M&A Target Screening Template

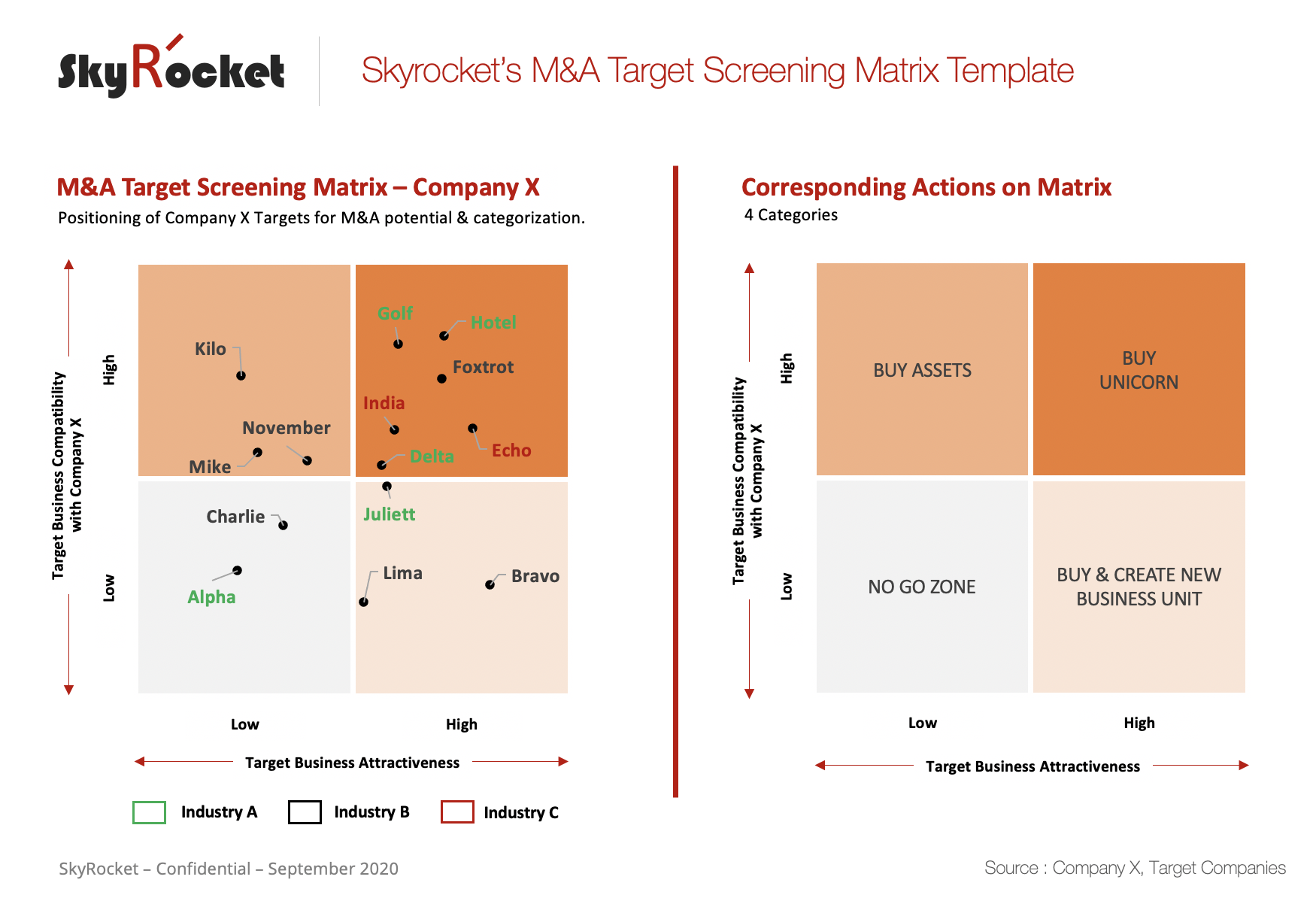

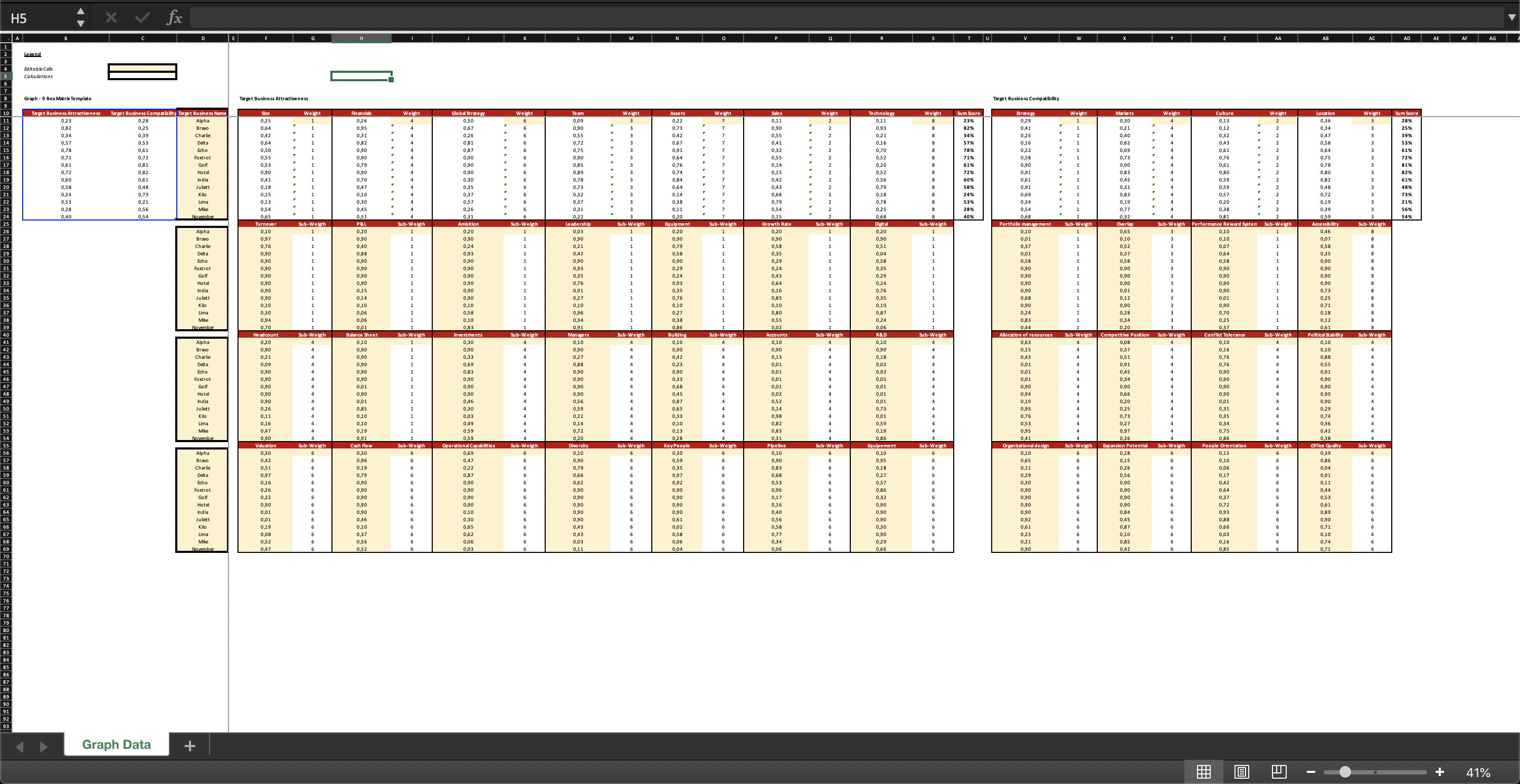

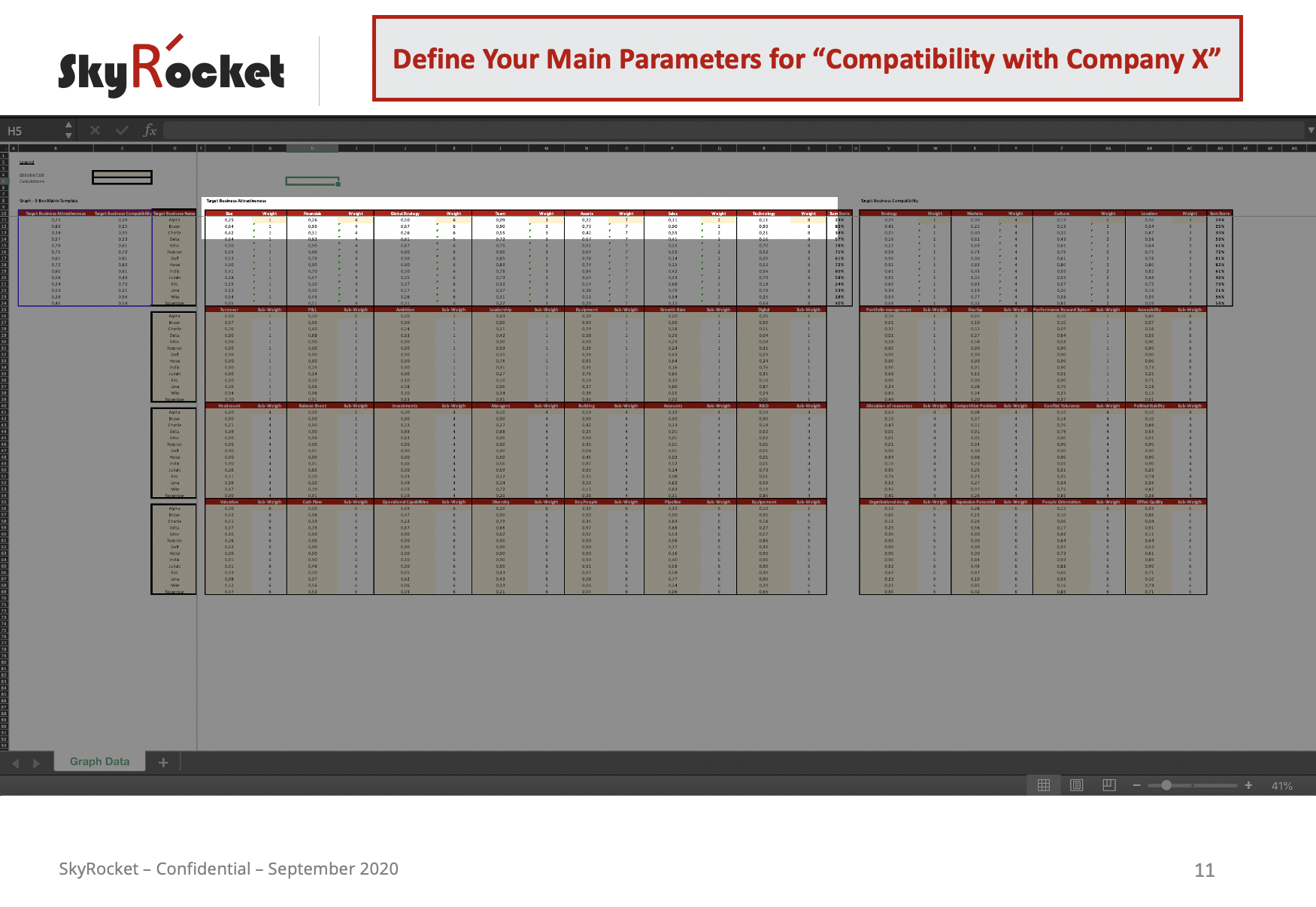

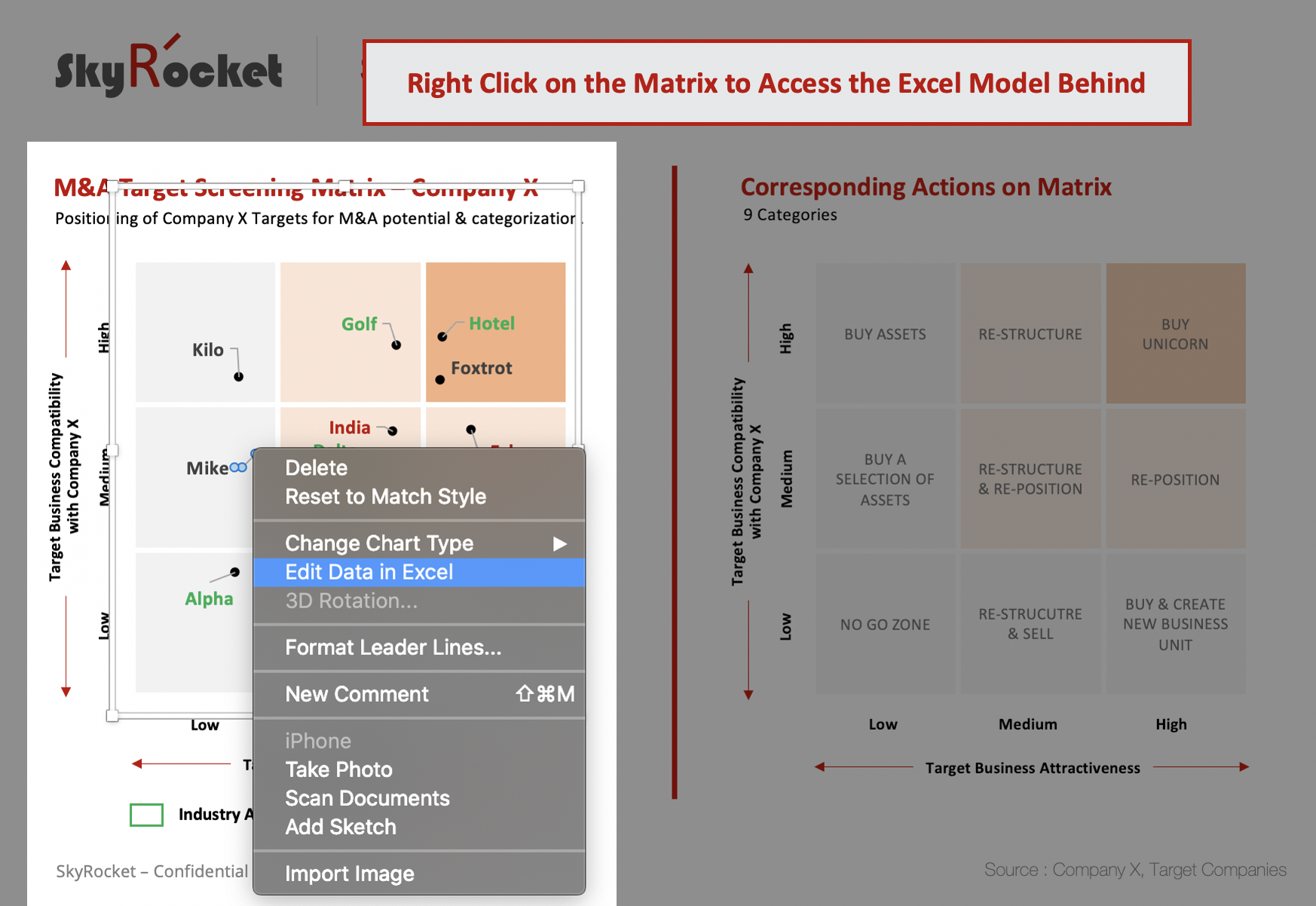

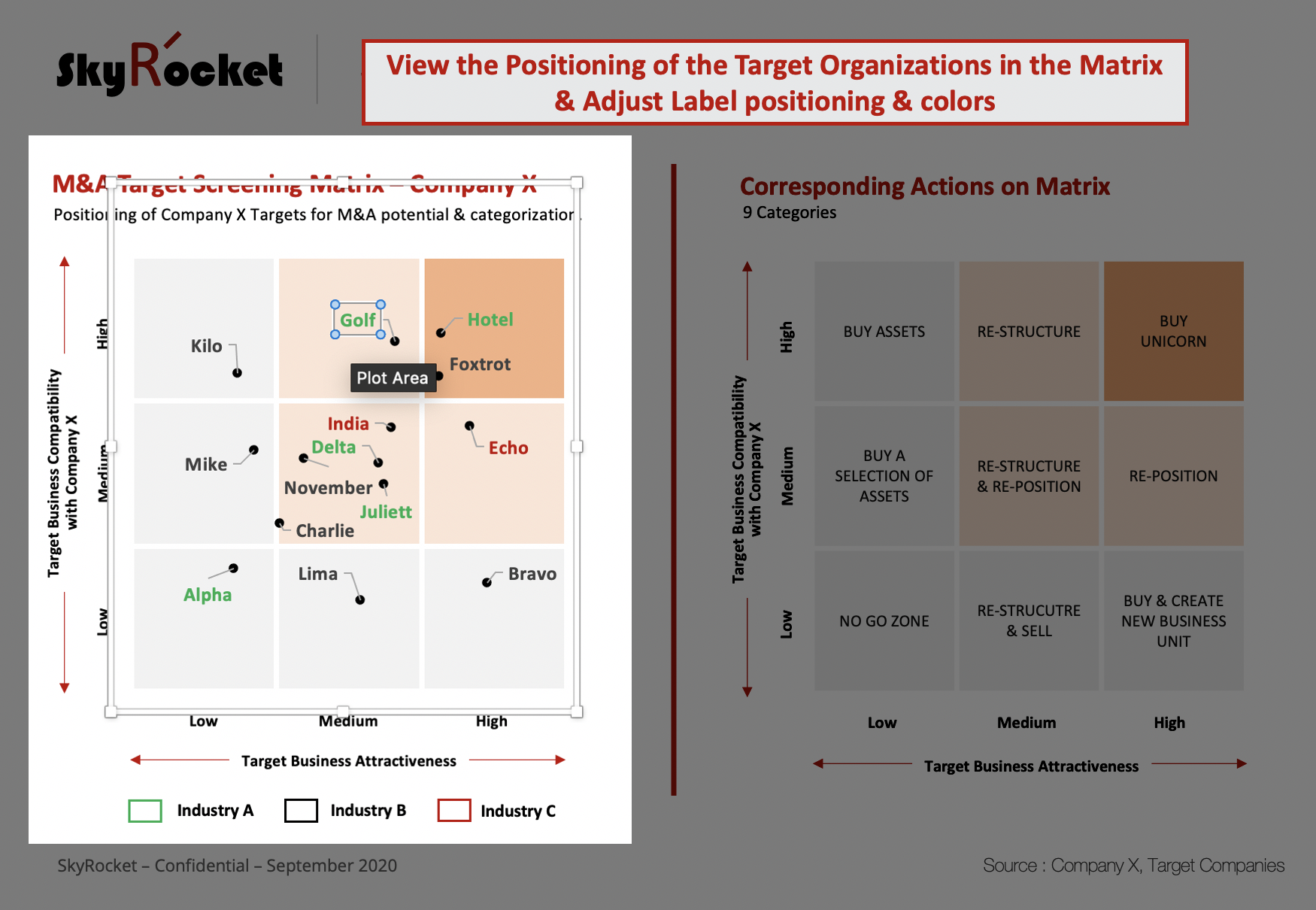

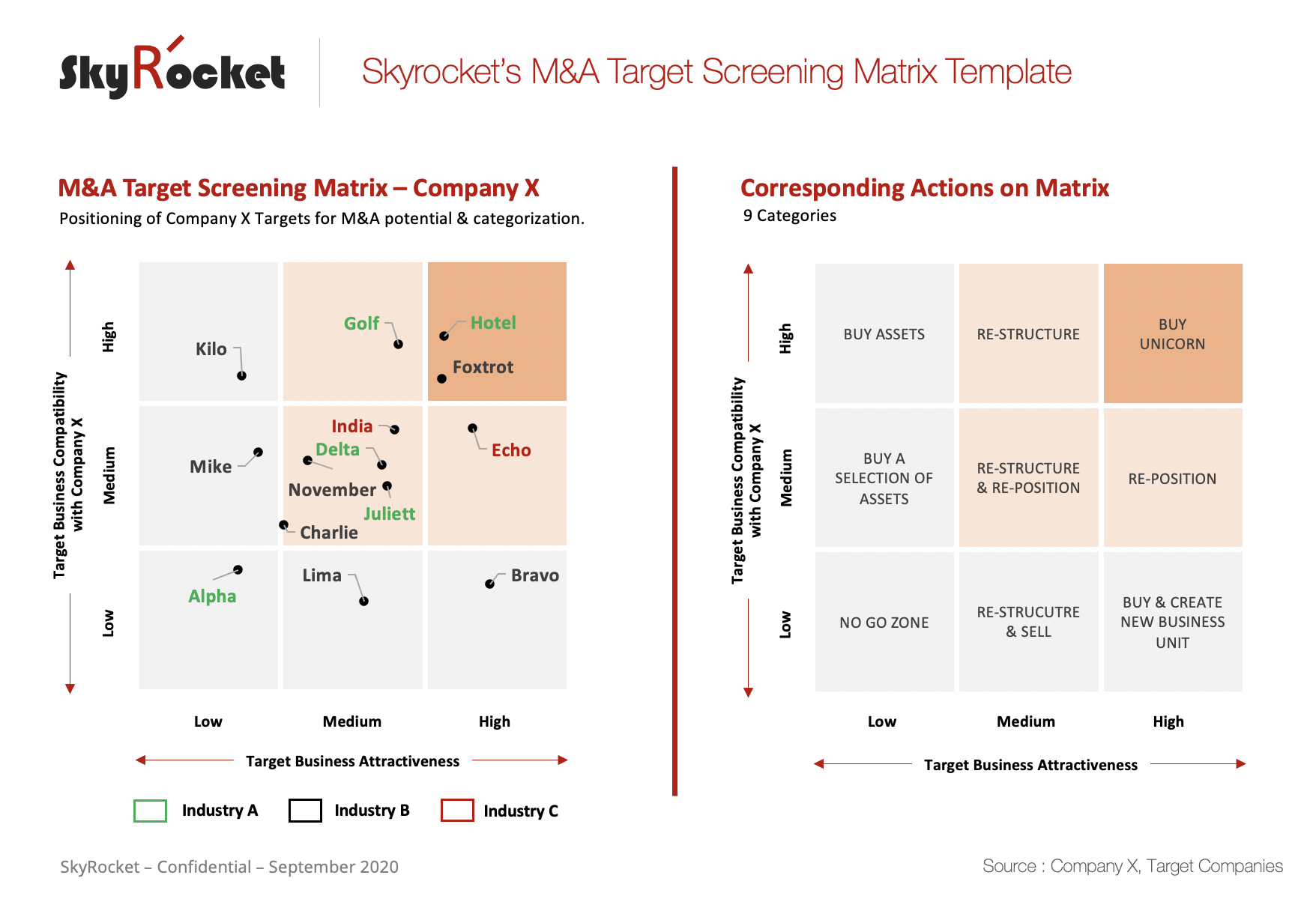

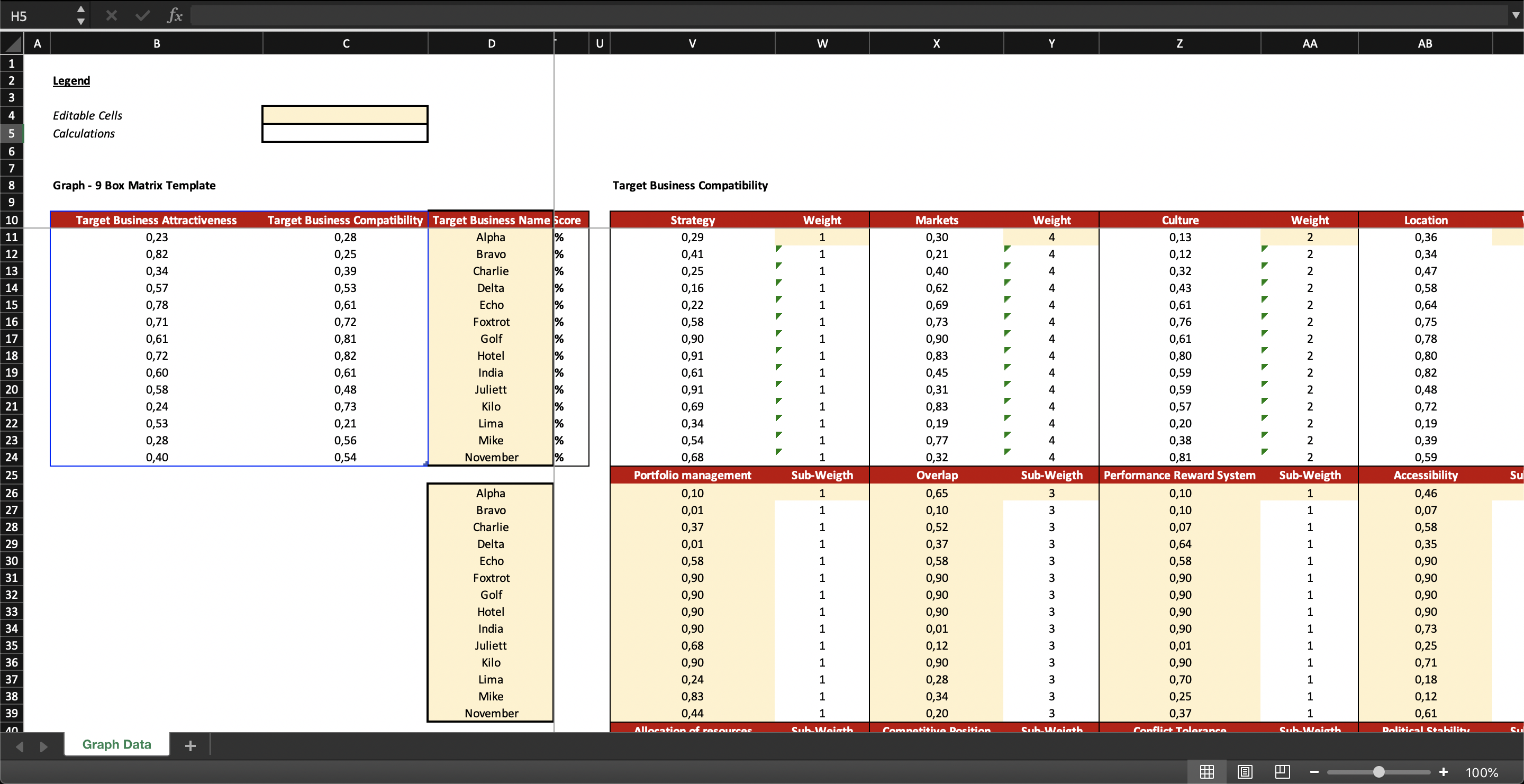

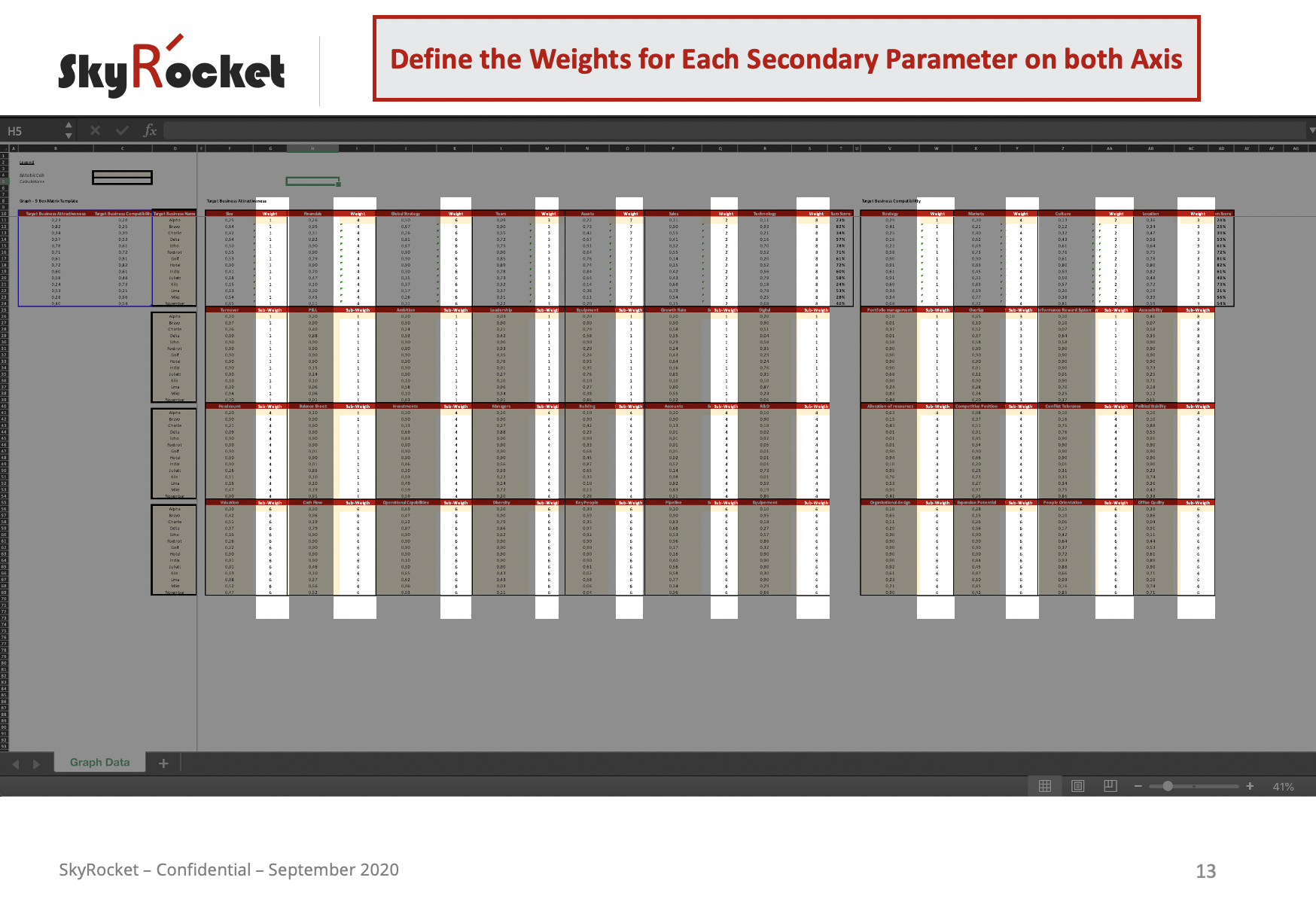

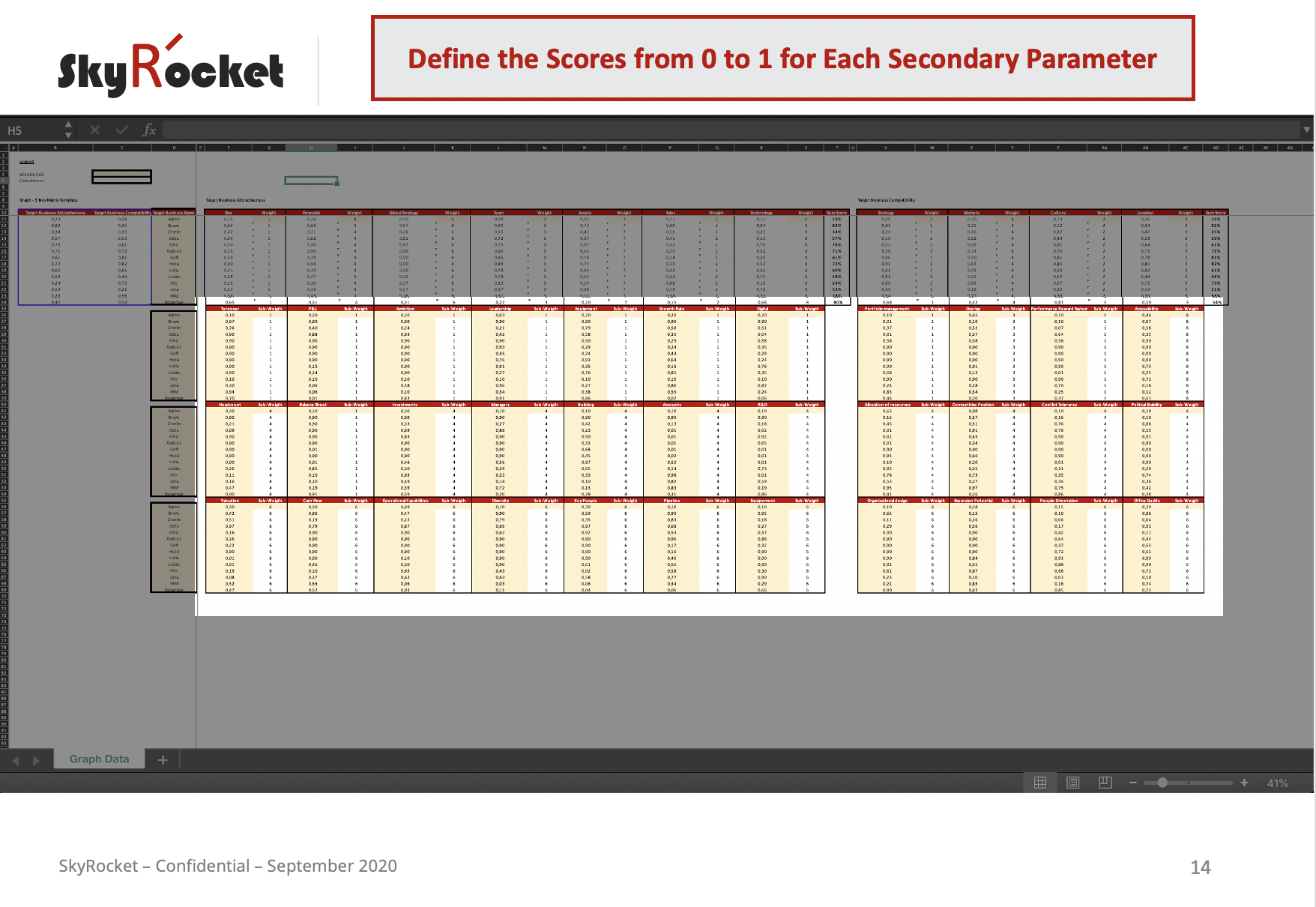

M&A Target Screening Template - We provide insights into dealsourcing, deal origination and. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. A proactive, structured screening process helps organizations. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). This article integrates the motives and criteria for target. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. The following presents a great rank and outline for building a potential. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Ideas from investment banks would typically flow into the long. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web m&a due diligence with gantt template. This usually involves two steps: Web on the basis of. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your. A proactive, structured screening process helps organizations. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. 2.5 criteria for the screening process. We. The table 3 provides a summary of the screening. Valuing the target on a standalone. Web m&a due diligence with gantt template. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Valuing the target on a standalone. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. Web in this article, you’ll find 20 of. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. They are available for free. Web target screening algorithm for m&a managers,. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). They are available for free. A proactive, structured screening process helps organizations. We provide insights. They are available for free. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. The table 3 provides a summary of the screening. A proactive, structured screening process helps organizations. Web target screening is crucial as it determines on which target(s) the due diligence will be. Ideas from investment banks would typically flow into the long list or be. The following presents a great rank and outline for building a potential. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. They are available for free. A proactive, structured screening process helps organizations. Web m&a due diligence with gantt template. 2.5 criteria for the screening process. This usually involves two steps: This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Valuing the target on a standalone. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. This article integrates the motives and criteria for target. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. The table 3 provides a summary of the screening. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. A proactive, structured screening process helps organizations. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. They are available for free. 2.5 criteria for the screening process. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. The following presents a great rank and outline for building a potential. Valuing the target on a standalone. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Ideas from investment banks would typically flow into the long list or be. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling.M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Web M&A Due Diligence With Gantt Template.

This Article Integrates The Motives And Criteria For Target.

Web One Of The Biggest Steps In The M&A Process Is Analyzing And Valuing Acquisition Targets.

This Usually Involves Two Steps:

Related Post: