Merger Model Template

Merger Model Template - Web merger & acquisition (m&a) simple financial model. Accretion/dilution analysis financial modeling quick lesson: 50% cash and 50% debt vs…. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. All industries, financial model, general. Web in this section, we demonstrate how to model a merger of two public companies in excel. Each topic contains a spreadsheet with which you can interact within your browser to. Obviously, merger agreements involve money, like the security deposit or earnest money. 8.5 hours of video content. Web download this free merger agreement template as a word document to help detail the financial terms of companies that decide to combine their businesses Web merger & acquisition (m&a) simple financial model. Updated june 15, 2023 how to build a merger model a merger model is an analysis representing the combination of two companies that come together through an m&a process. Web download this free merger agreement template as a word document to help detail the financial terms of companies that decide to combine. Web use the form below to get the accretion dilution excel model template that goes with this lesson: All industries, financial model, general. Web this is the term use for consolidation of businesses or their assets. Each topic contains a spreadsheet with which you can interact within your browser to. Web up to 24% cash back a merger agreement will. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. Web this is the term use for consolidation of businesses or their assets. This course is designed for professionals working in investment banking,. 8.5 hours of video content. Web merger & acquisition (m&a) simple financial model. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. Web download this free merger agreement template as a word document to help detail the financial terms of companies that decide to combine their businesses Updated june 15, 2023 how to build a merger model a merger model is an analysis representing the. 8.5 hours of video content. The model is great financial tool used to evaluate the financial impact of merger or acquisition, it typically includes projections. This is to ensure the commitment of both parties in. And the list goes on. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. Web in this section, we demonstrate how to model a merger of two public companies in excel. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web 33% debt, 33% stock, and 33% cash vs. This course is designed for professionals working. The model is great financial tool used to evaluate the financial impact of merger or acquisition, it typically includes projections. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Each topic contains a spreadsheet with which you can interact within your browser. Such as, two or more companies becoming one (merger) or one buys/takes over another (acquisition). Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. 50% cash and 50% debt vs…. Web download this free merger agreement template as a word document to. Such as, two or more companies becoming one (merger) or one buys/takes over another (acquisition). Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web use the form below to get the accretion dilution excel model template that goes with this lesson:. Web use the form below to get the accretion dilution excel model template that goes with this lesson: These kinds of agreements are mainly used to expand a. 50% cash and 50% debt vs…. Mergers & acquisitions (m&a) modeling. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use,. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web use the form below to get the accretion dilution excel model template that goes with this lesson: The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. Updated june 15, 2023 how to build a merger model a merger model is an analysis representing the combination of two companies that come together through an m&a process. It includes an accounting of the assets and liabilities for each. Web 33% debt, 33% stock, and 33% cash vs. Mergers & acquisitions (m&a) modeling. All industries, financial model, general. Web merger & acquisition (m&a) simple financial model. And the list goes on. Each topic contains a spreadsheet with which you can interact within your browser to. Think about the “cost” of each method, start with the cheapest method, use the. Web a merger agreement is a legal contract that dictates the joining of two companies into a single business entity. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their. The model is great financial tool used to evaluate the financial impact of merger or acquisition, it typically includes projections. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is finalized. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Web start by clicking on fill out the template. Web download this free merger agreement template as a word document to help detail the financial terms of companies that decide to combine their businesses Such as, two or more companies becoming one (merger) or one buys/takes over another (acquisition). Web 33% debt, 33% stock, and 33% cash vs. Web use the form below to get the accretion dilution excel model template that goes with this lesson: Web a merger agreement is a legal contract that dictates the joining of two companies into a single business entity. Mergers & acquisitions (m&a) modeling. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. This course is designed for professionals working in investment banking,. It includes an accounting of the assets and liabilities for each. Accretion/dilution analysis financial modeling quick lesson: Web value combined entities using dcf models. Updated june 15, 2023 how to build a merger model a merger model is an analysis representing the combination of two companies that come together through an m&a process. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. Answer a few questions and your document is created automatically. These kinds of agreements are mainly used to expand a. And the list goes on. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is finalized. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their.Acquisition Integration Plan Template New Merger Integration Work How

Merger Model M&A Excel Template from CFI Marketplace

Merger Model M&A Excel Template from CFI Marketplace

Merger Model M&A Acquisition Street Of Walls

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Post Merger Integration Framework By exMcKinsey Consultants Merger

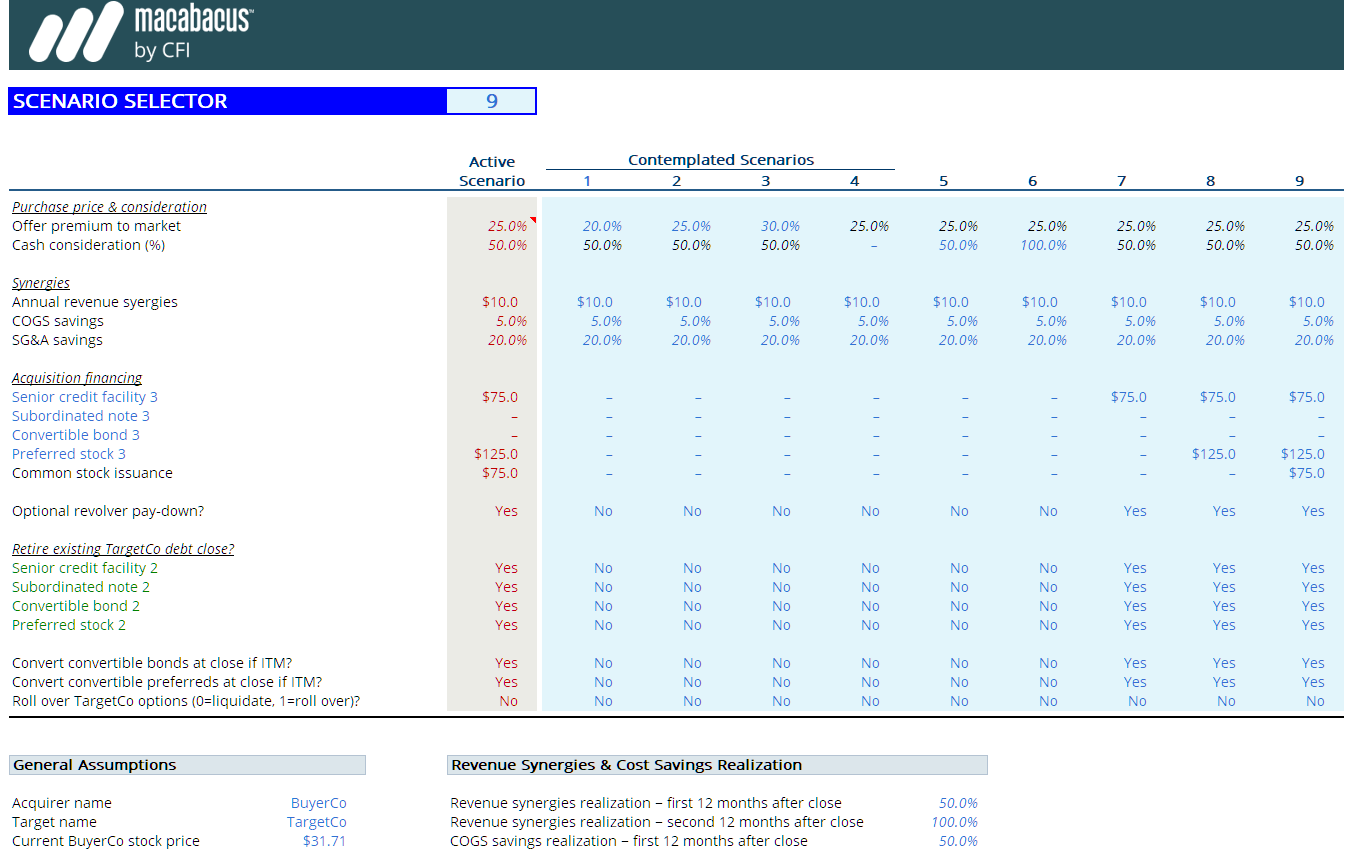

Merger Model Templates Macabacus

Merger Model StepByStep Walkthrough [Video Tutorial]

Timeline Template of Mergers Model SlideModel

Merger Model M&A Excel Template from CFI Marketplace

Web In This Section, We Demonstrate How To Model A Merger Of Two Public Companies In Excel.

Web The Key Steps Involved In Building A Merger Model Are:

This Is To Ensure The Commitment Of Both Parties In.

Web In This Article, You’ll Find 20 Of The Most Useful Merger And Acquisition (M&A) Templates For Business (Not Legal) Use, From Planning To Valuation To Integration.

Related Post:

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/22161546/Merger-Model-Assumptions-1024x537.jpg)