Irs Form 8857 Printable

Irs Form 8857 Printable - Find out today if you qualify. To request innocent spouse relief for your illinois individual income tax liability, you must file this form even if you. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Web the irs is examining your tax return and proposing to increase your tax liability. Complete, edit or print tax forms instantly. Ad shop devices, apparel, books, music & more. Web use form 8857 to request relief from liability for tax, plus related penalties and interest, that you believe should be paid only by your spouse (or former spouse). The irs sends you a notice. Turn the wizard tool on to complete the procedure much easier. When you prepare your taxes with. Edit your form 8857 instructions online. Get ready for tax season deadlines by completing any required tax forms today. You can download or print. Web request for innocent spouse relief. Ad access irs tax forms. Sign it in a few clicks draw your. Complete, edit or print tax forms instantly. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Web you should file form 8857 as soon as you become aware of a tax liability for which you. Save or instantly send your ready documents. Web send 8857 instructions via email, link, or fax. Get ready for tax season deadlines by completing any required tax forms today. The irs will use the information you provide on the form, and any attachments you submit, to determine if you are eligible for relief. All extras are included—no fees necessary The irs sends you a notice. Find out today if you qualify. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a. Sign it in a few clicks draw your. Get ready for tax season deadlines by completing any required tax forms today. Discovering samples is not the hard portion when it comes to online document management; Web you should file form 8857 as soon as you become aware of a tax liability for which you believe only your spouse or former spouse should be held responsible. Edit your form 8857 instructions online type text, add images, blackout confidential details, add comments, highlights. Ad access irs tax forms. Web download your fillable irs form 8857 in pdf table of contents the legal definition of the case two primary ways of reporting the tax return what is the general purpose of. Complete, edit or print tax forms instantly. Web you can claim innocent spouse relief via form 8857 when you file your taxes online. Web 8857 request for innocent spouse relief form (rev. 9 draft ok to print pager/sgml fileid: Web download your fillable irs form 8857 in pdf table of contents the legal definition of the case two primary ways of reporting the tax return what is the general purpose of. Web what is irs form 8857? To request innocent spouse relief for. To request innocent spouse relief for your illinois individual income tax liability, you must file this form even if you. Free shipping on qualified orders. Web fill in all required lines in the selected file utilizing our convenient pdf editor. Sign it in a few clicks draw your. Ad access irs tax forms. Web we last updated the request for innocent spouse relief in february 2023, so this is the latest version of form 8857, fully updated for tax year 2022. However, you must generally file form 8857 no later than 2 years. Ad access irs tax forms. Web download your fillable irs form 8857 in pdf table of contents the legal definition. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Discovering samples is not the hard portion when it comes to online document management; Complete, edit or print tax forms instantly. Web you should file form 8857 as soon as you become aware of a tax liability for which. Web the irs is examining your tax return and proposing to increase your tax liability. Web you should file form 8857 as soon as you become aware of a tax liability for which you believe only your spouse or former spouse should be held responsible. Web what makes the irs form 8857 printable legally valid? The irs sends you a notice. Edit your form 8857 instructions online. Find out today if you qualify. Get ready for tax season deadlines by completing any required tax forms today. What should i know before i file irs. Easily fill out pdf blank, edit, and sign them. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a. Get ready for tax season deadlines by completing any required tax forms today. Ad do you have irs debt & need an irs installment agreement? Web 8857 request for innocent spouse relief form (rev. Web what is irs form 8857? 9 draft ok to print pager/sgml fileid: Ad shop devices, apparel, books, music & more. All extras are included—no fees necessary • review and follow the instructions to complete this form. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Sign it in a few clicks draw your. Type text, add images, blackout. • review and follow the instructions to complete this form. Get ready for tax season deadlines by completing any required tax forms today. Find out today if you qualify. Ad access irs tax forms. Web request for innocent spouse relief. Discovering samples is not the hard portion when it comes to online document management; Get back in irs good standing. Web the irs is examining your tax return and proposing to increase your tax liability. 9 draft ok to print pager/sgml fileid: The irs will use the information you provide on the form, and any attachments you submit, to determine if you are eligible for relief. All extras are included—no fees necessary Free shipping on qualified orders. You can also download it, export it or print it out. Ad shop devices, apparel, books, music & more. Web you can claim innocent spouse relief via form 8857 when you file your taxes online or complete it separately and mail it in.IRS Formulario 8857(SP) Download Fillable PDF or Fill Online Solicitud

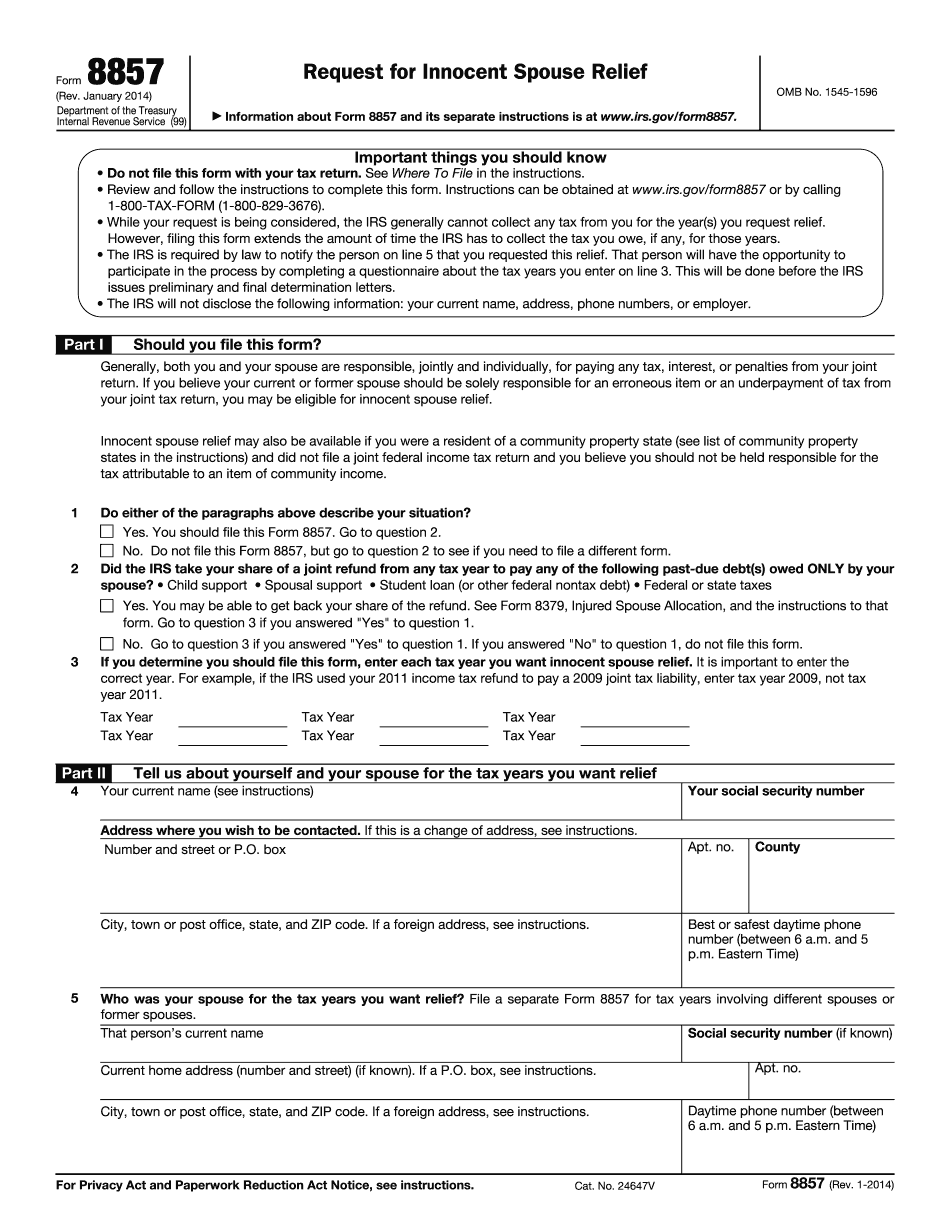

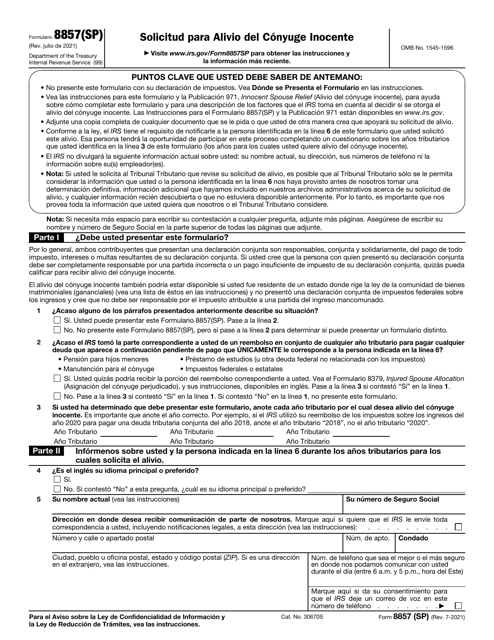

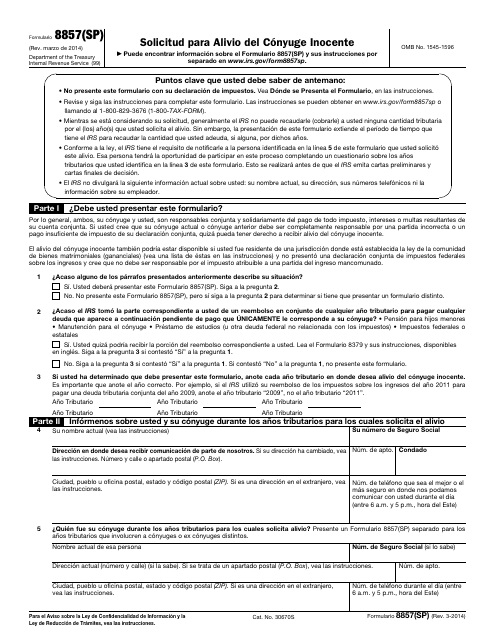

IRS Formulario 8857(SP) Download Fillable PDF or Fill Online Solicitud

Irs form 8857 2023 Fill online, Printable, Fillable Blank

Irs Form 8857 Fillable Printable Forms Free Online

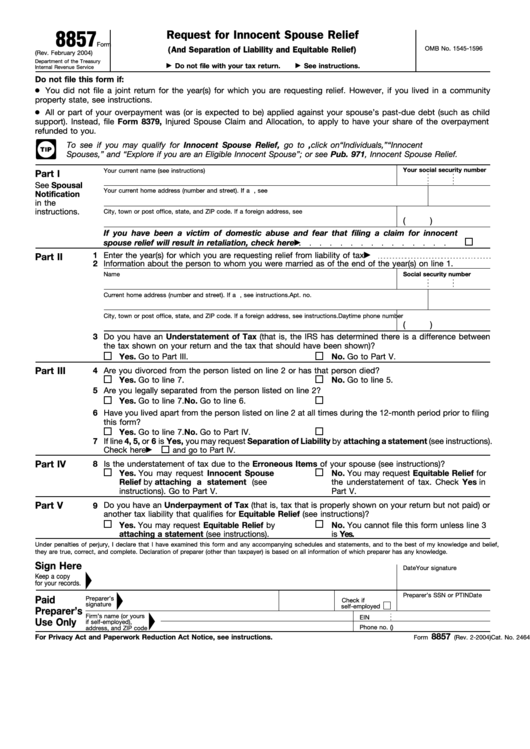

Fillable Form 8857 (Rev. February 2004) Request For Innocent Spouse

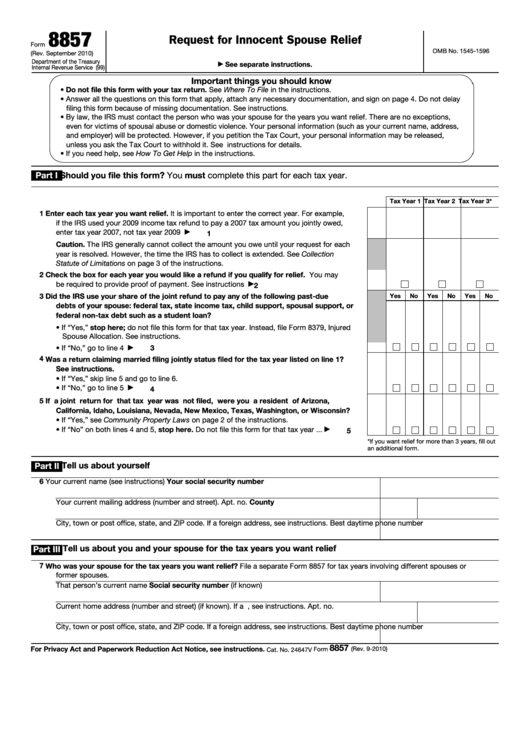

Irs 8857 forms Awesome Scb [pdf Document]

IRS Form 8857 Instructions Innocent Spouse Relief

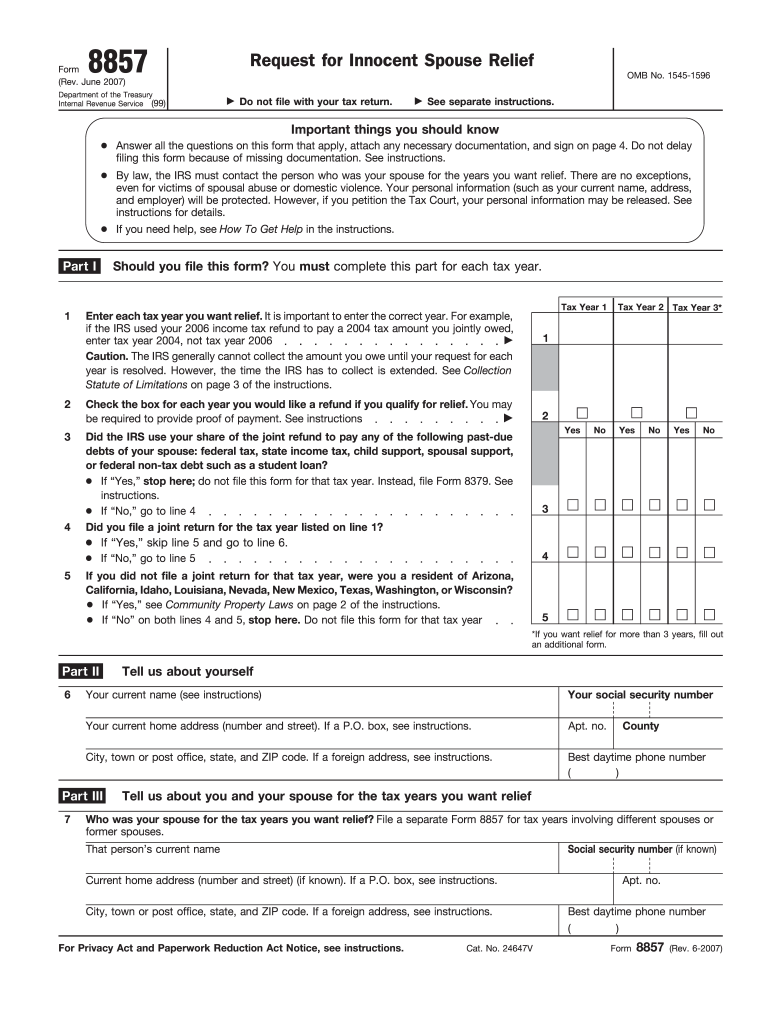

2007 Form IRS 8857 Fill Online, Printable, Fillable, Blank pdfFiller

Irs Form 8857 Fillable Printable Forms Free Online

Irs Form 8857 Fillable Printable Forms Free Online

Web Fill In All Required Lines In The Selected File Utilizing Our Convenient Pdf Editor.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Innocent Spouse Relief Separation Of Liability Relief Equitable Relief When Should I File Irs Form 8857?

Web We Last Updated The Request For Innocent Spouse Relief In February 2023, So This Is The Latest Version Of Form 8857, Fully Updated For Tax Year 2022.

Related Post:

![Irs 8857 forms Awesome Scb [pdf Document]](https://www.flaminke.com/wp-content/uploads/2020/02/irs-8857-forms-awesome-scb-pdf-document-of-irs-8857-forms.png)