Letter To Irs Template Word

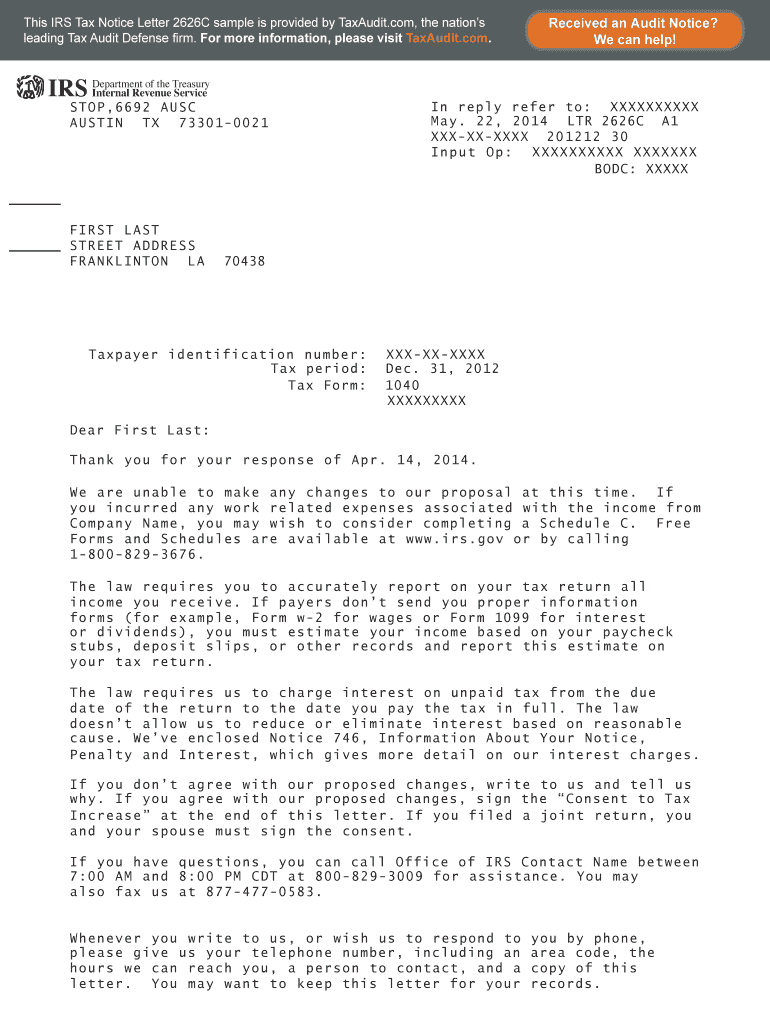

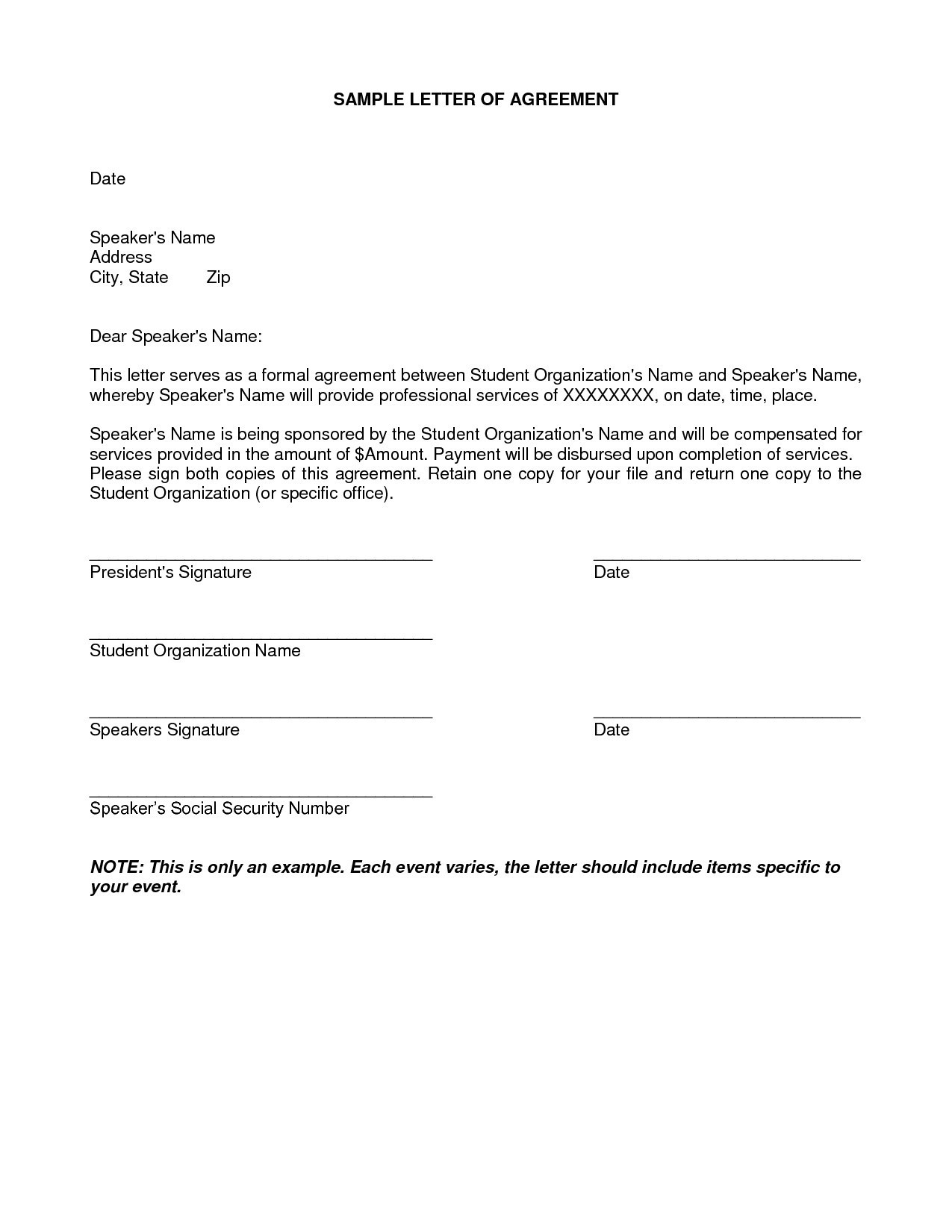

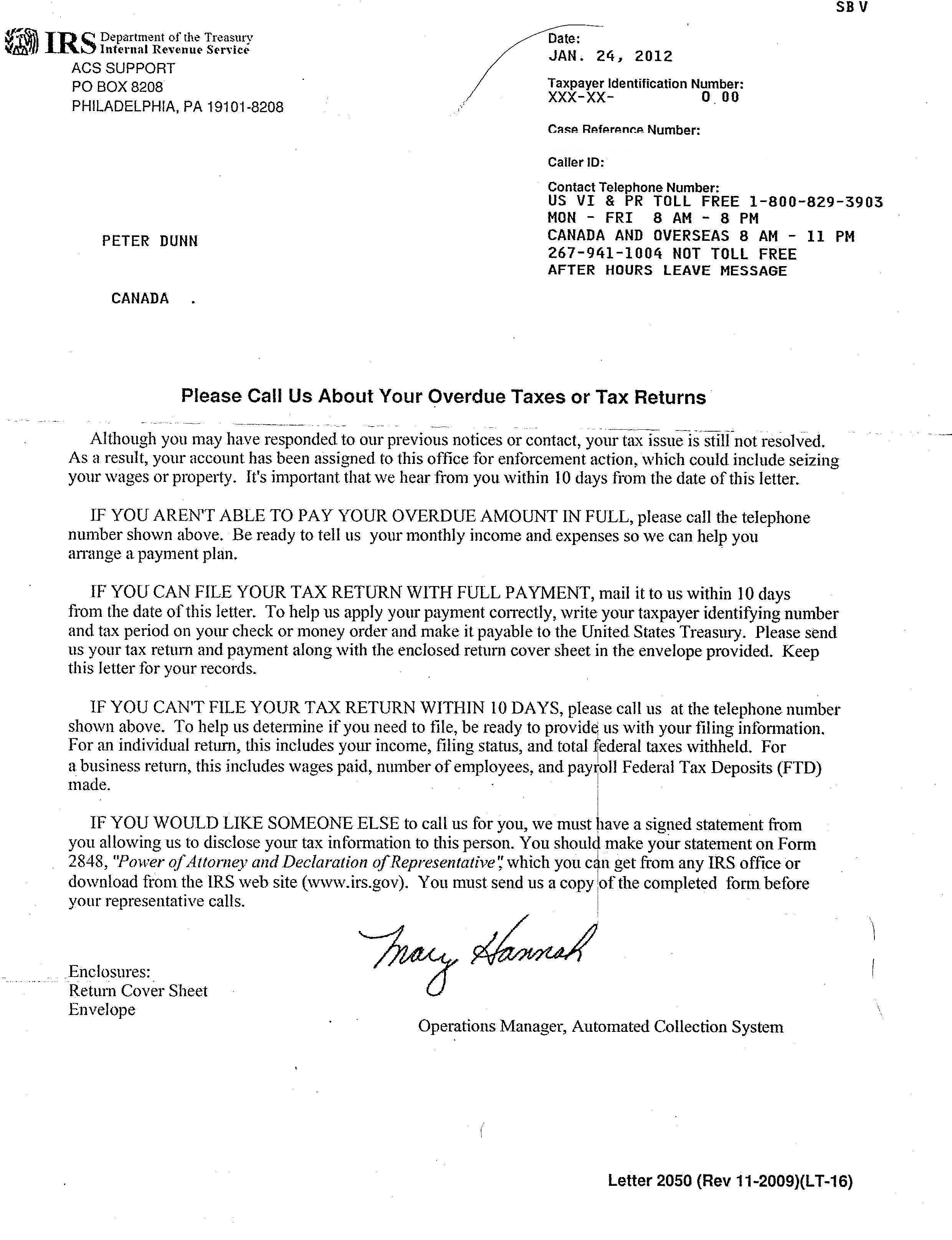

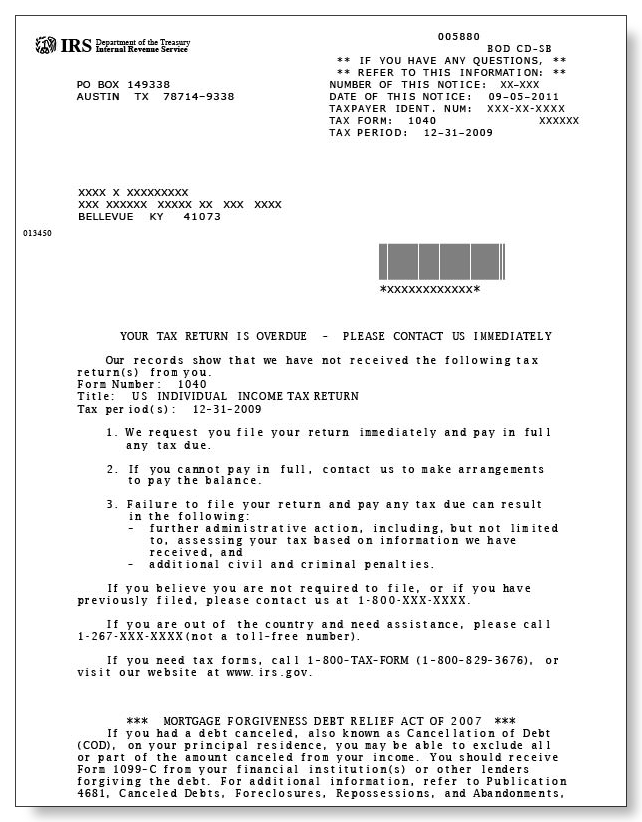

Letter To Irs Template Word - To start, choose your favorite template on microsoft create. Posted by frank gogol in taxes | updated on june 20, 2023. Get details on letters about the 2021 advance child tax credit payments: [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. Web the tax code provides that if you don’t object to an automated adjustment notice within 60 days, it becomes final. Web this letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process (cdp) or equivalent. Web according to the irs, your letter should include the following: They are both the exact same form:. You can give your letter a simple look with a. Web advance child tax credit letters. A template to help those. Download ein cancellation letter download our free cancel ein letter below in either pdf or microsoft word format. The letter specifies the tax form that. Web according to the irs, your letter should include the following: Get details on letters about the 2021 advance child tax credit payments: Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Enter the title of the document in the search area. There is no preprinted irs form to contest. Web [address 1] [address 2] [city, state zip] re: Web irs letter templates and samples. Web get the proper form in a few simple steps: Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Taxpayer’s name, address, and contact information. Ad answer simple questions to make legal forms on any device in minutes. A template to help those. Ad answer simple questions to make legal forms on any device in minutes. Get details on letters about the 2021 advance child tax credit payments: Web irs letters typically are about a specific issue on your federal tax return or tax account and include specific instructions on what you need to do to respond. An explanation letter, also known as. Web irs letter templates and samples what is an irs letter? Web how to write an explanation letter to the irs. [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. There is no preprinted irs form to contest. Web according to the irs, your letter should include the following: Web get the proper form in a few simple steps: Web how to write an explanation letter to the irs. A template to help those. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Web irs letters typically are about a specific issue on your federal. Web the irs shall of of the most feared government agencies. A statement expressing your desire to appeal. Ad answer simple questions to make legal forms on any device in minutes. Web the tax code provides that if you don’t object to an automated adjustment notice within 60 days, it becomes final. They are both the exact same form:. Web the irs shall of of the most feared government agencies. Web make your letter more graphically appealing in a flash using templates. Web advance child tax credit letters. The letter specifies the tax form that. A template to help those. [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. Web irs letters or notices typically are about a specific issue on your federal tax return or tax account and include specific instructions on what you need to do to respond. Ad answer simple questions to make legal forms on any. However, you have nothing to fear when you want to write them a letter. Web that letter and includes information that will help the taxes identify the source of the penalty and the causes why it should be savings. Web [address 1] [address 2] [city, state zip] re: Format a business letter and. Web irs letters or notices typically are. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Web [address 1] [address 2] [city, state zip] re: Enter the title of the document in the search area. A template to help those. Web advance child tax credit letters. However, you have nothing to fear when you want to write them a letter. Web most irs letters have two options: Web irs letters typically are about a specific issue on your federal tax return or tax account and include specific instructions on what you need to do to respond. Posted by frank gogol in taxes | updated on june 20, 2023. Web irs letters or notices typically are about a specific issue on your federal tax return or tax account and include specific instructions on what you need to do to respond. You can give your letter a simple look with a. Get details on letters about the 2021 advance child tax credit payments: Web how to write an explanation letter to the irs. Web that letter and includes information that will help the taxes identify the source of the penalty and the causes why it should be savings. A statement expressing your desire to appeal. Web irs letter templates and samples what is an irs letter? Web let the irs know of a disputed notice. Web according to the irs, your letter should include the following: [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. They are both the exact same form:. Enter the title of the document in the search area. Format a business letter and. There is no preprinted irs form to contest. You can give your letter a simple look with a. Web irs letters or notices typically are about a specific issue on your federal tax return or tax account and include specific instructions on what you need to do to respond. Web advance child tax credit letters. Web how to write an explanation letter to the irs. Web most irs letters have two options: Web the irs shall of of the most feared government agencies. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web the tax code provides that if you don’t object to an automated adjustment notice within 60 days, it becomes final. [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. A statement expressing your desire to appeal. Web let the irs know of a disputed notice. The letter specifies the tax form that.Sample Letter To Irs Free Printable Documents

Letter To Irs Free Printable Documents

[View 44+] Sample Letter Format To Irs LaptrinhX / News

Irs Name Change Letter Sample Internal revenue service deception

Pin on Templates

Irs Letter Template shatterlion.info

How To Get An Irs Settlement

Letter to Irs Template Samples Letter Template Collection

Best Irs Response Letter Format Background Format Kid

Letter To Irs Free Printable Documents

An Irs Letter Is A Formal Document Issued By The Internal Revenue Service (Irs) To Notify The Taxpayer About.

If A Taxpayer Doesn't Agree With The Irs, They Should Mail A Letter Explaining Why They Dispute The Notice.

Taxpayer’s Name, Address, And Contact Information.

Web Irs Letters Typically Are About A Specific Issue On Your Federal Tax Return Or Tax Account And Include Specific Instructions On What You Need To Do To Respond.

Related Post:

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://www.hrblock.com/tax-center/wp-content/uploads/2018/01/Letter-2904.png)