Irs Form 843 Printable

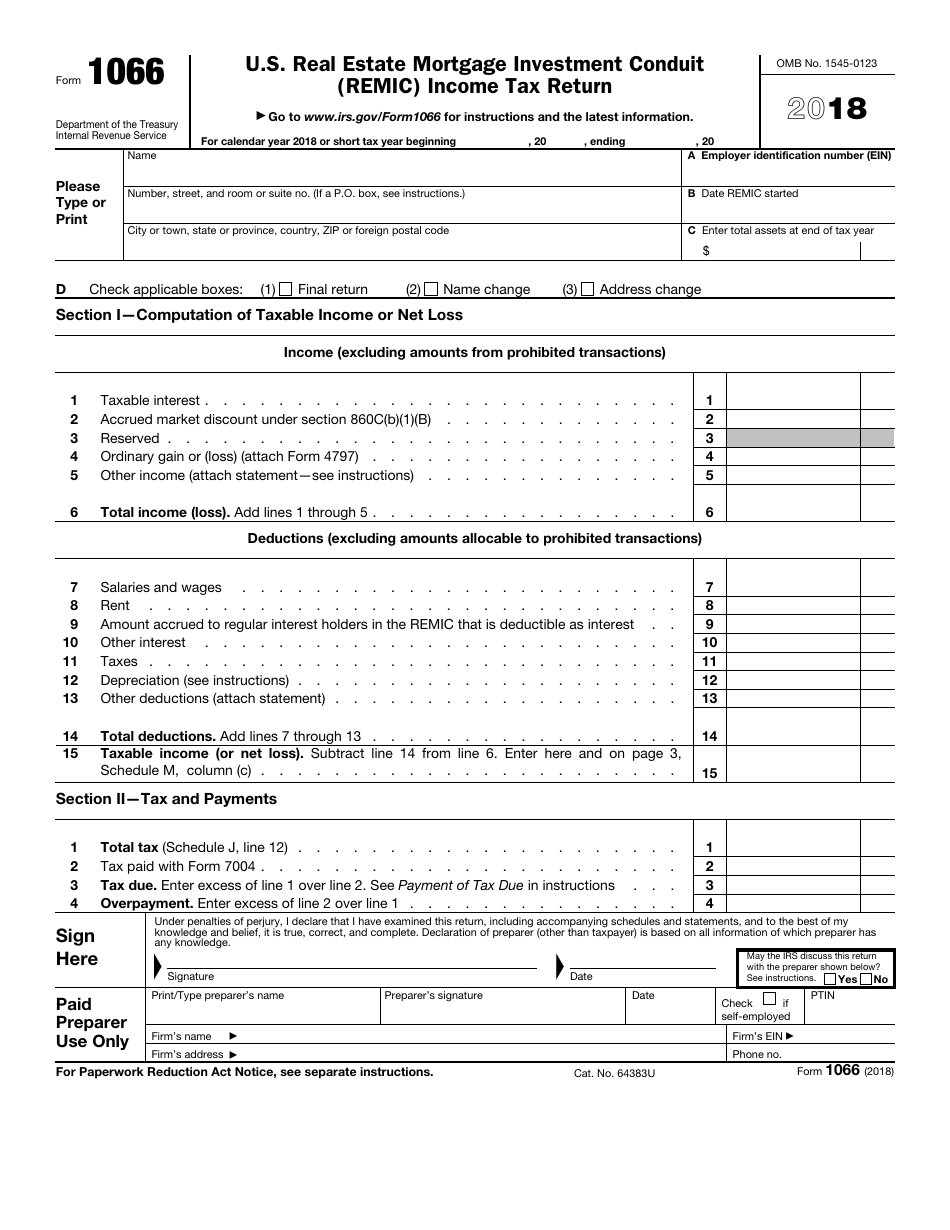

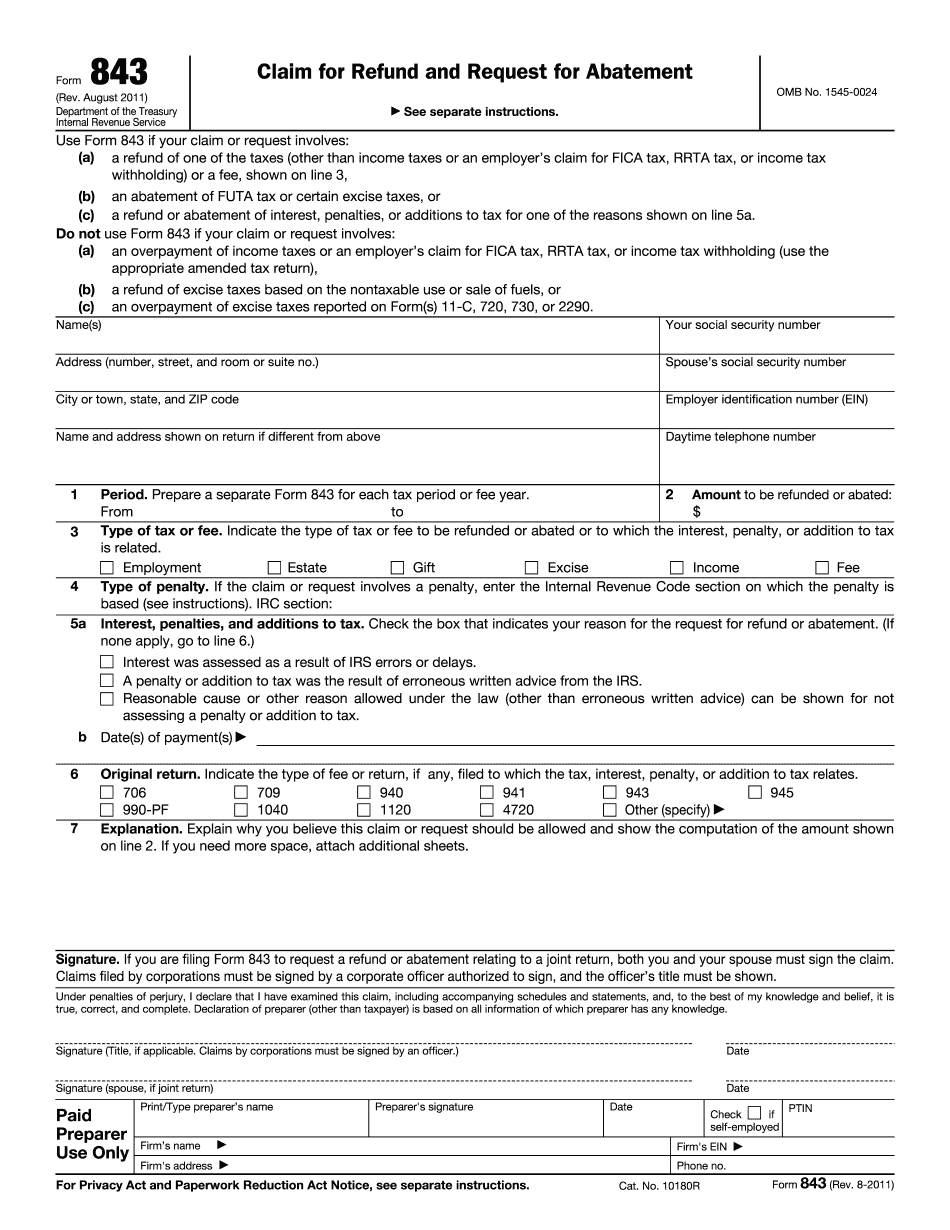

Irs Form 843 Printable - Use fill to complete blank online irs pdf forms for free. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. The form must be filed within two years. Click on claim for refund (843). However, there are quite a few ways you can use form 843 to get. It seems, without meaning to be a monday morning quarterback,. Share your form with others. Finding documents is not the complicated aspect in terms of web document management; Web internal revenue service use form 843 if your claim or request involves: These include penalties for failure to pay, failure. In response to an irs notice regarding a tax or fee related to certain taxes. You can use form 843 to request the irs to abate or erase certain taxes,. Web form 843 allows you to request a refund of irs penaltiesand certain types of taxes. More about the federal form 843 we last updated federal. You can also download. Ad get ready for tax season deadlines by completing any required tax forms today. The irs will take form 843 or a letter from the taxpayer. It seems, without meaning to be a monday morning quarterback,. Share your form with others. Purposes of irs form 843. Send irs form 843 printable via email, link, or fax. Ad get ready for tax season deadlines by completing any required tax forms today. In response to an irs notice regarding a tax or fee related to certain taxes. Web get irs form 843 instructions 2020 and then click get form to get started. Web what makes the irs form. In response to an irs notice regarding a tax or fee related to certain taxes. Finding documents is not the complicated aspect in terms of web document management; You can also download it, export it or print it out. Web use form 843 to claim or request the following. Web the form 843 instructions indicate that the form is for. More about the federal form 843 we last updated federal. Web irs form 843 (request for abatement & refund): You can also download it, export it or print it out. Complete, edit or print tax forms instantly. Web go to the input return tab. Complete, edit or print tax forms instantly. Check the box print form 843 with complete return. However, there are quite a few ways you can use form 843 to get. 15% off diy online tax filing services | h&r block coupon. Utilize the tools we provide to submit your document. Highlight relevant paragraphs of your documents or. However, there are quite a few ways you can use form 843 to get. These include penalties for failure to pay, failure. This form has a very specific purpose, and it does not apply to all types of tax refunds. Web what makes the irs form 843 printable legally valid? Web form 843 is used to claim a refund of certain assessed taxes or to request abatement of interest or penalties applied in error by the irs. The form must be filed within two years. Web use form 843 to claim or request the following. Web fill online, printable, fillable, blank form 843: This form has a very specific purpose,. Web mailing addresses for form 843. Get ready for tax season deadlines by completing any required tax forms today. Download this form print this form more about the. Ad get ready for tax season deadlines by completing any required tax forms today. Utilize the tools we provide to submit your document. Ad get ready for tax season deadlines by completing any required tax forms today. However, there are quite a few ways you can use form 843 to get. Web form 843 is used to claim a refund of certain assessed taxes or to request abatement of interest or penalties applied in error by the irs. Web export or print download. These include penalties for failure to pay, failure. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Web 3 hours agoh&r block tax: 15% off diy online tax filing services | h&r block coupon. In response to an irs notice regarding a tax or fee related to certain taxes. Web use form 843 to claim or request the following. Ad access irs tax forms. Web internal revenue service use form 843 if your claim or request involves: Purposes of irs form 843. Utilize the tools we provide to submit your document. Web what makes the irs form 843 printable legally valid? •a refund of tax, other than a tax for which a different form must be used. Web the form 843 instructions indicate that the form is for a refund of taxes other than income tax. Click on claim for refund (843). Download this form print this form more about the. Then mail the form to…. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Web fill online, printable, fillable, blank form 843: Share your form with others. More about the federal form 843 we last updated federal. Share your form with others. Highlight relevant paragraphs of your documents or. Ad get ready for tax season deadlines by completing any required tax forms today. Send irs form 843 printable via email, link, or fax. In response to an irs notice regarding a tax or fee related to certain taxes. These include penalties for failure to pay, failure. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Web fill online, printable, fillable, blank form 843: Utilize the tools we provide to submit your document. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Download this form print this form more about the. Finding documents is not the complicated aspect in terms of web document management; Web mailing addresses for form 843. Use fill to complete blank online irs pdf forms for free. Web export or print download your fillable irs form 843 in pdf table of contents how to fill out the form how to send the form correctly what happens next?IRS Form 1066 Download Fillable PDF or Fill Online U.S. Real Estate

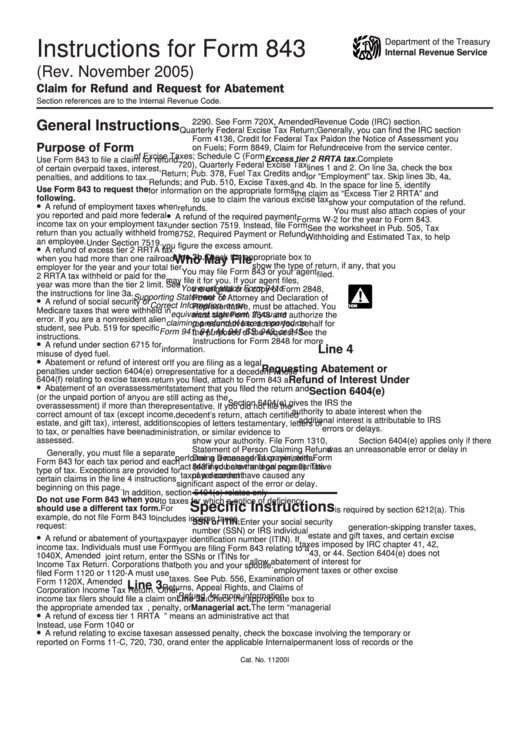

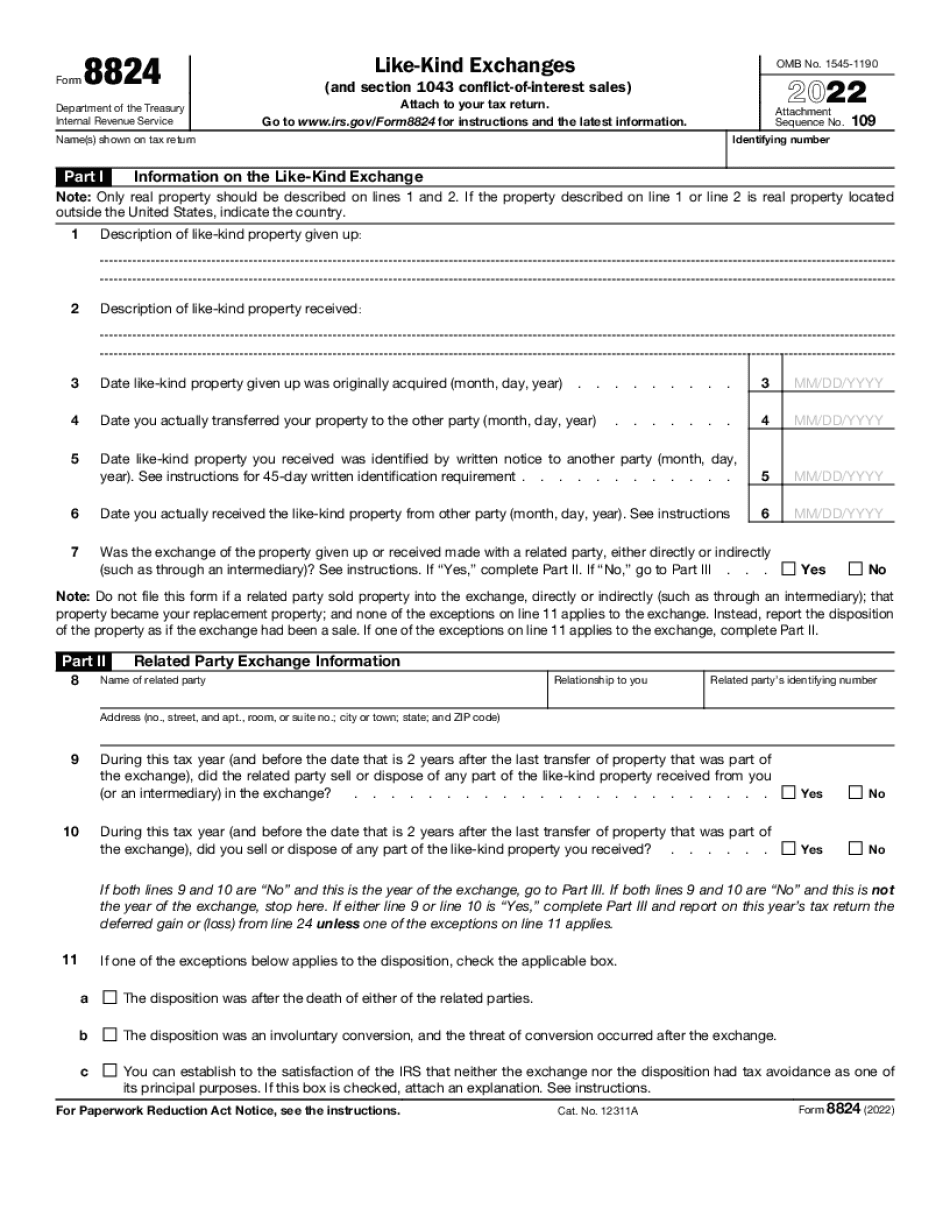

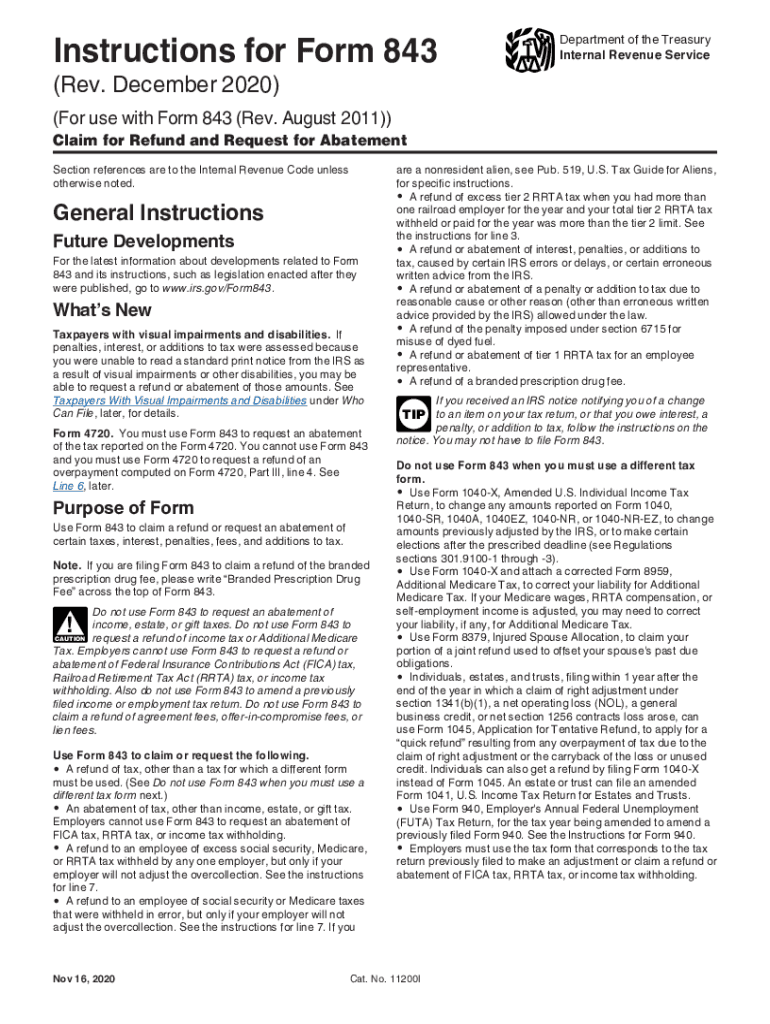

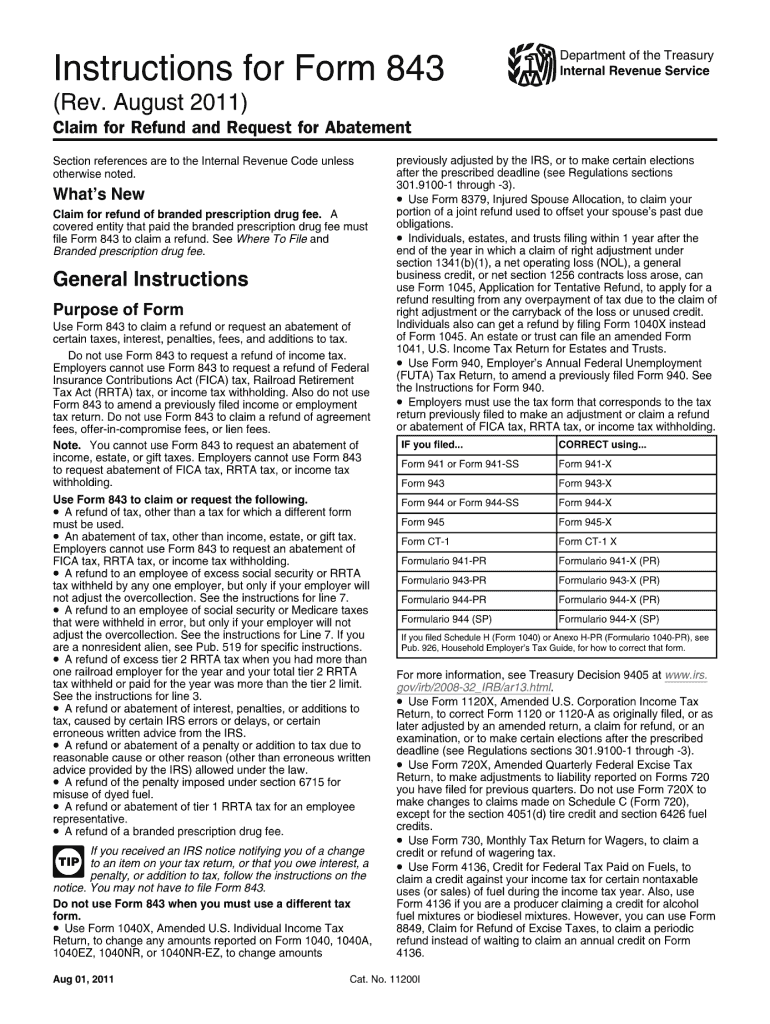

Instructions For Form 843 Claim For Refund And Request For Abatement

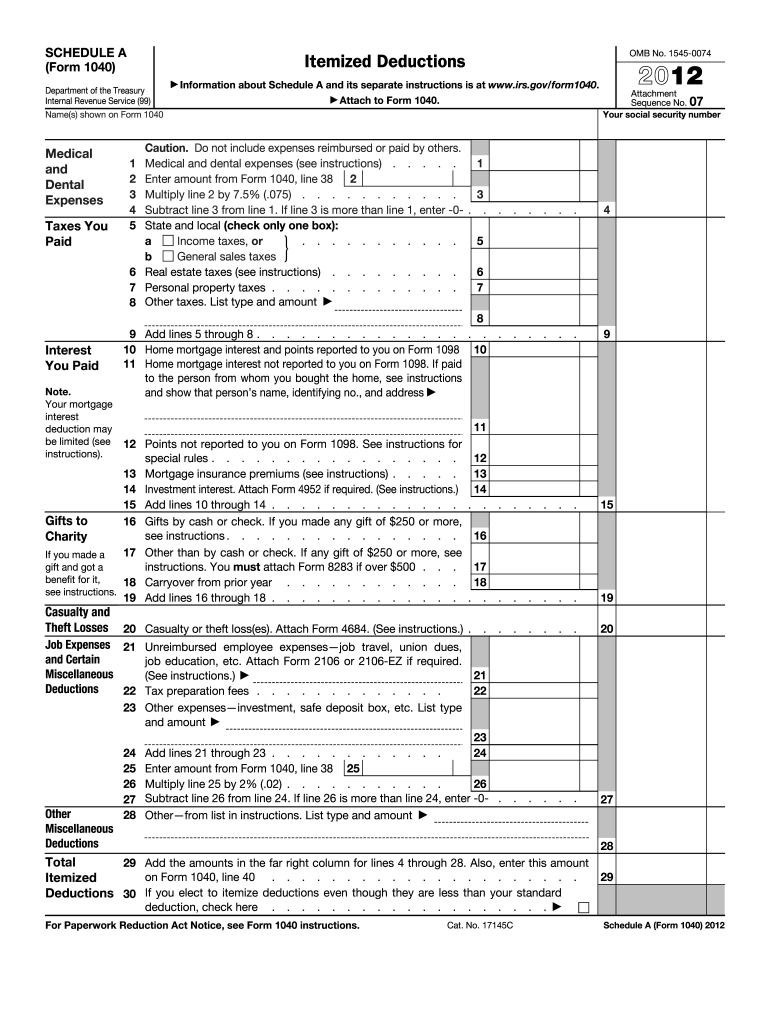

IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

Irs Form 843 Fillable and Editable PDF Template

Irs Fill and Sign Printable Template Online US Legal Forms

Form 843, Claim for Refund and Request for Abatement IRS Fill

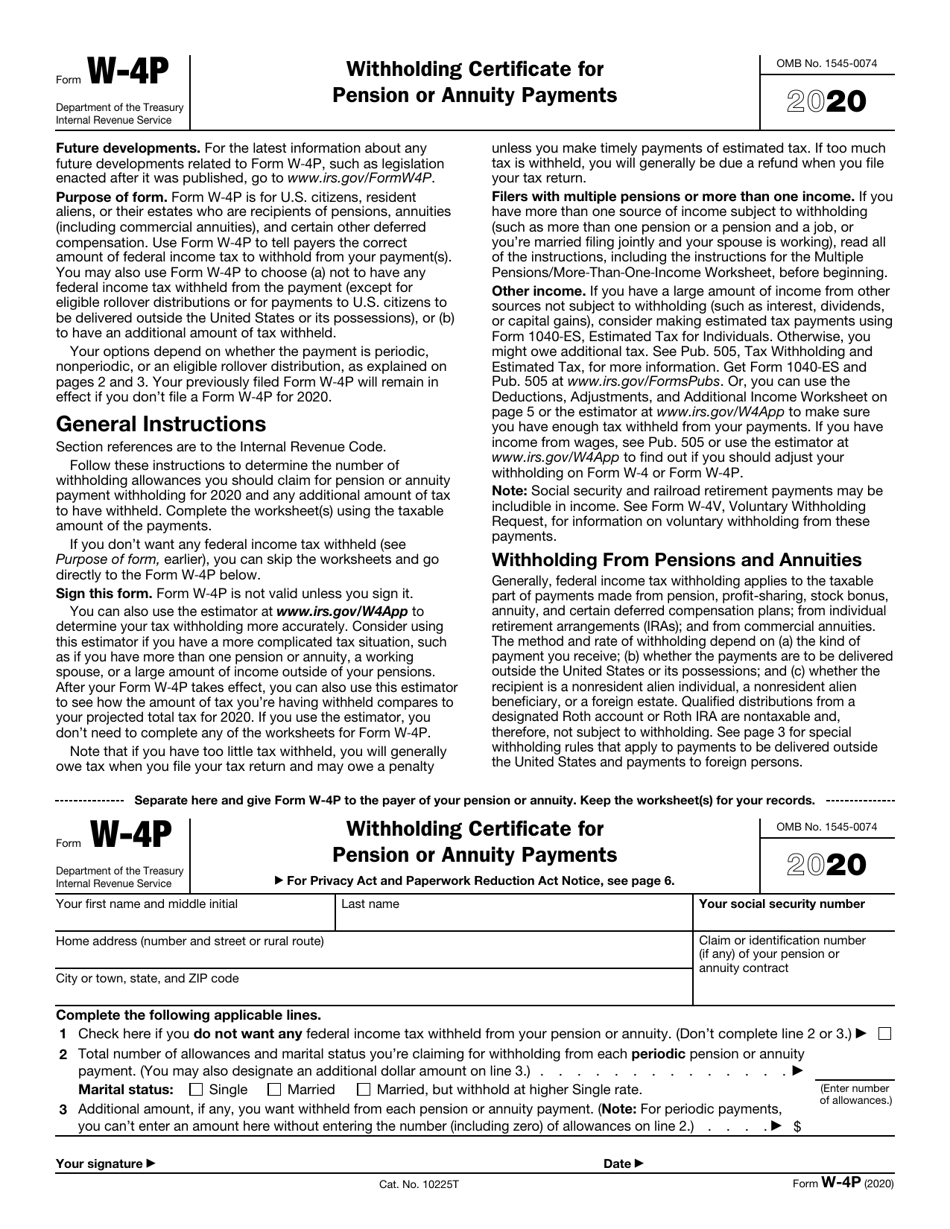

IRS Form W4P 2020 Fill Out, Sign Online and Download Fillable PDF

IRS Instruction 843 20202021 Fill out Tax Template Online US Legal

Irs form 843 2011 Fill out & sign online DocHub

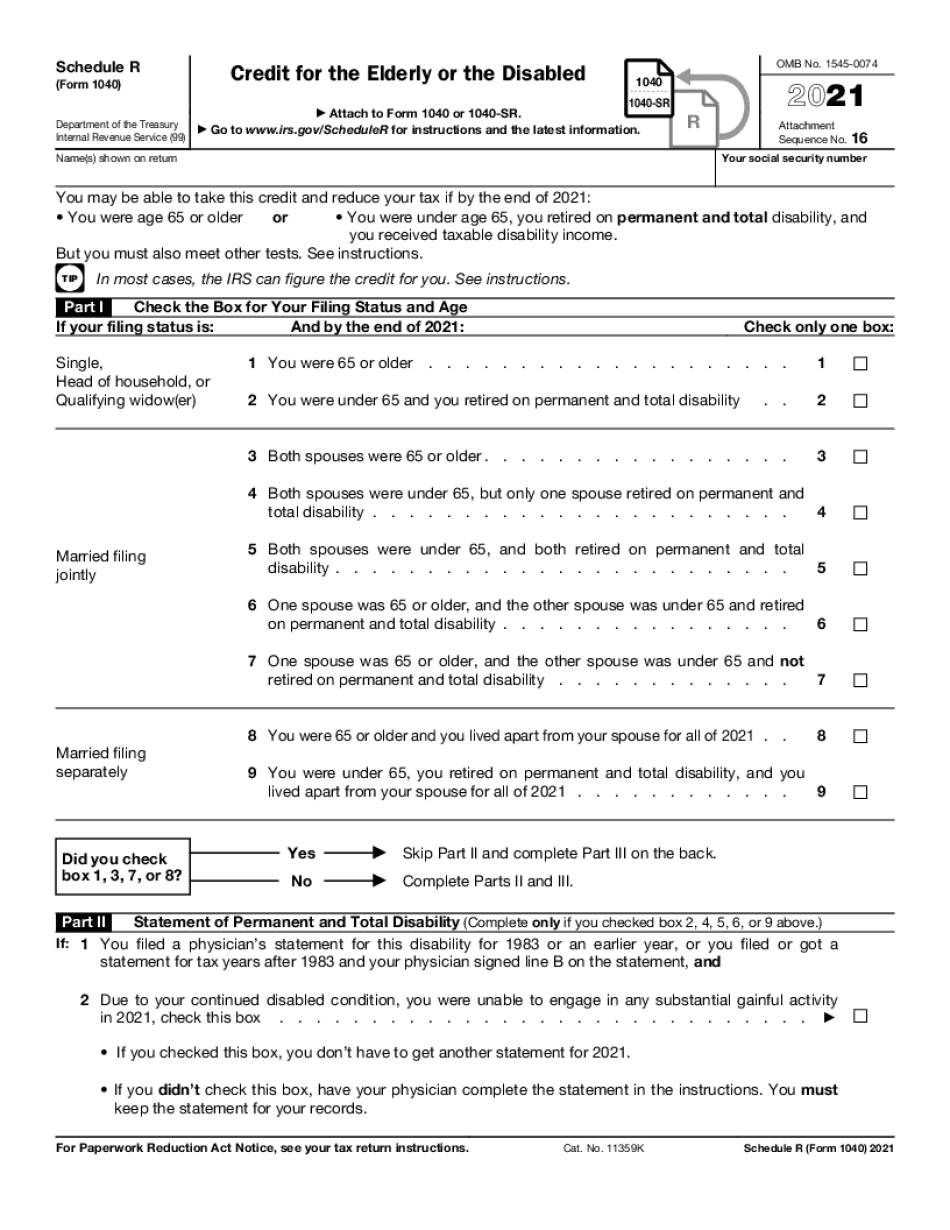

2022 Schedule R (Form 1040) Internal Revenue Service Fill Online

Purposes Of Irs Form 843.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

A Refund Of One Of The Taxes (Other Than Income Taxes Or An Employer’s Claim For Fica Tax, Rrta Tax, Or.

Web Form 843 Allows You To Request A Refund Of Irs Penaltiesand Certain Types Of Taxes.

Related Post: