Irs Penalty Abatement Templates

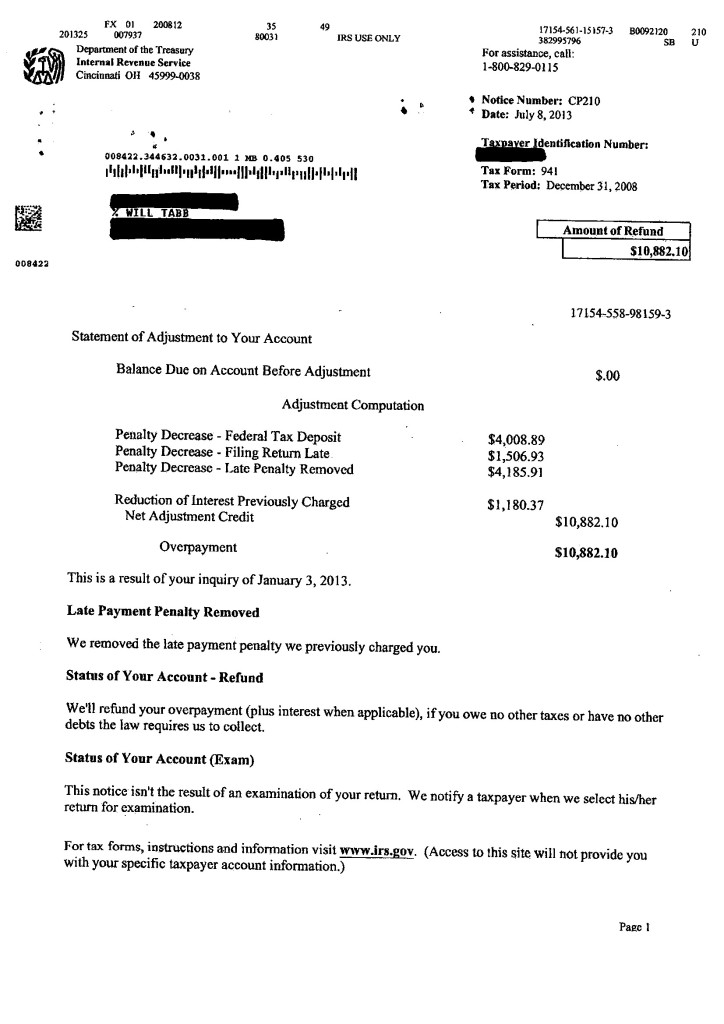

Irs Penalty Abatement Templates - Web template for a penalty abatement letter. You didn't fully pay your taxes in 2021 and got a notice with the balance due and penalty charges. Web aicpa® & cima® is the most influential body of accountants and finance experts in the world, with 689,000 members, students and engaged professionals globally. Web the irs can assess many types of penalties against taxpayers: Web use the safe harbor. Here are sample letters to request irs penalty abatement. Web you may be given one of the following types of penalty relief depending on the penalty: This relief applies to forms. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. First time penalty abate and administrative waiver reasonable cause. This template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed. However, the failure to pay penalty will continue to increase until you pay the tax in full. Web template for a penalty abatement letter. Web [address 1] [address 2] [city, state zip] re: Web the penalty is typically assessed. This template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed. Web fill out irs form 843. Current revision form 843 pdf. Web you may be given one of the following types of penalty relief depending on the penalty: Ad we help get taxpayers relief from owed irs back taxes. However, the failure to pay penalty will continue to increase until you pay the tax in full. If you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Current revision form 843 pdf. Web the irs denied your request to remove the penalty (penalty abatement) you. Web template for a penalty abatement letter. Current revision form 843 pdf. Buyerassisthub.com has been visited by 10k+ users in the past month Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request, which gives you your appeal rights for an. Individual taxpayers will avoid the penalty altogether when they pay. Web template for a penalty abatement letter. You can request first time abate for a penalty even if you haven't fully paid the tax on your return. Web the irs can assess many types of penalties against taxpayers: Current revision form 843 pdf. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on. Sample irs penalty abatement request letter. The template is available free to. For example, a taxpayer wants to request penalty abatement because a fire destroyed his. Web [address 1] [address 2] [city, state zip] re: This template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed. [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. Current revision form 843 pdf. This relief applies to forms. If you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web the irs can assess many. Web the illinois department of revenue (idor) will abate late estimated payment penalties assessed on fourth quarter estimated payments due december 15, 2022, for. Web the irs will also consider your prior history of filing and paying your taxes on time. If you've already paid a penalty and now realize you might be able to get your money back, you’ll. For example, a taxpayer wants to request penalty abatement because a fire destroyed his. Web here is a simplified irs letter template that you can use when writing to the irs: The template is available free to. Web use the safe harbor. First time penalty abate and administrative waiver reasonable cause. Web the irs will also consider your prior history of filing and paying your taxes on time. Sample irs penalty abatement request letter. Ad we help get taxpayers relief from owed irs back taxes. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request, which gives you your appeal rights for. The template is available free to. Individual taxpayers will avoid the penalty altogether when they pay 90% of the tax shown on the current year's return or 100% of the tax. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Estimate how much you could potentially save in just a matter of minutes. Buyerassisthub.com has been visited by 10k+ users in the past month Web [address 1] [address 2] [city, state zip] re: Web template for a penalty abatement letter. First time penalty abate and administrative waiver reasonable cause. Web the irs can assess many types of penalties against taxpayers: Web use the safe harbor. Web aicpa® & cima® is the most influential body of accountants and finance experts in the world, with 689,000 members, students and engaged professionals globally. Web abatement of any penalty or addition to tax attributable to erroneous written advice by the internal revenue service: Ad we help get taxpayers relief from owed irs back taxes. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. For example, a taxpayer wants to request penalty abatement because a fire destroyed his. However, the failure to pay penalty will continue to increase until you pay the tax in full. If you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Here are sample letters to request irs penalty abatement. [enter taxpayer name and identification number] [enter tax form and tax period] [enter notice number and date, if applicable]. Web reasonable cause reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation. For example, a taxpayer wants to request penalty abatement because a fire destroyed his. Current revision form 843 pdf. Web use the safe harbor. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request, which gives you your appeal rights for an. First time penalty abate and administrative waiver reasonable cause. Web the illinois department of revenue (idor) will abate late estimated payment penalties assessed on fourth quarter estimated payments due december 15, 2022, for. Web abatement of any penalty or addition to tax attributable to erroneous written advice by the internal revenue service: Web aicpa® & cima® is the most influential body of accountants and finance experts in the world, with 689,000 members, students and engaged professionals globally. Ad we help get taxpayers relief from owed irs back taxes. However, the failure to pay penalty will continue to increase until you pay the tax in full. Sample irs penalty abatement request letter. Individual taxpayers will avoid the penalty altogether when they pay 90% of the tax shown on the current year's return or 100% of the tax. Estimate how much you could potentially save in just a matter of minutes. Web the irs will also consider your prior history of filing and paying your taxes on time. You can request first time abate for a penalty even if you haven't fully paid the tax on your return. The template is available free to.Penalty Abatement Tabb Financial Services

Tax Tax Penalty Appeal Letter Sample Printable tax penalty

Letter Request To Waive Penalty Charges Sample late fee waiver letter

Irs form 5472 Penalty Abatement New How to Write Letter to Irs About

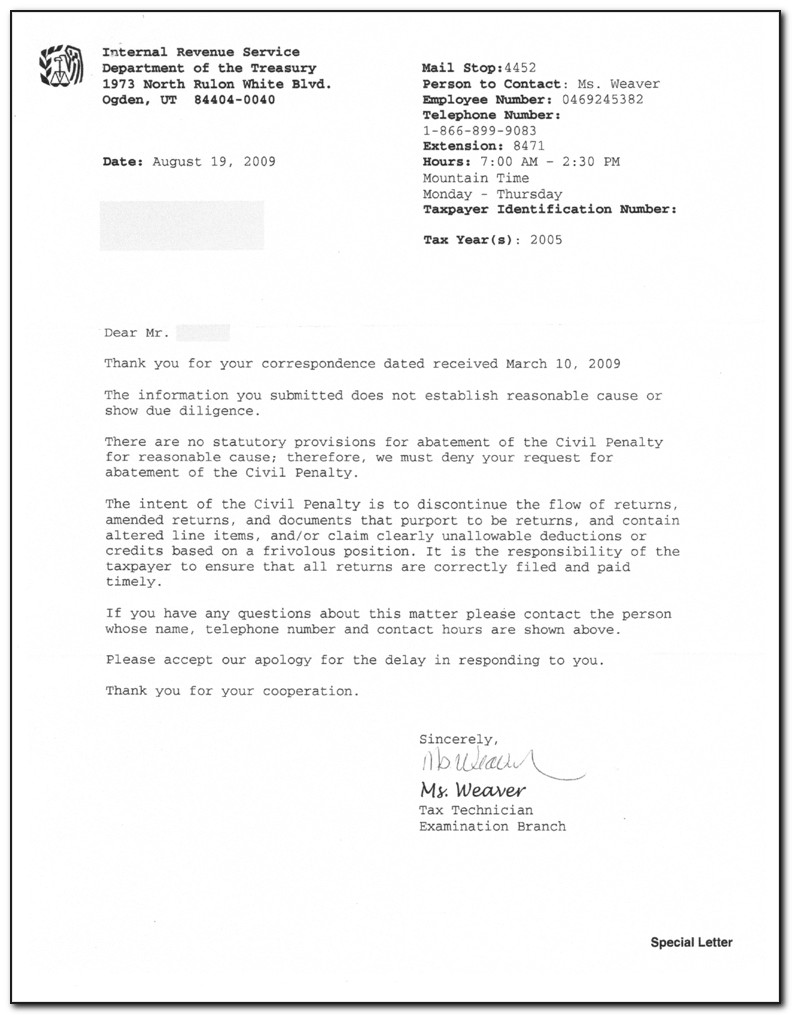

IRS Letter 854C Penalty Waiver or Abatement Disallowed H&R Block

50 Irs First Time Penalty Abatement Letter Example Ig2s Letter

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

31+ Penalty Abatement Letter Sample Sample Letter

Irs Penalty Abatement Request Letter Example

Web Here Is A Simplified Irs Letter Template That You Can Use When Writing To The Irs:

If You've Already Paid A Penalty And Now Realize You Might Be Able To Get Your Money Back, You’ll Want To File Irs Form 843.

Web The Irs Offers A Penalty Abatement On Failure To File And Failure To Pay Penalties On The First Year Of Tax Debts That You Owe.

Web [Address 1] [Address 2] [City, State Zip] Re:

Related Post: