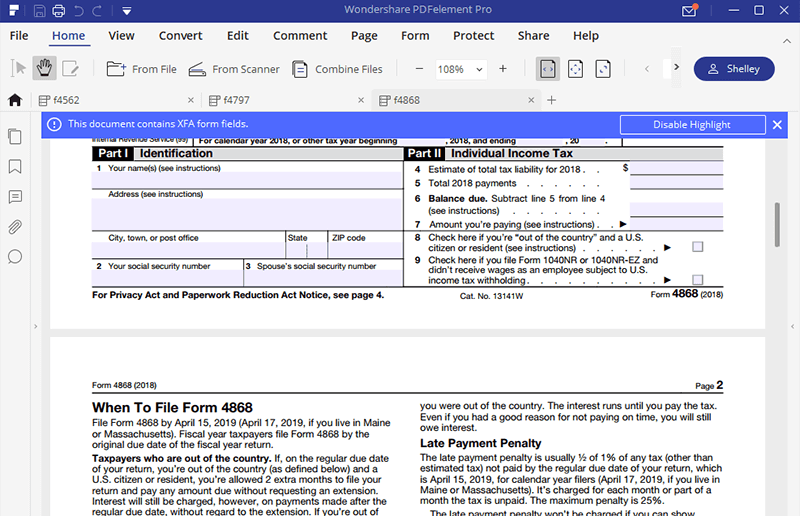

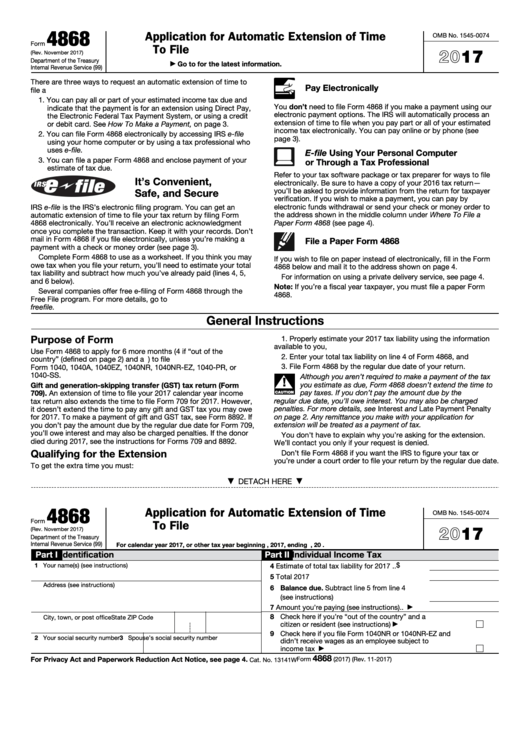

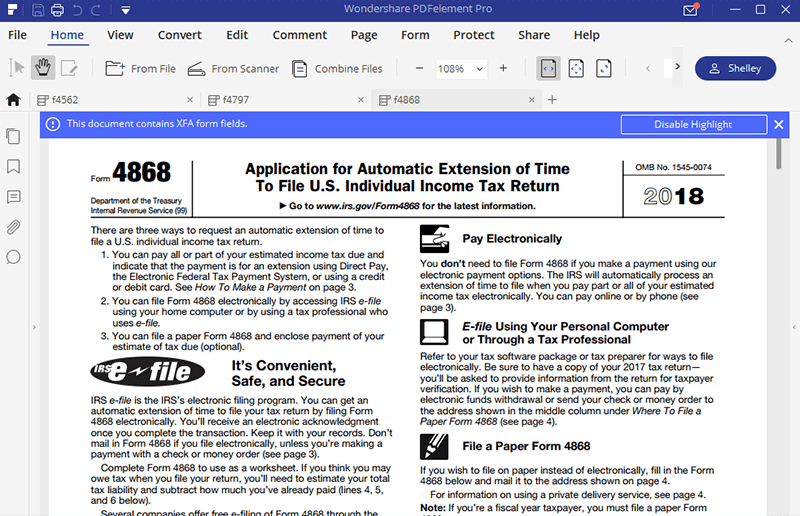

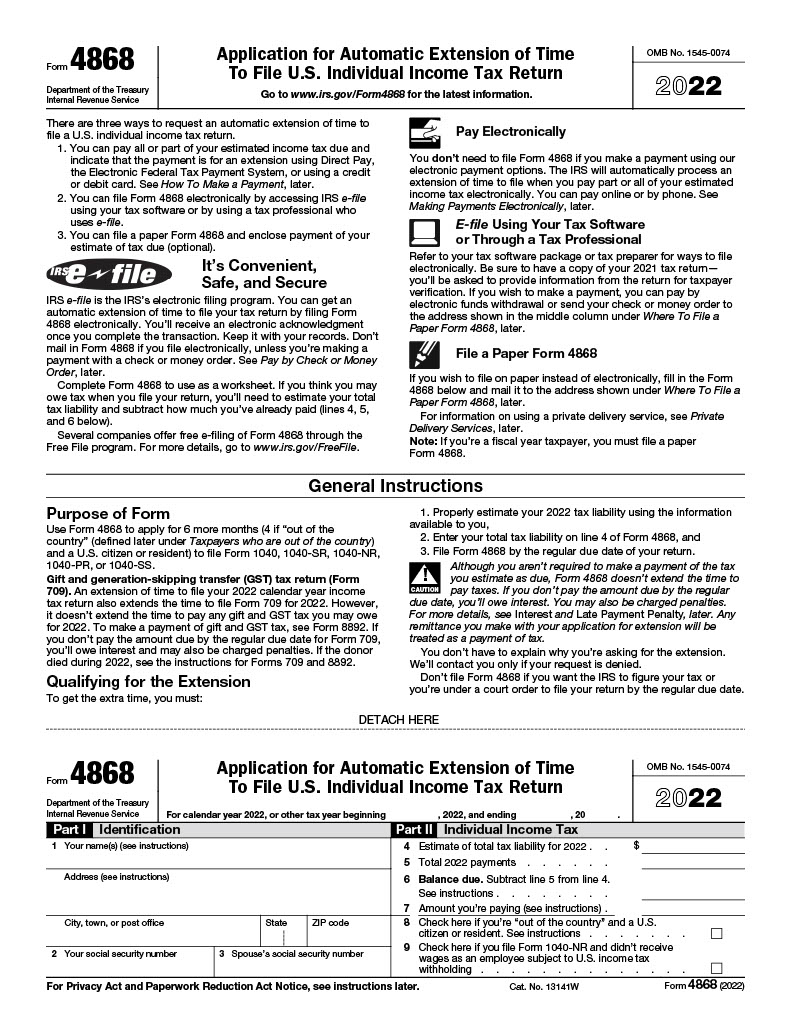

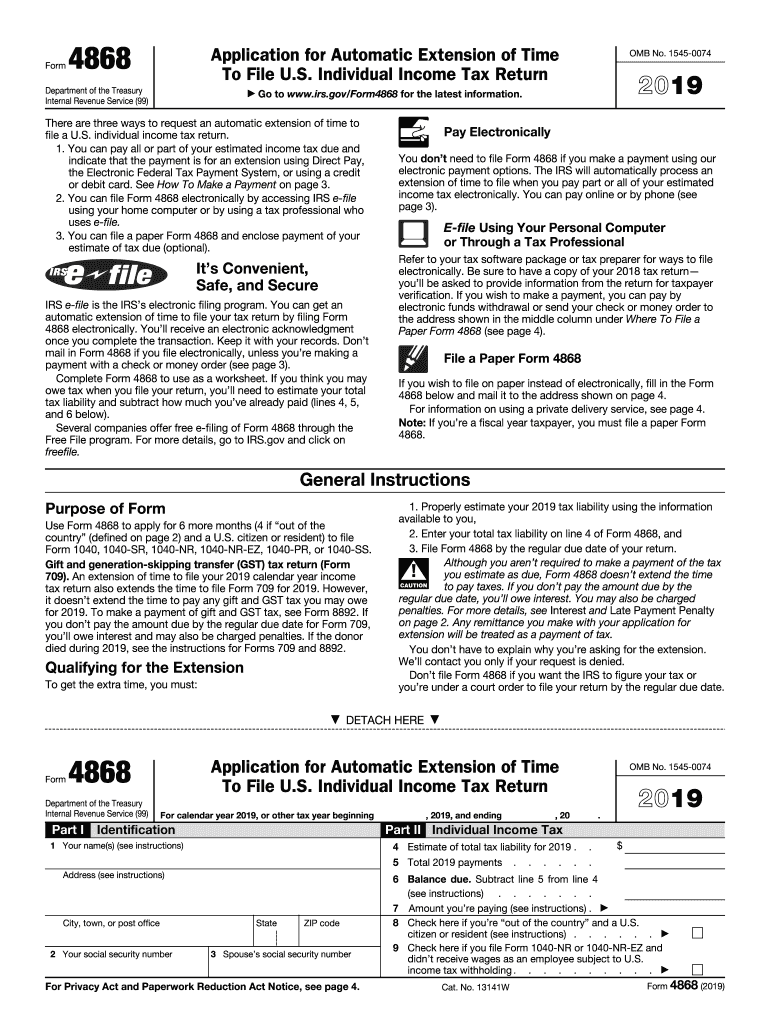

Printable Irs Form 4868

Printable Irs Form 4868 - Download the blank tax form 4868. File the printable 4868 form correctly mail the completed form 4868 to the appropriate irs address by the due date (see. Individual income tax return,” is a form that taxpayers can file with the irs if. Web up to $40 cash back easily complete a printable irs 4868 form 2022 online. Ad access irs tax forms. You have two options to submit your irs form 4868. More about the federal form 4868 extension we last. Individual income tax return in december 2022, so this is the latest version of form 4868, fully. An extension for federal income tax returns due on april 15. Individual income tax return ; Web form 4868, application for automatic extension of time to file u.s. More about the federal form 4868 extension we last. Mail in the paper irs form 4868. Web paper form 4868, later. Web on the left side of your screen, select tax tools, then print center from the menu; File the printable 4868 form correctly mail the completed form 4868 to the appropriate irs address by the due date (see. Pay for turbotax if you haven't. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 4868 form,. Ad access irs tax forms. You have two options to submit your irs form 4868. Web irs form 4868, application for automatic extension of time to file. Select print, save or preview this year's return; Complete, edit or print tax forms instantly. Web on the left side of your screen, select tax tools, then print center from the menu; Web complete form 4868 to use as a worksheet. Web we last updated the application for automatic extension of time to file u.s. Web irs form 4868, application for automatic extension of time to file. File a paper form 4868 if you wish to file on paper instead of electronically, fill in the form 4868 below and mail it to the address shown under where. Web sign and date. Web filling out irs extension form 4868 printable accurately is essential for filing a federal tax return. Web one of the most important documents that need to be filled out and submitted is form 4868, which is used to request an extension for filing federal income tax returns. Web we last updated the application for automatic extension of time to. Web irs form 4868 📝 get tax extension form 4868: Select print, save or preview this year's return; Mail in the paper irs form 4868. Individual income tax return ; File a paper form 4868 if you wish to file on paper instead of electronically, fill in the form 4868 below and mail it to the address shown under where. Printable & online pdf for 2022 with instructions tax extension form 4868 for 2022 fill form irs form 4868: Web one of the most important documents that need to be filled out and submitted is form 4868, which is used to request an extension for filing federal income tax returns. Mail in the paper irs form 4868. Web form 4868,. More about the federal form 4868 extension we last. Pdffiller.com has been visited by 1m+ users in the past month Individual income tax return in december 2022, so this is the latest version of form 4868, fully. Individual tax filers, regardless of income, can use irs. Web one of the most important documents that need to be filled out and. Web irs form 4868 📝 get tax extension form 4868: Web complete form 4868 to use as a worksheet. Download the blank tax form 4868. Complete, edit or print tax forms instantly. Individual income tax return in december 2022, so this is the latest version of form 4868, fully. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. An extension for federal income tax returns due on april 15. Web up to $40 cash back easily complete a printable irs 4868 form 2022 online. File a paper form 4868 if you wish to. You have two options to submit your irs form 4868. Complete, edit or print tax forms instantly. Web form 4868, application for automatic extension of time to file u.s. Individual income tax return,” is a form that taxpayers can file with the irs if. File the printable 4868 form correctly mail the completed form 4868 to the appropriate irs address by the due date (see. More about the federal form 4868 extension we last. Ad access irs tax forms. Web form 4868, also known as an “application for automatic extension of time to file u.s. Individual tax filers, regardless of income, can use irs. Web one of the most important documents that need to be filled out and submitted is form 4868, which is used to request an extension for filing federal income tax returns. Web complete form 4868 to use as a worksheet. Pdffiller.com has been visited by 1m+ users in the past month Web irs form 4868 📝 get tax extension form 4868: Mail in the paper irs form 4868. Printable & online pdf for 2022 with instructions tax extension form 4868 for 2022 fill form irs form 4868: If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Web complete form 4868 to use as a worksheet. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 4868 form,. Select print, save or preview this year's return; Web paper form 4868, later. Select print, save or preview this year's return; Web paper form 4868, later. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 4868 form,. Web irs form 4868, application for automatic extension of time to file. More about the federal form 4868 extension we last. Web up to $40 cash back easily complete a printable irs 4868 form 2022 online. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web complete form 4868 to use as a worksheet. Individual income tax return ; File a paper form 4868 if you wish to file on paper instead of electronically, fill in the form 4868 below and mail it to the address shown under where. Web we last updated the application for automatic extension of time to file u.s. Web irs form 4868 📝 get tax extension form 4868: Download the blank tax form 4868. You have two options to submit your irs form 4868. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve.IRS Form 4868 Fill it Right to File Tax Form

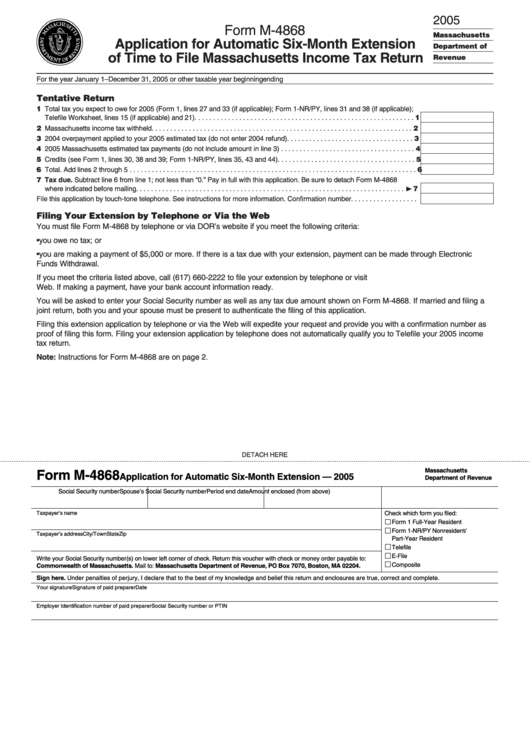

Form M4868 Application For Automatic SixMonth Extension Of Time To

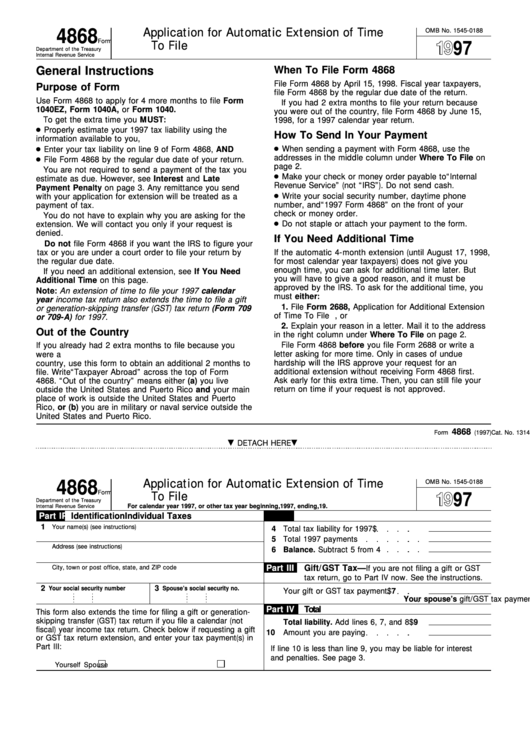

Fillable Form 4868 Application For Automatic Extension Of Time To

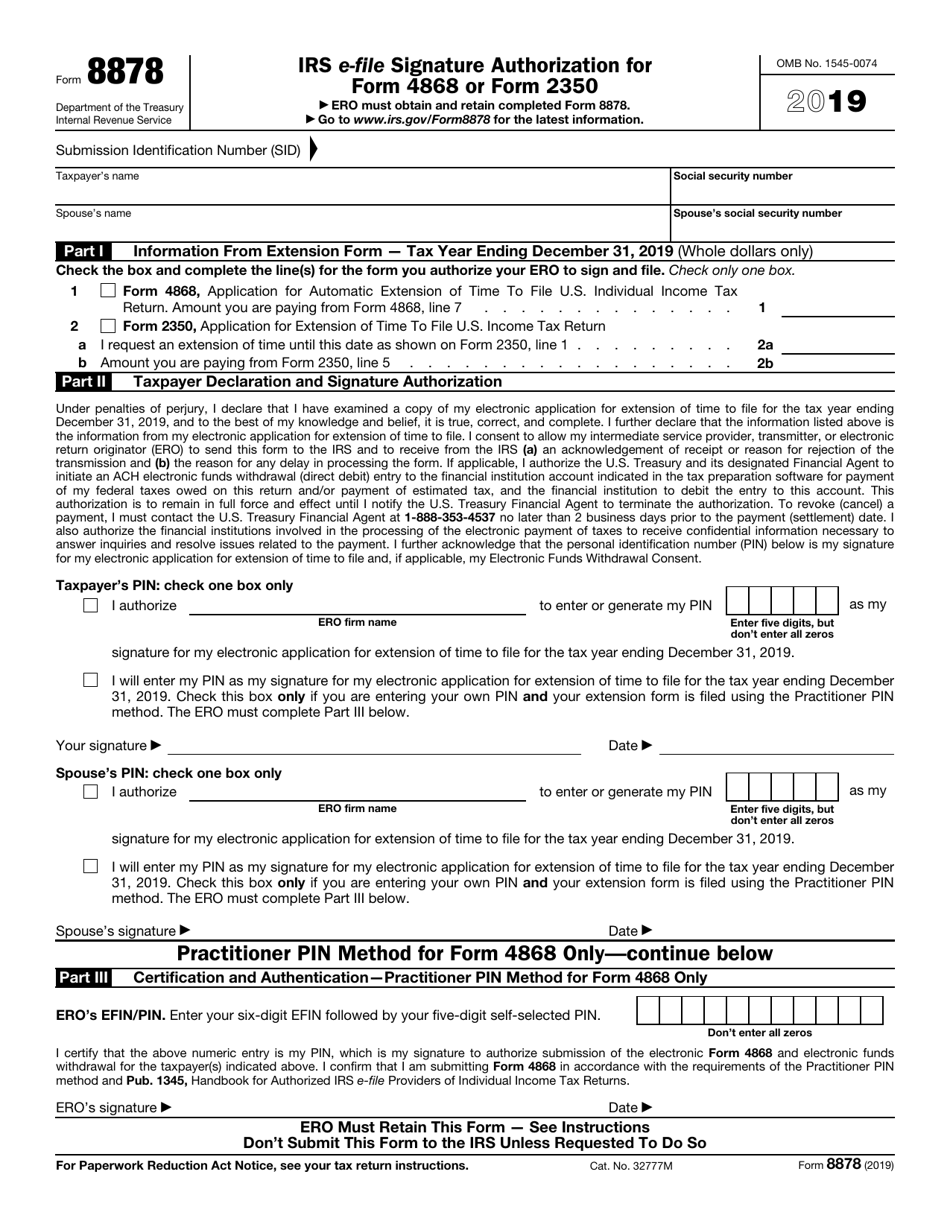

IRS Form 8878 Download Fillable PDF or Fill Online IRS EFile Signature

Fillable Form 4868 Application For Automatic Extension Of Time To

IRS Form 4868 Fill it Right to File Tax Form

EFile IRS Form 4868 File Personal Tax Extension Online

IRS form 4868 extension printable 4868 form 2023

IRS 4868 2019 Fill and Sign Printable Template Online US Legal Forms

Form 4868 Application for Automatic Extension of Time to File U.S

Printable & Online Pdf For 2022 With Instructions Tax Extension Form 4868 For 2022 Fill Form Irs Form 4868:

Mail In The Paper Irs Form 4868.

An Extension For Federal Income Tax Returns Due On April 15.

Complete, Edit Or Print Tax Forms Instantly.

Related Post: