Printable Form 2290

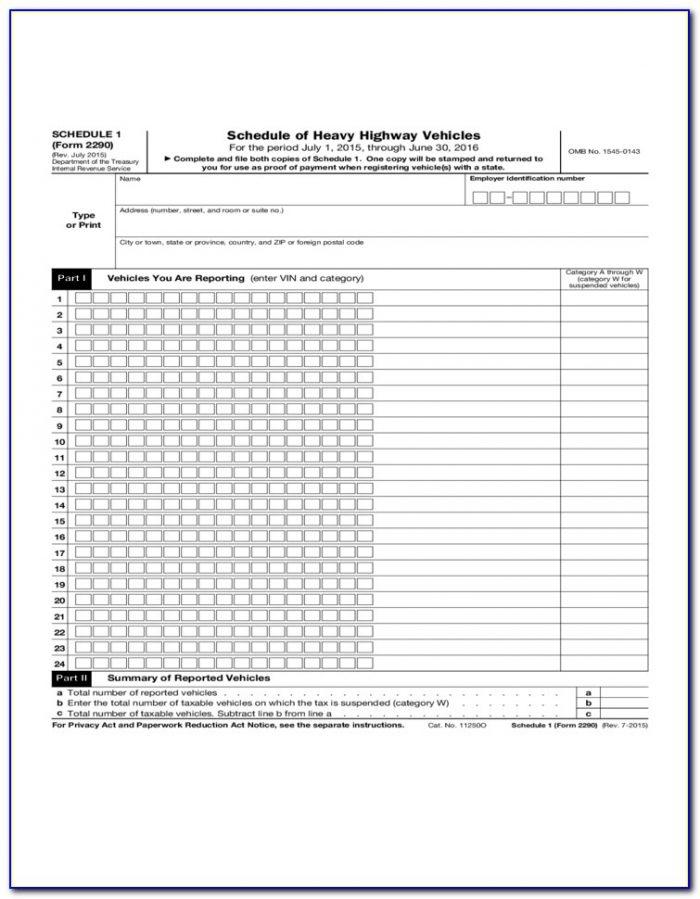

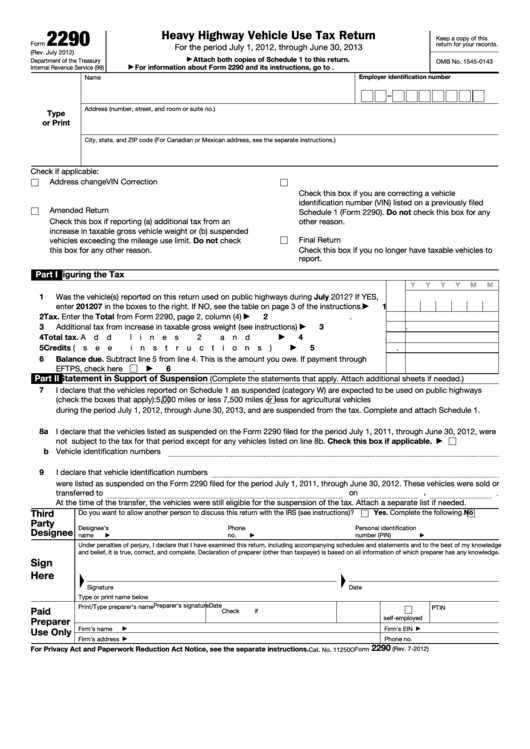

Printable Form 2290 - When it comes to filing taxes, getting it right the first time can save you a lot of headaches. Keep a copy of this return for your records. The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. You will find three available options; First used month (fum), vehicle identification number (vin), and taxable gross weight category. Find answers to all your questions on our website Form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. • figure and pay the tax due on a vehicle for. Web fill every fillable area. Select the sign button and create a digital signature. Go to www.irs.gov/form2290 for instructions and the latest information. Keep a copy of this return for your records. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of schedule 1 to this return. Select the sign button and create a. Web when form 2290 taxes are due. General instructions purpose of form use form 2290 for the following actions. The relevant guide for 2023 Form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Keep a copy of this. 31, 2023, payment deadline for vehicles. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. The form collects the information about all. Web what is a 2290 form? • figure and pay. Find answers to all your questions on our website The form is used to report the taxable use of heavy vehicles duri. The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. July 2019) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july. Keep a copy of this return for your records. Include the last two pages, if applicable. The form collects the information about all. Web fill every fillable area. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of. The irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. The form is used to report the taxable use of heavy vehicles duri. 31, 2023, payment deadline for vehicles. The relevant guide for 2023 Go to www.irs.gov/form2290 for instructions and the latest information. Web fill every fillable area. 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. The relevant guide for 2023 The form collects the information about all. When it comes to filing taxes, getting it right the first time can save you a lot of headaches. The irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. If you place an additional taxable truck registered in your name on the road during. Web when form 2290 taxes are due. • figure and pay the tax due on a vehicle for. Include. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds. Keep a copy of this return for your records. Our website offers a comprehensive collection of resources related to the 2290 tax form, including detailed instructions, filing guidelines, and faqs. Detailed instructions & samples to fill out the template correctly. Complete the first four pages of form 2290. Web 12/6/2022 new updates printable version: The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. Keep a copy of this return for your records. Efw, eftps, check or money order create form 2290 now why should you choose expressefile to. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Go to www.irs.gov/form2290 for instructions and the latest information. Form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Detailed instructions & samples to fill out the template correctly. Do your truck tax online & have it efiled to the irs! The form is used to report the taxable use of heavy vehicles duri. Web the 2290 form, also known as the heavy highway vehicle use tax return, is a crucial document for truck owners and operators in the united states. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Go to www.irs.gov/form2290 for instructions and the latest information. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. 2022 the 2290 form is used to report the annual heavy vehicle use tax. Uslegalforms.com has been visited by 100k+ users in the past month Our website offers a comprehensive collection of resources related to the 2290 tax form, including detailed instructions, filing guidelines, and faqs. Web what information is required to get the printable 2290 form? The current period begins july 1, 2023, and ends june 30, 2024. Go to www.irs.gov/form2290 for instructions and the latest information. Do your truck tax online & have it efiled to the irs! Web what is a 2290 form? The irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. Include the date to the form with the date option. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of schedule 1 to this return. Typing, drawing, or uploading one. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. 31, 2023, payment deadline for vehicles. Go to www.irs.gov/form2290 for instructions and the latest information. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Complete the first four pages of form 2290. Include the last two pages, if applicable. Detailed instructions & samples to fill out the template correctly. Web when form 2290 taxes are due. Web the 2290 form, also known as the heavy highway vehicle use tax return, is a crucial document for truck owners and operators in the united states. Keep a copy of this return for your records.Free Printable Form 2290 Printable Templates

Free Printable Form 2290 Printable Templates

Printable IRS Form 2290 for 2020 Download 2290 Form

Printable 2290 Form Customize and Print

Free Printable Form 2290 Printable Templates

Printable 2290 Form Customize and Print

Printable 2290 Form Customize and Print

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Free Printable 2290 Tax Form Printable Templates

Ssurvivor Form 2290 Irs

Easy, Fast, Secure & Free To Try.

Web Irs Form 2290 Printable 📝 Get 2290 Tax Form & Instructions For 2023:

First Used Month (Fum), Vehicle Identification Number (Vin), And Taxable Gross Weight Category.

Form 2290, Heavy Highway Vehicle Use Tax Return, Is Generally Used By Those Who Own Or Operate A Highway Motor Vehicle With A Taxable Gross Weight Of 55,000 Pounds Or More.

Related Post: