Printable 1099 Form Independent Contractor

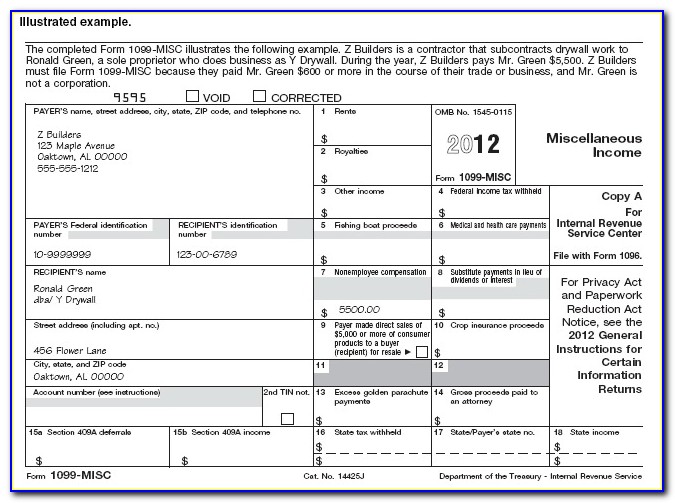

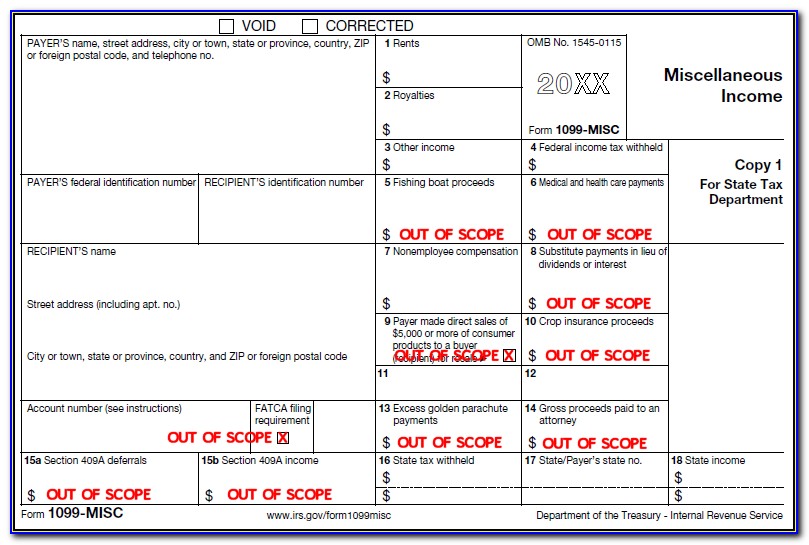

Printable 1099 Form Independent Contractor - Ad fast, easy & secure. Complete your pay stub easily. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. This form can be used to request the correct name and taxpayer identification number, or tin, of. Web independent contractors guide to 1099 misc forms: Getting confused who is a 1099. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Did you receive a 1099 misc form in the mail? There are three different versions, each with different purposes: At least $10 in royalties or broker. Ad fast, easy & secure. For your protection, this form may show only the last four digits of your. Ad read customer reviews & find best sellers. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of.. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. Did you receive a 1099 misc form in the mail? 1099 form is an information return form used to report the payments made in a calendar year to the irs. Bring a colleague and save $100!. Getting confused who is a 1099. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or. Web create a high quality document now! 1099 form is an information return form used to report the payments made in a calendar year to the irs. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. Ad read customer reviews & find best sellers. You must also complete form 8919 and attach it to. You received the form for working as an independent contractor for the. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. Web create a high quality document now! There are three different versions, each with different purposes: Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. For your protection, this form may show only the last four digits of your. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Ad fast, easy. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Getting confused who is a 1099. An independent contractor agreement is a. Ad fast, easy & secure. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. This form can be used to request the correct name and taxpayer identification number, or tin, of. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Did you receive a 1099 misc. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. At least $10 in royalties or broker. Did you receive a 1099 misc form in the mail? Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee. You received the form for working as an independent contractor for the. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Web create a high quality document now! Ad fast, easy & secure. 1099 form is an information return form used to report the payments made in a calendar year. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. A person who contracts to perform services for others without having the legal status of an employee is an independent. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Ad fast, easy & secure. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. For your protection, this form may show only the last four digits of your. Ad read customer reviews & find best sellers. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. There are three different versions, each with different purposes: Web you’ll issue a 1099 form. Did you receive a 1099 misc form in the mail? At least $10 in royalties or broker. Getting confused who is a 1099. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web what is a 1099 independent contractor? Save time with our amazing tool This form can be used to request the correct name and taxpayer identification number, or tin, of. You must also complete form 8919 and attach it to. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Web independent contractors guide to 1099 misc forms: Web independent contractors are also known as consultants, freelancers, or 1099 contractors. You received the form for working as an independent contractor for the. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. Ad read customer reviews & find best sellers. You must also complete form 8919 and attach it to. Web create a high quality document now! For your protection, this form may show only the last four digits of your. Web independent contractors guide to 1099 misc forms: Bring a colleague and save $100!. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Web form 1099 is a tax information return that reports income received outside of wages, salaries and tips. Web you’ll issue a 1099 form. Did you receive a 1099 misc form in the mail?1099 Form For Independent Contractors 2019 Form Resume Examples

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

Printable 1099 Form Independent Contractor Printable Form, Templates

1099 tax form independent contractor printable 1099 forms independent

1099 Form Independent Contractor Pdf Independent Contractor Invoice

Free 1099 Forms For Independent Contractors Universal Network

1099 form independent contractor Fill Online, Printable, Fillable

Printable 1099 Form Independent Contractor Master of

A Person Who Contracts To Perform Services For Others Without Having The Legal Status Of An Employee Is An Independent.

Web An Independent Contractor Invoice Is Used By Anyone Independently Working For Themselves To Request Payment For Services Provided To A Client Or Customer.

There Are Three Different Versions, Each With Different Purposes:

(This Last Name Is Derived From The Irs Form 1099 Which The.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)