Irs Form 9465 Printable

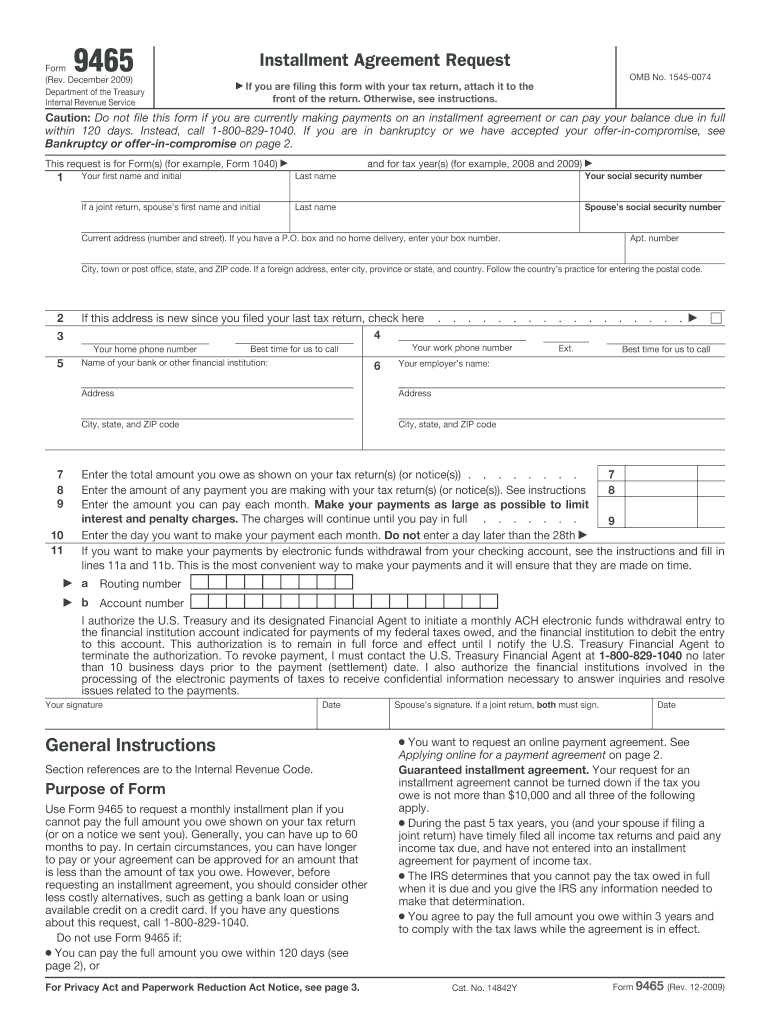

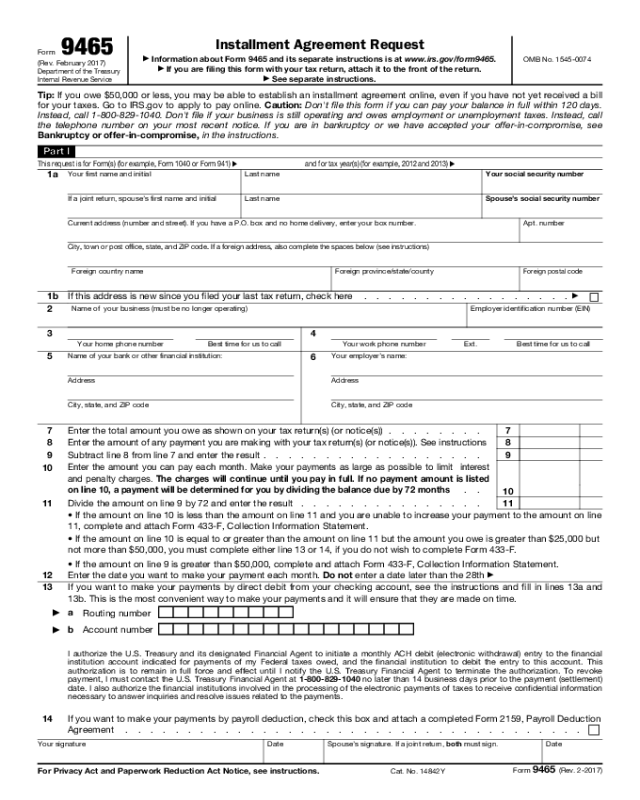

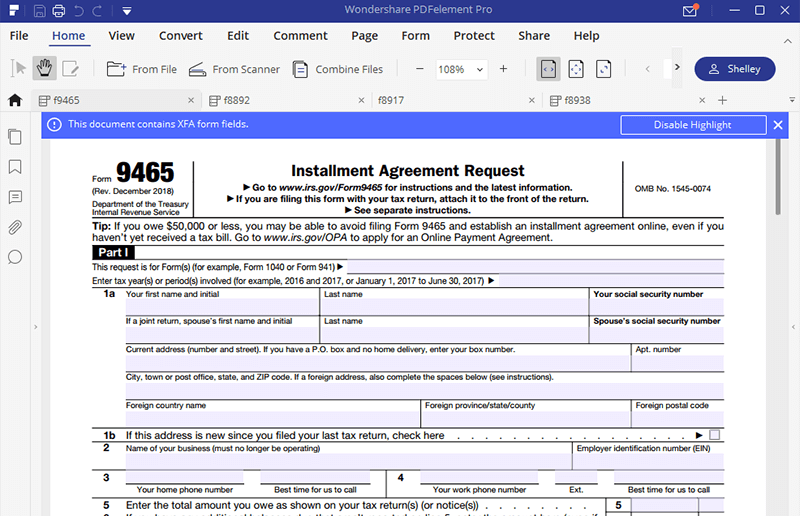

Irs Form 9465 Printable - You can file form 9465 by itself, even if you've already filed your individual tax return. For instructions and the latest information. To print and mail form 9465: Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Answer the following questions to find an irs free file provider. No street address is needed. Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. If you are filing this form with your tax return, attach it to the front of the return. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. Form 9465 is available in all versions of taxact ®. To print and mail form 9465: This form is for income. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. You can file form 9465 by itself, even if you've already filed your individual tax return. February 2017) installment agreement request information about form 9465 and its separate instructions is at department of the treasury internal revenue service www.irs.gov/form9465. Most installment. If you are filing this form with your tax return, attach it to the front of the return. February 2017) installment agreement request information about form 9465 and its separate instructions is at department of the treasury internal revenue service www.irs.gov/form9465. If you are filing this form with your tax return, attach it to the front of the return. Web. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Most installment agreements meet our streamlined installment agreement criteria. From within your taxact return ( online ), click the print center dropdown, then click custom print. Web irs free file online: Web attach form 9465 to the. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Answer the following questions to find an irs free file provider. No street address is needed. Web the irs. Form 9465 is available in all versions of taxact ®. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. More about the federal form 9465 we last updated federal form. December 2018) department of the treasury internal revenue service. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Answer the following questions to find an irs free file provider. For instructions and the latest information. February 2017) installment agreement request information about form 9465 and its. Most installment agreements meet our streamlined installment agreement criteria. Form 9465 is available in all versions of taxact ®. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal. The maximum term for a streamlined agreement is 72 months. Web irs free file online: Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. This form is for income earned in tax year 2022, with tax returns due in april 2023. Most installment agreements meet our streamlined. Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. Web irs free file online: No street address is needed. Web the irs encourages you to pay a portion of the amount you owe and then request an. For instructions and the latest information. If you are filing this form with your tax return, attach it to the front of the return. More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. Web irs free file online: Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. From within your taxact return ( online ), click the print center dropdown, then click custom print. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). The maximum term for a streamlined agreement is 72 months. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). February 2017) installment agreement request information about form 9465 and its separate instructions is at department of the treasury internal revenue service www.irs.gov/form9465. Most installment agreements meet our streamlined installment agreement criteria. December 2018) department of the treasury internal revenue service. If you are filing this form with your tax return, attach it to the front of the return. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. No street address is needed. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. No street address is needed. Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. Click print, then click the pdf link that is provided for printing. December 2018) department of the treasury internal revenue service. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. Most installment agreements meet our streamlined installment agreement criteria. From within your taxact return ( online ), click the print center dropdown, then click custom print. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) To print and mail form 9465: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Answer the following questions to find an irs free file provider. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. For instructions and the latest information. Web irs free file online:2009 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

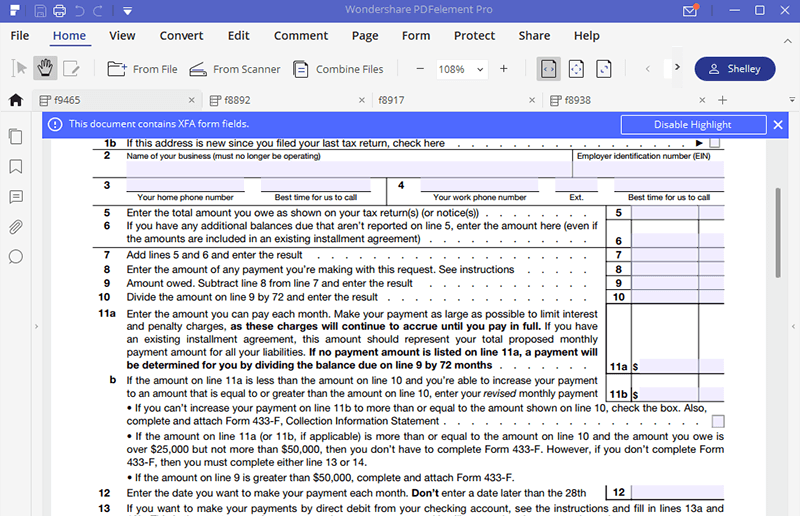

Form 9465 Edit, Fill, Sign Online Handypdf

IRS Form 9465 Installment Agreement Request Fill Online, Printable

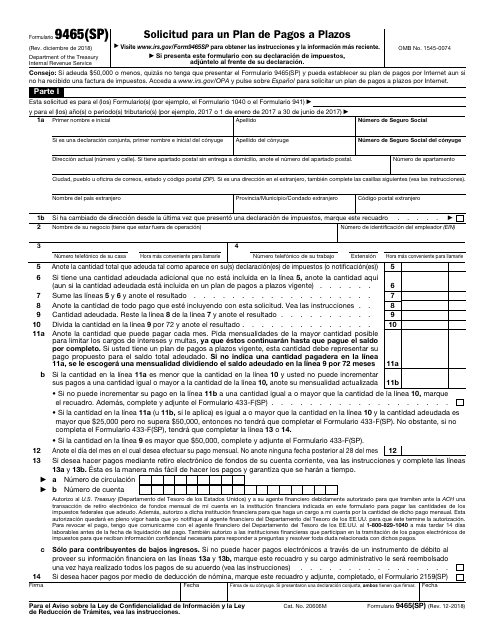

IRS Formulario 9465(SP) Download Fillable PDF or Fill Online Solicitud

IRS Form 9465 Instructions for How to Fill it Correctly File

Irs Form 9465 Fillable and Editable PDF Template

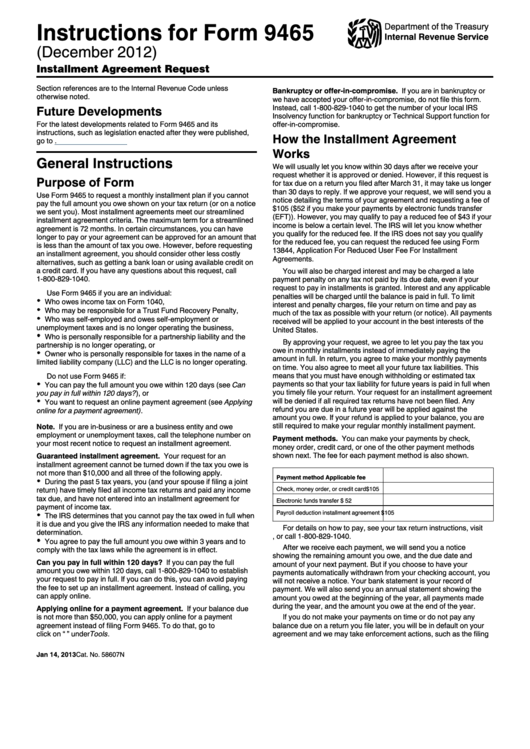

Instructions For Form 9465 (Rev. December 2012) printable pdf download

Filling Out Money Order For Taxes Make Money Taking Surveys App

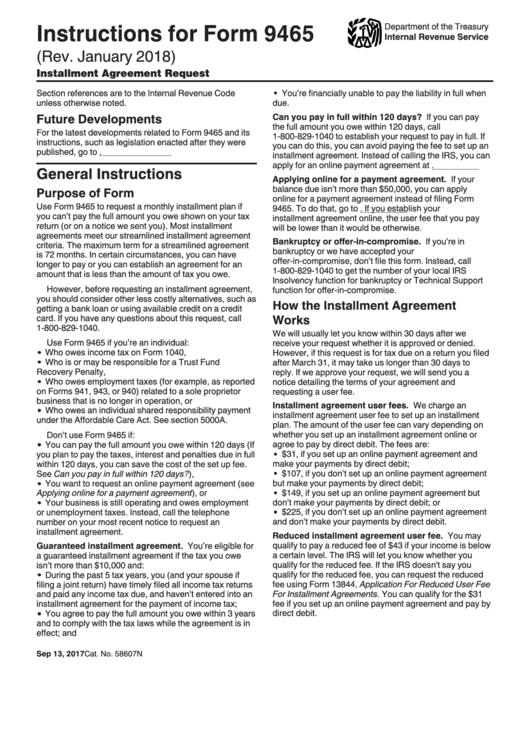

Instructions For Form 9465 Installment Agreement Request printable

Irs Form 9465 Fs Universal Network

Web The Irs Encourages You To Pay A Portion Of The Amount You Owe And Then Request An Installment For The Remaining Balance.

More About The Federal Form 9465 We Last Updated Federal Form 9465 In January 2023 From The Federal Internal Revenue Service.

Web Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

February 2017) Installment Agreement Request Information About Form 9465 And Its Separate Instructions Is At Department Of The Treasury Internal Revenue Service Www.irs.gov/Form9465.

Related Post: