Irs Wisp Template Download

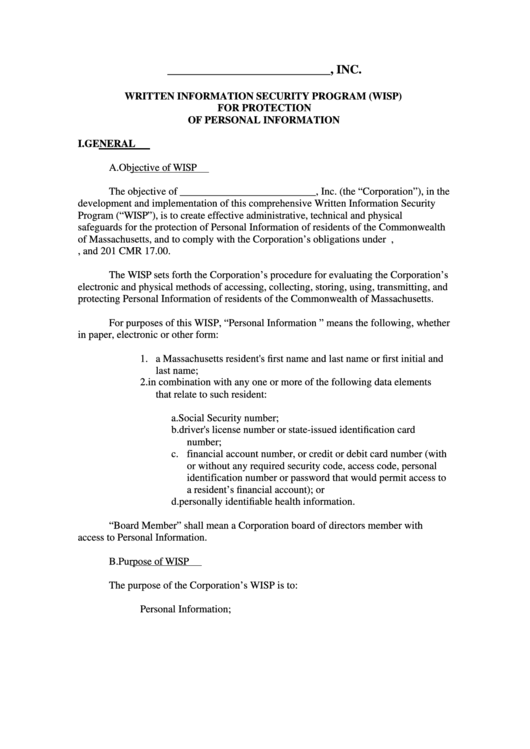

Irs Wisp Template Download - A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Washington — the security summit partners. System protection data breach plan irs wisp. Web introduction safeguarding taxpayer data. Web you can also download it, export it or print it out. Special sessions on the wisp. Free irs wisp template to. Web download your free written information security plan template & secure your firm name * first last email * download wisp template as of august 8, 2022. The sample plan is available on irs.gov. (word) click to download written information security plan template. Web introduction safeguarding taxpayer data. New wisp simplifies complex area. Protect yourself take basic security steps. This defines the reason for the plan, stating any legal obligations such as compliance with the provisions of glba. System protection data breach plan irs wisp. (word) click to download written information security plan template. Free shipping on qualified orders. System protection data breach plan irs wisp. You will need to use an editor such as microsoft word or equivalent to open and edit the file. (pdf) click to download written information security plan. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web sample template written information security plan (wisp) added detail for consideration when creating your wisp define the wisp objectives, purpose, and scope identify. Safeguard your business with irs compliance regulatory compliance / may 17, 2023 free wisp template: Ad. Special sessions on the wisp. Web security summit releases new data security plan to help tax professionals; You will need to use an editor such as microsoft word or equivalent to open and edit the file. The sample plan is available on irs.gov. Safeguard your business with irs compliance regulatory compliance / may 17, 2023 free wisp template: Web the special template is designed to help tax professionals, especially smaller practices, make data security planning easier. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web security summit releases new data security plan to help tax professionals; Free shipping on qualified orders. New wisp simplifies complex area. Web introduction safeguarding taxpayer data. Ad download our free written information security plan template for accountants. The irs requires written information security plans to protect data. Washington — the security summit partners. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Get back in irs good standing. Web free wisp template: Ad shop devices, apparel, books, music & more. Web download your free written information security plan template & secure your firm name * first last email * download wisp template as of august 8, 2022. The sample plan is available on irs.gov. Free irs wisp template to. Web the special template is designed to help tax professionals, especially smaller practices, make data security planning easier. Web introduction safeguarding taxpayer data. Type text, add images, blackout confidential details, add comments, highlights and more. The irs requires written information security plans to protect data. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Both formats are bundled together in a zip (.zip) file. Web the special template is designed to help tax professionals, especially smaller practices, make data security planning easier. The irs requires written information security plans to protect data. Web introduction. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Edit your wisp template online. Safeguard your business with irs compliance. (word) click to download written information security plan template. All tax and accounting firms should do the following:. Download free irs wisp template download our free irs written information security plan template. Ad download our free written information security plan template for accountants. This defines the reason for the plan, stating any legal obligations such as compliance with the provisions of glba. Web click the data security plan template link to download it to your computer. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. System protection data breach plan irs wisp. Web download your free written information security plan template & secure your firm name * first last email * download wisp template as of august 8, 2022. (pdf) click to download written information security plan. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web define the wisp objectives, purpose, and scope. Type text, add images, blackout confidential details, add comments, highlights and more. Web sample template written information security plan (wisp) added detail for consideration when creating your wisp define the wisp objectives, purpose, and scope identify. Web introduction safeguarding taxpayer data. Edit your wisp template online. Protect yourself take basic security steps. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Find out today if you qualify. The sample plan is available on irs.gov. Get back in irs good standing. (pdf) click to download written information security plan. (word) click to download written information security plan template. Web free wisp template: Web define the wisp objectives, purpose, and scope. Download free irs wisp template download our free irs written information security plan template. Ad do you have irs debt & need an irs installment agreement? Free irs wisp template to. Protect yourself take basic security steps. System protection data breach plan irs wisp. Special sessions on the wisp. Web click the data security plan template link to download it to your computer. The sample plan is available on irs.gov. Free shipping on qualified orders. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Ad download our free written information security plan template for accountants.Irs Wisp Template

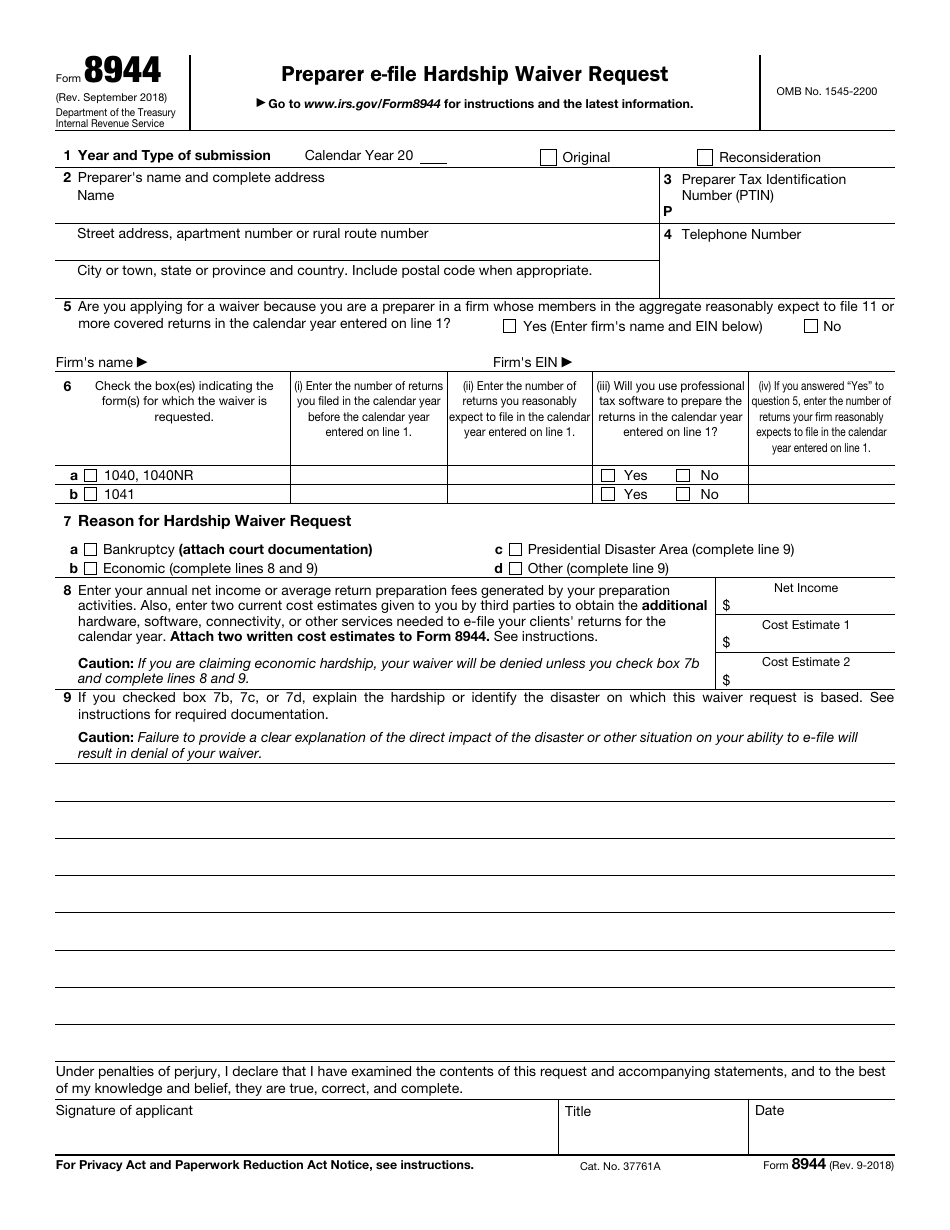

IRS Form 8944 Download Fillable PDF or Fill Online Preparer EFile

Written Information Security Program (WISP) Security Waypoint

Written Information Security Program (WISP) Security Waypoint

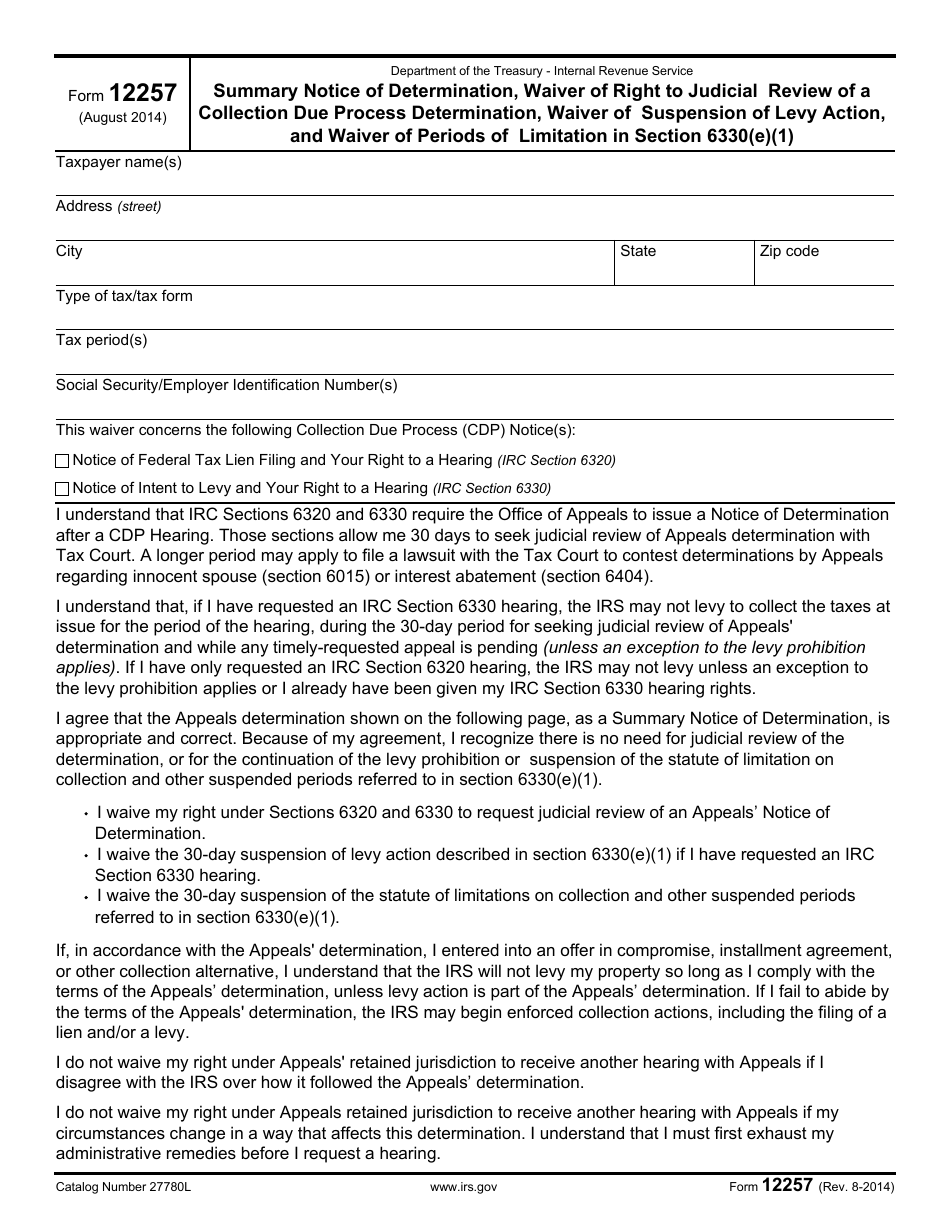

IRS Form 12257 Download Fillable PDF or Fill Online Summary Notice of

Written Information Security Program (WISP) Security Waypoint

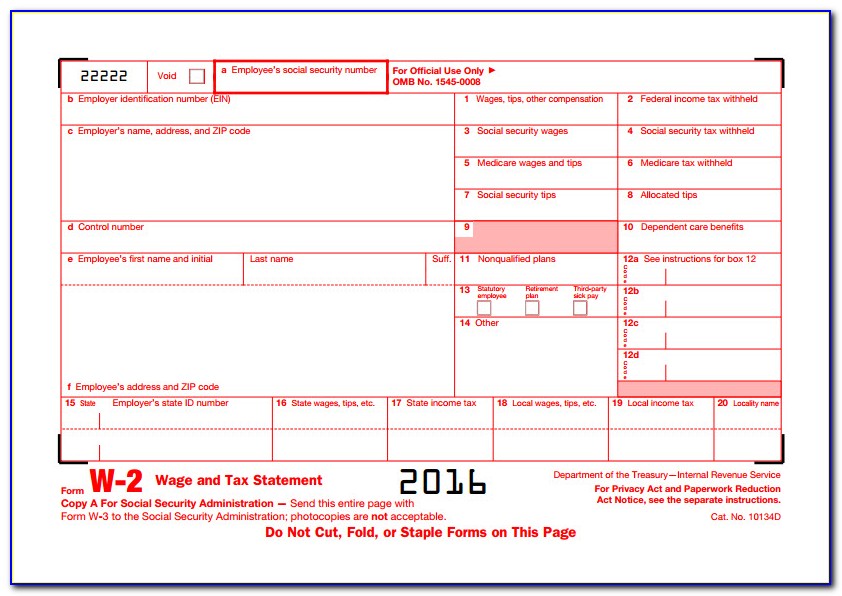

New Eeo 1 Form 2017 Form Resume Examples aZDYGa3O79

Irs Wisp Template

Irs Wisp Template

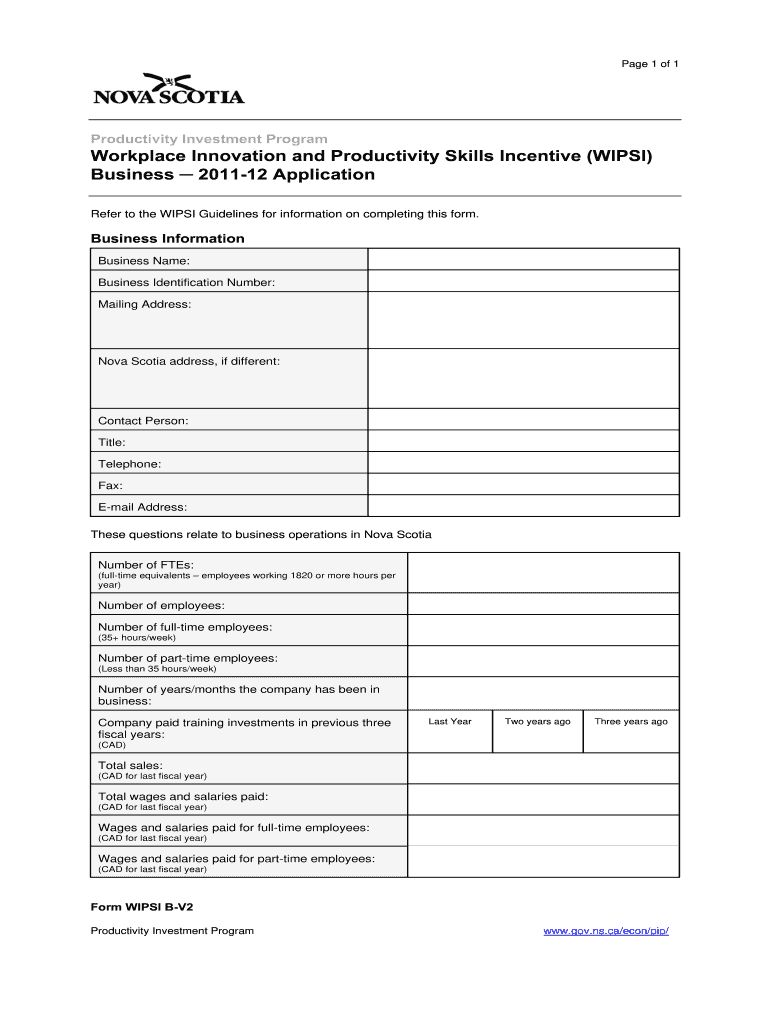

Wipsi Fill Out and Sign Printable PDF Template signNow

Web Security Summit Releases New Data Security Plan To Help Tax Professionals;

Safeguard Your Business With Irs Compliance Regulatory Compliance / May 17, 2023 Free Wisp Template:

Web Irs Publications 4557 And 5293 Provide Guidance In Creating A Wisp That Is Scaled To The Firm’s Operations.

Web This Page Contains Irs Tax Forms And Instructions In Text (.Txt) And Braille Ready File (.Brf) Formats.

Related Post: