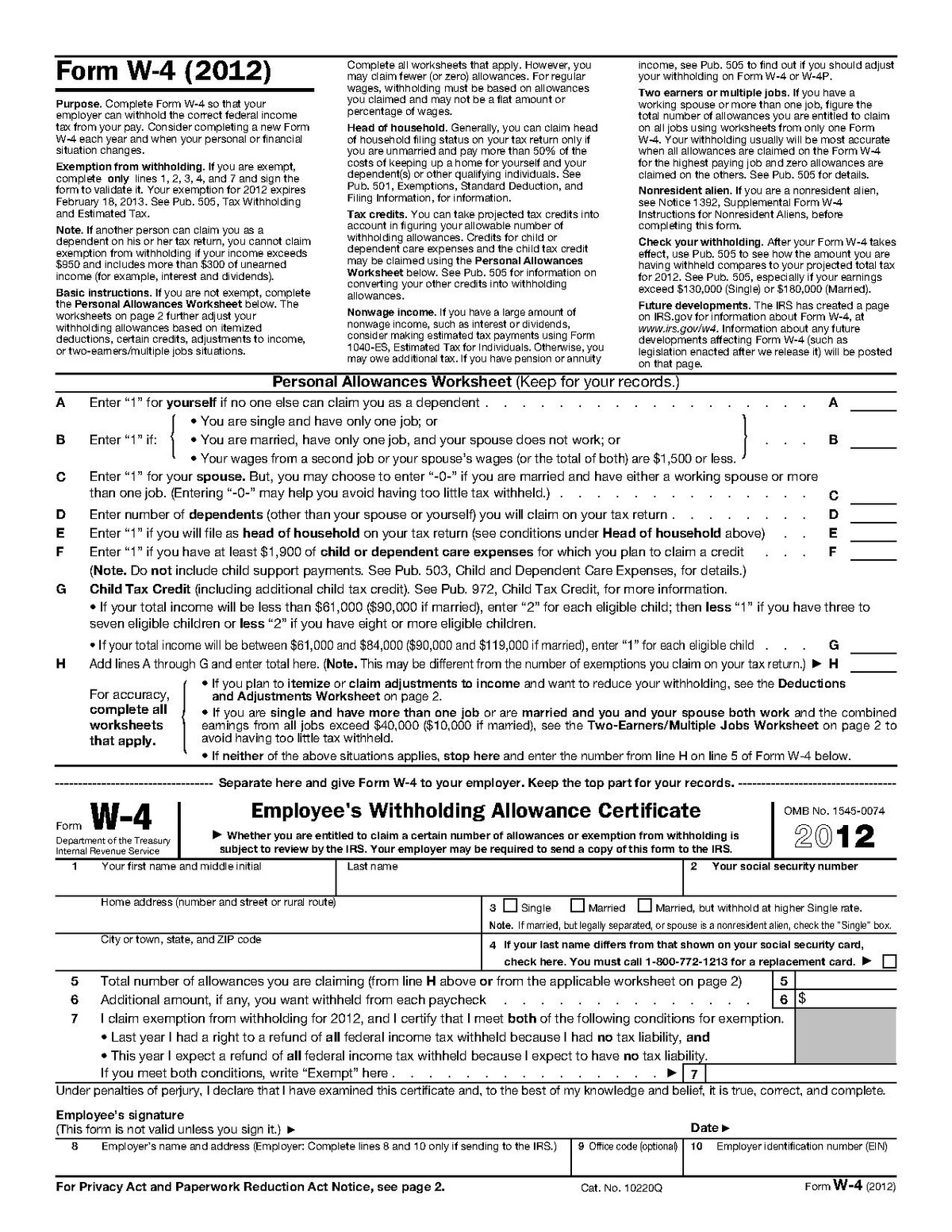

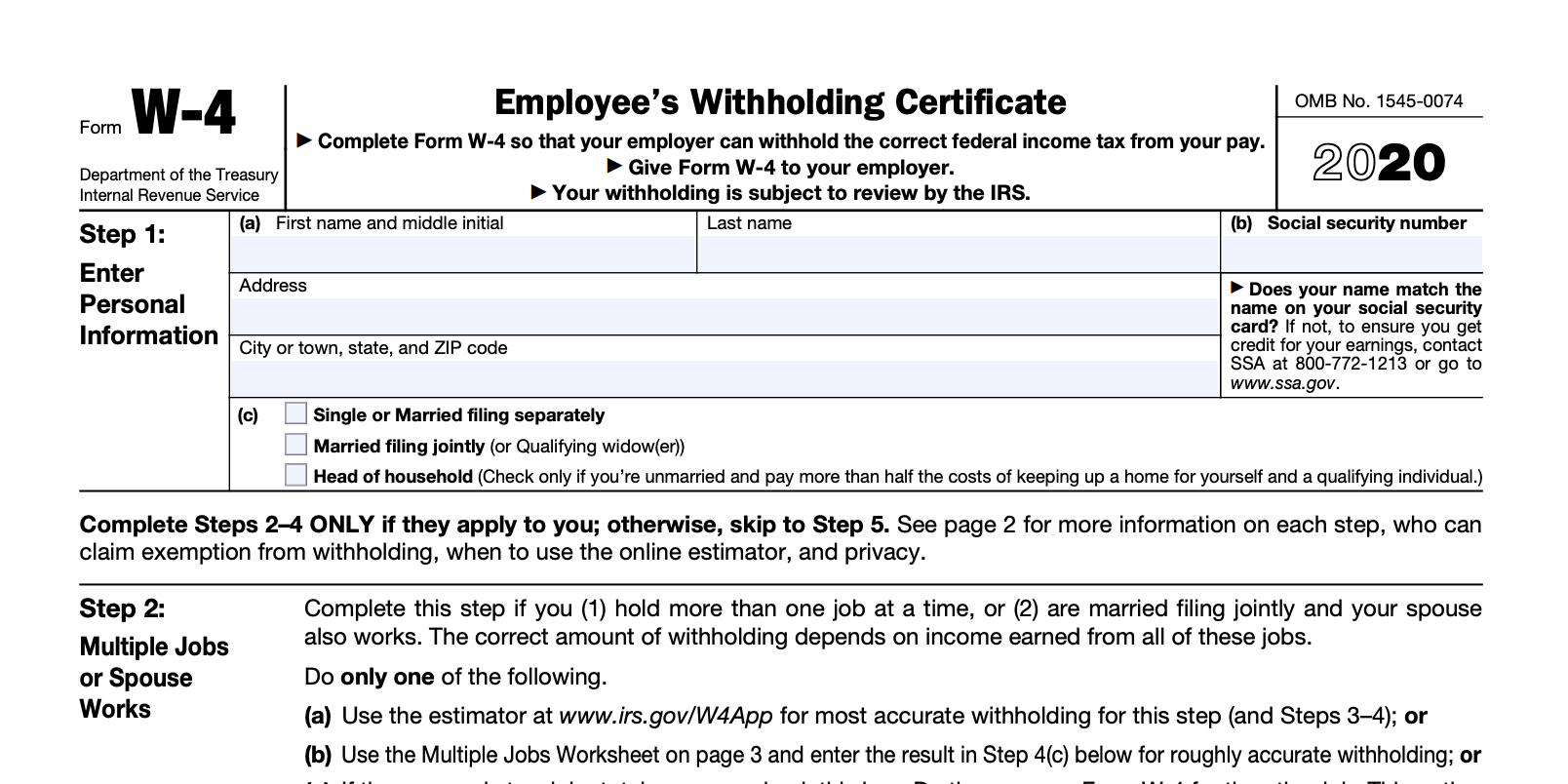

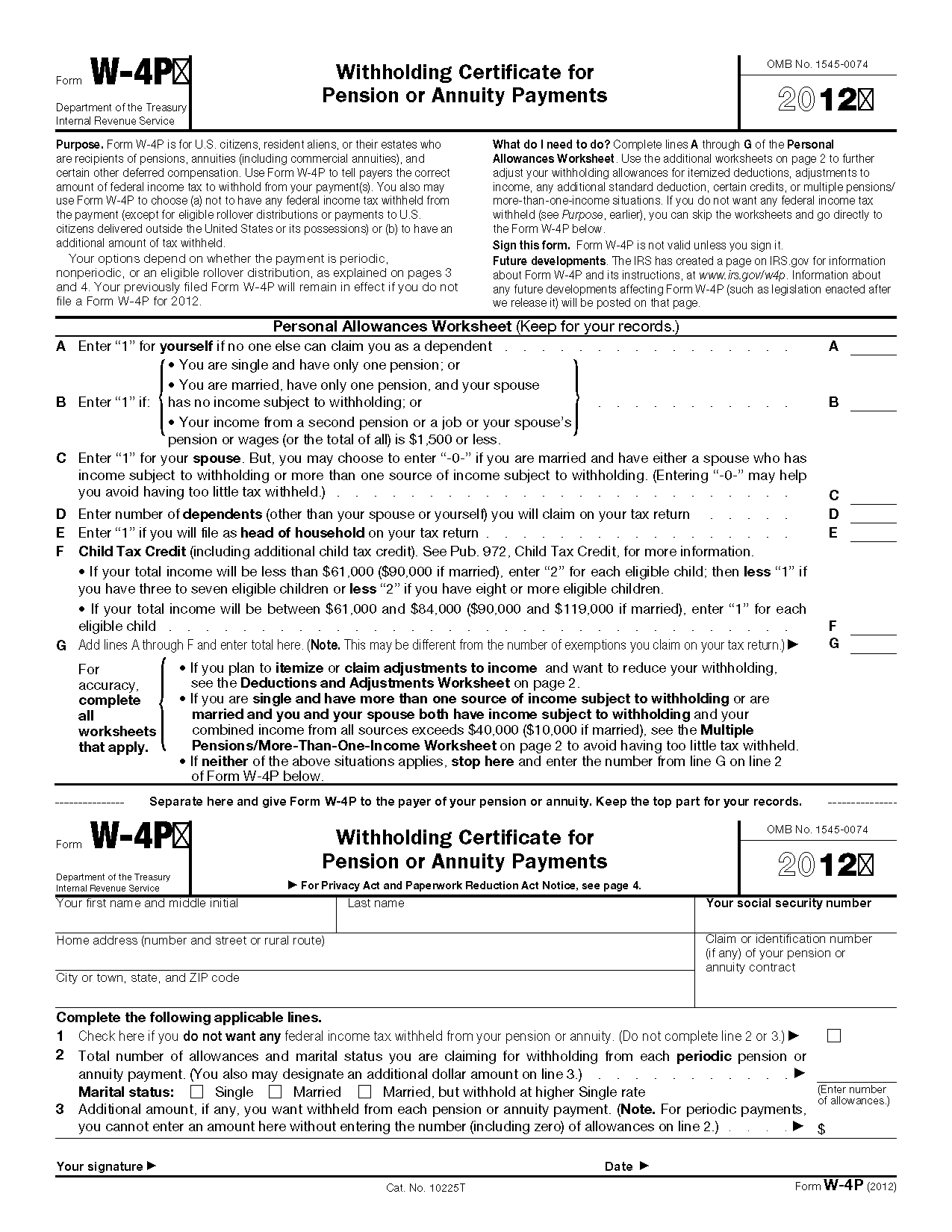

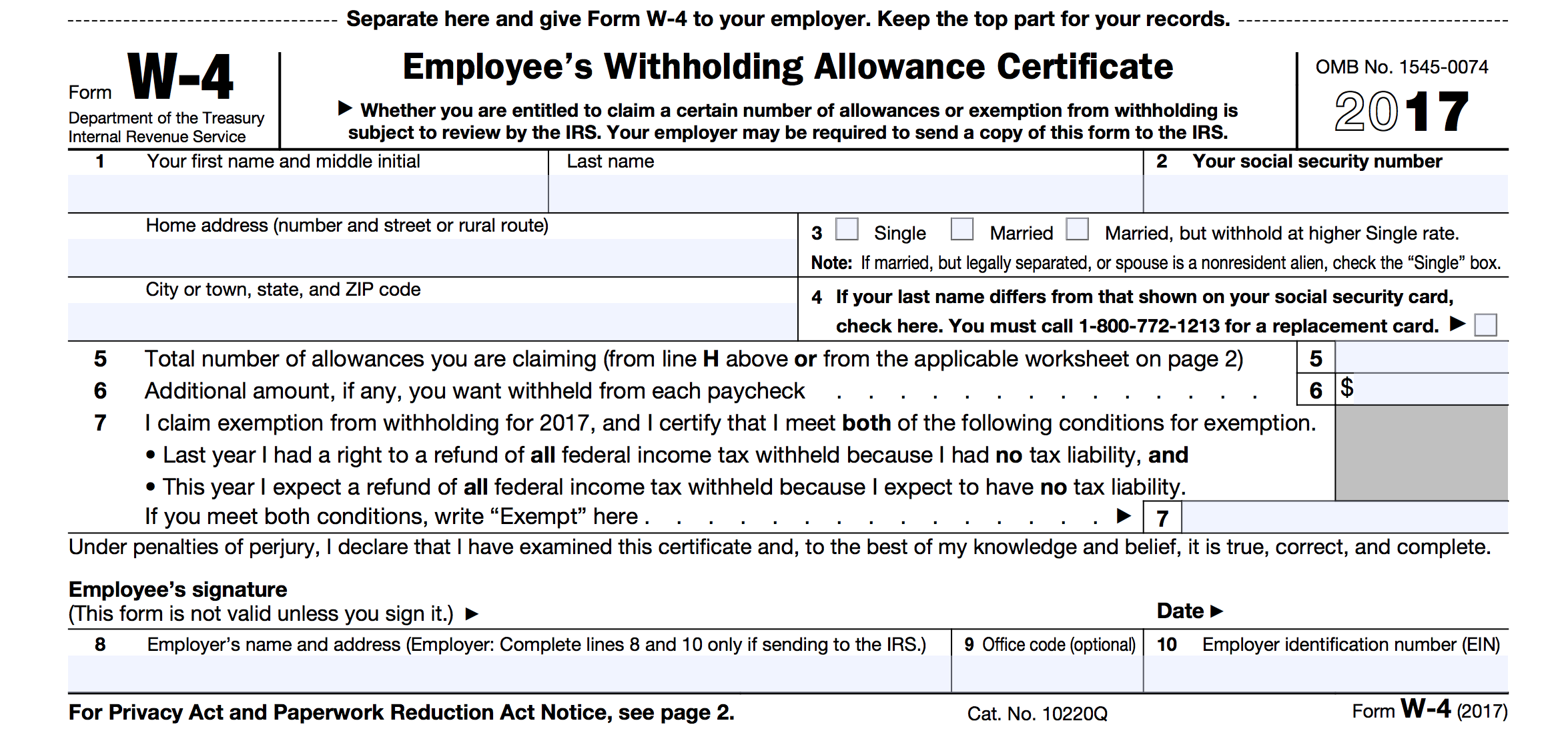

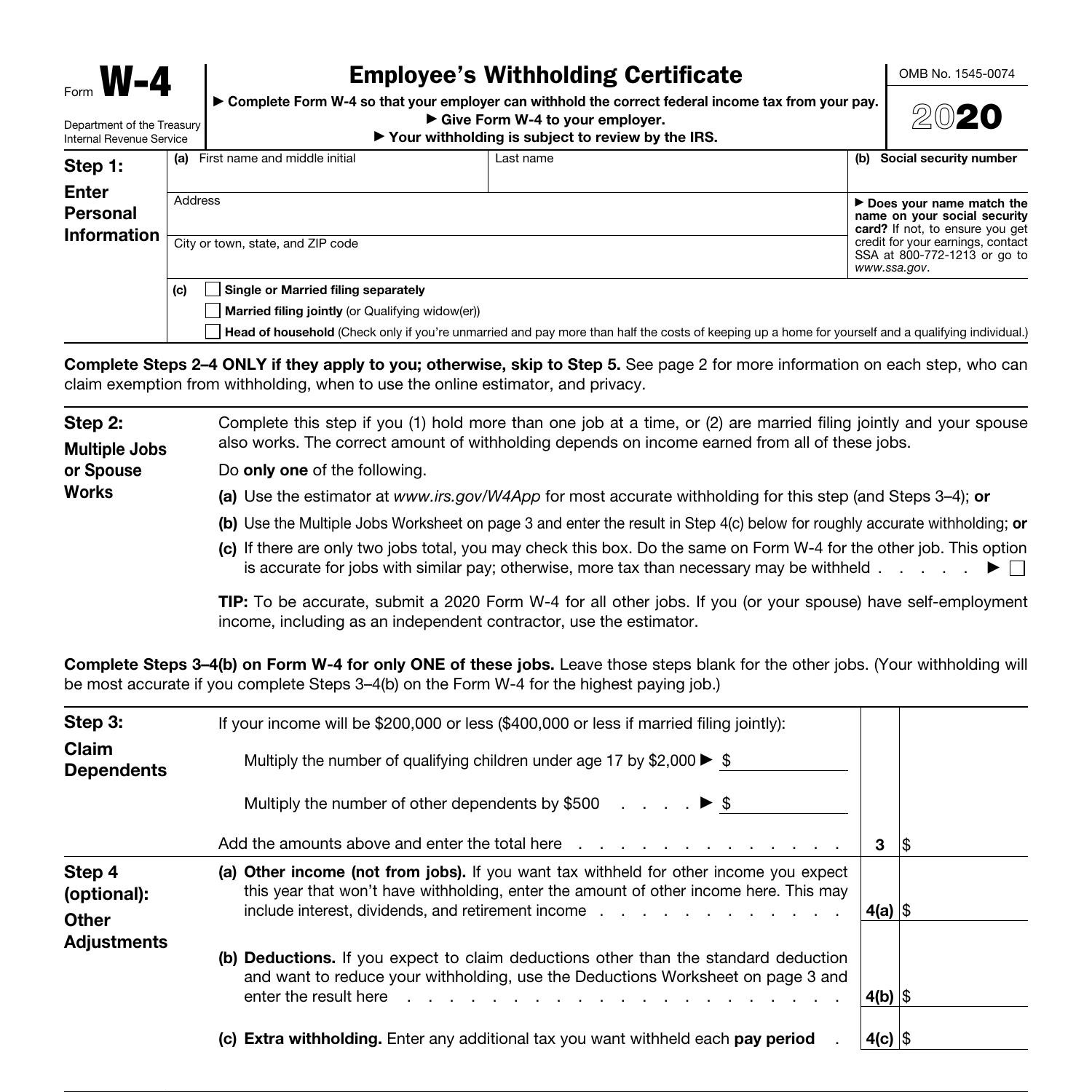

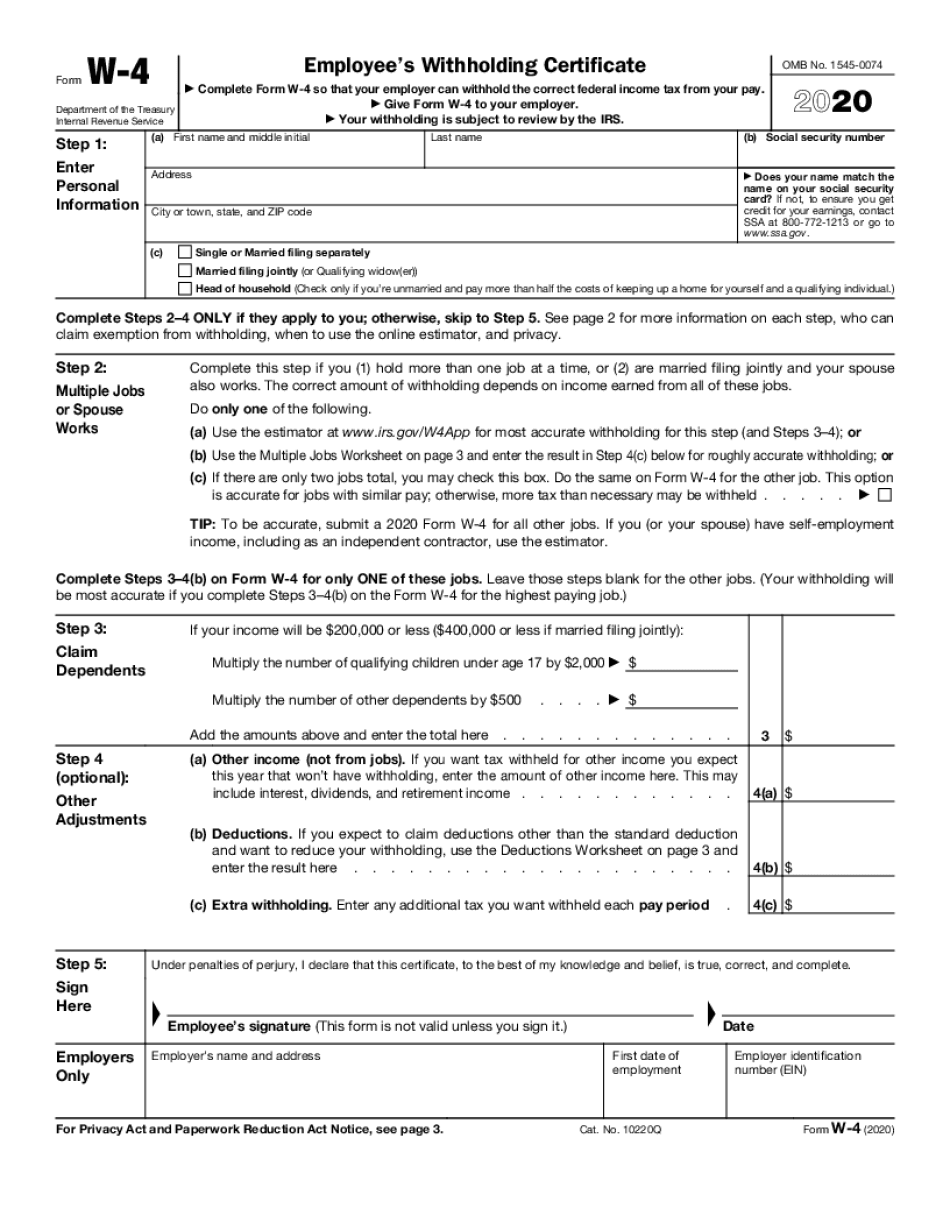

Printable W 4 Form - Leave those steps blank for the other jobs. Web updated august 05, 2023. You have to submit only the 1st page that includes the aforementioned 5 steps. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Your withholding is subject to review. The amount withheld from your. Begin by entering your personal information, including your full name, address, and social security number. Amazon.com has been visited by 1m+ users in the past month If too little is withheld, you will generally owe tax when you file. It tells the employer how much to withhold from an employee’s paycheck for taxes. Your withholding is subject to review. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. Use the 2nd page for calculations to. The amount withheld from your. It tells the employer how much to withhold from an employee’s paycheck for taxes. Your withholding is subject to review. Amazon.com has been visited by 1m+ users in the past month Begin by entering your personal information, including your full name, address, and social security number. Begin by entering your personal information, including your full name, address, and social security number. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Amazon.com has been visited by 1m+. Leave those steps blank for the other jobs. Use the 2nd page for calculations to. If too little is withheld, you will generally owe tax when you file. Web for maryland state government employees only. (check only one box) 1. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Web up to $40 cash back how to fill out w4 form 2022: Web updated august 05, 2023. Amazon.com has been visited by 1m+ users in the past month Begin by entering your personal information,. (check only one box) 1. Amazon.com has been visited by 1m+ users in the past month Use the 2nd page for calculations to. Web for maryland state government employees only. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. (check only one box) 1. Leave those steps blank for the other jobs. Your withholding is subject to review. Web updated august 05, 2023. Web up to $40 cash back how to fill out w4 form 2022: (check only one box) 1. Web updated august 05, 2023. It tells the employer how much to withhold from an employee’s paycheck for taxes. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. If too little is withheld, you will generally owe tax when. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file. Your withholding is subject to review. Amazon.com has been visited by 1m+ users in the past month If too little is withheld, you will generally owe tax when you file your. If too little is withheld, you will generally owe tax when you file your tax return. Begin by entering your personal information, including your full name, address, and social security number. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. (check only one box). Web in this video you’ll learn: Leave those steps blank for the other jobs. If too little is withheld, you will generally owe tax when you file. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. If too little is withheld, you will generally owe tax when you file your tax return. Web up to $40 cash back how to fill out w4 form 2022: Amazon.com has been visited by 1m+ users in the past month (check only one box) 1. The amount withheld from your. It tells the employer how much to withhold from an employee’s paycheck for taxes. Begin by entering your personal information, including your full name, address, and social security number. You have to submit only the 1st page that includes the aforementioned 5 steps. Your withholding is subject to review. Use the 2nd page for calculations to. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Use the 2nd page for calculations to. Web for maryland state government employees only. Web updated august 05, 2023. Web up to $40 cash back how to fill out w4 form 2022: Amazon.com has been visited by 1m+ users in the past month Your withholding is subject to review. (check only one box) 1. If too little is withheld, you will generally owe tax when you file your tax return. Web in this video you’ll learn: It tells the employer how much to withhold from an employee’s paycheck for taxes. The amount withheld from your. Begin by entering your personal information, including your full name, address, and social security number. If too little is withheld, you will generally owe tax when you file your tax return. You have to submit only the 1st page that includes the aforementioned 5 steps.How to fill out 2018 IRS Form W4 PDF Expert

W4

Form W4 Employee'S Withholding Allowance Certificate 2015

Il W 4 2020 2022 W4 Form

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Printable W4 Form For Employees Free Printable Templates

Irs Form W4p Printable Printable Forms Free Online

Free Printable W 4 Forms 2022 W4 Form

Form W4 2020.pdf DocDroid

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

If Too Little Is Withheld, You Will Generally Owe Tax When You File.

Leave Those Steps Blank For The Other Jobs.

If You Are An Employee, You Must Complete This Form So Your Employer Can Withhold The Correct Amount Of Illinois Income Tax From Your Pay.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

Related Post: