Printable Itemized Deductions Worksheet

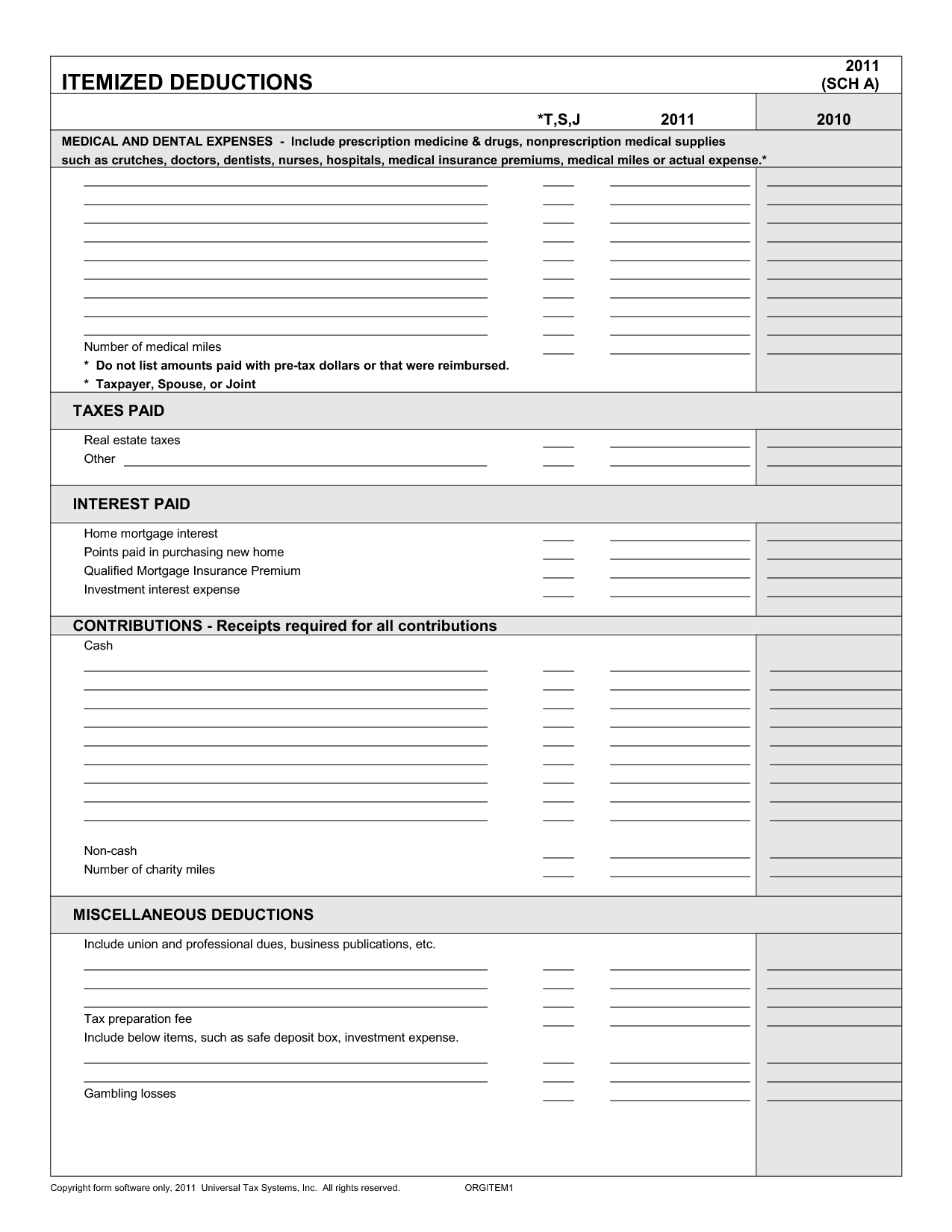

Printable Itemized Deductions Worksheet - Complete, edit or print tax forms instantly. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Maximum $250 each ($500 joint). Involved parties names, places of. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. Easily fill out pdf blank, edit, and sign them. Web we’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Get ready for tax season deadlines by completing any required tax forms today. Web find the list of itemized deductions worksheet you require. Save or instantly send your ready. Open it up using the online editor and start altering. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. Web claiming standard deduction or itemized deductions: Classroom expenses of teachers, counselors, and principals. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can. Printable itemized deductions worksheet get printable itemized. They help you get your taxes done. Most taxpayers have a choice of taking a. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can. 29 30 enter the larger of the amount on line 29 or your standard deduction. Easily fill out pdf blank, edit, and sign them. Ad access irs tax forms. Federal section>deductions>itemized deductions>medical and dental. Maximum $250 each ($500 joint). This schedule is used by filers to. Ad access irs tax forms. Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Open it up using the online editor and start altering. Web adjustment worksheet educator expenses. Web worksheet allows you to itemize your tax deductions for a given year. Most taxpayers have a choice of taking a. This schedule is used by filers to. They help you get your taxes done right, save you time, and explain your unique situation. This schedule is used by filers to. Web find the list of itemized deductions worksheet you require. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Most taxpayers have a choice of taking. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Most taxpayers have a choice of taking a. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Web complete. Printable itemized deductions worksheet get printable itemized. Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Open it up using the online editor and start altering. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can. Classroom expenses of teachers, counselors, and principals. Complete, edit or print tax forms instantly. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Easily fill out pdf blank, edit, and sign. Web adjustment worksheet educator expenses. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can. Printable itemized deductions worksheet get printable itemized. Classroom expenses of teachers, counselors, and principals. 29 30 enter the larger of the amount on line 29 or your standard deduction. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. Web claiming standard deduction or itemized deductions: Web find the list of itemized deductions worksheet you require. 29 30 enter the larger of the amount on line 29 or your standard deduction. Easily fill out pdf blank, edit, and sign them. Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Printable itemized deductions worksheet get printable itemized. Federal section>deductions>itemized deductions>medical and dental. • see form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can. Most taxpayers have a choice of taking a. Web adjustment worksheet educator expenses. Fill out the blank areas; Maximum $250 each ($500 joint). Save or instantly send your ready. Ad a tax preparation service makes sure you get every deduction you've earned. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Open it up using the online editor and start altering. They help you get your taxes done right, save you time, and explain your unique situation. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Ad access irs tax forms. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Save or instantly send your ready. Web find the list of itemized deductions worksheet you require. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. Fill out the blank areas; Printable itemized deductions worksheet get printable itemized. Open it up using the online editor and start altering. Ad a tax preparation service makes sure you get every deduction you've earned. Web we’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): They help you get your taxes done right, save you time, and explain your unique situation. Maximum $250 each ($500 joint). Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Tax deductions for calendar year 2 0 ___ ___ marketing $___________ advertising continued.Itemized Deductions Worksheet 2017 Printable Worksheets and

Printable Itemized Deductions Worksheet

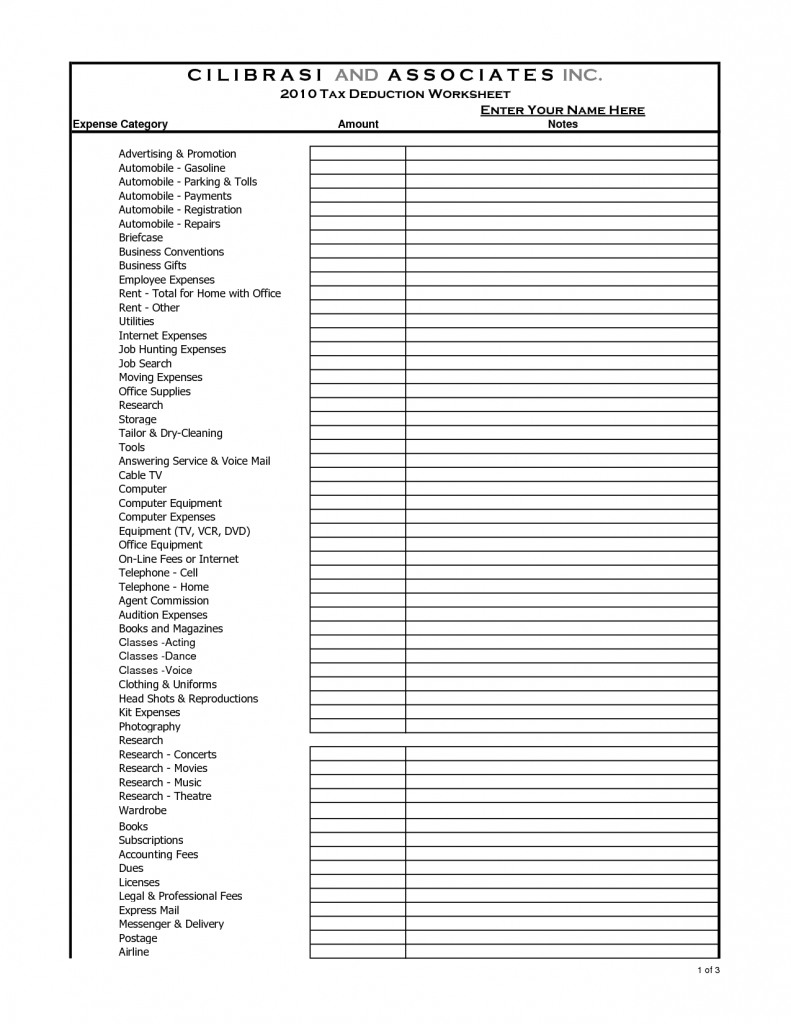

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

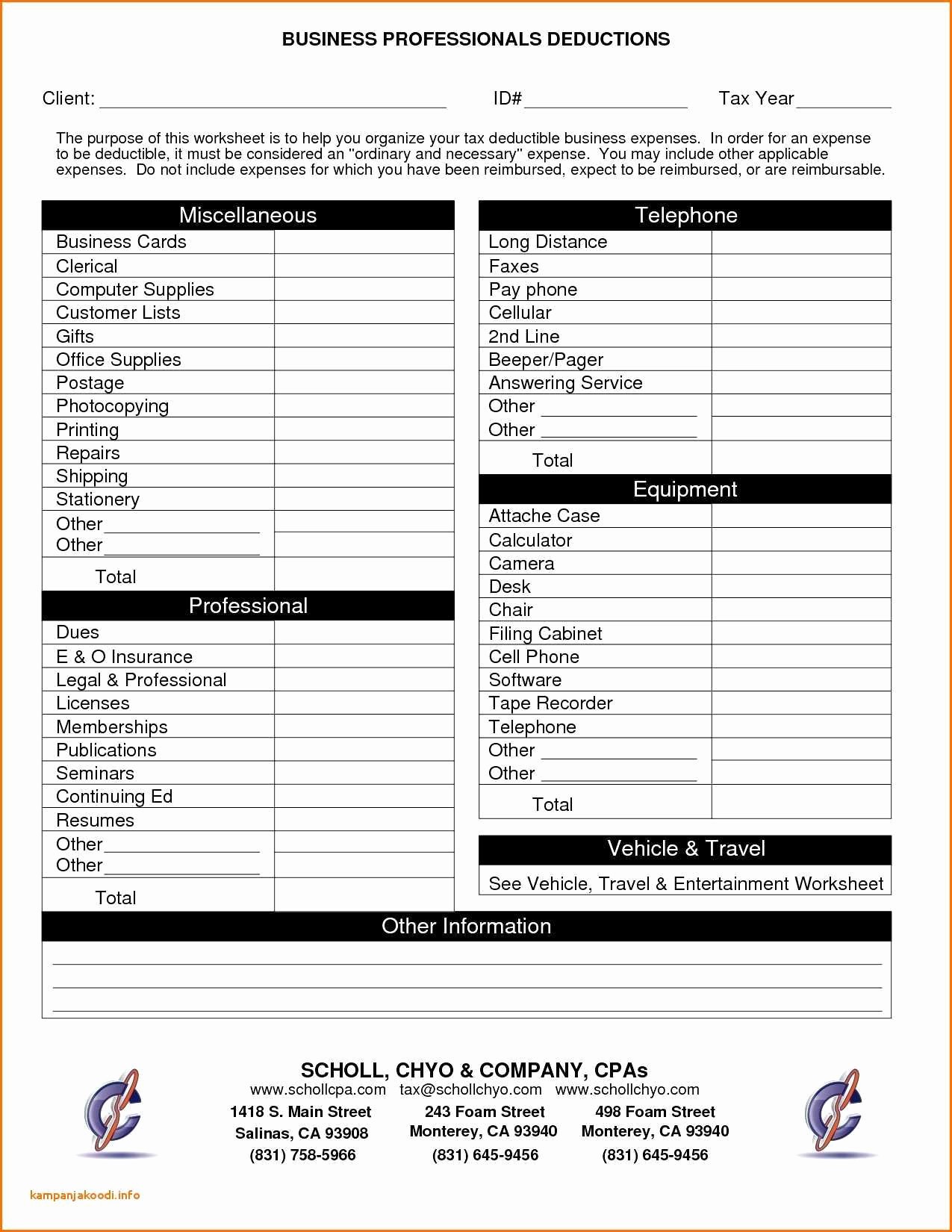

39 realtor tax deduction worksheet Worksheet Master

Itemized Deduction Worksheet

Small Business Deductions Worksheet petermcfarland.us

5 Itemized Tax Deduction Worksheet /

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Tax Deduction Worksheet Realtors Fill Online, Printable, Fillable

Printable Itemized Deductions Worksheet

Web Claiming Standard Deduction Or Itemized Deductions:

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Federal Section>Deductions>Itemized Deductions>Medical And Dental.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Related Post: