Federal W4 Form Printable

Federal W4 Form Printable - 3 $ (a) other income (not from jobs). Web enter the total here. What is this form for. Web enter the total here. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Pdf 2021 form w4 download: If too little is withheld, you will generally owe tax when you file your tax return. 3 $ (a) other income (not from jobs). Certificado de retenciones del empleado. 3 $ (a) other income (not from jobs). If too little is withheld, you will generally owe tax when you file your tax return. What is this form for. If too little is withheld, you will generally owe tax when you file your tax return. Department of the treasury internal revenue service. 3 $ (a) other income (not from jobs). If you want tax withheld for other income you expect this year that won’t have withholding, enter the. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Web enter. Certificado de retenciones del empleado. Web in this video you’ll learn: Web enter the total here. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Department of the treasury internal revenue service. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. 3 $ (a) other income (not from jobs). Amazon.com has been visited by 1m+ users in the past month Web enter the total here. Certificado de retenciones del empleado. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Web in this video you’ll learn: 3 $ (a) other income (not from jobs). 3 $ (a) other income (not from jobs). If you want tax withheld for other income you expect this year that won’t have withholding, enter the. If too little is withheld, you will generally owe tax when you file your tax return. Amazon.com has been visited by 1m+ users in the past month Certificado de retenciones del empleado. If too little is withheld, you will generally owe tax when you file your tax return. What is this form for. Pdf 2021 form w4 download: Web enter the total here. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file. If too little is withheld, you will generally owe tax when you file your tax return. Web enter the total here. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file. 3 $ (a) other income (not from jobs). Certificado de retenciones del empleado. If too little is withheld, you will generally owe tax when you file. Web enter the total here. Pdf 2021 form w4 download: If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. What is this form for. Pdf 2021 form w4 download: (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Web enter the total here. Certificado de retenciones del empleado. Web in this video you’ll learn: Web enter the total here. Web enter the total here. If too little is withheld, you will generally owe tax when you file. Department of the treasury internal revenue service. (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Pdf 2021 form w4 download: If you want tax withheld for other income you expect this year that won’t have withholding, enter the. 3 $ (a) other income (not from jobs). If you want tax withheld for other income you expect this year that won’t have withholding, enter the. If too little is withheld, you will generally owe tax when you file your tax return. 3 $ (a) other income (not from jobs). If too little is withheld, you will generally owe tax when you file your tax return. Amazon.com has been visited by 1m+ users in the past month What is this form for. If too little is withheld, you will generally owe tax when you file your tax return. Pdf 2021 form w4 download: Web enter the total here. If too little is withheld, you will generally owe tax when you file. If too little is withheld, you will generally owe tax when you file your tax return. What is this form for. Web enter the total here. (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. 3 $ (a) other income (not from jobs). If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. 3 $ (a) other income (not from jobs). If you want tax withheld for other income you expect this year that won’t have withholding, enter the.Tax Form W 4 Printable Printable Forms Free Online

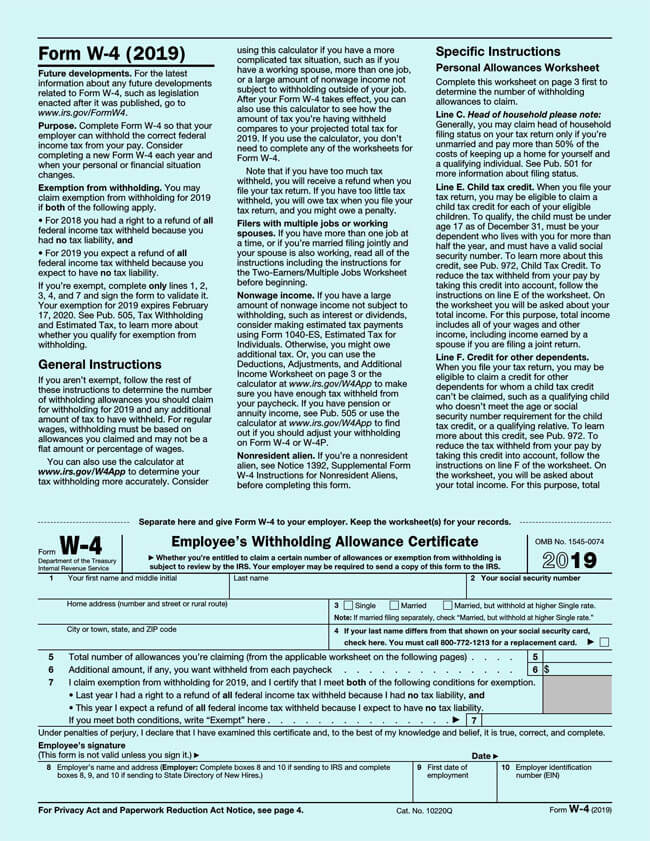

What you should know about the new Form W4 Atlantic Payroll Partners

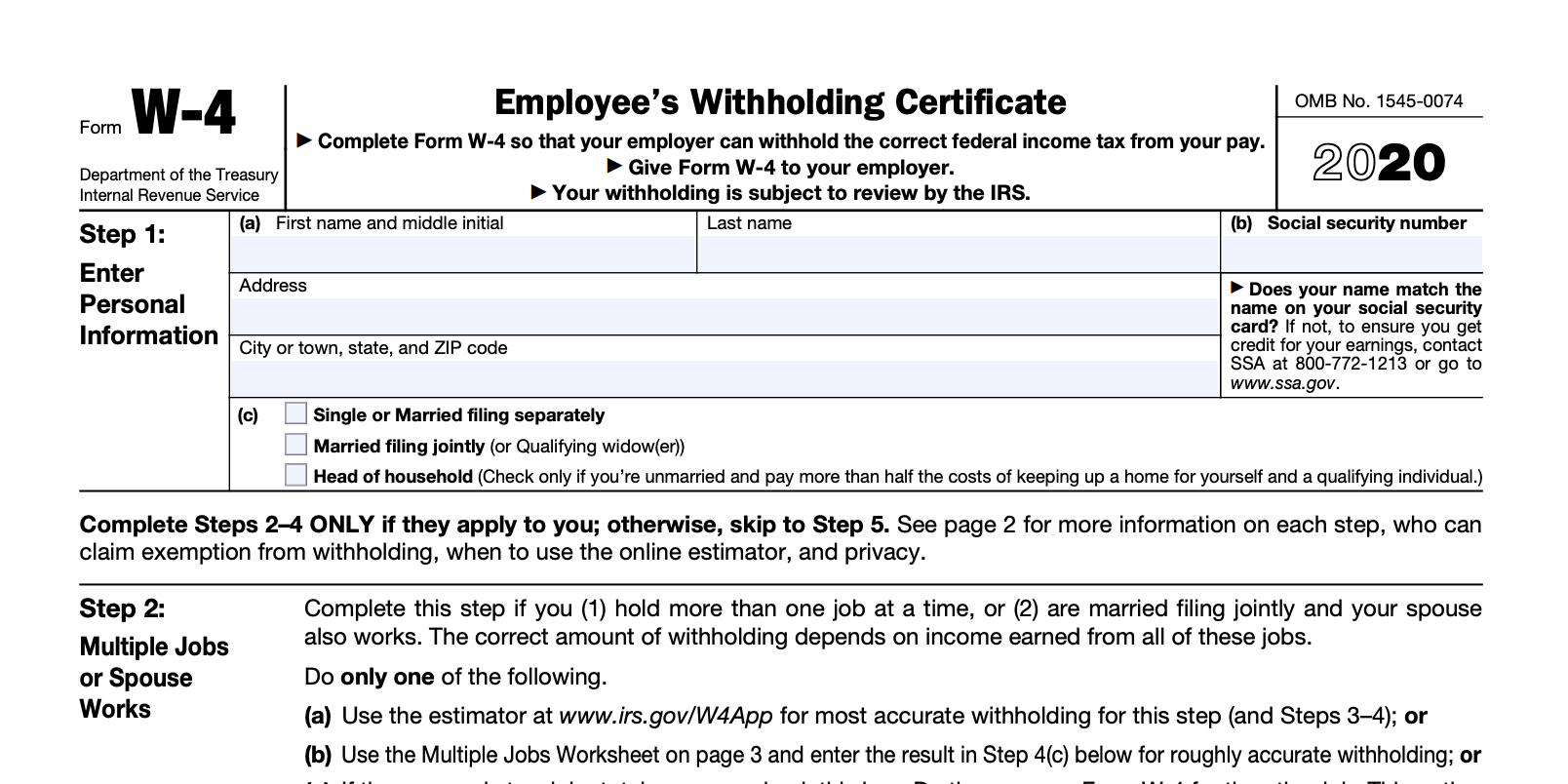

Il W 4 2020 2022 W4 Form

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Free Printable W 4 Forms 2022 W4 Form

Form W4 Complete Guide How to Fill (with Examples)

IRS W4 Federal Tax Form 2018 2019 Printable & Fillable Online

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Free Printable W 4 Form For Employees Printable Templates

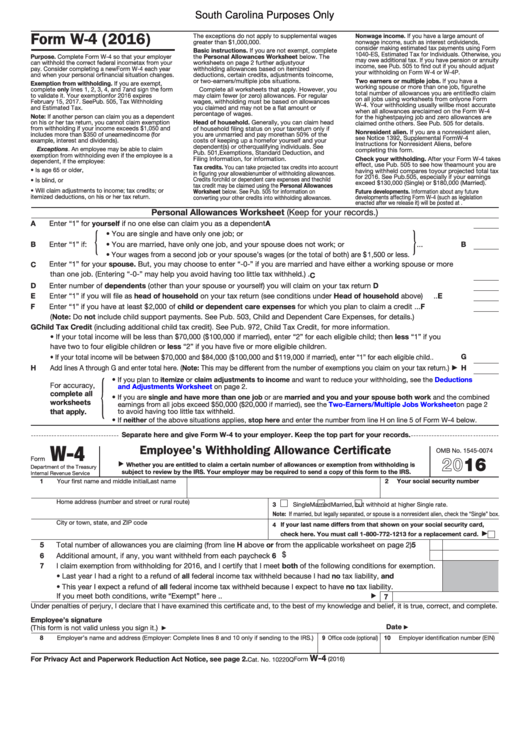

Form W4 Employee'S Withholding Allowance Certificate (South Carolina

Department Of The Treasury Internal Revenue Service.

Web In This Video You’ll Learn:

Certificado De Retenciones Del Empleado.

Amazon.com Has Been Visited By 1M+ Users In The Past Month

Related Post: