Offer In Compromise Letter Template

Offer In Compromise Letter Template - If the template suits your needs, click. Apply with of new form 656you must use the april 2023 version of. Apply with the new fashion 656you must use the springtime 2023. Web what should i do? Examine the explanation of the sample or open its preview. Web the offer in compromise (oic) program allows you to offer a lesser amount for payment of an undisputed tax liability. Web 1) a signed and dated detailed letter explaining the financial hardship or reasons for the request, including the amount being offered. Print out your form to fill it out by hand or upload the sample if you. Ad vast library of fillable legal documents. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. An offer in compromise will be considered only after liquidation of all collateral pursuant to agency guidelines. Web an offer in compromise (oic) is an agreement between the taxpayer and the government that settles a tax liability for payment of less than the full amount owed. Web offer in compromise requirement letter. Get an irs offer in compromise form help. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Ad vast library of fillable legal documents. Print out your form to fill it out by hand or upload the sample if you. Irs offer in compromise form help. Apply with of new form 656you must use the april 2023 version of. March 29, 2023 offer in compromise if you can’t pay your tax debt in full, or if paying it all will create a financial. November 4, 2020 | last updated: Web to find out whether you qualify for an offer in compromise, contact our experienced attorneys. If the template suits your needs, click. Print out your form to fill it. Web what is an offer? Web the offer in compromise (oic) program allows you to offer a lesser amount for payment of an undisputed tax liability. Web to find out whether you qualify for an offer in compromise, contact our experienced attorneys. An offer in compromise will be considered only after liquidation of all collateral pursuant to agency guidelines. Web. Web an offer in compromise (oic) is an agreement between the taxpayer and the government that settles a tax liability for payment of less than the full amount owed. Does form 8821 allow me to designate a third party to represent me before the irs on an offer in compromise? Web to find out whether you qualify for an offer. Web an offer in compromise allows you to settlements your tax obligation for less than the full amount you owe. Ad vast library of fillable legal documents. Print out your form to fill it out by hand or upload the sample if you. Web to find out whether you qualify for an offer in compromise, contact our experienced attorneys. Web. Web up to 25% cash back a proposal to the irs (on an irs tax form) to settle a tax debt for less than the amount owed. The letter must identify the source of the. Print out your form to fill it out by hand or upload the sample if you. Web sample offer in compromise letter to irs for. Web offer in compromise requirement letter. An offer in compromise will be considered only after liquidation of all collateral pursuant to agency guidelines. Apply with the new fashion 656you must use the springtime 2023. The letter must identify the source of the. Apply with of new form 656you must use the april 2023 version of. Web use us legal forms to obtain a printable sample letter for application for approval of compromise settlement. Apply with of new form 656you must use the april 2023 version of. December 17, 2021 | last updated: Ad vast library of fillable legal documents. November 4, 2020 | last updated: Web find the right sample letter for offer in compromise on the list of results. Ad get free, competing quotes from leading tax experts. Web when you submit an offer in compromise to the irs, it must be submitted on a special form 656 with any attachments that are required. The parties agree that this agreement is made in the. Print out your form to fill it out by hand or upload the sample if you. Web 1) a signed and dated detailed letter explaining the financial hardship or reasons for the request, including the amount being offered. Web find the right sample letter for offer in compromise on the list of results. Web use us legal forms to obtain a printable sample letter for application for approval of compromise settlement. Irs offer in compromise form help. Web sample offer in compromise letter to irs for payment plan category: If the template suits your needs, click. Ad get free, competing quotes from leading tax experts. What if the employee assigned to. Apply with the new fashion 656you must use the springtime 2023. Does form 8821 allow me to designate a third party to represent me before the irs on an offer in compromise? Get an irs offer in compromise form help here. An offer in compromise will be considered only after liquidation of all collateral pursuant to agency guidelines. I am giving you a link. Legalcontracts.com has been visited by 10k+ users in the past month Web an offer in compromise allows you to settlements your tax obligation for less than the full amount you owe. November 4, 2020 | last updated: Web what should i do? Web offer in compromise requirement letter. Web an offer in compromise (oic) is an agreement between the taxpayer and the government that settles a tax liability for payment of less than the full amount owed. Web find the right sample letter for offer in compromise on the list of results. The parties agree that this agreement is made in the interest of anticipating and fully and forever compromising, settling and resolving all. Web what should i do? Does form 8821 allow me to designate a third party to represent me before the irs on an offer in compromise? Irs offer in compromise form help. Web to find out whether you qualify for an offer in compromise, contact our experienced attorneys. An offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. Apply with the new fashion 656you must use the springtime 2023. Web our platform provides more than 85k templates for any business and personal legal scenarios arranged by state and area of use all forms are appropriately drafted and. Web use us legal forms to obtain a printable sample letter for application for approval of compromise settlement. Web up to 25% cash back a proposal to the irs (on an irs tax form) to settle a tax debt for less than the amount owed. Examine the explanation of the sample or open its preview. The letter must identify the source of the. Web an offer in compromise (oic) is an agreement between the taxpayer and the government that settles a tax liability for payment of less than the full amount owed. Best tool to create, edit & share pdfs. Web the offer in compromise (oic) program allows you to offer a lesser amount for payment of an undisputed tax liability.Offer In Compromise Worksheet —

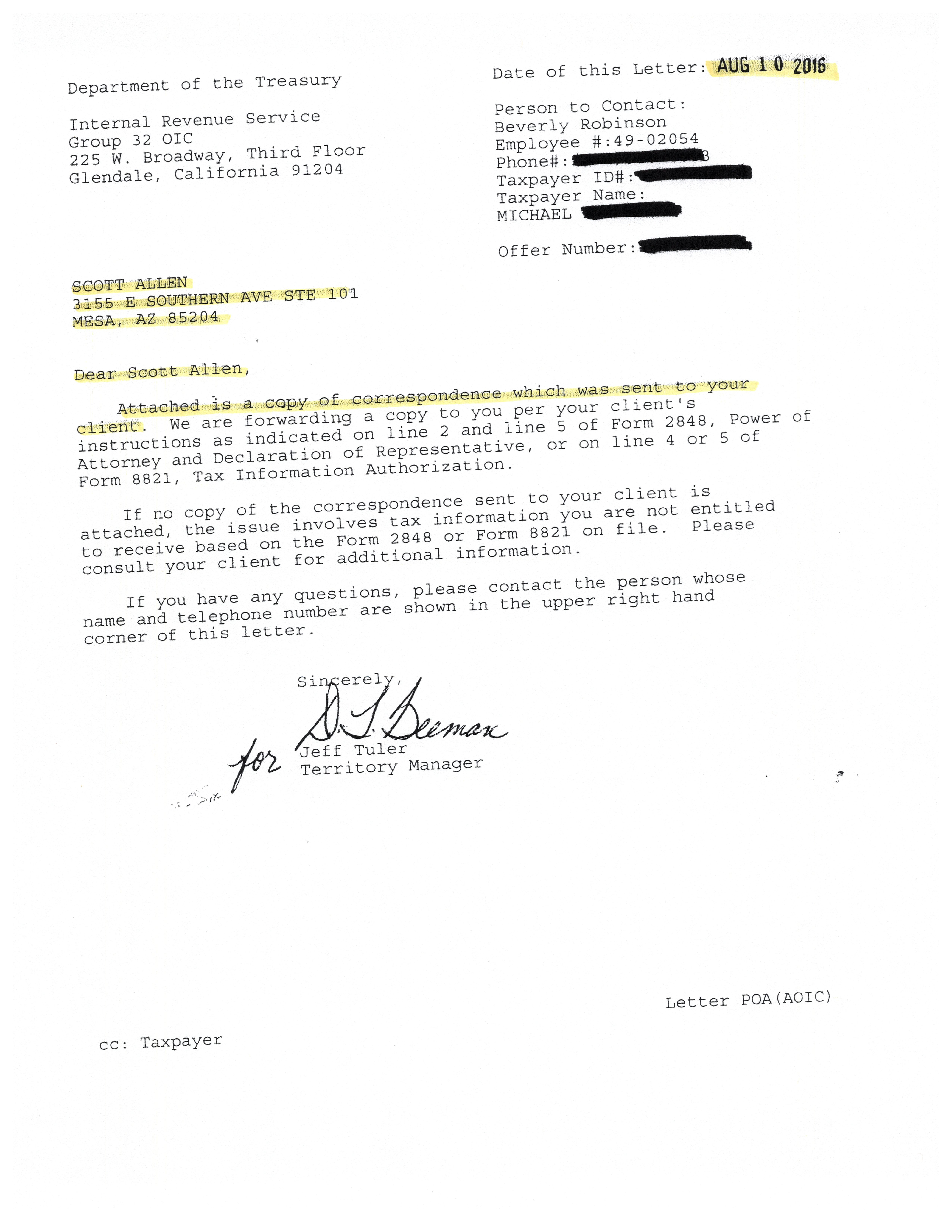

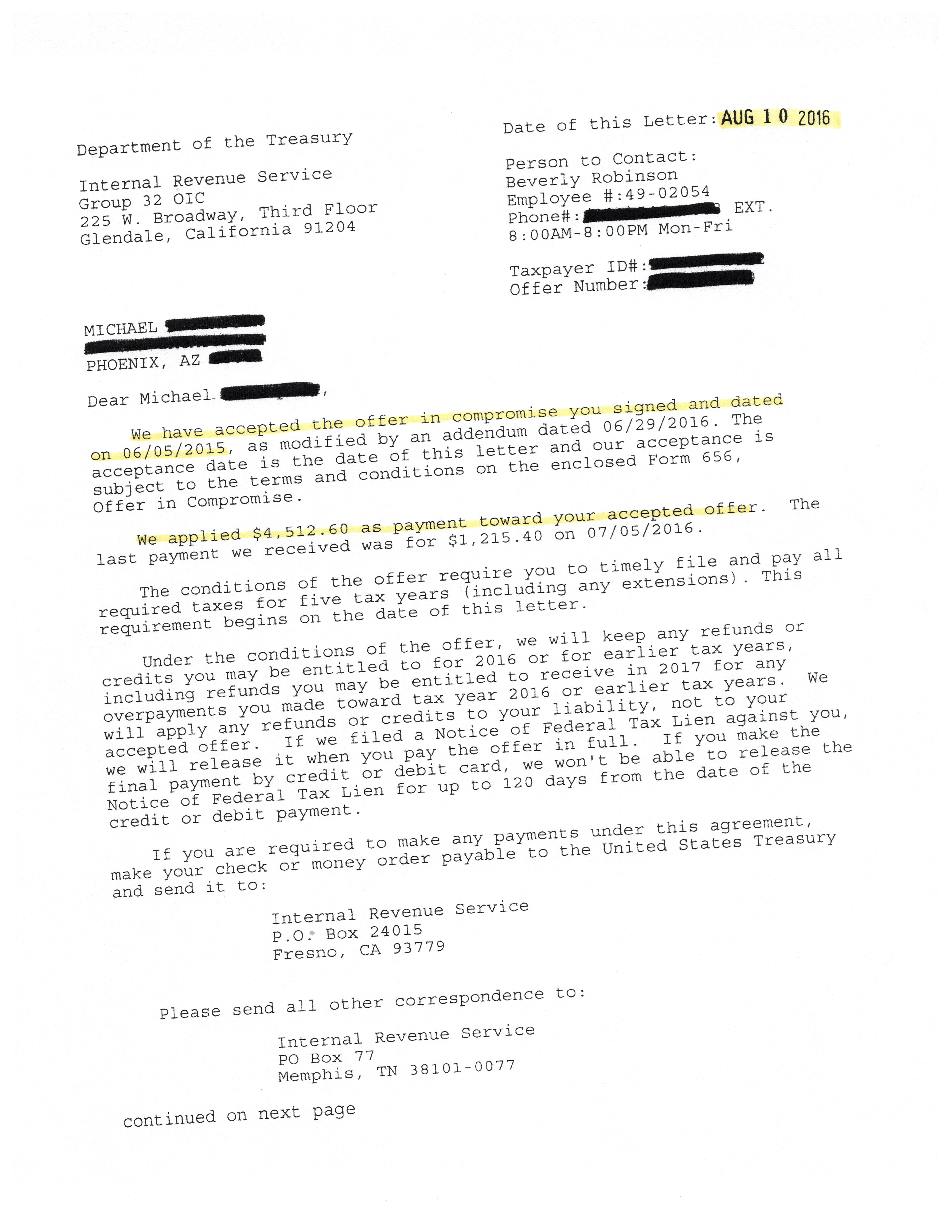

Phoenix AZ IRS Offer in Compromise Tax Debt Advisors

Phoenix AZ IRS Offer in Compromise Tax Debt Advisors

Offer In Compromise Letter Template Fill Online, Printable, Fillable

Offer In Compromise Offer In Compromise Example

Offer In Compromise Offer In Compromise Hardship Letter

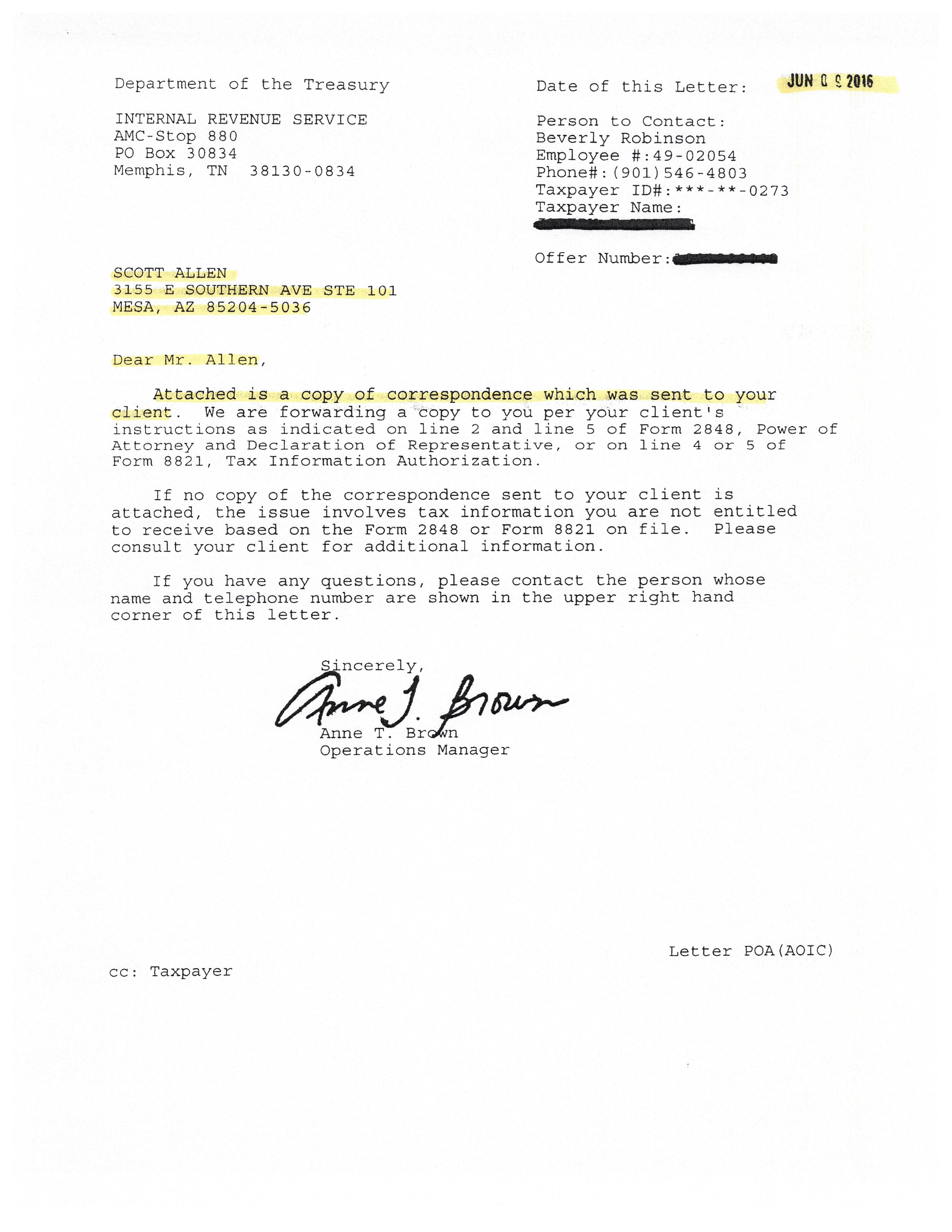

Mesa AZ IRS Offer in Compromise Tax Debt Advisors

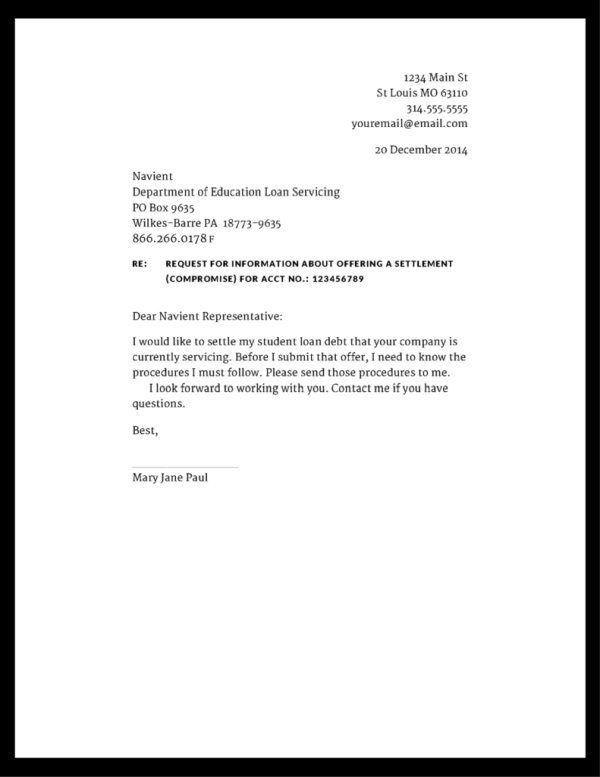

Offer In Compromise Offer In Compromise Example Letter

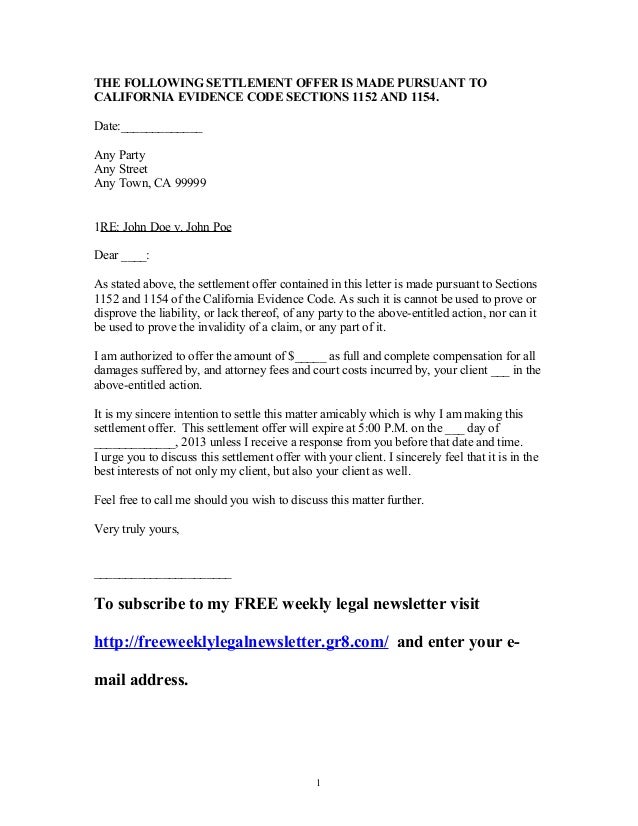

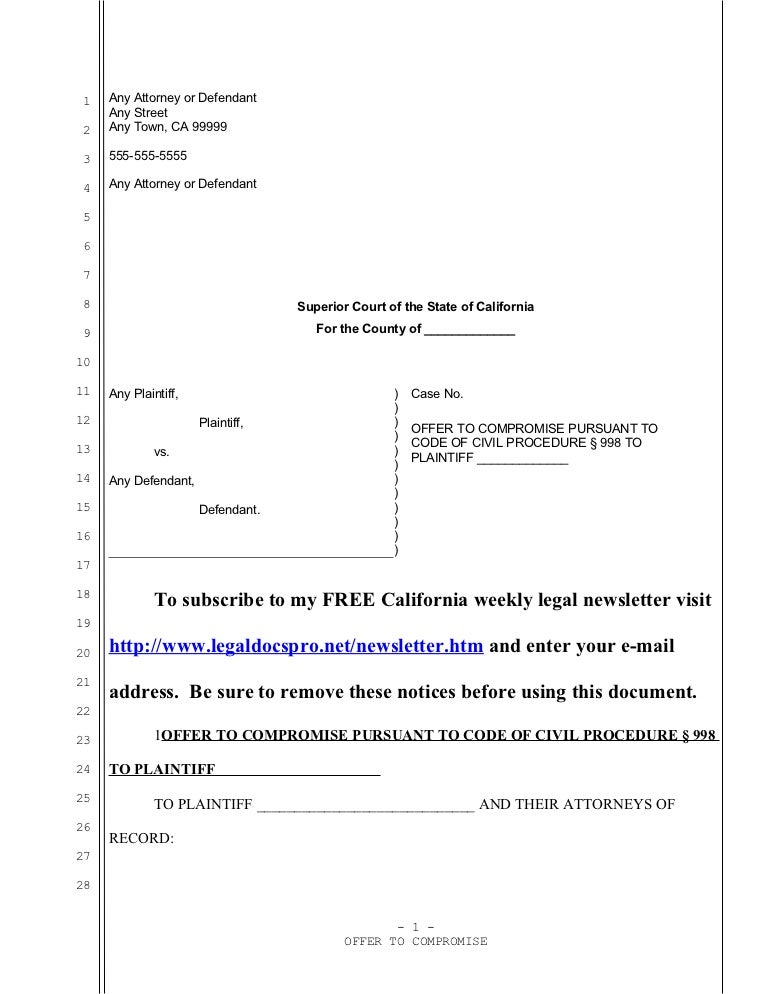

Sample California offer to compromise

Irs Name Change Letter Sample Internal revenue service deception

Ad Vast Library Of Fillable Legal Documents.

Web An Offer In Compromise Authorized You To Settle Owner Taxing Debt For Less Than The Full Amount You Owe.

Pdffiller Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

They Can Also Provide You With An Offer In Compromise Letter.

Related Post: