Free Printable W9 Form

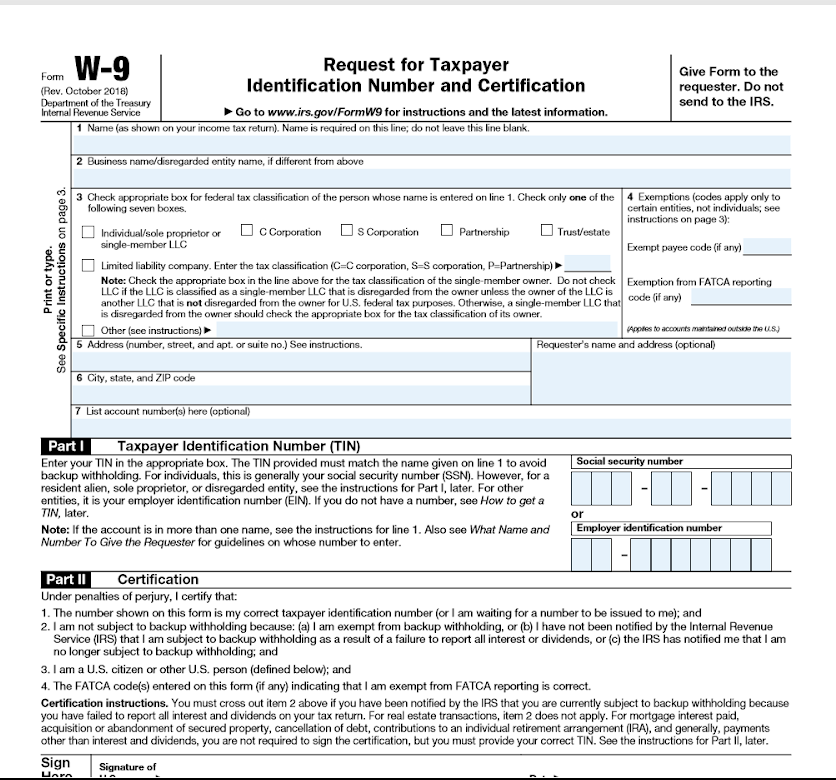

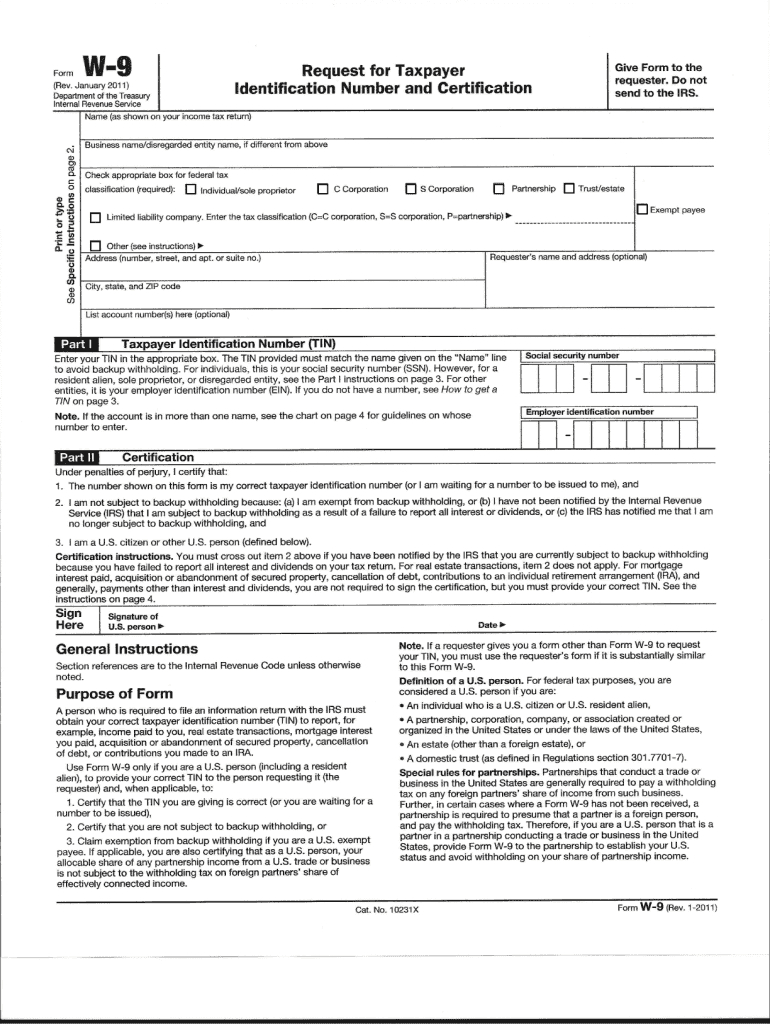

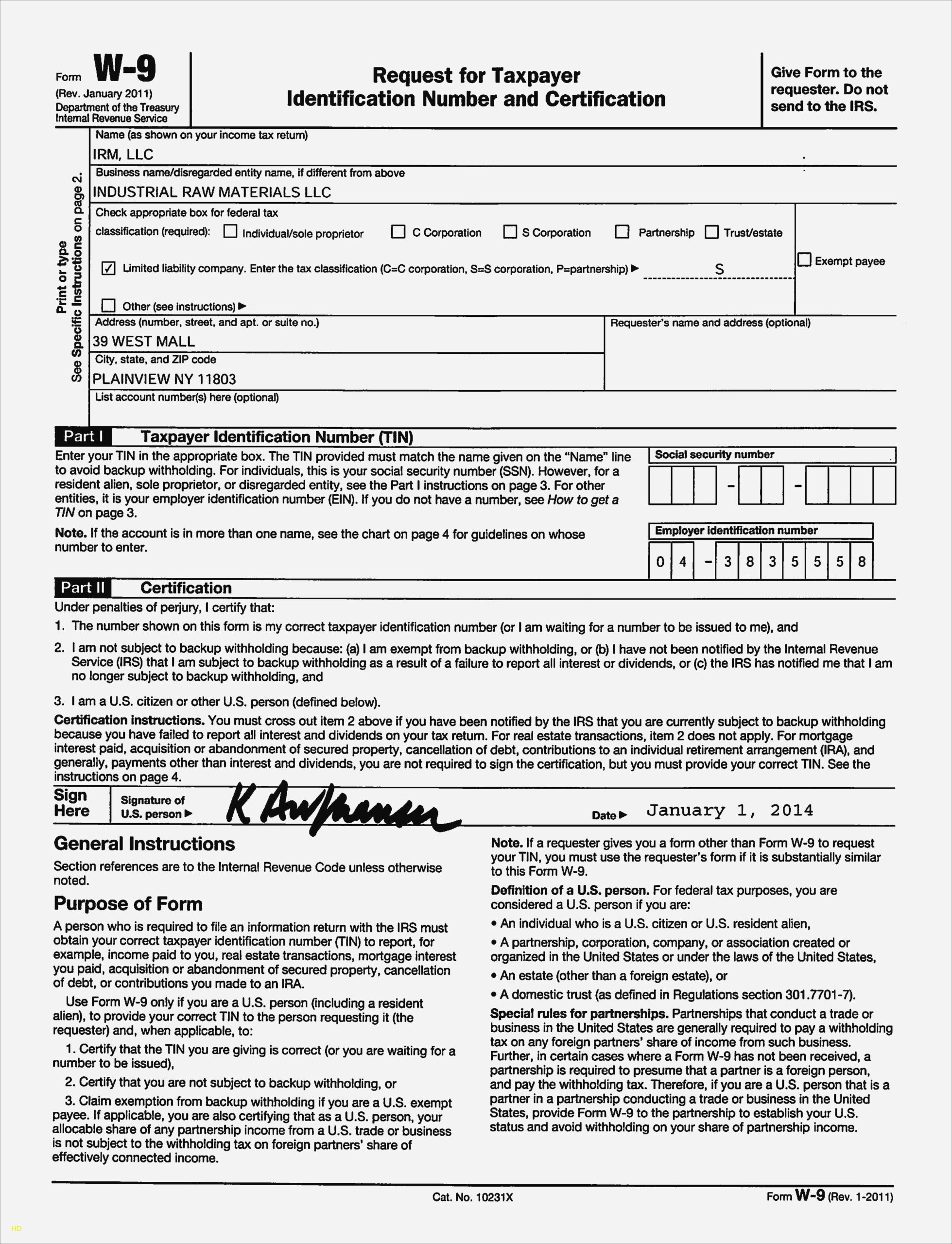

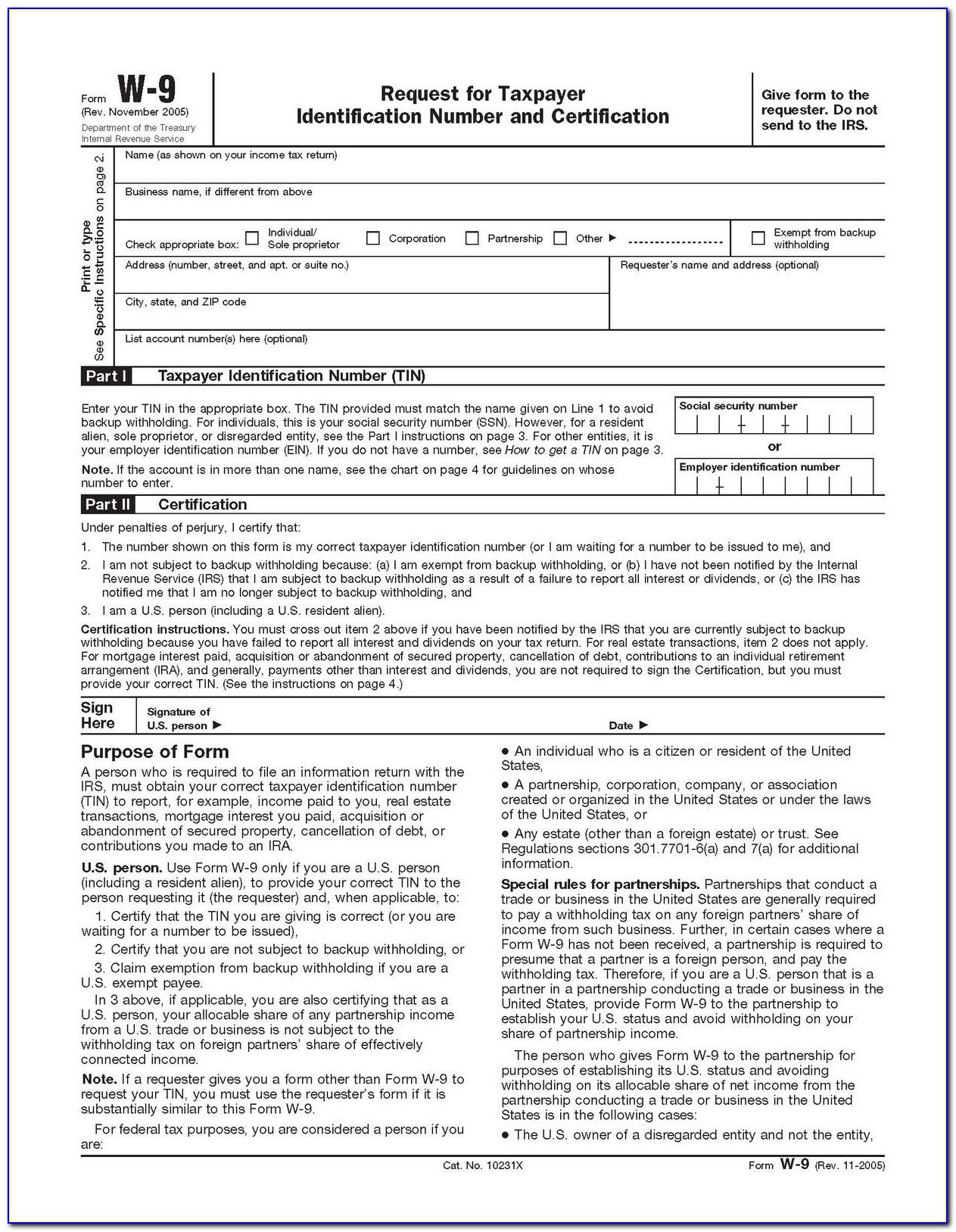

Free Printable W9 Form - Web open the dochub website and click the sign up key. The tin you gave is correct. Octubre de 2018) de identificación del contribuyente solicitante. Individual tax return form 1040 instructions; Follow directions on the screen to register your free account. Anyone who says otherwise is a scammer. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Ad look no further for the irs w9 form, we have it here at pdfsimpli. Web it’s free to apply for any type of veterans’ benefits. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. $260 for each taxpayer with an adjusted gross income of $75,000. Ad look no further for the irs w9 form, we have it here at pdfsimpli. December 2014) department of the treasury identification number and certification internal revenue service give form to the requester. No lo department of the. Person (including a resident alien) and to request certain certifications and claims for. Web popular forms & instructions; No lo department of the. Web open the dochub website and click the sign up key. This can be a social security. The tin you gave is correct. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions). December 2014) department of the treasury identification number and certification internal revenue service give form to the requester. Do not send to the irs. $520 for married couples who filed jointly with an. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from. Web it’s free to apply for any type of veterans’ benefits. This can be a social security. Web partnership trust/estate limited liability company. Ad look no further for the irs w9 form, we have it here at pdfsimpli. Octubre de 2018) de identificación del contribuyente solicitante. Name (as shown on your income tax return). Ad look no further for the irs w9 form, we have it here at pdfsimpli. This can be a social security. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web it’s a request for information about the contractors you pay as well as an agreement. This can be a social security. Follow directions on the screen to register your free account. Name (as shown on your income tax return). Web partnership trust/estate limited liability company. Do not send to the irs. Octubre de 2018) de identificación del contribuyente solicitante. The tin you gave is correct. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web how much will i receive? Anyone who says otherwise is a scammer. The tin you gave is correct. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions). $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web it’s free to apply for any type of veterans’ benefits. Ad look no further for the irs w9 form, we have it here at. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9. File your pact act claim for free online through the. Individual tax return form 1040 instructions; Web partnership trust/estate limited liability company. Do not send to the irs. Octubre de 2018) de identificación del contribuyente solicitante. Web open the dochub website and click the sign up key. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9. Follow directions on the screen to register your free account. By signing it you attest that: $520 for married couples who filed jointly with an. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions). December 2014) department of the treasury identification number and certification internal revenue service give form to the requester. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. This can be a social security. Anyone who says otherwise is a scammer. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. The tin you gave is correct. Person (including a resident alien) and to request certain certifications and claims for. Web it’s free to apply for any type of veterans’ benefits. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. No lo department of the. Web it’s a request for information about the contractors you pay as well as an agreement with those contractors that you won’t be withholding income tax from their pay — contractors. Anyone who says otherwise is a scammer. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions). Web it’s free to apply for any type of veterans’ benefits. Web how much will i receive? Web popular forms & instructions; Individual tax return form 1040 instructions; Do not send to the irs. Octubre de 2018) de identificación del contribuyente solicitante. Ad look no further for the irs w9 form, we have it here at pdfsimpli. Give your current email and develop an elaborate security. The tin you gave is correct. Person (including a resident alien) and to request certain certifications and claims for. Follow directions on the screen to register your free account. This can be a social security. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021.Free W 9 Form Printable Calendar Printables Free Blank

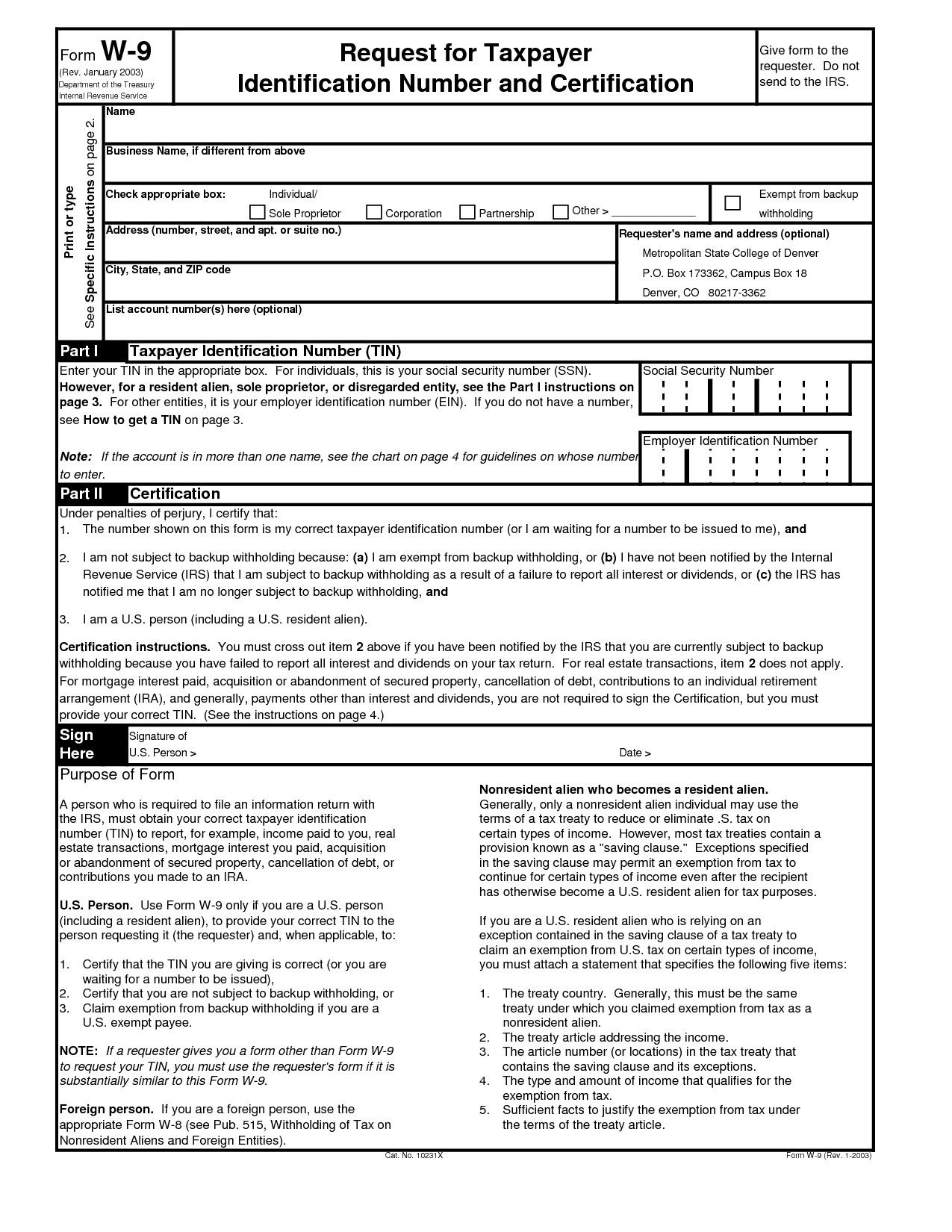

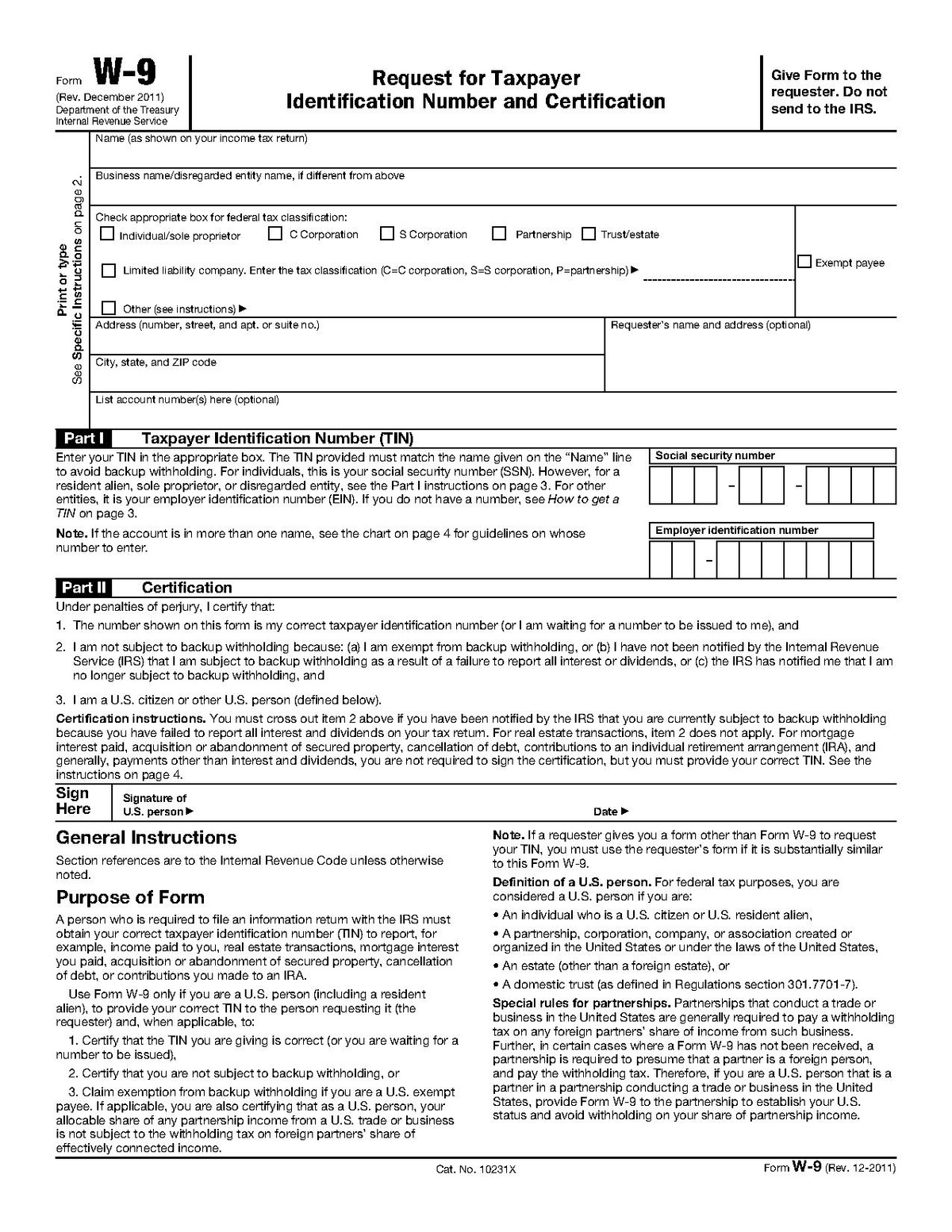

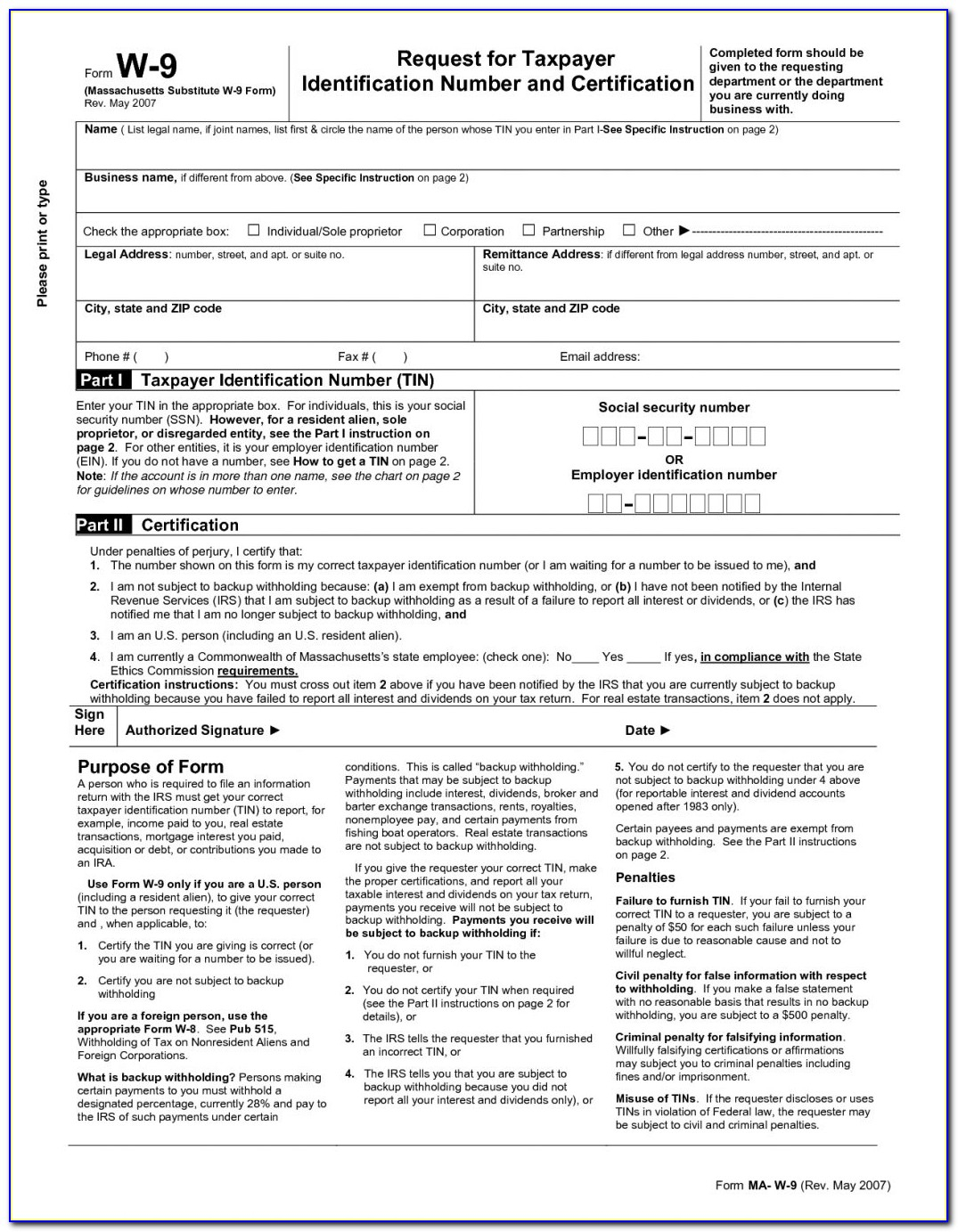

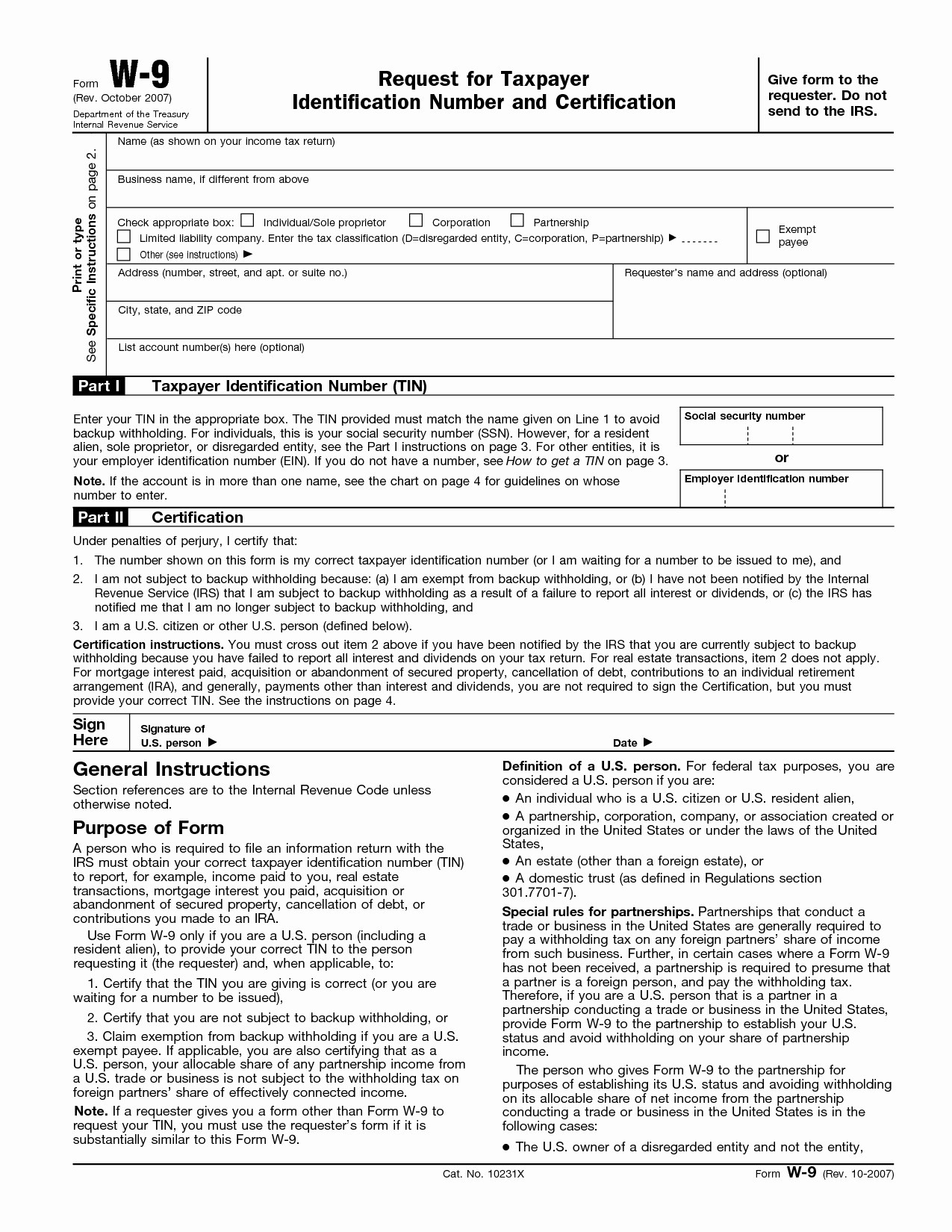

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within W 9

W9 Tax Form Printable

Printable Blank W9 Form Example Calendar Printable

W9 Form 2019 Printable Irs W9 Tax Blank In Pdf Free Printable W9

Free Printable W9 Form From Irs

Blank W9 Form Fill Online, Printable, Fillable, Blank within Free W 9

W9 Forms 2020 Printable Free Example Calendar Printable

Sample W 9 Form Example Calendar Printable

W9 Free Printable Form 2016 Free Printable

Web Open The Dochub Website And Click The Sign Up Key.

File Your Pact Act Claim For Free Online Through The Va’s.

$520 For Married Couples Who Filed Jointly With An.

December 2014) Department Of The Treasury Identification Number And Certification Internal Revenue Service Give Form To The Requester.

Related Post: