Irs Response Letter Template

Irs Response Letter Template - Provide specific reasons why you believe the irs is mistaken, and reference your. Web i’m sherise… and i work for the internal revenue service. Download it to your computer, or just reference it when composing your own. Web not sure where to start? Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Ssn here (if you and your spouse filed jointly, use the ssn that appears first. ________ therefore, i respectfully request that the penalty in the amount of $ ________ be canceled due to reasonable. Get free, competing quotes from irs tax issue experts. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. A cp12 notice is sent when the irs corrects one or more mistakes on your tax. Web draft a response letter to the irs, outlining any claims that you dispute. Review the information on the cp2000 carefully for accuracy. Determine if you agree or disagree with the. The first opportunity for taxpayer advocate. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web here are some tips to help you when you receive a notice or letter from the irs. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Web review. Web not sure where to start? Get free, competing quotes from irs tax issue experts. Provide specific reasons why you believe the irs is mistaken, and reference your. Web i’m sherise… and i work for the internal revenue service. Web the irs and its authorized private collection agencies generally contact taxpayers by mail. Web draft a response letter to the irs, outlining any claims that you dispute. Web up to $3 cash back 1. Ad don't let the irs intimidate you. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. A cp12 notice is sent when the irs corrects. A cp12 notice is sent when the irs corrects one or more mistakes on your tax. Ad don't let the irs intimidate you. Most of the time, all the taxpayer needs to do is read the letter. Provide specific reasons why you believe the irs is mistaken, and reference your. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal. The irs corrected one or more mistakes on your tax return. Most of the time, all the taxpayer needs to do is read the letter. Keep copies of any correspondence with your tax. ________ therefore, i respectfully request that the penalty in the amount of $ ________ be canceled due to reasonable. Web here are some tips to help you. Keep copies of any correspondence with your tax. Web draft a response letter to the irs, outlining any claims that you dispute. Web provide a timely response. The irs corrected one or more mistakes on your tax return. Web review your notice or letter closely to find out if the irs agreed with your request to refund or abate interest,. Download it to your computer, or just reference it when composing your own. When our records don’t match what you reported on your tax. ________ therefore, i respectfully request that the penalty in the amount of $ ________ be canceled due to reasonable. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Web most irs letters. The first opportunity for taxpayer advocate. Web up to $3 cash back 1. A cp12 notice is sent when the irs corrects one or more mistakes on your tax. Review the information on the cp2000 carefully for accuracy. Web provide a timely response. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Web most irs letters have two options: Web here are some tips to help you when you receive a notice or letter from the irs. Get free, competing quotes from leading irs tax issue experts. Ssn here (if you and your spouse filed jointly, use the ssn. Download it to your computer, or just reference it when composing your own. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Most of the time, all the taxpayer needs to do is read the letter. ________ therefore, i respectfully request that the penalty in the amount of $ ________ be canceled due to reasonable. Web up to $3 cash back 1. You can copy our free irs audit response letter template. Keep copies of any correspondence with your tax. A cp12 notice is sent when the irs corrects one or more mistakes on your tax. Web provide a timely response. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. Web i plan to address the issue in the following manner: Web draft a response letter to the irs, outlining any claims that you dispute. The first opportunity for taxpayer advocate. November 4, 2020 | last updated: Web the irs and its authorized private collection agencies generally contact taxpayers by mail. Your notice or letter will. Irs letters or notices typically are about a specific issue on your. The irs corrected one or more mistakes on your tax return. Determine if you agree or disagree with the. Web most irs letters have two options: Web don’t panic if you receive one of the millions of notices and letters the irs sends to taxpayers every year. Web with thomson reuters checkpoint irs response library, you can simply search by notice number or topic to respond to the irs and your clients using a variety of tax resolution. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Get free, competing quotes from irs tax issue experts. Determine if you agree or disagree with the. Web the irs and its authorized private collection agencies generally contact taxpayers by mail. Irs letters or notices typically are about a specific issue on your. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Download it to your computer, or just reference it when composing your own. Web provide a timely response. You can copy our free irs audit response letter template. Web review your notice or letter closely to find out if the irs agreed with your request to refund or abate interest, penalties, overpaid tax and or additional tax. November 4, 2020 | last updated: Determine the reason the notice or letter was sent. Get free, competing quotes from leading irs tax issue experts. Web got a letter or notice from the irs?Irs Response Letter Template Samples Letter Template Collection

Irs Cp2000 Example Response Letter amulette

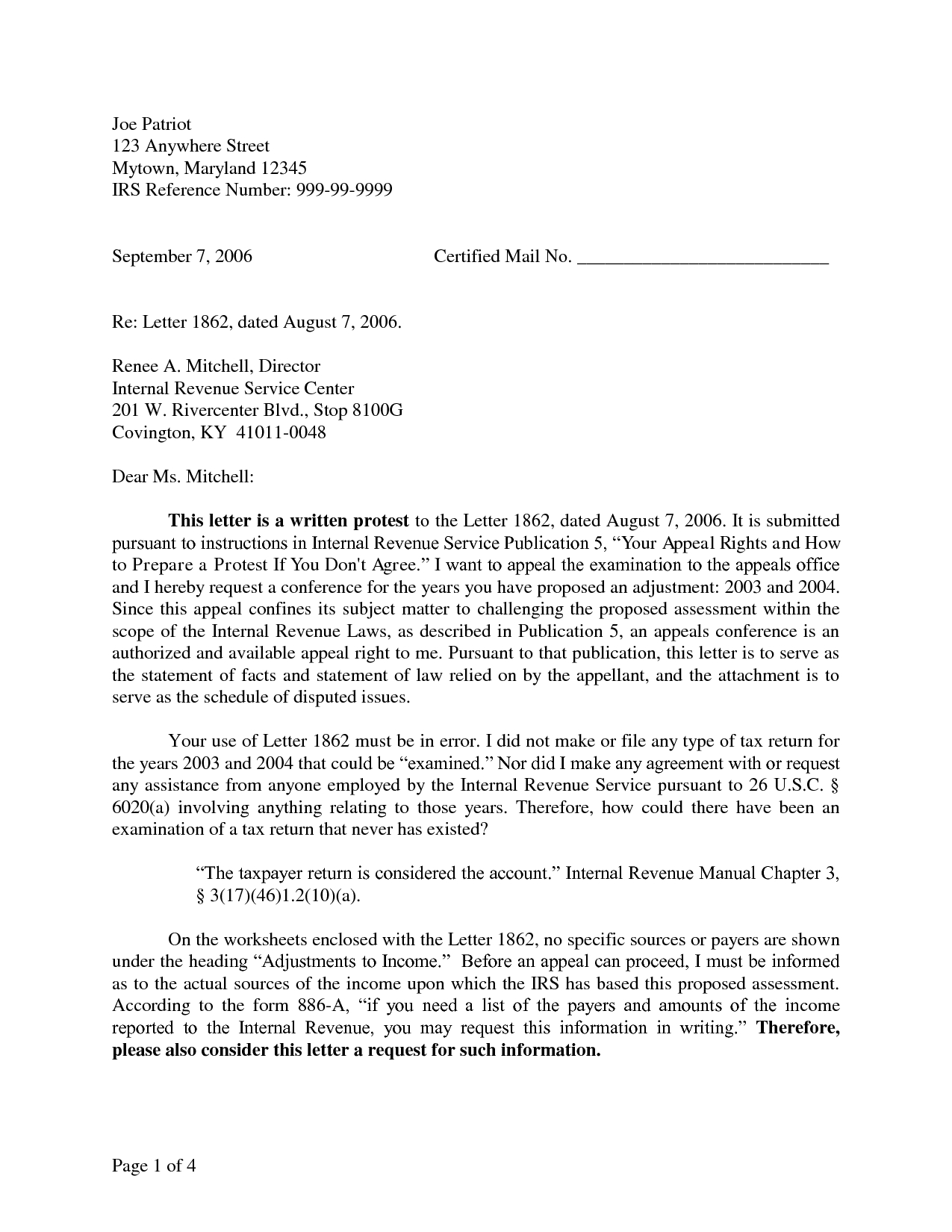

Free Response to IRS Notice Make & Download Rocket Lawyer

IRS Audit Letter 12C Sample 1

Irs Response Letter Template Samples Letter Template Collection

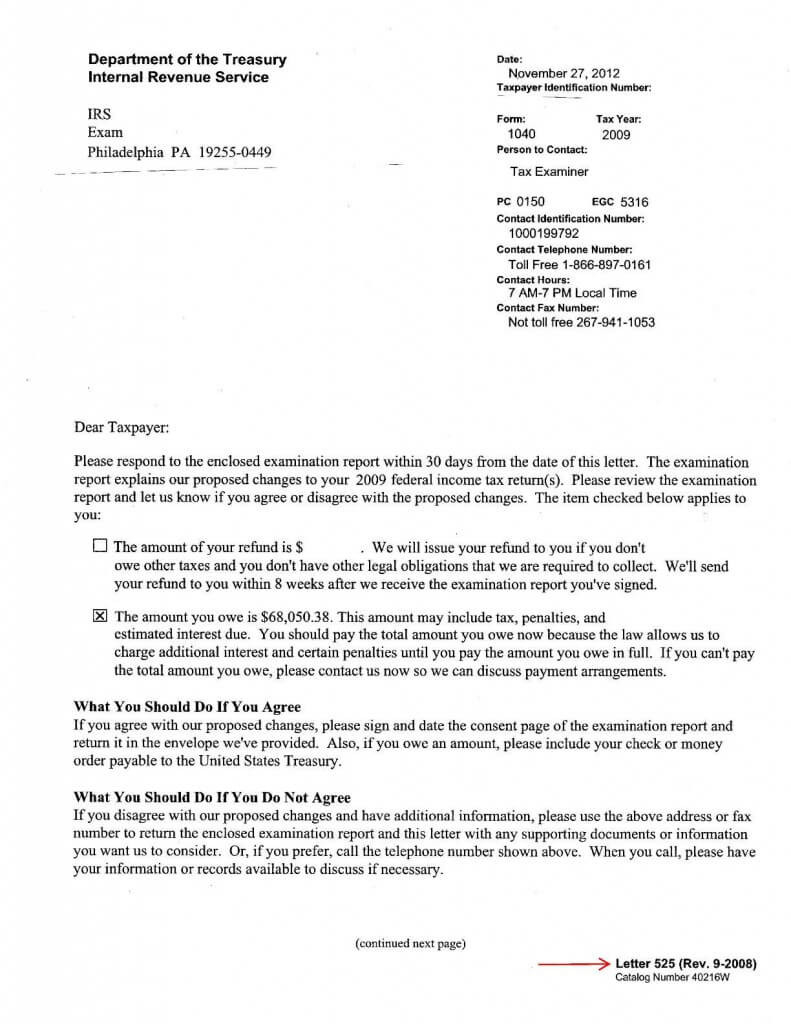

IRS Response Letter Template Federal Government Of The United States

47+ Cp2000 Notice Irs Cp2000 Response Letter Sample Sample Letter

20 Fresh Lease Agreement Letter Template

Irs Audit Letter Sample Audit Follow Up Template Awesome Inside Irs

Letter to the IRS IRS Response Letter Form (with Sample)

Web Most Irs Letters Have Two Options:

Agree With The Changes The Irs Is Making Or Send A Written Explanation Of Why The Irs Is Wrong And You Are Right.

Review The Information On The Cp2000 Carefully For Accuracy.

Ssn Here (If You And Your Spouse Filed Jointly, Use The Ssn That Appears First.

Related Post: