Printable Tax Exempt Form

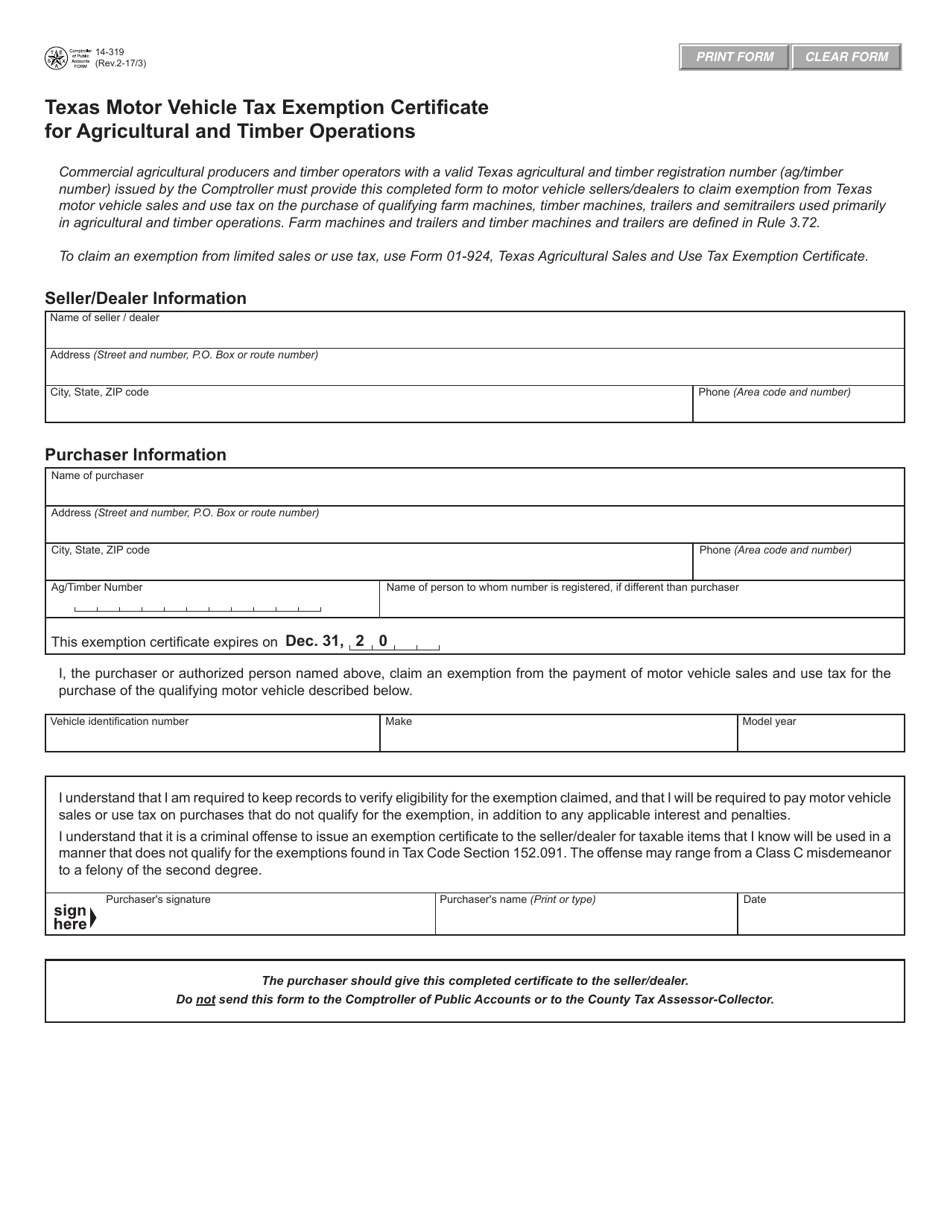

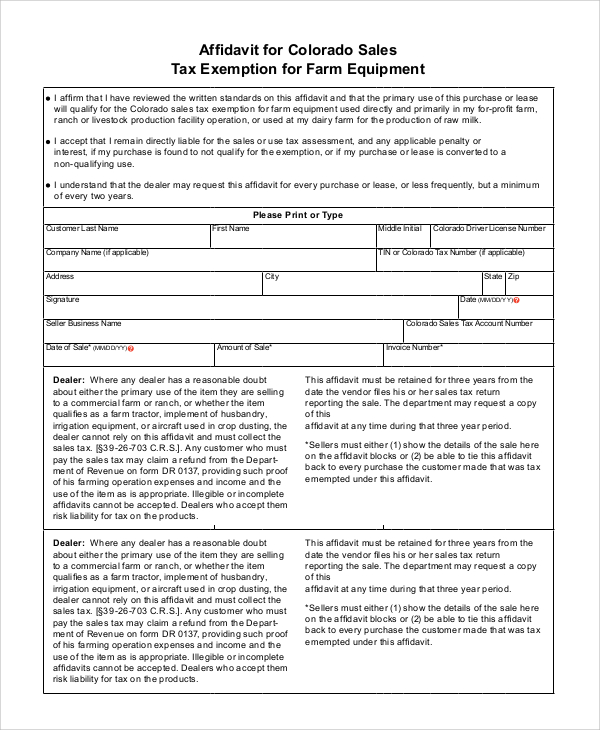

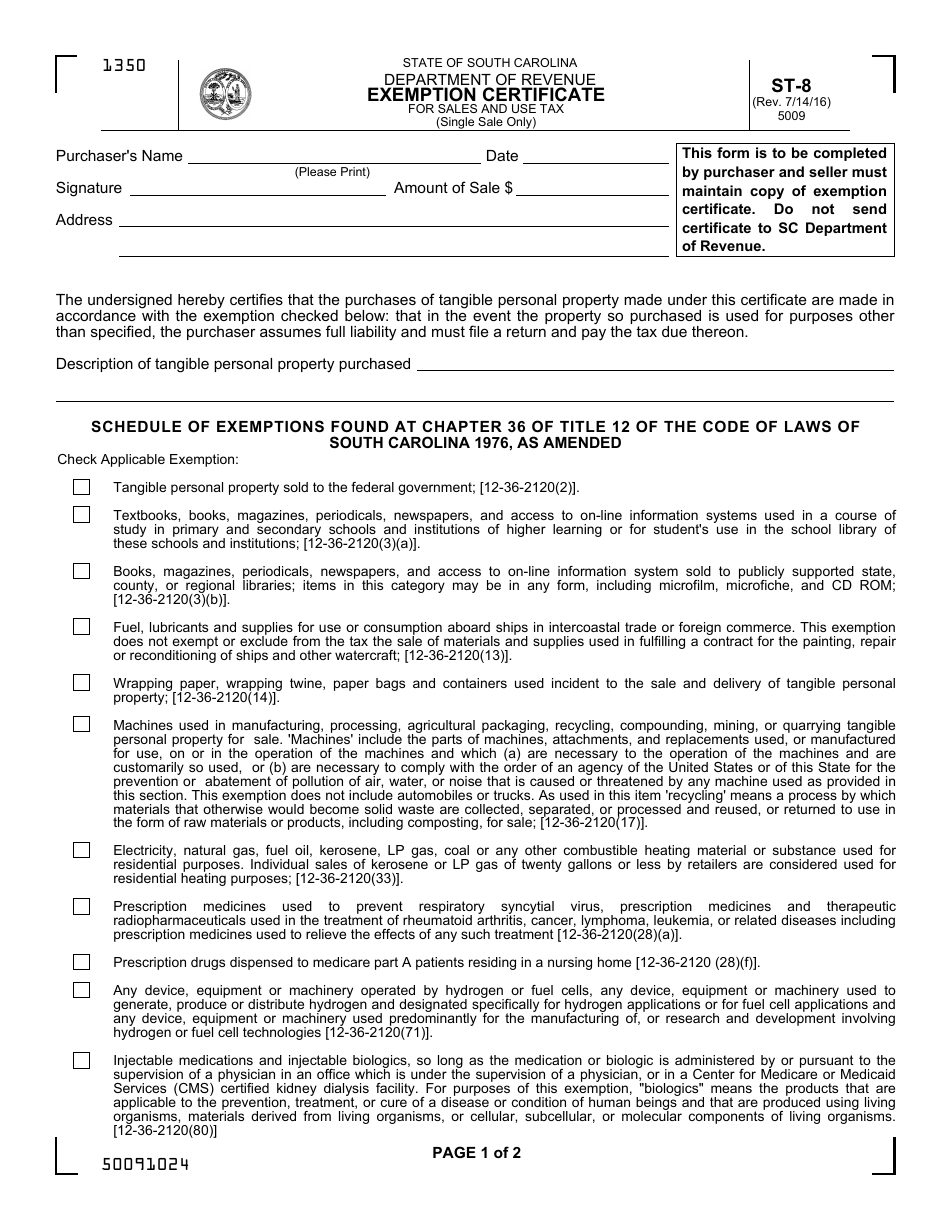

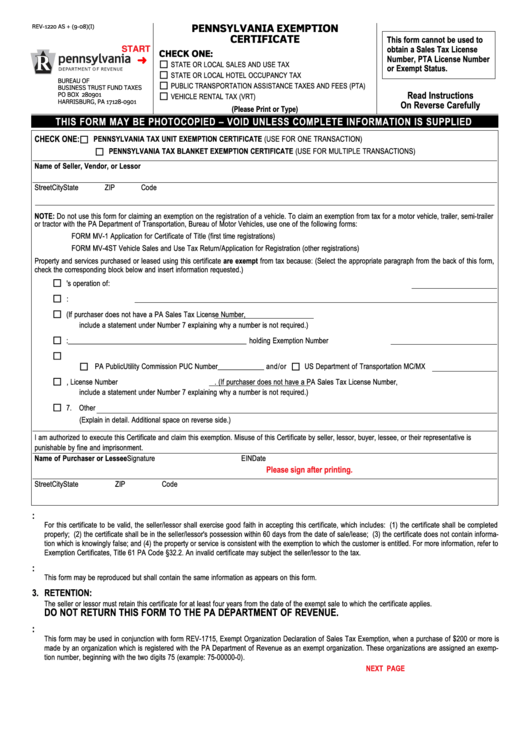

Printable Tax Exempt Form - Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). $520 for married couples who filed jointly with an. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Sales and use tax blanket exemption certificate. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web sales tax exemption documents. The application must be submitted. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Purchasers are to give the seller a properly completed form 13, section a, when making purchases of property or taxable services. December 2017) department of the treasury internal revenue service. Form 990, return of organization exempt from income tax. Certificate of indian exemption for certain property or services. Web exempt organizations forms & instructions. Only one form of exemption can. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Sales and use tax blanket exemption certificate. Under section 501(c)(3) of the internal. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Web united states tax exemption form. Web exempt organizations forms & instructions. The application must be submitted. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. Application for recognition of exemption. Only one form of exemption can. Web part 1 — exemptions related to production. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web texas applications for tax exemption. By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. $260 for each. By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. Under section 501(c)(3) of the internal. Web sales tax exemption documents. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Web purchases of tangible personal property for resale: Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Sales and use tax blanket exemption certificate. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. Application for recognition of exemption.. Web part 1 — exemptions related to production. Sales and use tax blanket exemption certificate. The application must be submitted. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. The forms listed below are pdf files. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. This certificate is only for use by a purchaser who: They include graphics, fillable form fields, scripts and functionality that work best with the free adobe. Under section 501(c)(3) of the internal. Application for recognition of exemption. Web how much will i receive? Under section 501(c)(3) of the internal. December 2017) department of the treasury internal revenue service. Web purchases of tangible personal property for resale: By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. Web texas applications for tax exemption. Sales and use tax blanket exemption certificate. Under section 501(c)(3) of the internal. United states tax exemption form. Pages 1 and 2 must be completed by the purchaser and given to the seller. Form 990, return of organization exempt from income tax. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Instructions for form 990 pdf. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Purchasers are to give the seller a properly completed form 13, section a, when making purchases of property or taxable services. $520 for married couples who filed jointly with an. December 2017) department of the treasury internal revenue service. This certificate is only for use by a purchaser who: By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. The forms listed below are pdf files. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). They include graphics, fillable form fields, scripts and functionality that work best with the free adobe. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web part 1 — exemptions related to production. Application for recognition of exemption. Web instructions who may issue a resale certificate. Web united states tax exemption form. Web purchases of tangible personal property for resale: United states tax exemption form. Web sales tax exemption documents. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web part 1 — exemptions related to production. $520 for married couples who filed jointly with an. Only one form of exemption can. Under section 501(c)(3) of the internal. December 2017) department of the treasury internal revenue service. Certificate of indian exemption for certain property or services. Purchasers are to give the seller a properly completed form 13, section a, when making purchases of property or taxable services. The application must be submitted. Web how much will i receive? Web united states tax exemption form. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. Web instructions who may issue a resale certificate. Application for recognition of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice).California Farm Tax Exemption Form Fill Online, Printable, Fillable

Bupa Tax Exemption Form FREE 10+ Sample Tax Exemption Forms in PDF

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

Sd Tax Exempt Form Fill and Sign Printable Template Online US Legal

St119 1 Fillable Form 20202022 Fill and Sign Printable Template

FREE 10+ Sample Tax Exemption Forms in PDF

20172020 Form PA DoR REV1220 AS Fill Online, Printable, Fillable

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Form ST8 Download Fillable PDF or Fill Online Exemption Certificate

Fillable Form Rev1220 Pennsylvania Exemption Certificate printable

Web Sales Tax Exemption Documents.

It Is To Be Fi Lled Out Completely By The Purchaser And Furnished To The Vendor.

The Forms Listed Below Are Pdf Files.

Edit Pdfs, Create Forms, Collect Data, Collaborate With Your Team, Secure Docs And More.

Related Post: