Printable Tax Deduction Worksheet

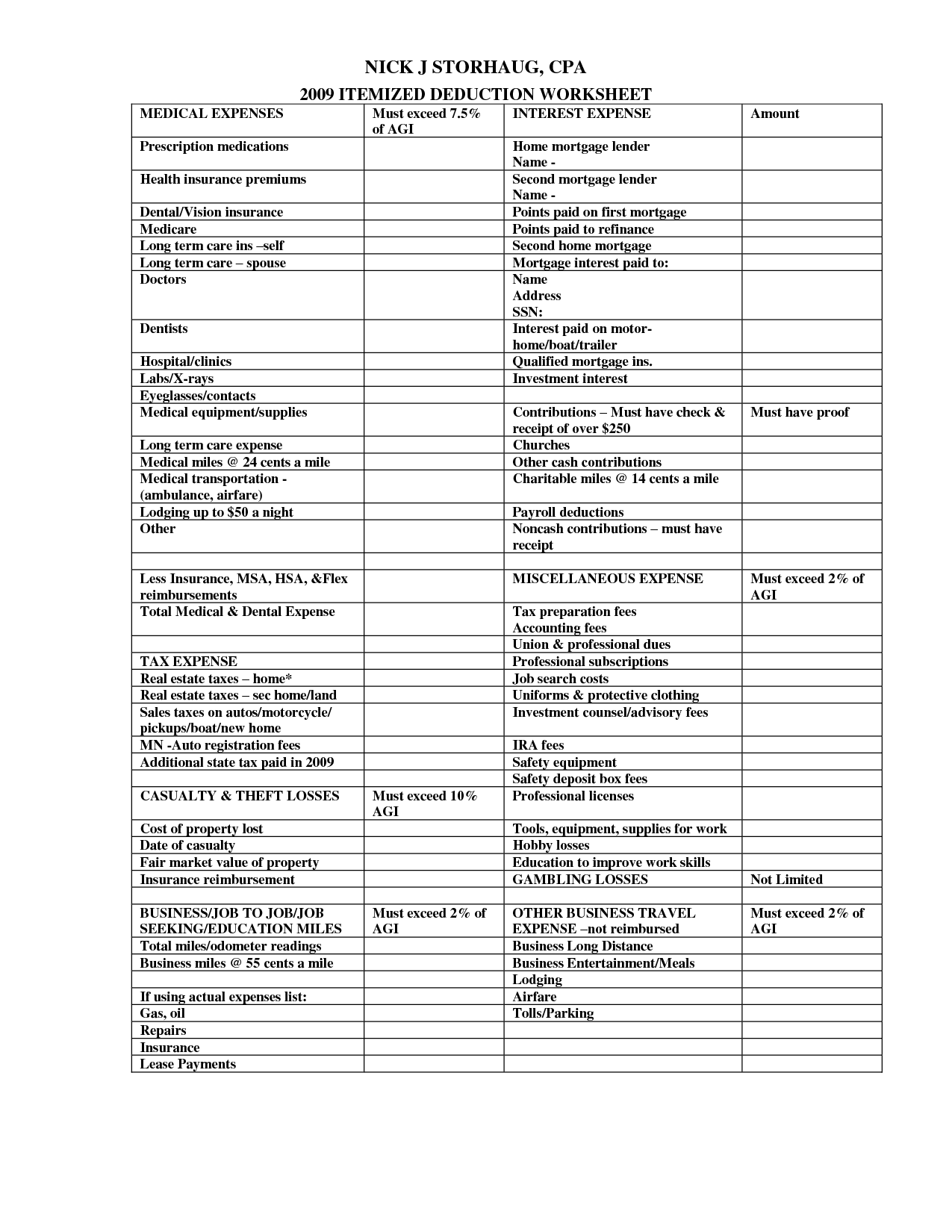

Printable Tax Deduction Worksheet - Web use worksheet a for regular withholding allowances. Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your. Type text, add images, blackout confidential details, add comments,. Number of regular withholding allowances. Enter here and on schedule 1 (form 1040), line 15. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Multiply line 12 by 50% (0.50). Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. If too little is withheld, you will generally owe tax when you file. Web small business worksheet client: Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Web standard deduction can’t be used. Edit your itemized deductions worksheet online. Use other worksheets on the following pages as applicable. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. It doesn’t matter which spouse files first. Web about schedule a (form 1040), itemized deductions. Web tax deduction worksheet this worksheet allows you to itemize. Use other worksheets on the following pages as applicable. Enter here and on schedule 1 (form 1040), line 15. Examples of what type of. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web use worksheet a for regular withholding allowances. Sign it in a few clicks draw. Number of regular withholding allowances. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Type text, add images, blackout confidential details, add comments,. Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your. Web standard deduction can’t be used. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Web download your free copy of our business expense categories worksheet. Tax deductions for. Web standard deduction can’t be used. In most cases, your federal income tax. Sign it in a few clicks draw. Web download your free copy of our business expense categories worksheet. Printable yearly itemized tax deduction worksheet get printable yearly. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Edit your itemized deductions worksheet online. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it. Number of regular withholding allowances. Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. It doesn’t matter which spouse files first. In most cases, your federal income tax. This list is a great quick reference guide and includes: Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. If too little is withheld, you will generally owe tax when you file. Edit your itemized deductions worksheet online. Web the government offers a number of deductions and credits to help lower the. It doesn’t matter which spouse files first. Web about schedule a (form 1040), itemized deductions. Enter here and on schedule 1 (form 1040), line 15. Edit your itemized deductions worksheet online. Type text, add images, blackout confidential details, add comments,. It doesn’t matter which spouse files first. Web you can also download it, export it or print it out. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Tax deductions for calendar year 2 0 ___ ___ marketing. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Use other worksheets on the following pages as applicable. Edit your itemized deductions worksheet online. Web use worksheet a for regular withholding allowances. This list is a great quick reference guide and includes: Web download your free copy of our business expense categories worksheet. Sign it in a few clicks draw. Enter here and on schedule 1 (form 1040), line 15. Web small business worksheet client: Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Printable yearly itemized tax deduction worksheet get printable yearly. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Number of regular withholding allowances. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. Type text, add images, blackout confidential details, add comments,. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web download your free copy of our business expense categories worksheet. Web the government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. Edit your itemized deductions worksheet online. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Web small business worksheet client: Printable yearly itemized tax deduction worksheet get printable yearly. Type text, add images, blackout confidential details, add comments,. Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Sign it in a few clicks draw. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web standard deduction can’t be used. Tax deductions for calendar year 2 0 ___ ___ marketing. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. If too little is withheld, you will generally owe tax when you file. As a result, your maximum.Printable Yearly Itemized Tax Deduction Worksheet Fill Online

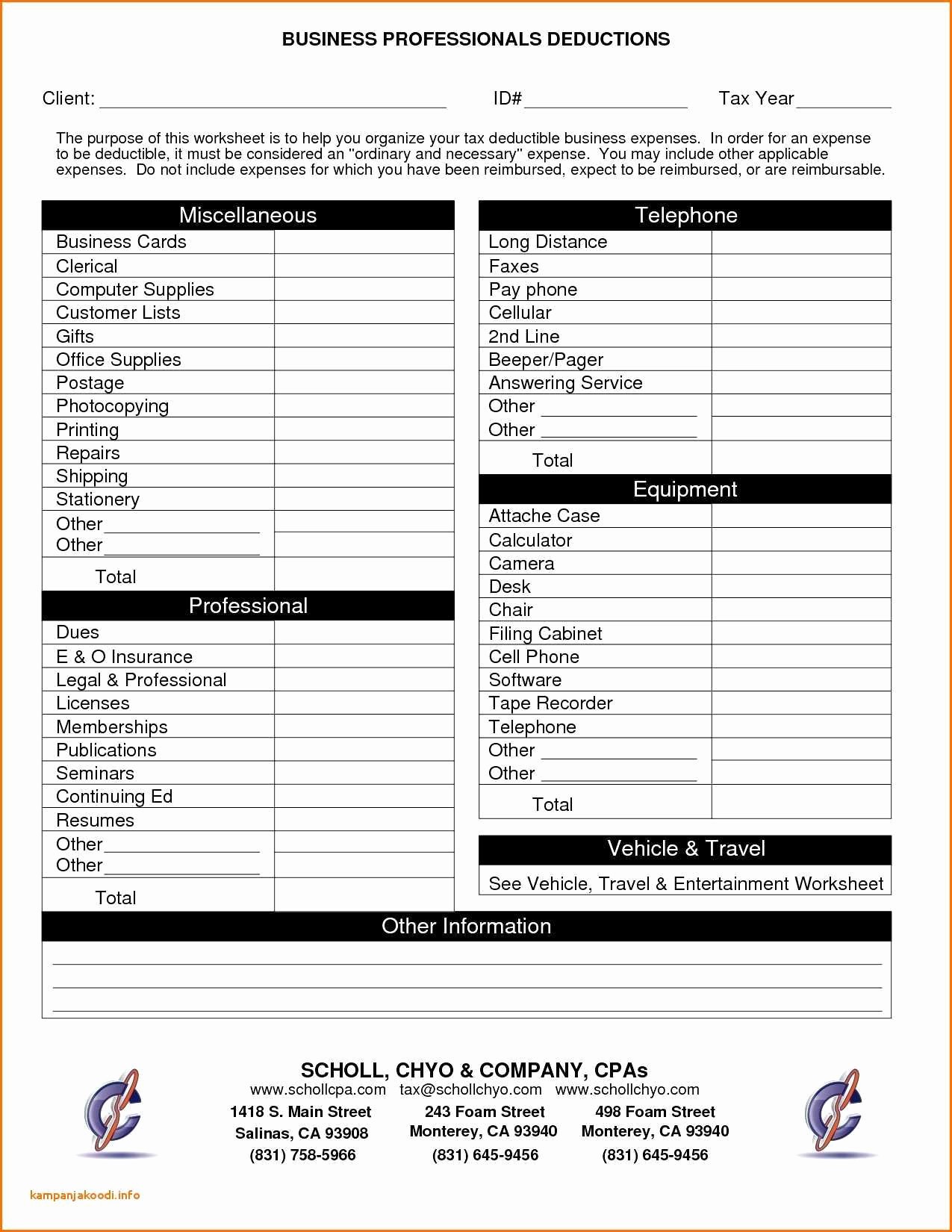

Small Business Deductions Worksheet petermcfarland.us

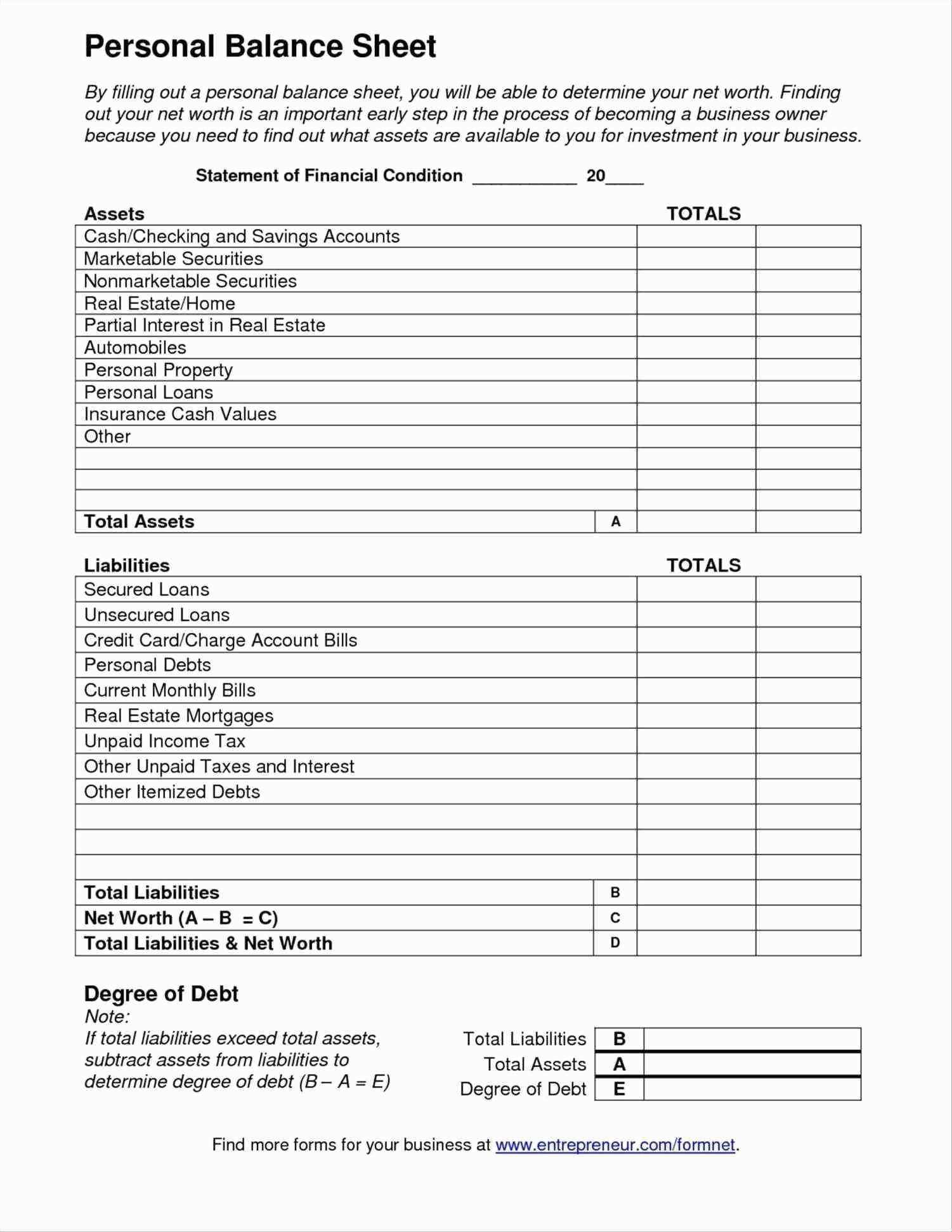

Itemized Deductions Spreadsheet in Business Itemized Deductions

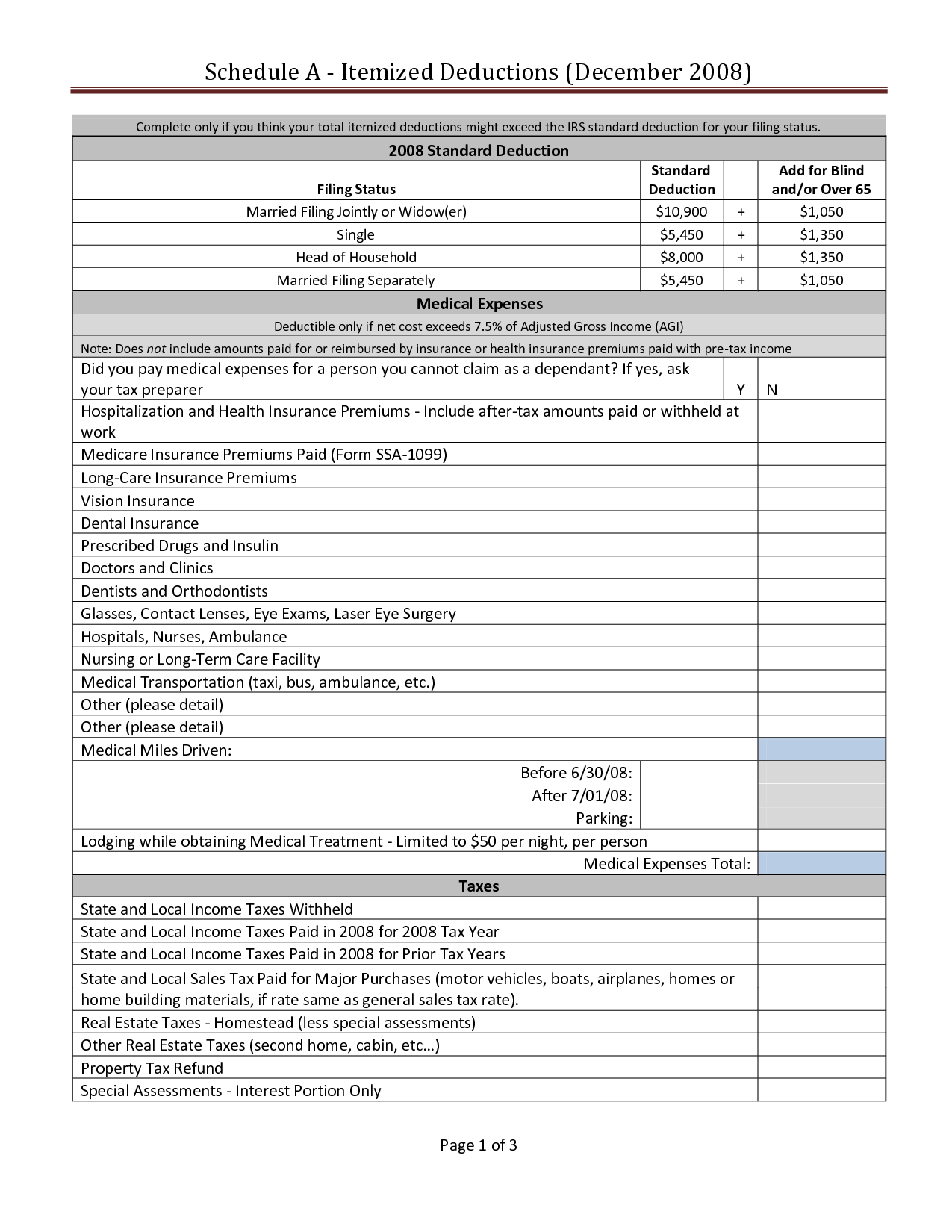

5 Itemized Tax Deduction Worksheet /

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

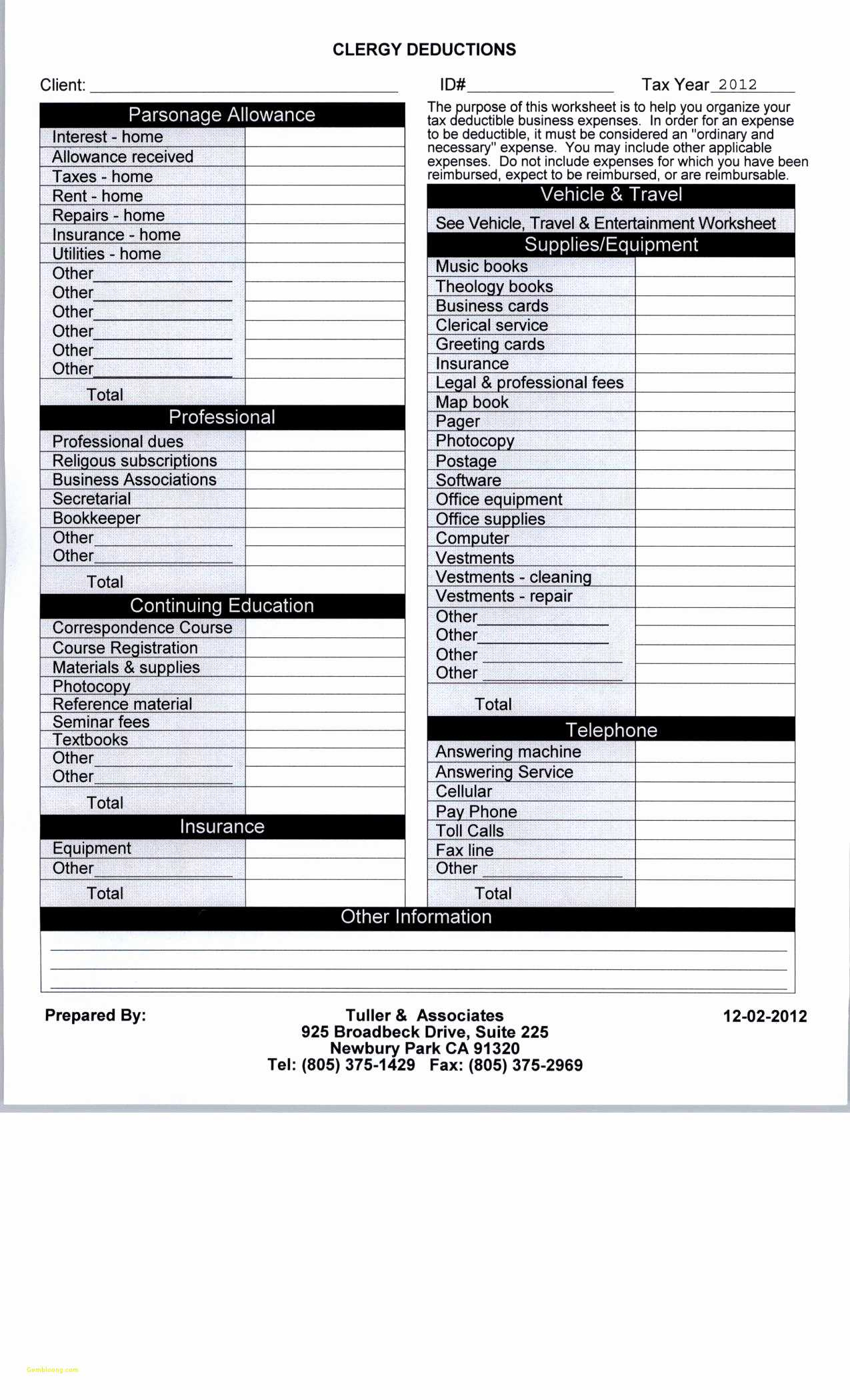

14 Best Images of Home Office Employee Worksheet Tax Deduction

10 Best Images of Business Tax Deductions Worksheet Tax Itemized

8 Tax Itemized Deduction Worksheet /

Printable Itemized Deductions Worksheet

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

Number Of Regular Withholding Allowances.

Multiply Line 12 By 50% (0.50).

Web If Your Total Income Will Be $200,000 Or Less ($400,000 Or Less If Married Filing Jointly):

Enter Here And On Schedule 1 (Form 1040), Line 15.

Related Post: