Irs Printable W2 Form

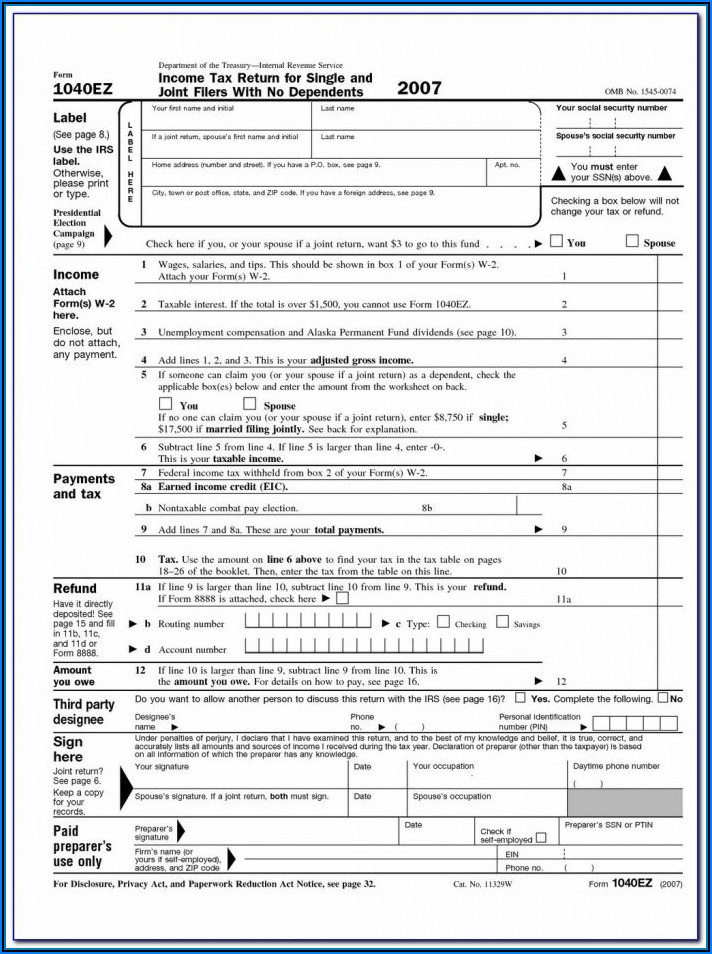

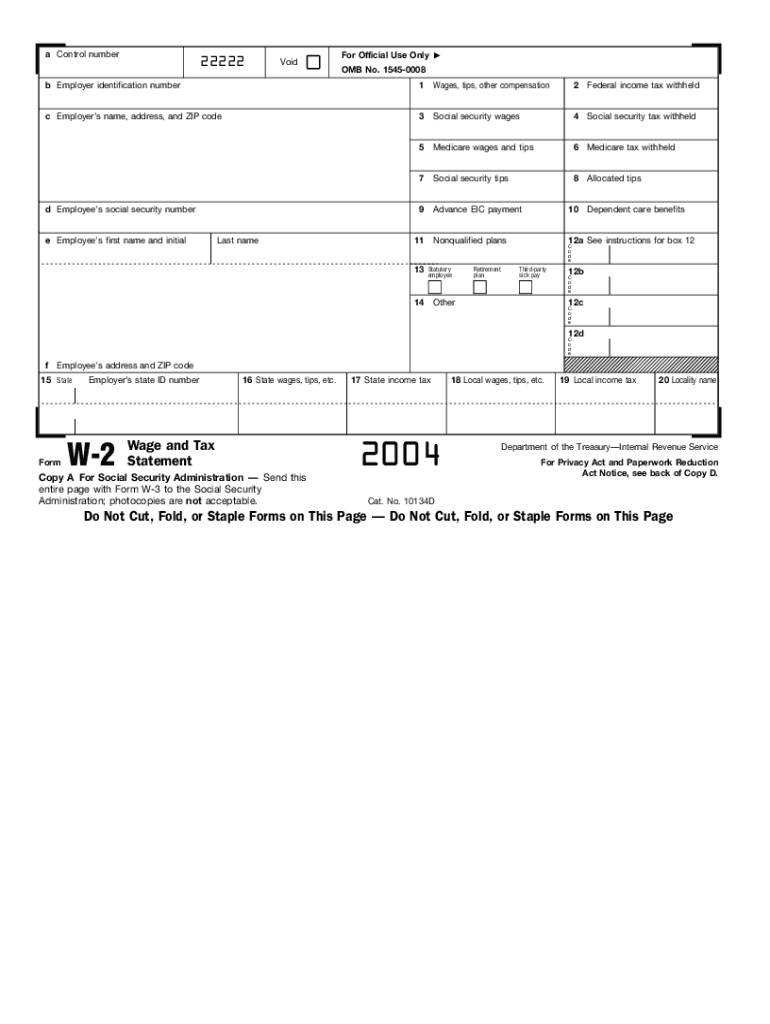

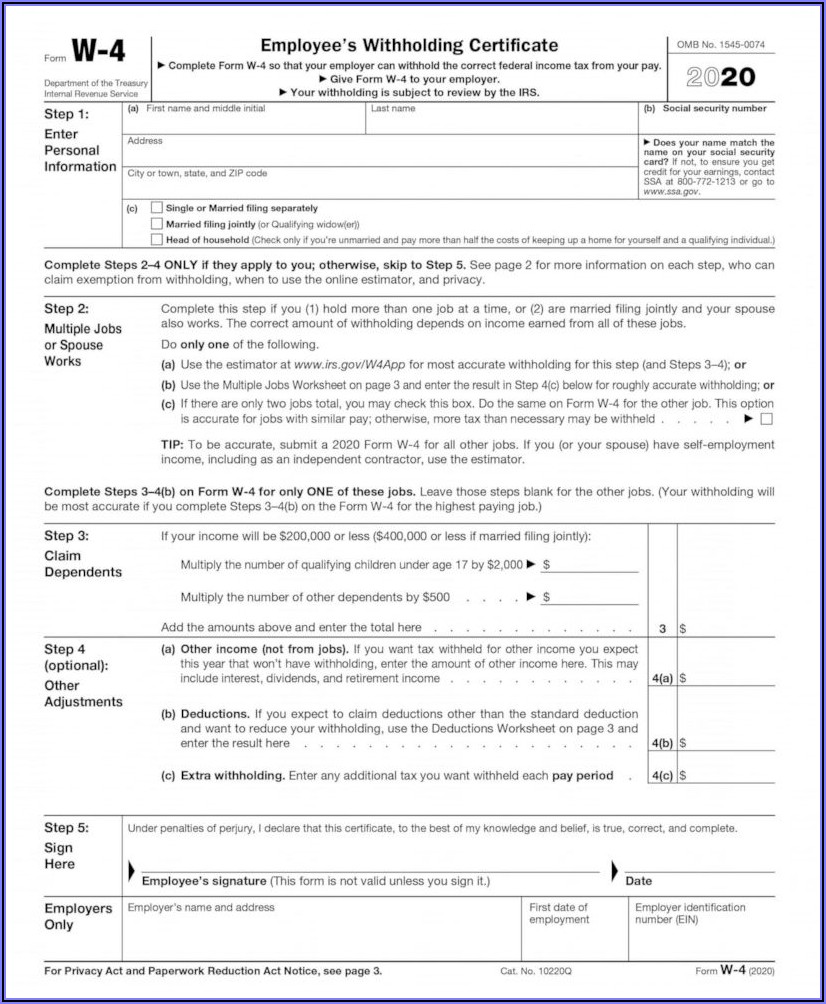

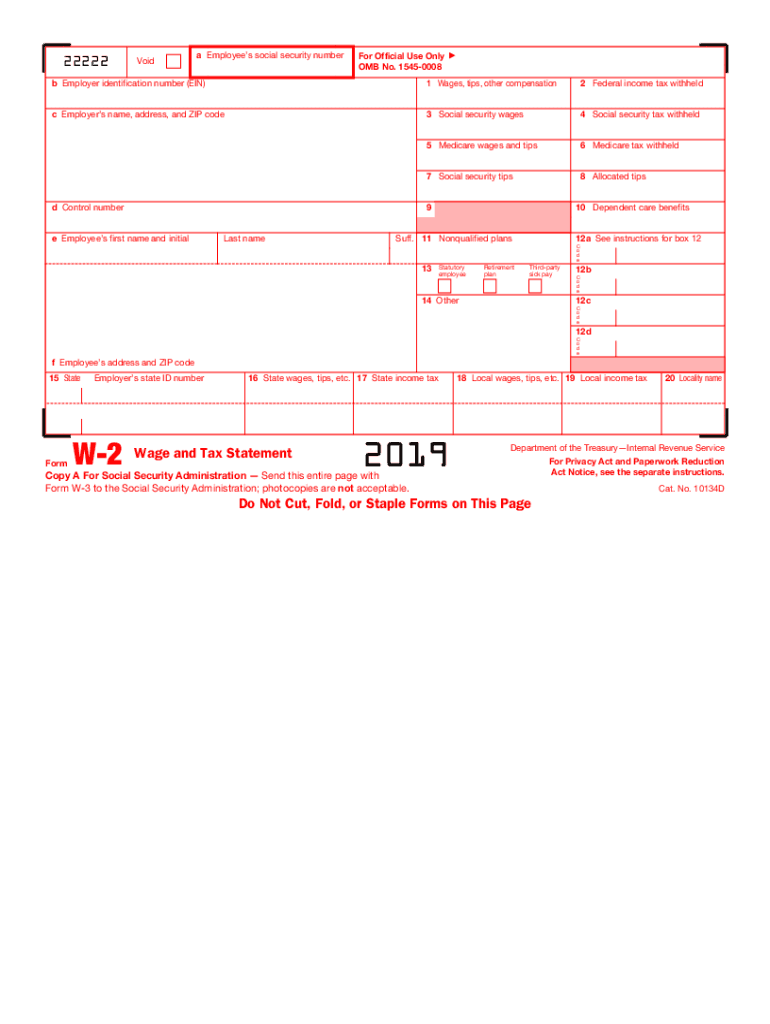

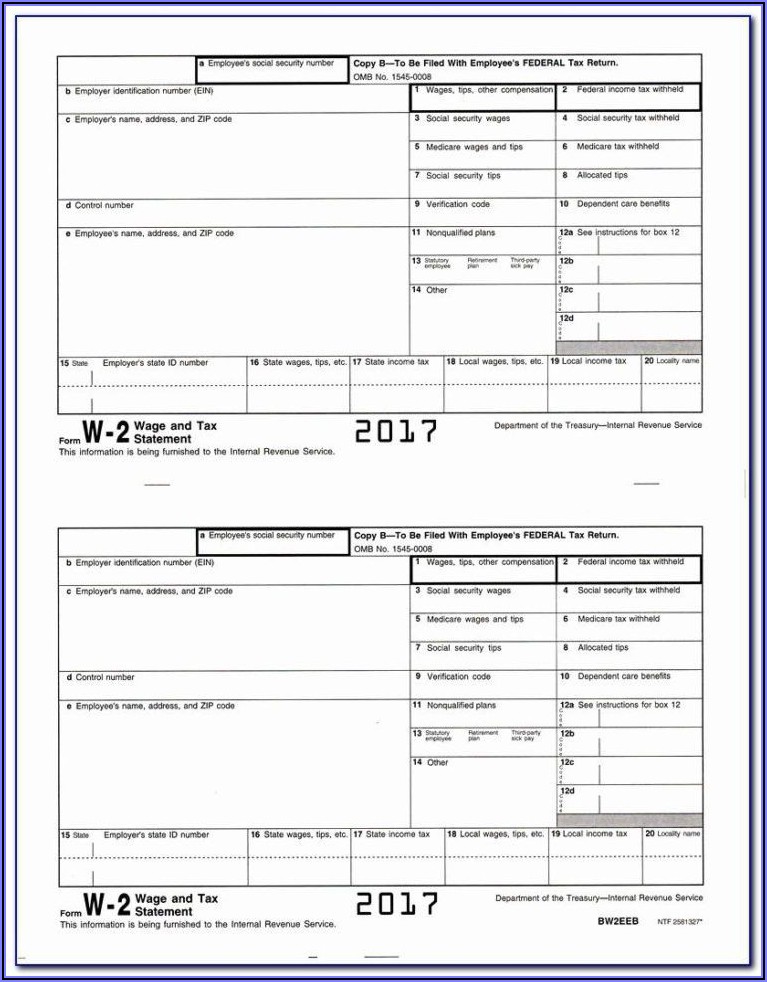

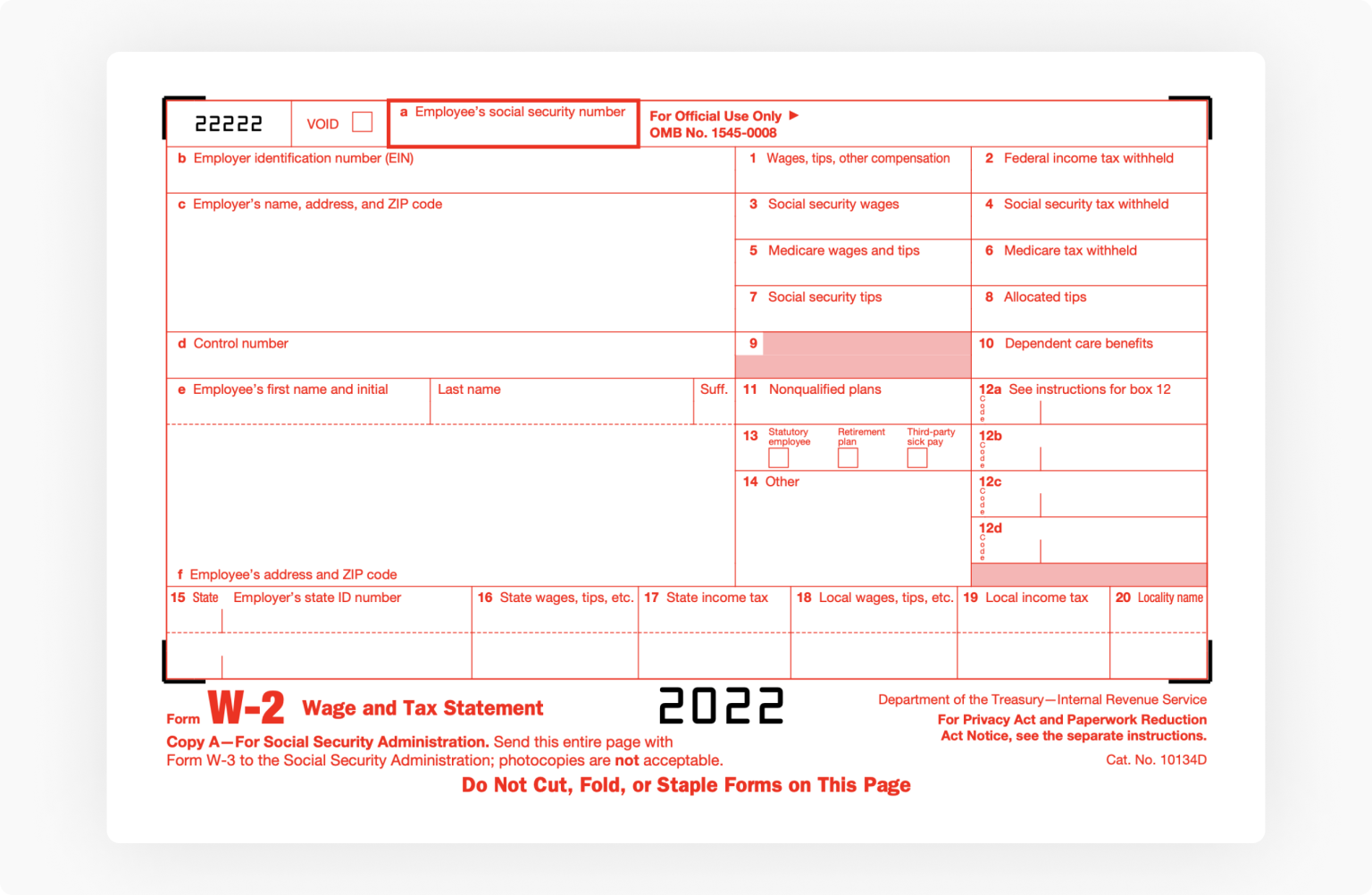

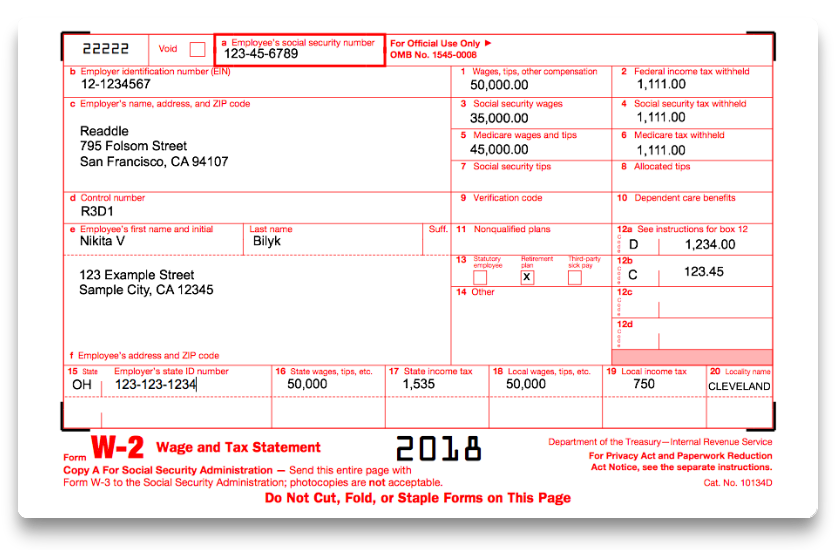

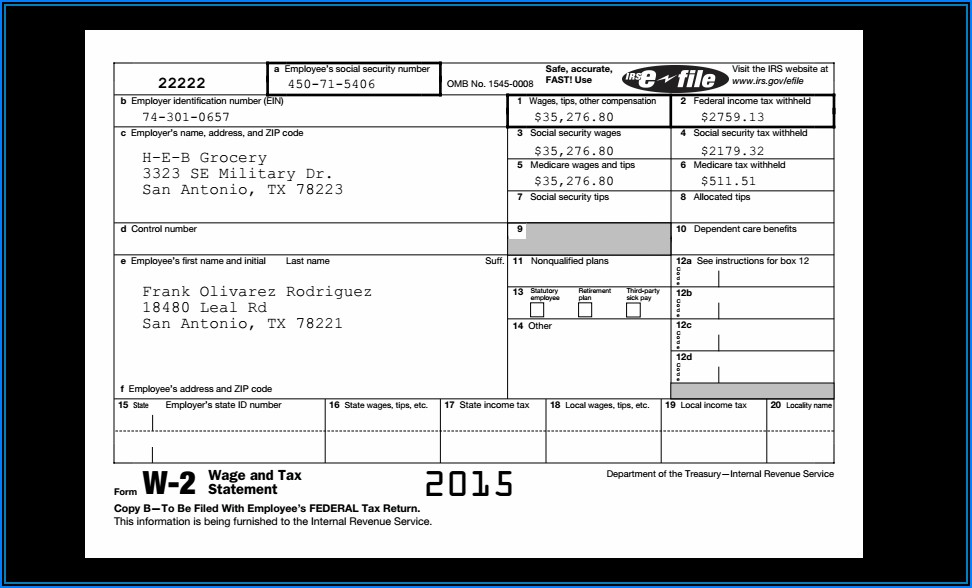

Irs Printable W2 Form - Do not leave this line blank. Complete, edit or print tax forms instantly. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Internal revenue service (irs) form that employers provide to their employees yearly. You must file form 4137 with your income tax return to figure the. Name (as shown on your income tax return). You may also print out copies for filing with state or local governments, distribution to your employees, and. The form shows the employee’s wages. 17, 2023 — the internal revenue service today encouraged all those who have registered, or are required to register, large trucks and. Gusto payroll is easy to use and loved by customers. Comply with irs standards and be machine readable. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Save time with our amazing tool & try 24 hours free! Choose the income tax form you need. Web send to the irs. Web send to the irs. 1 control number deceased pension plan legal rep. Choose the income tax form you need. This shows the income you earned for the previous year and the taxes withheld from those earnings. Name (as shown on your income tax return). Get tax form (1099/1042s) update direct deposit. This shows the income you earned for the previous year and the taxes withheld from those earnings. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. You may also print out copies for filing with state or local governments, distribution to your employees, and. Internal revenue service (irs) form that employers provide to their employees yearly. Name (as shown on your income tax return). You must file form 4137 with your income tax return to figure the. 1 control number deceased pension plan legal rep. Save time with our amazing tool & try 24 hours free! You must file form 4137 with your income tax return to figure the. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. 17, 2023 — the internal revenue service today encouraged all those who have registered, or are required to register, large trucks and. Name is required on this line; Web. Ad complete your form w 2. Web send to the irs. Get tax form (1099/1042s) update direct deposit. The form shows the employee’s wages. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. $520 for married couples who filed jointly with an. 17, 2023 — the internal revenue service today encouraged all those who have registered, or are required to register, large trucks and. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. You may also print out copies for filing with state or local governments, distribution. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. Web first, download the printable w2 tax form from our website. Internal revenue service (irs) form that employers provide to their employees yearly. Complete, edit or print tax forms instantly. Choose the income tax form you need. 1 control number deceased pension plan legal rep. This shows the income you earned for the previous year and the taxes withheld from those earnings. The form shows the employee’s wages. 17, 2023 — the internal revenue service today encouraged all those who have registered, or are required to register, large trucks and. $520 for married couples who filed jointly. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. $520 for married couples who filed jointly with an. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. You must file form 4137 with your income tax return to figure. Do not leave this line blank. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web use form 4137 to figure the social security and medicare tax owed on tips you didn’t report to your employer. This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. Web first, download the printable w2 tax form from our website. Name is required on this line; Enter this amount on the wages line of your tax return. Save time with our amazing tool & try 24 hours free! Ad complete your form w 2. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Web send to the irs. $520 for married couples who filed jointly with an. The form shows the employee’s wages. Complete, edit or print tax forms instantly. Choose the income tax form you need. Comply with irs standards and be machine readable. Web how much will i receive? You must file form 4137 with your income tax return to figure the. You may also print out copies for filing with state or local governments, distribution to your employees, and. Complete, edit or print tax forms instantly. Web how much will i receive? Save time with our amazing tool & try 24 hours free! This will provide a blank template for you to complete, ensuring that you don't miss any crucial information. 1 control number deceased pension plan legal rep. This shows the income you earned for the previous year and the taxes withheld from those earnings. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. $520 for married couples who filed jointly with an. You must file form 4137 with your income tax return to figure the. Enter this amount on the wages line of your tax return. Get tax form (1099/1042s) update direct deposit. You may also print out copies for filing with state or local governments, distribution to your employees, and. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Do not leave this line blank. Gusto payroll is easy to use and loved by customers.W2 Form Irs Form Resume Examples GM9Or6k2DL

IRS W2 2004 Fill and Sign Printable Template Online US Legal Forms

What is IRS Form W2? Federal W2 Form for 2021 Tax Year

Irs.gov Form W 9 2020 Form Resume Examples ojYqX4Z9zl

IRS W2 2020 Fill and Sign Printable Template Online US Legal Forms

Irs Forms W 2 2015 Form Resume Examples QJ9ezDKYmy

Irs Forms W 2 Printable Form Resume Examples JvDXqmJ5VM

2022 Irs W 2 Fillable Form Fillable Form 2022

How to fill out IRS Form W2 20172018 PDF Expert

W2 Form Copy A 2018 Form Resume Examples MeVRB6LjVD

$260 For Each Taxpayer With An Adjusted Gross Income Of $75,000 Or Less In 2021.

Web First, Download The Printable W2 Tax Form From Our Website.

Internal Revenue Service (Irs) Form That Employers Provide To Their Employees Yearly.

Web Use Form 4137 To Figure The Social Security And Medicare Tax Owed On Tips You Didn’t Report To Your Employer.

Related Post: