First Time Home Buyer Budget Template

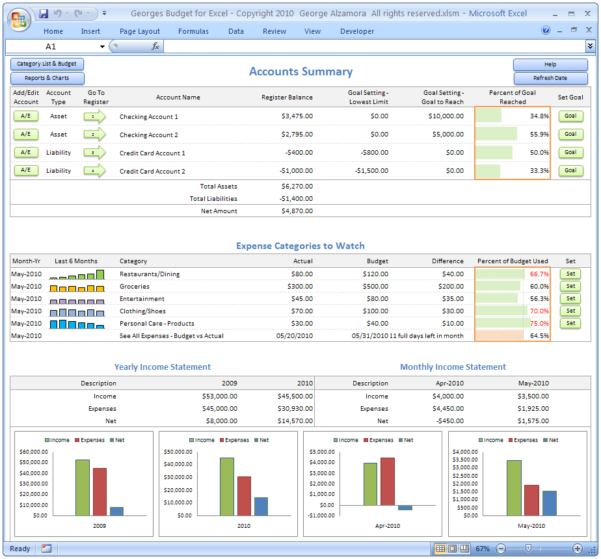

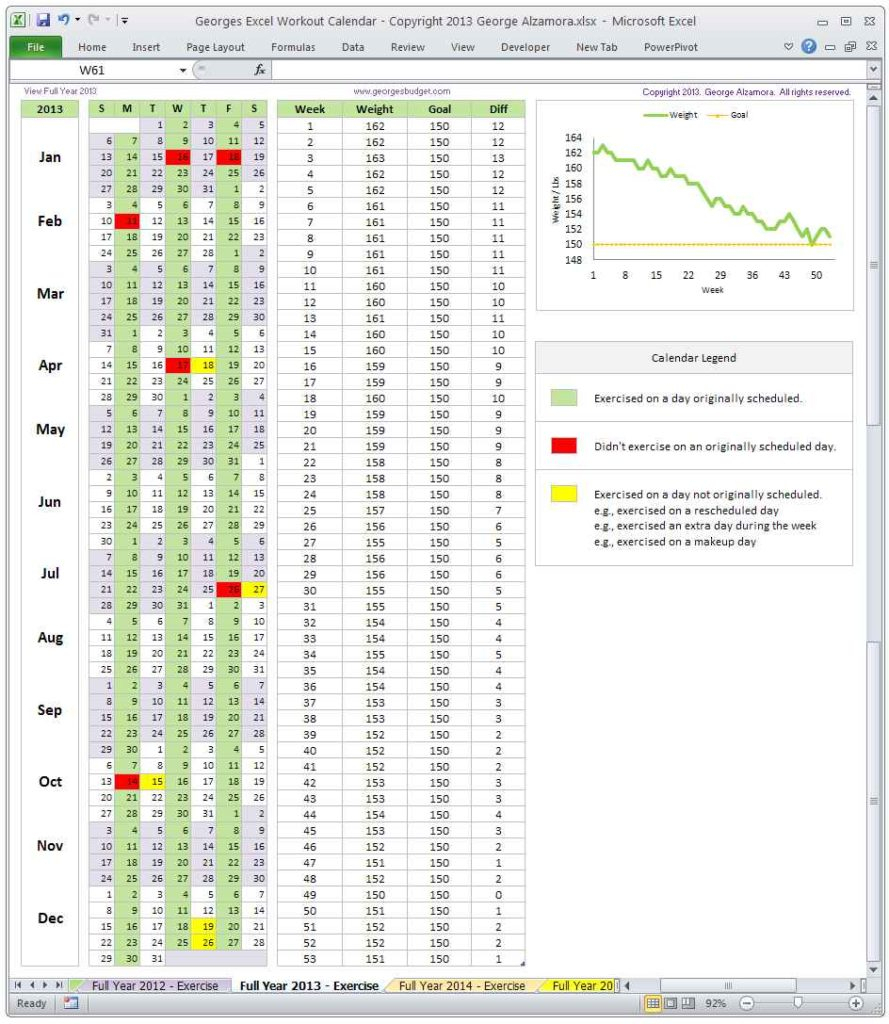

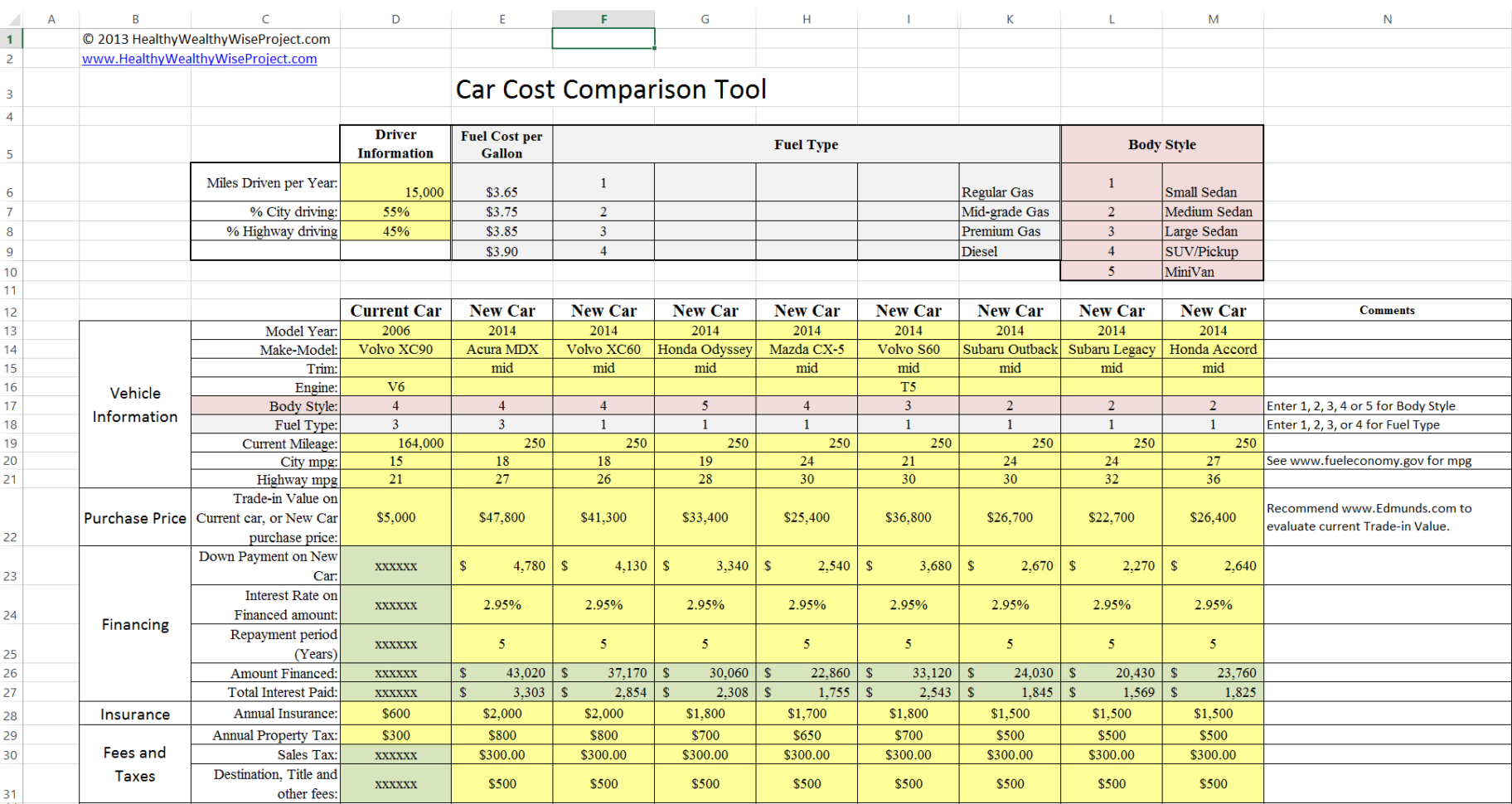

First Time Home Buyer Budget Template - As of today, this bill has yet to become law. Web gmfsmortgage.com/first does your monthly budget have room for a mortgage? Web with a home budget worksheet, you can learn the basics of budgeting and start to get your household finances in order. Ad use our online mortgage calculators. Since more buyers are shopping in the spring, a home you buy between march and may could cost you more than a similar home bought in. Now it's time to start shopping for a mortgage lender. The third top metro where homebuyers have to earn more is. Use this worksheet to give you an indication of your financial health when including a monthly. It helps to see expected expenses all in one place to plan for what you’ll need. Answer simple questions & see personalized results with our va loan calculator. Web in miami, buyers need to earn $79,500 (up 24.8%) to afford the typical $300,000 starter home. Web from here, you will want to keep track of your monthly expenses. The third top metro where homebuyers have to earn more is. Answer simple questions & see personalized results with our va loan calculator. Web with a home budget worksheet, you. Buying a home 12 min read. Web with a home budget worksheet, you can learn the basics of budgeting and start to get your household finances in order. Web you know your homebuying budget, and you've decided what type of home loan will work for you. Now it's time to start shopping for a mortgage lender. Web in miami, buyers. Web with a home budget worksheet, you can learn the basics of budgeting and start to get your household finances in order. As of today, this bill has yet to become law. New homes that bring you closer to the best restaurants, shopping, schools, and more. Once you have a better idea of your current spending habits, you can make. Web january 11, 2022 setting a realistic homebuying budget is an important step toward being financially prepared to own a home. Ad use our online mortgage calculators. Web you know your homebuying budget, and you've decided what type of home loan will work for you. At the end of the first section, you will use the amount you determined in. Web use our budget worksheet to calculate where you are spending your money. This article explains how the. Calculate your monthly loan payment. Web january 11, 2022 setting a realistic homebuying budget is an important step toward being financially prepared to own a home. Get your mortgage rate quote. Web bankrate.com provides a free home budget calculator and other personal finance calculators. Once you have a better idea of your current spending habits, you can make adjustments to reach. Ad create a budget to pay off debt, save for a down payment, or plan for retirement. The third top metro where homebuyers have to earn more is. New homes. Answer simple questions & see personalized results with our va loan calculator. Use this worksheet to give you an indication of your financial health when including a monthly. The top result shows total closing costs, in dollars and as a percentage of the loan amount (usually between 2%. Web gmfsmortgage.com/first does your monthly budget have room for a mortgage? The. Get your mortgage rate quote. Web monthly budget template. Web in miami, buyers need to earn $79,500 (up 24.8%) to afford the typical $300,000 starter home. Web the calculator will provide the following: Use this worksheet to give you an indication of your financial health when including a monthly. Since more buyers are shopping in the spring, a home you buy between march and may could cost you more than a similar home bought in. Ad use our online mortgage calculators. Now it's time to start shopping for a mortgage lender. Web monthly budget template. When you buy a home, there are one. Web gmfsmortgage.com/first does your monthly budget have room for a mortgage? Answer simple questions & see personalized results with our va loan calculator. This article explains how the. Web buy in november for a better price. Get your mortgage rate quote. Some expenses stay the same (rent/mortgage payment) from month to month and other expenses will vary (food,. The federal housing administration allows down payments as low as 3.5% for. Once you have a better idea of your current spending habits, you can make adjustments to reach. Web in miami, buyers need to earn $79,500 (up 24.8%) to afford the typical $300,000 starter home. Ad use our online mortgage calculators. Web you know your homebuying budget, and you've decided what type of home loan will work for you. Get your mortgage rate quote. Web gmfsmortgage.com/first does your monthly budget have room for a mortgage? Web use our budget worksheet to calculate where you are spending your money. The federal housing administration (fha) is a bit more generous, allowing consumers to spend as much as 31% of their gross income on a. Use this worksheet to give you an indication of your financial health when including a monthly. Ad create a budget to pay off debt, save for a down payment, or plan for retirement. Ad see if you’re eligible for a $0 down payment. Web the calculator will provide the following: Ad use our online mortgage calculators. Buying a home 12 min read. The top result shows total closing costs, in dollars and as a percentage of the loan amount (usually between 2%. Your complete money management solution to reduce debt and maximize finances Web monthly budget template. When you buy a home, there are one. This article explains how the. Ad use our online mortgage calculators. At the end of the first section, you will use the amount you determined in the second section and the. Web the calculator will provide the following: Answer simple questions & see personalized results with our va loan calculator. Use this worksheet to give you an indication of your financial health when including a monthly. Web in miami, buyers need to earn $79,500 (up 24.8%) to afford the typical $300,000 starter home. Since more buyers are shopping in the spring, a home you buy between march and may could cost you more than a similar home bought in. Web from here, you will want to keep track of your monthly expenses. Web buy in november for a better price. Once you have a better idea of your current spending habits, you can make adjustments to reach. Ad use our online mortgage calculators. When you buy a home, there are one. Managing household expenses can seem like a scary thing, regardless of. One of the easiest ways to calculate your homebuying budget is the 28% rule, which dictates that your mortgage shouldn't be more than 28% of your gross income each month. The top result shows total closing costs, in dollars and as a percentage of the loan amount (usually between 2%.First Time Home Buyer Spreadsheet Spreadsheet Downloa first time home

First Time Home Buyer Spreadsheet throughout Home Buying Spreadsheet

Browse Our Image of First Time Home Buyer Budget Template Budget

How To Plan A Diy Home Renovation Budget Spreadsheet First Time Home

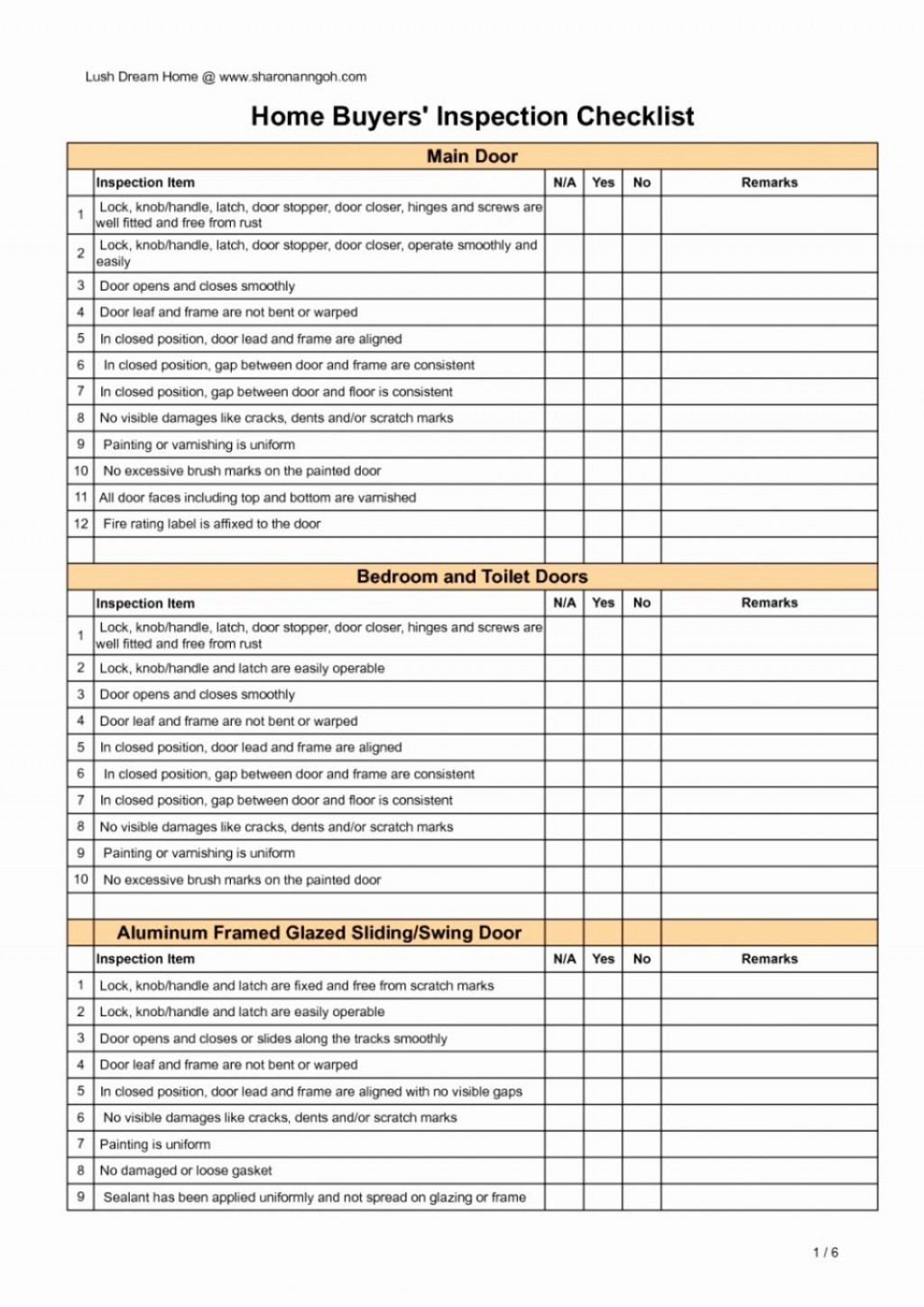

Free Printable Checklist for 1st Time Home Buyers (17 Critical Steps

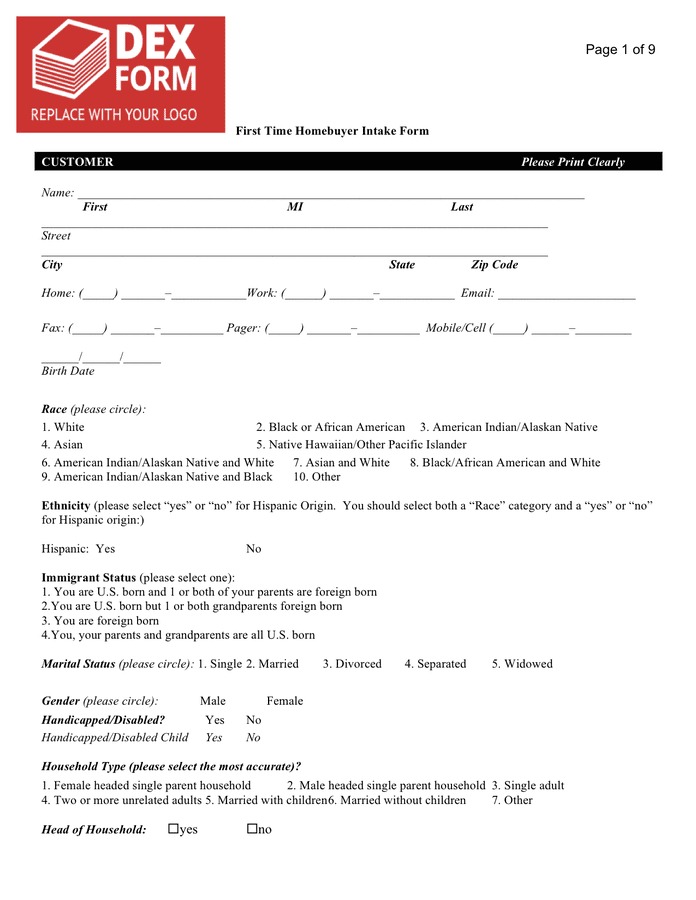

First time homebuyer intake form in Word and Pdf formats

Home Buyer Checklist of Home Features and Amenities. Follow link to

First Time Home Buyer Spreadsheet Spreadsheet Downloa first time home

First Time Home Buyer Spreadsheet —

Printable Free Budget Spreadsheets And Templates Nerdwallet First Time

Web Monthly Budget Template.

The Federal Housing Administration Allows Down Payments As Low As 3.5% For.

Your Complete Money Management Solution To Reduce Debt And Maximize Finances

Web Bankrate.com Provides A Free Home Budget Calculator And Other Personal Finance Calculators.

Related Post: