Payroll Deduction Template

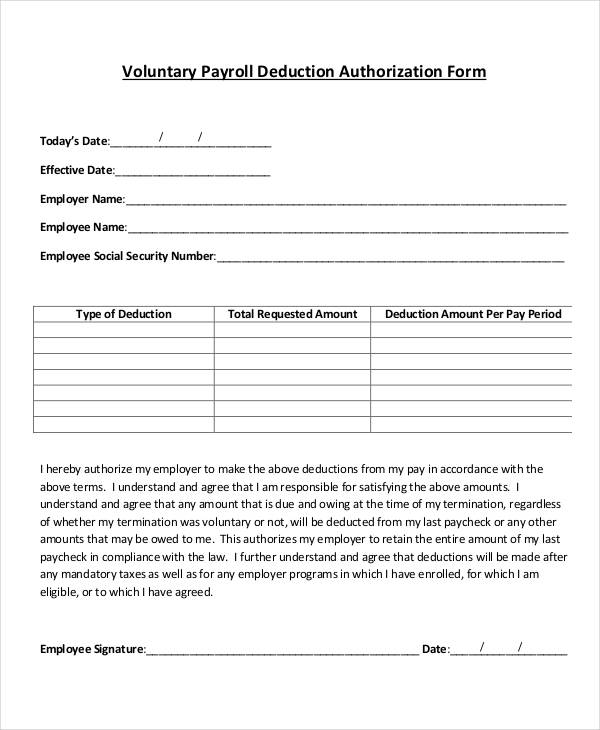

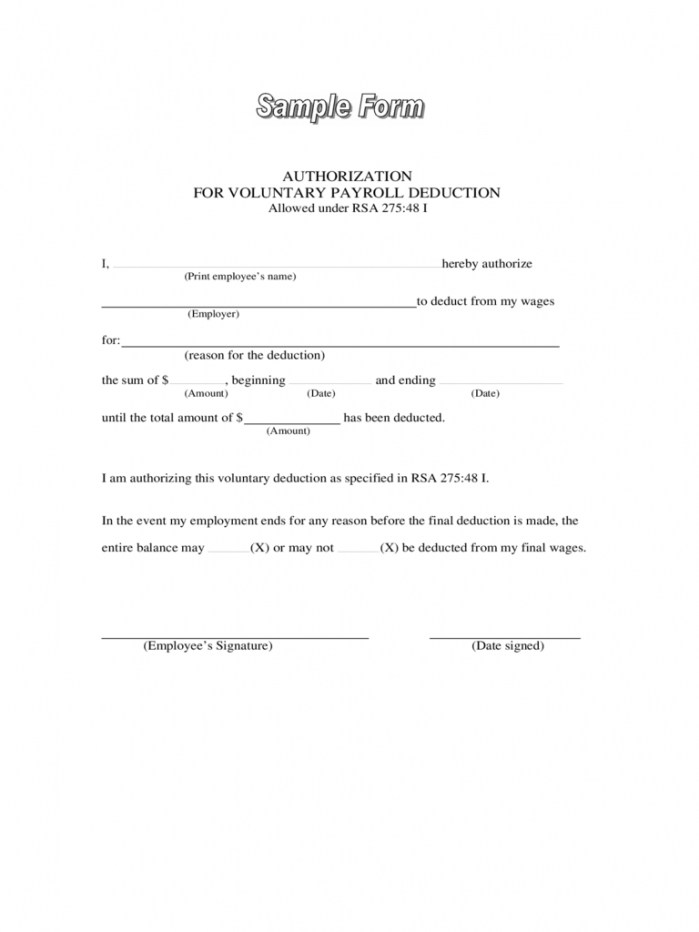

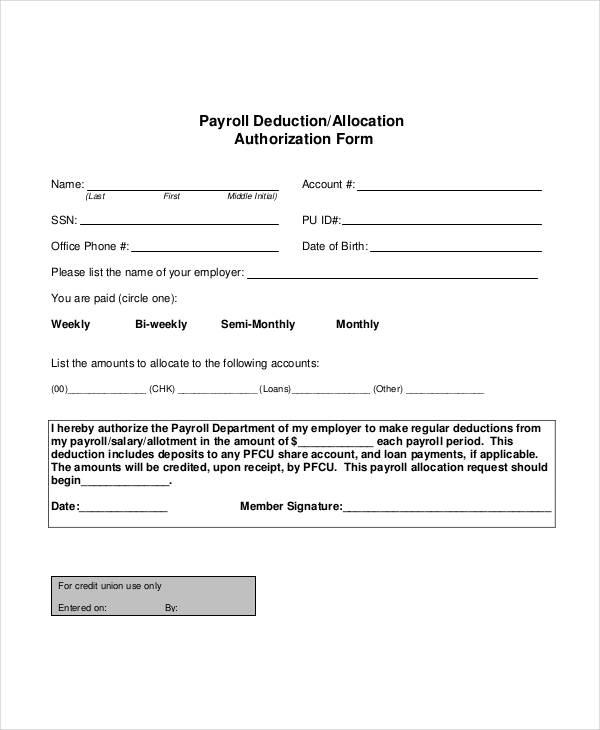

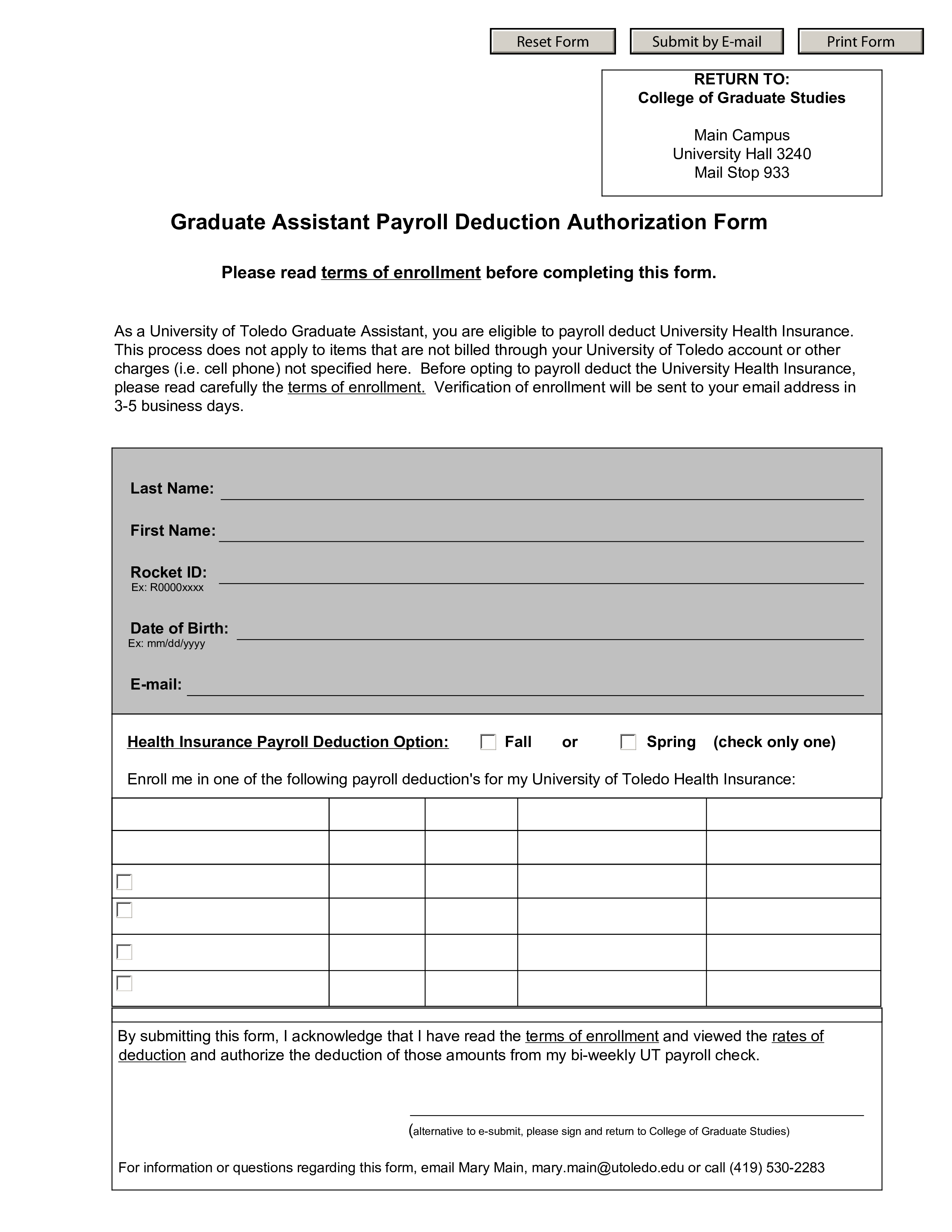

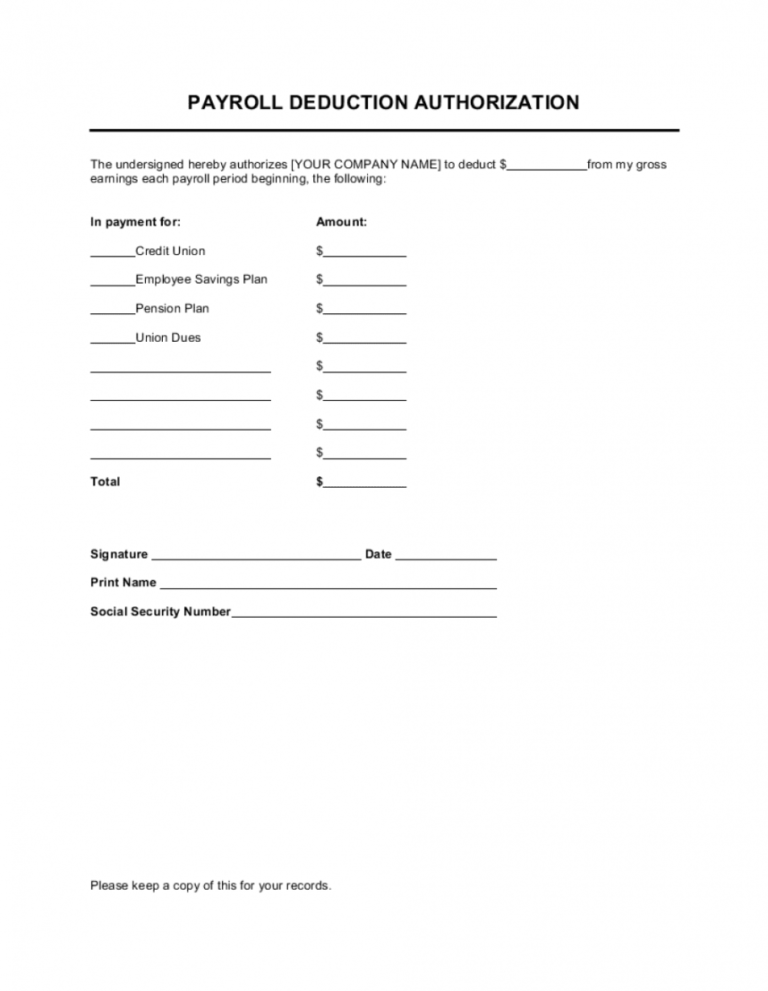

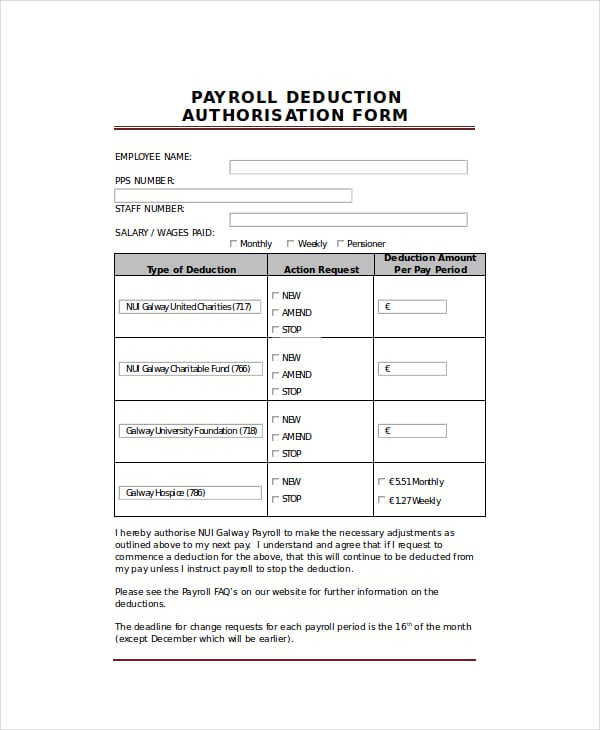

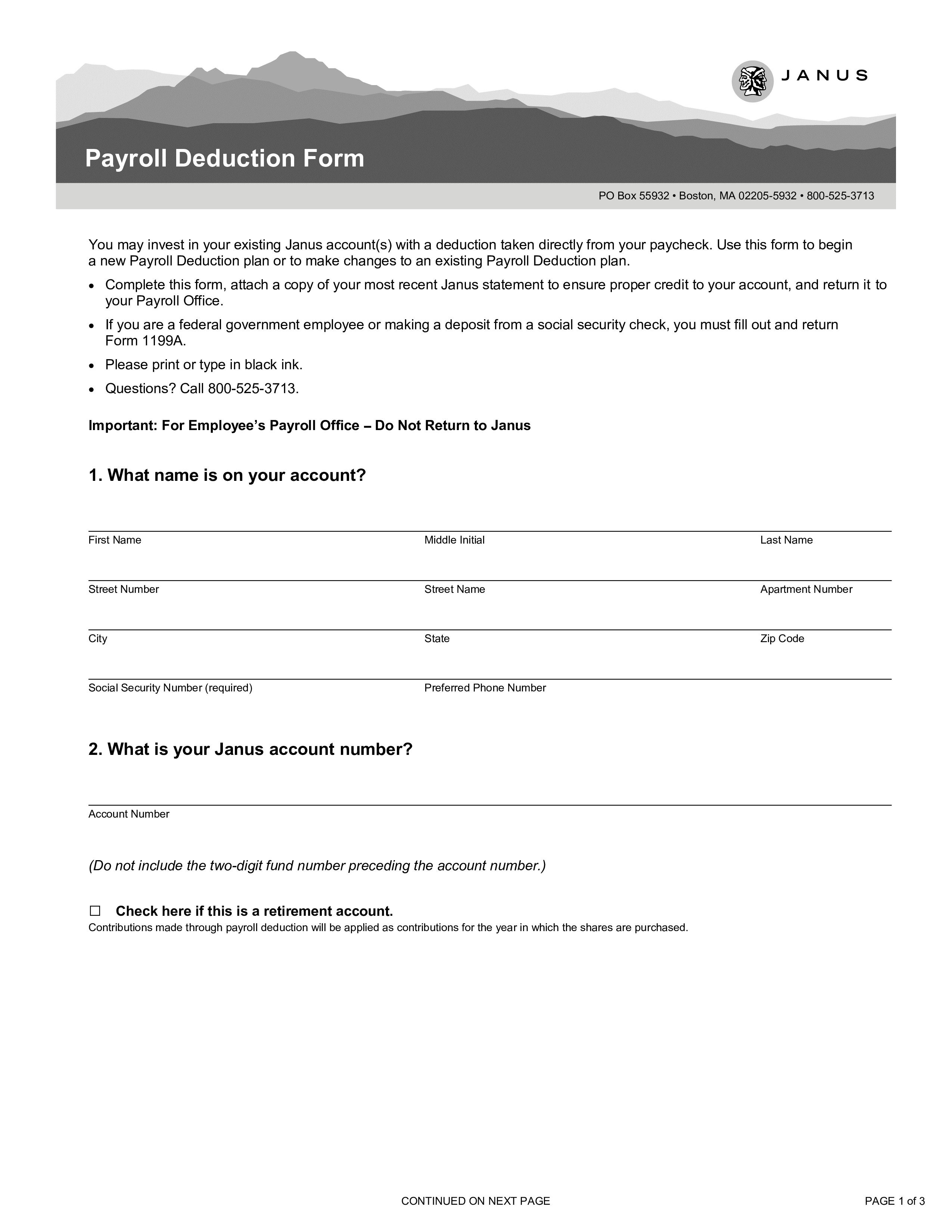

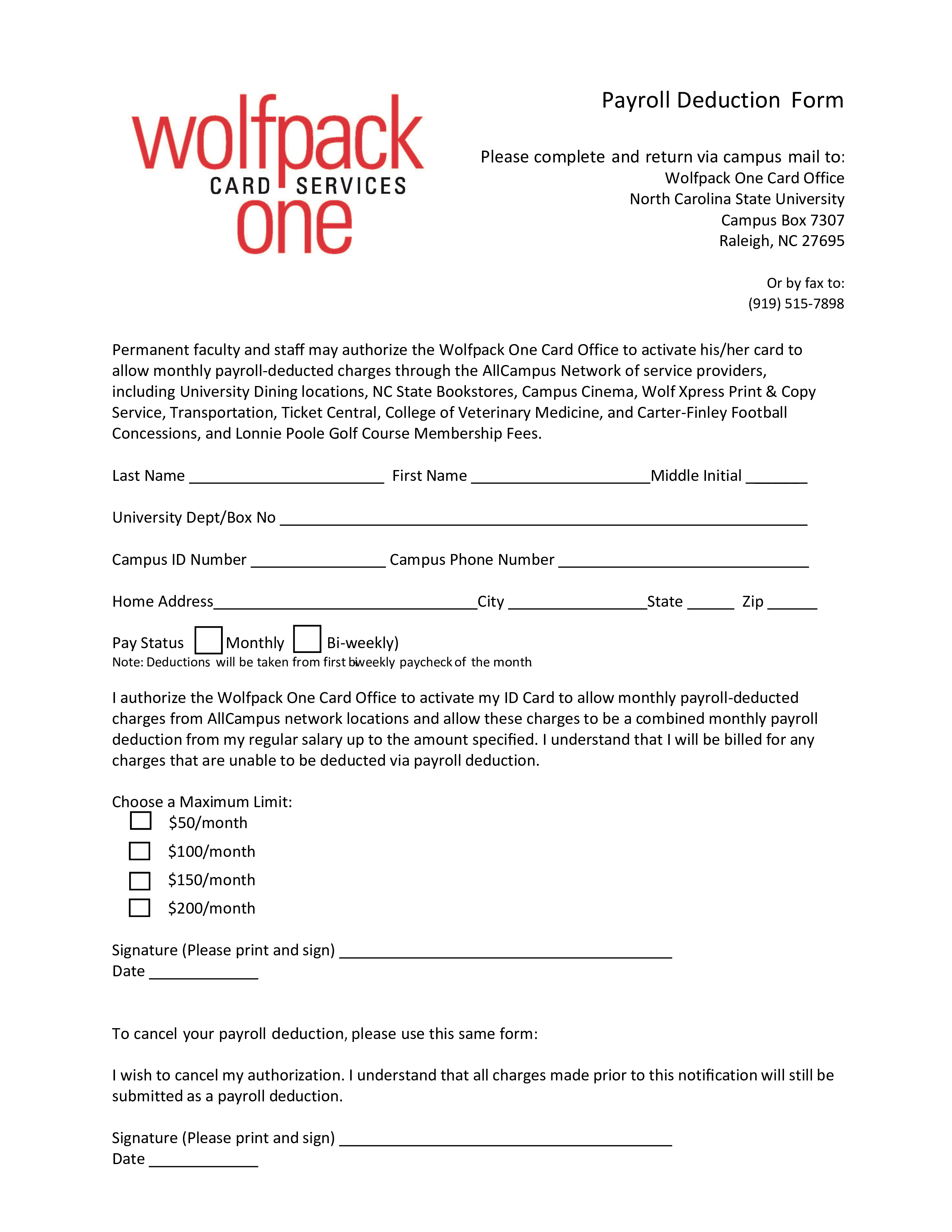

Payroll Deduction Template - Pay your team and access hr and benefits with the #1 online payroll provider. Are you looking for a template that can help you manage the payroll deductions of the employees? It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Make an authorization form regarding payroll deduction with the aid of our. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. Web payroll deduction download this payroll deduction form template design in word, google docs, apple pages format. Web a payroll summary report template is a template that contains detailed information about employees’ payments and deductions. Web download this payroll deduction authorization form template design in word, google docs, apple pages format. Get the most out of your team with gusto’s global payroll and hr features. These deductions are used for a few purposes, such as paying taxes, contributing to a retirement plan, and paying for benefits like health insurance. These are the new template questions: Excel timesheet for payroll template. Web specify a deduction reference code for each element entry that has arrears and total owed options enabled for the newly created element. Web the payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes,. You can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month. Ad simply the best payroll service for small business. Generate clear dynamic statements and get your reports, the way you like them. Get access to full application and agreement on payroll deduction ira. This customizable form template streamlines the process of deducting specific amounts from employees’ paychecks, offering convenience for. Get access to full application and agreement on payroll deduction ira in this template which you can refer to. Learn how to create an ira account application checklist by following the steps and procedures provided here to make your work effortless and simple.. Excel timesheet for payroll template. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Any deduction in an employee’s salary should be written in clarity to determine what are the purpose of deductions. Web download this payroll deduction authorization form template design in word, google docs, apple pages format. If you are, then. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web download this payroll deduction authorization form template design in word, google docs, apple pages format. (taxpayer name and address) contact person’s name telephone (include. Get access to full application and agreement on payroll deduction ira in this template which you can refer to. These are the new template questions: Generate clear dynamic statements and get your reports, the way you like them. The element template for voluntary deductions is modified by replacing the existing template questions for arrears and total owed. Excel timesheet for. Timesheet templates are a great way to keep track of the amount of time an employee spends performing duties for the job. Web specify a deduction reference code for each element entry that has arrears and total owed options enabled for the newly created element. Are you looking for a template that can help you manage the payroll deductions of. Learn how to create an ira account application checklist by following the steps and procedures provided here to make your work effortless and simple. Ad simply the best payroll service for small business. Get to create a document employees can use to authorize the company in deducting their pay for whatever reason using this accessible. Web payroll deduction download this. Pay your team and access hr and benefits with the #1 online payroll provider. Web download this payroll deduction authorization form template design in word, google docs, apple pages format. The payroll deduction form template provided by wpforms offers a simple and efficient way for businesses to facilitate payroll deductions while ensuring accuracy and compliance. Learn how to create an. Ad simply the best payroll service for small business. The payroll deduction form template provided by wpforms offers a simple and efficient way for businesses to facilitate payroll deductions while ensuring accuracy and compliance. Excel timesheet for payroll template. Are you looking for a template that can help you manage the payroll deductions of the employees? Web payroll deductionform template. You can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month. These are the new template questions: Ad approve payroll when you're ready, access employee services & manage it all in one place. Payroll deductions can also be voluntary or mandated. These deductions are used for a few purposes, such as paying taxes, contributing to a retirement plan, and paying for benefits like health insurance. Generate clear dynamic statements and get your reports, the way you like them. Pay your team and access hr and benefits with the #1 online payroll provider. (taxpayer name and address) contact person’s name telephone (include area code) social security or employer identification number (taxpayer)(spouse, last four digits) employer — s ee the instructions on the back of part 2. Know the legal payroll deductions. Web payroll deduction download this payroll deduction form template design in word, google docs, apple pages format. This customizable form template streamlines the process of deducting specific amounts from employees’ paychecks, offering convenience for. (employer name and address) regarding: Web get the checks out with these payroll templates. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Web the payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Download this payroll deduction authorization template design in word, google docs, apple pages format. Excel timesheet for payroll template. Timesheet templates are a great way to keep track of the amount of time an employee spends performing duties for the job. Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. Web payroll deduction authorization template. (taxpayer name and address) contact person’s name telephone (include area code) social security or employer identification number (taxpayer)(spouse, last four digits) employer — s ee the instructions on the back of part 2. Pay your team and access hr and benefits with the #1 online payroll provider. Web payroll deduction download this payroll deduction form template design in word, google docs, apple pages format. Are you looking for a template that can help you manage the payroll deductions of the employees? This customizable form template streamlines the process of deducting specific amounts from employees’ paychecks, offering convenience for. Can use a payroll calculator to multiply the current tax rate against your employees' salaries and determine the right deduction (many templates include a payroll calculator in a separate tab), then. Web payroll deductionform template deduction description x type description amount x type description amount 401(k) other 401(k) loan other health other employee loan other additional info authorization i understand that this form authorizes the. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web payroll deduction authorization template. You can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month. Make an authorization form regarding payroll deduction with the aid of our. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Any deduction in an employee’s salary should be written in clarity to determine what are the purpose of deductions. Web a payroll summary report template is a template that contains detailed information about employees’ payments and deductions. (employer name and address) regarding: Web february 16, 2021 payroll deductions consist of money taken out of an employee’s paycheck.Payroll Deduction Form Template 14+ Sample, Example, Format

Payroll Deduction Form 2 Free Templates In Pdf Word Employee Payroll

Payroll Deduction Form

Printable Payroll Deduction Form Template Printable Templates

Sample Payroll Deduction Authorization Template Businessinabox

Payroll Template 8+ Free Word, PDF Documents Download

Payroll Deduction Form Templates at

Standard Payroll Deduction Form Templates at

Payroll Deduction form Template Elegant 10 Payroll Deduction

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

Web Specify A Deduction Reference Code For Each Element Entry That Has Arrears And Total Owed Options Enabled For The Newly Created Element.

The Payroll Deduction Form Template Provided By Wpforms Offers A Simple And Efficient Way For Businesses To Facilitate Payroll Deductions While Ensuring Accuracy And Compliance.

Know The Legal Payroll Deductions.

Get Access To Full Application And Agreement On Payroll Deduction Ira In This Template Which You Can Refer To.

Related Post: