Itemized Deductions Template

Itemized Deductions Template - Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. If you are claiming a net qualified. Edit, sign and save itemized fee worksheet form. You have the name of the deduction in the first column of the template, the items. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. This schedule is used by filers to report. Web download itemized deduction calculator 2022 (excel, openoffice calc & google sheets) we have created an itemized deduction calculator 2022 with predefined formulas and. Upload, modify or create forms. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Web an itemized deduction is an expense that can be subtracted from adjusted gross income (agi) to reduce your tax bill. Web included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Upload, modify or create forms. If you itemize, you can deduct a part of. Upload, modify or create forms. This category reposts the medical, dental and insurance premium expenses that are above 10 % of your adjusted gross. Web start at the top of your opened document and take a look at how the information is setup. Types of itemized deductions include mortgage. This schedule is used by filers to report. This category reposts the medical, dental and insurance premium expenses that are above 10 % of your adjusted gross. Itemized deductions must be listed on. Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Ad deductions checklist & more fillable forms, register and subscribe now! Web included in. You have the name of the deduction in the first column of the template, the items. Try it for free now! Upload, modify or create forms. Sign it in a few clicks draw. Most taxpayers have a choice of taking a. Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Web to deduct taxes or interest on schedule a (form 1040), itemized deductions, you generally must be legally obligated to pay the expense and must have paid the expense. This category reposts the medical, dental and insurance premium expenses. Web download itemized deduction calculator 2022 (excel, openoffice calc & google sheets) we have created an itemized deduction calculator 2022 with predefined formulas and. Dochub allows users to edit, sign, fill & share all type of documents online. Types of itemized deductions include mortgage. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income.. If you are claiming a net qualified. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Itemized deductions must be listed on. Sign it in a few clicks draw. If you are claiming a net qualified. Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Web an itemized deduction is a particular expense (for example, real estate or property tax) that can be claimed as an expense for that specific tax year. Ad deductions checklist & more. Web to deduct taxes or interest on schedule a (form 1040), itemized deductions, you generally must be legally obligated to pay the expense and must have paid the expense. Edit, sign and save itemized fee worksheet form. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard. This category reposts the medical, dental and insurance premium expenses that are above 10 % of your adjusted gross. Web to deduct taxes or interest on schedule a (form 1040), itemized deductions, you generally must be legally obligated to pay the expense and must have paid the expense. If you itemize, you can deduct a part of your. Web itemized. Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce the amount of income that is taxed. Web an itemized deduction is an expense that can be subtracted from adjusted gross income (agi) to reduce your tax bill. Itemized deductions must be listed on. Types of itemized deductions include mortgage. This schedule is used by filers to report. Edit, sign and save itemized fee worksheet form. Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Ad deductions checklist & more fillable forms, register and subscribe now! Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Dochub allows users to edit, sign, fill & share all type of documents online. Sign it in a few clicks draw. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Upload, modify or create forms. Try it for free now! Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. If you are claiming a net qualified. This category reposts the medical, dental and insurance premium expenses that are above 10 % of your adjusted gross. Web taxes homeowners can deduct the real estate taxes they were allocated within the year in which they are filing taxes. Web an itemized deduction is a particular expense (for example, real estate or property tax) that can be claimed as an expense for that specific tax year. Web download itemized deduction calculator 2022 (excel, openoffice calc & google sheets) we have created an itemized deduction calculator 2022 with predefined formulas and. Edit, sign and save itemized fee worksheet form. You have the name of the deduction in the first column of the template, the items. Most taxpayers have a choice of taking a. Itemized deductions must be listed on. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Upload, modify or create forms. Web start at the top of your opened document and take a look at how the information is setup. Web an itemized deduction is an expense that can be subtracted from adjusted gross income (agi) to reduce your tax bill. This schedule is used by filers to report. Web itemized deductions go to www.irs.gov/schedulea for instructions and the latest information. Web in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Web included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation. Sign it in a few clicks draw. Dochub allows users to edit, sign, fill & share all type of documents online. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file.Itemized Deductions Worksheet 2017 Printable Worksheets and

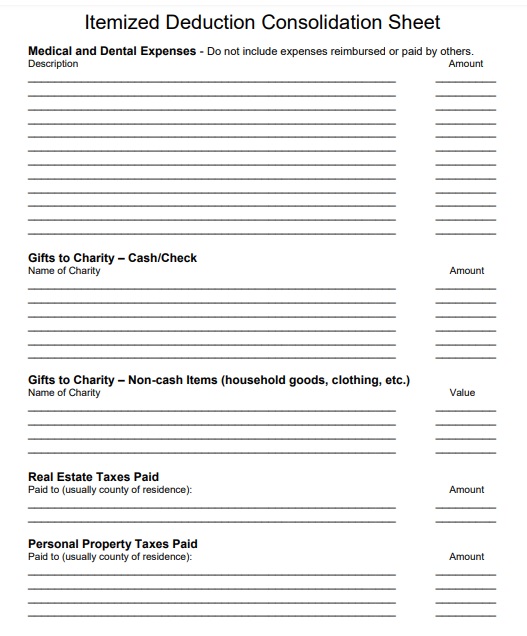

Itemized Deduction Worksheet Worksheet

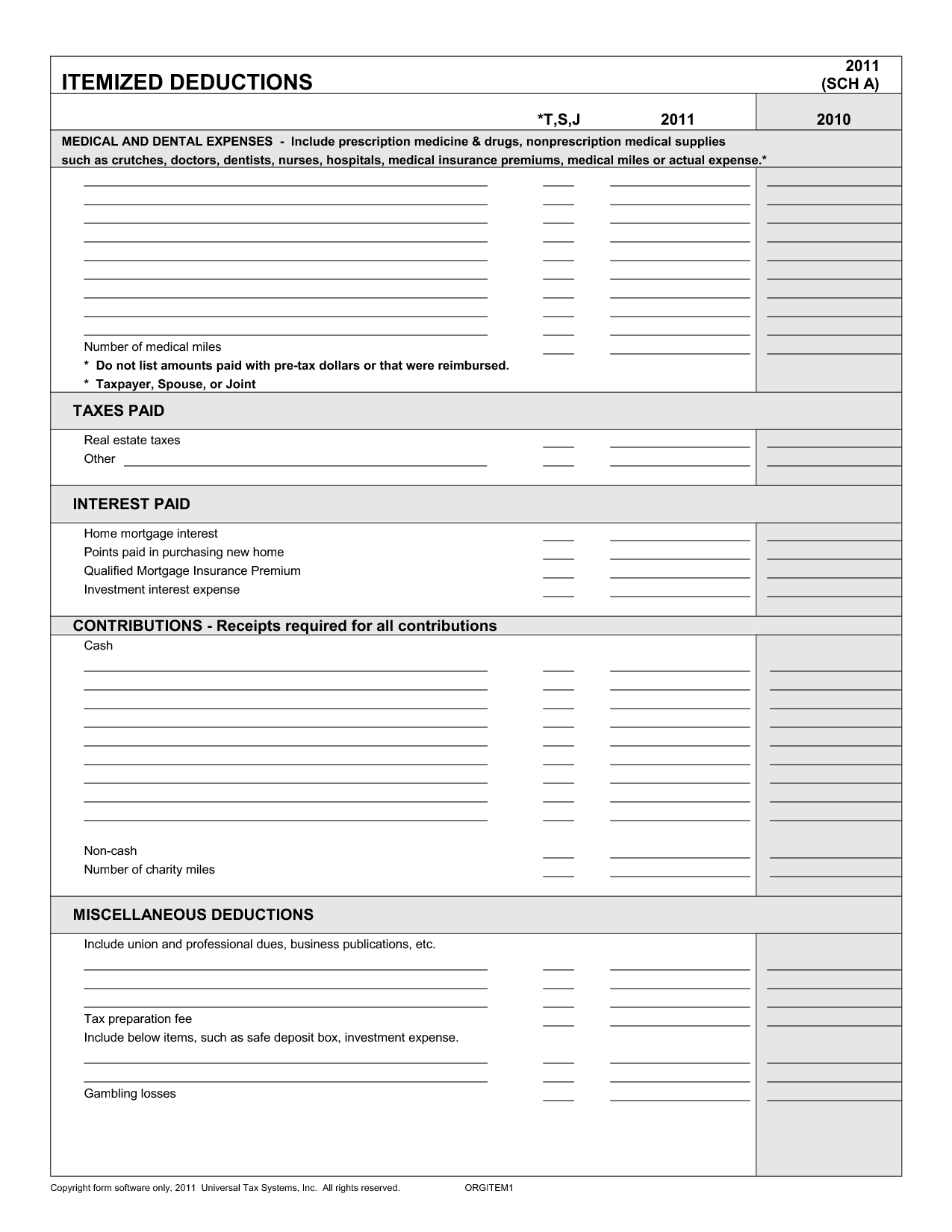

10 2014 Itemized Deductions Worksheet /

Explore Our Sample of Itemized Security Deposit Deduction Form for Free

Security Deposit Deduction Letter Form Fill Out and Sign Printable

California Itemized Deductions Worksheet

Itemized Deduction Templates 8+ Printable Word & PDF Formats

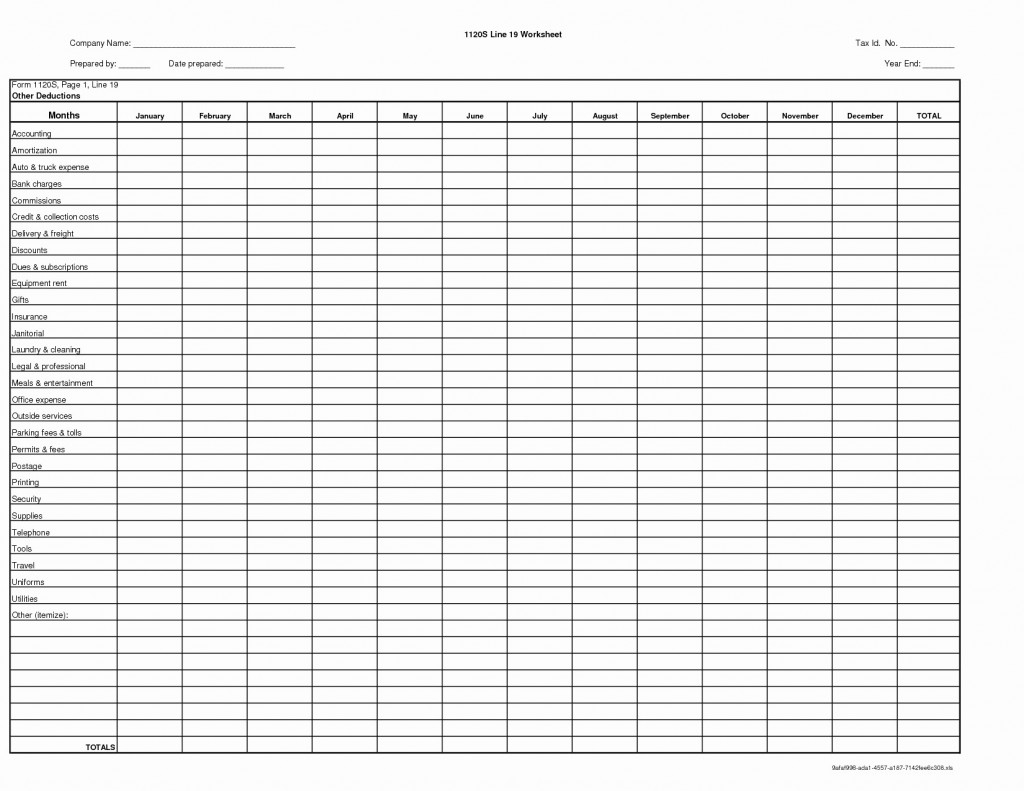

10 Business Tax Deductions Worksheet /

17 Schedule C Deductions Worksheet /

Itemized Deductions Spreadsheet —

If You Are Claiming A Net Qualified.

Web Taxes Homeowners Can Deduct The Real Estate Taxes They Were Allocated Within The Year In Which They Are Filing Taxes.

Web Itemized Deductions Are Specific Types Of Expenses The Taxpayer Incurred That May Reduce Taxable Income.

Edit Your Itemized Deductions Worksheet Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Related Post: