Discounted Cash Flow Template

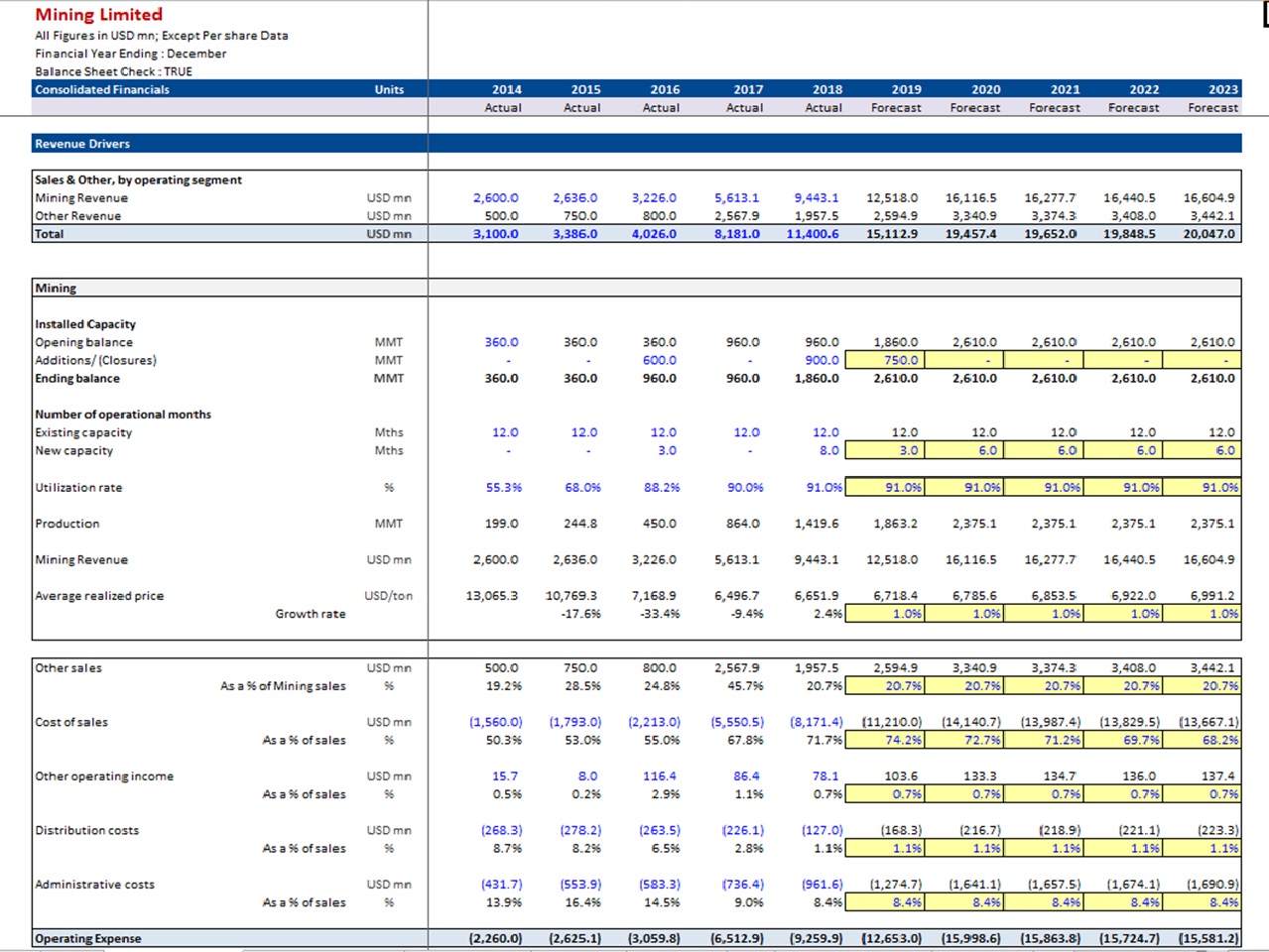

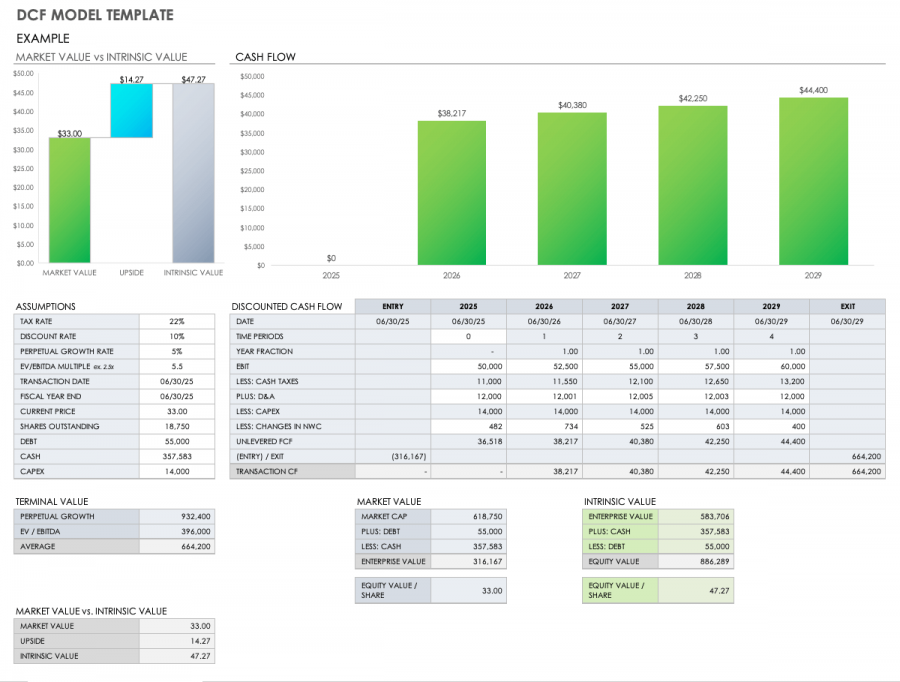

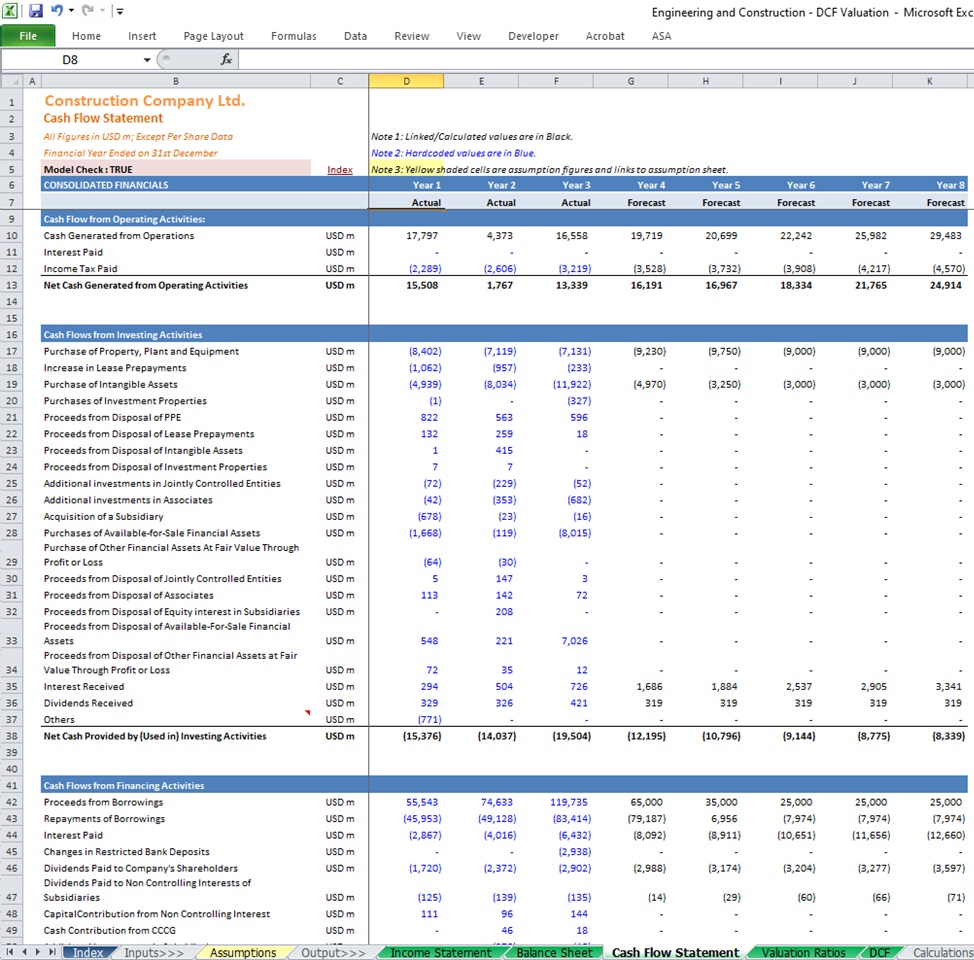

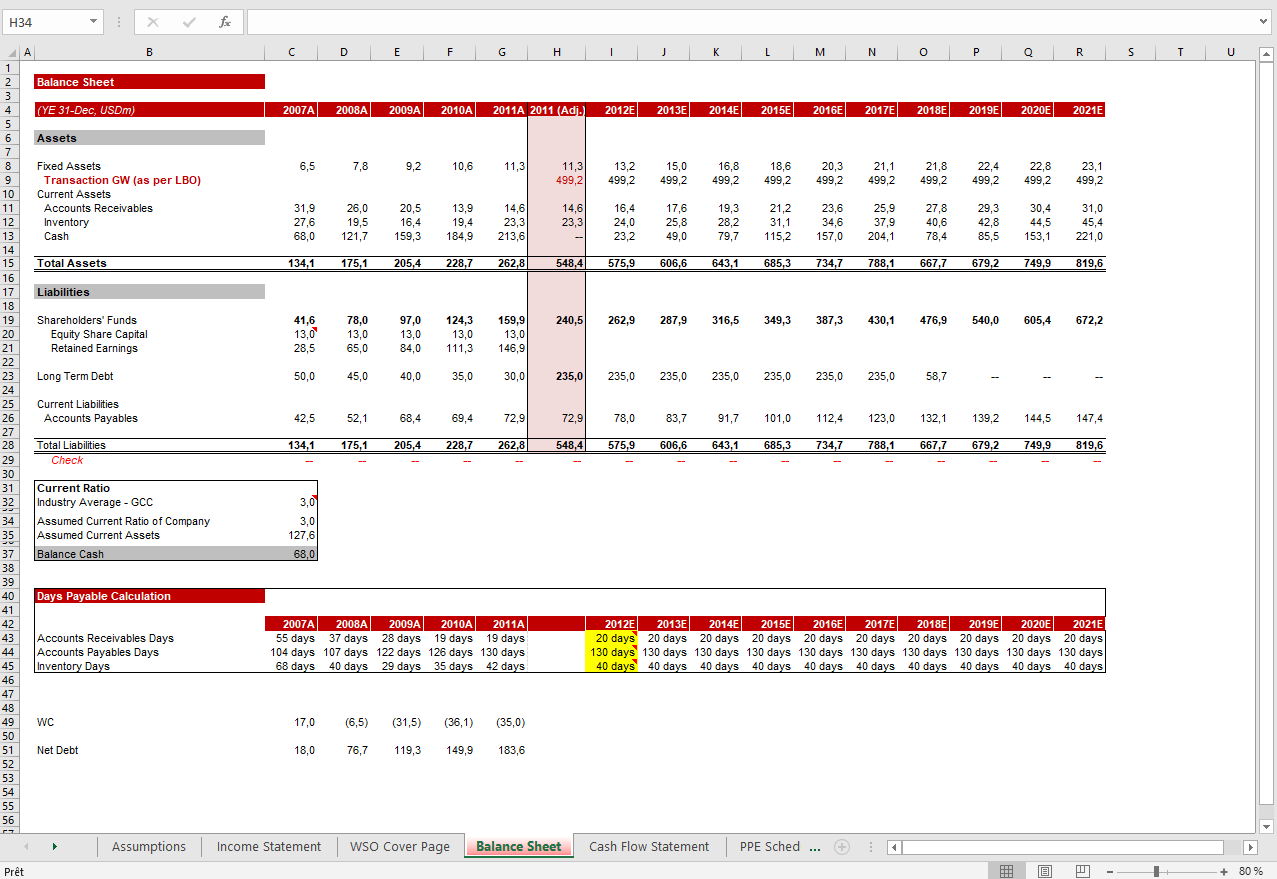

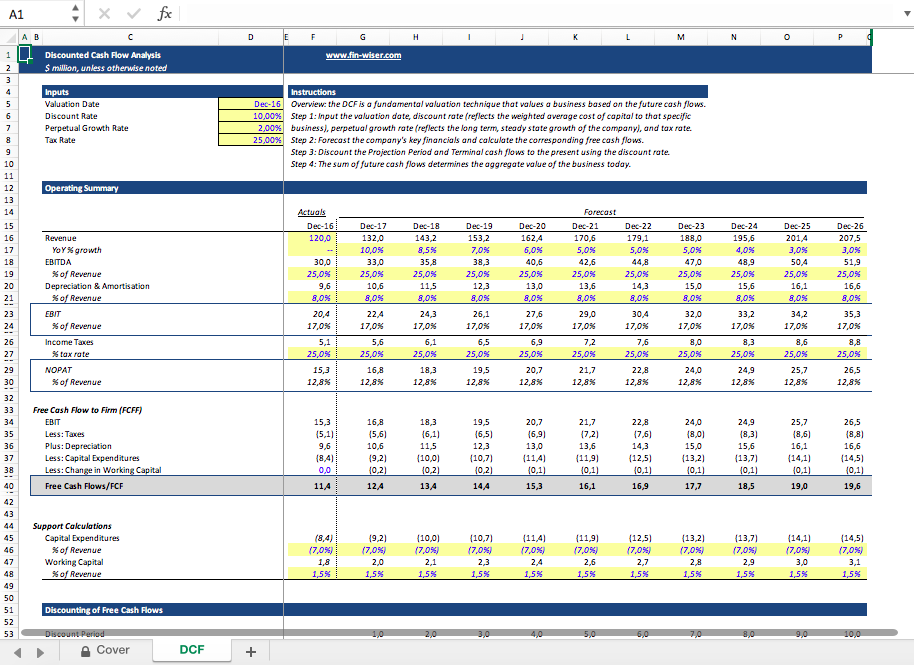

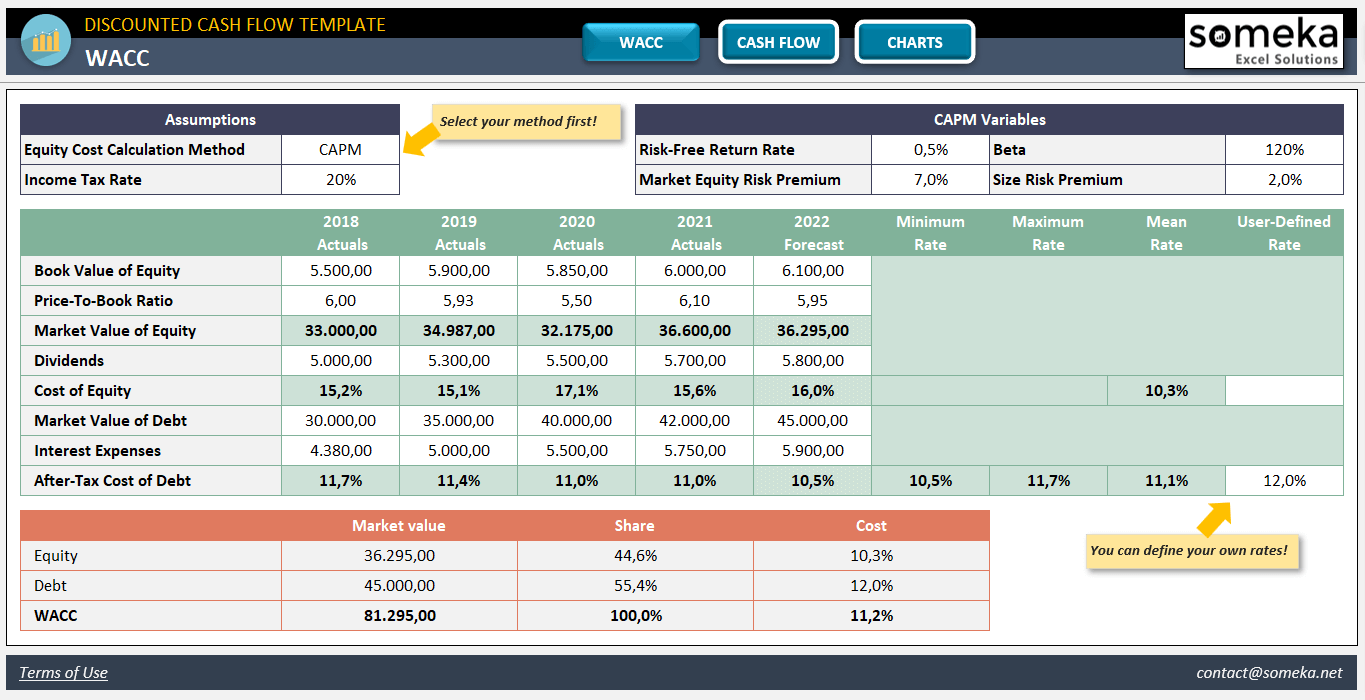

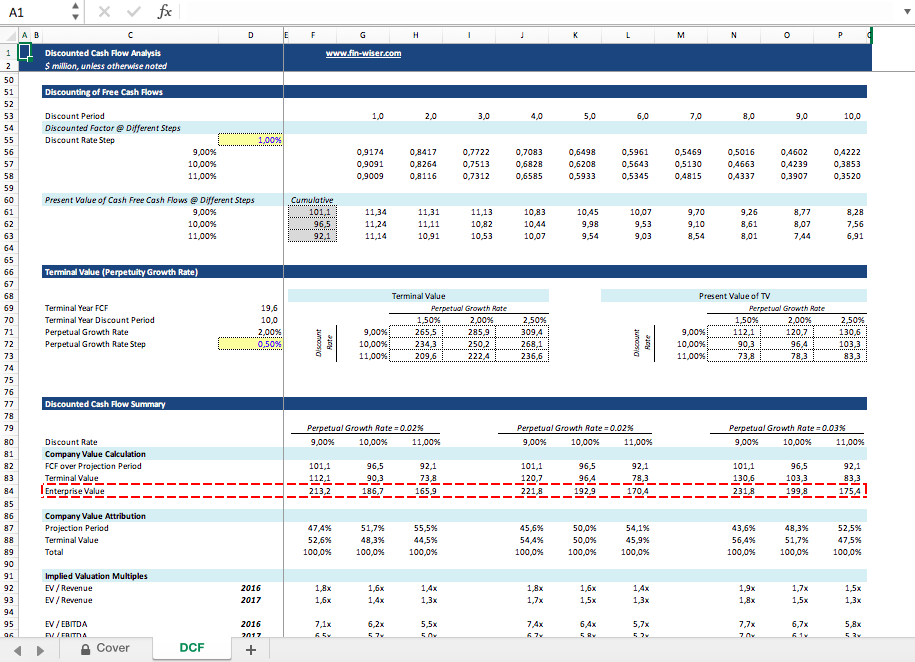

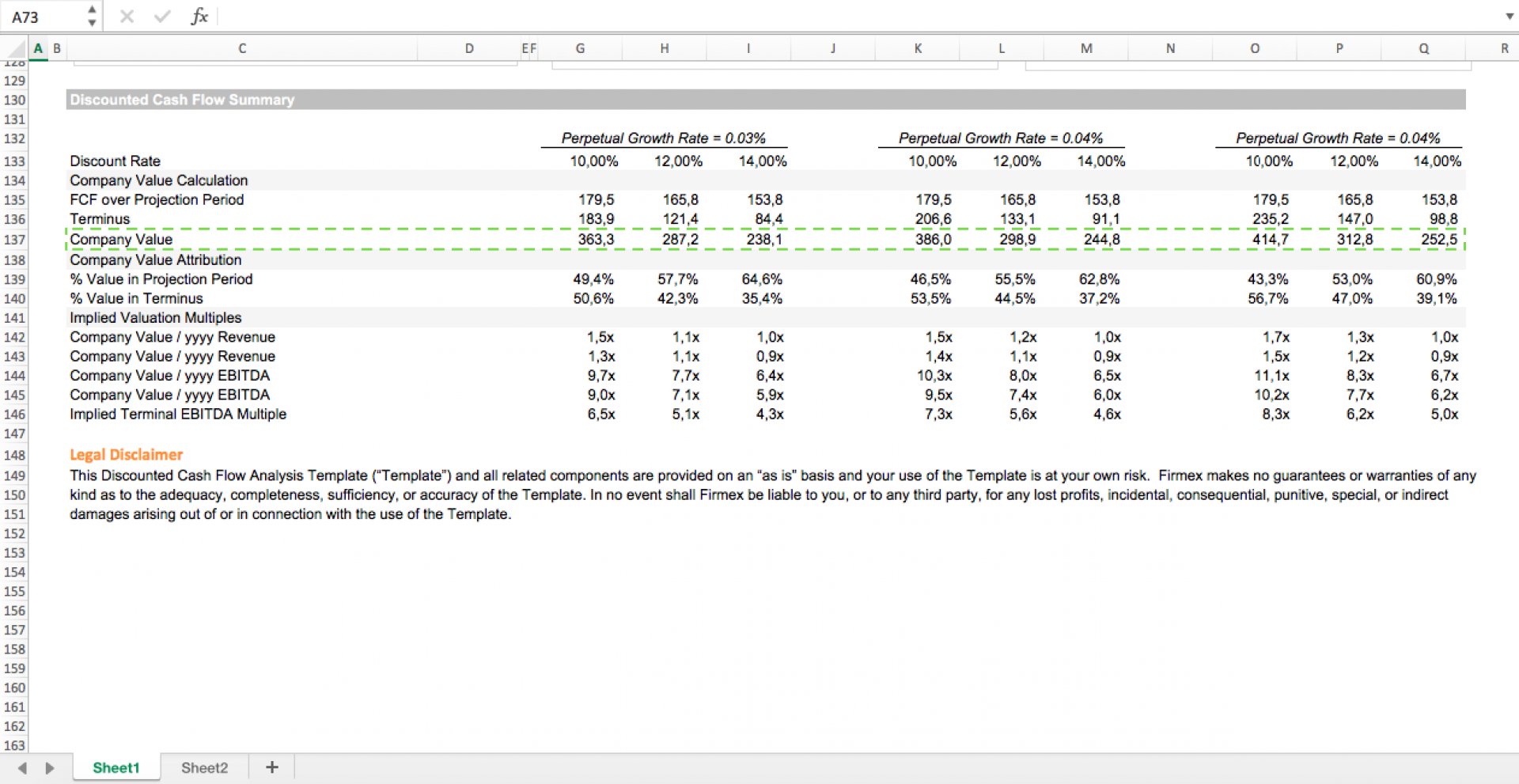

Discounted Cash Flow Template - Web ppl corporation (ppl) dcf excel template main parts of the financial model: This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors. Web on this page, you’ll find the following: Where, cf = cash flow in year. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic. + cfn / (1 + r)^n) + tv / (1+r)^n where: Web discount factor template. The discounted cash flow formula; This template allows you to build your own discounted cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Now that we know the dcf formula, let’s put it into practice with a hypothetical example. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the. Dcf = cf1/ (1+r)1 + cf2/ (1+r)2 +. Web the dcf formula is given as follows: Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. This template allows you to build your own discounted cash flow. Where, cf = cash flow in year. Web discount factor template. Web the discounted cash flow (dcf) method is one of the three main methods for calculating a company’s value. Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. This discount factor template helps you calculate the. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. The dcf formula allows you to determine the. In dcf analysis, essentially what you are doing is projecting the cash flows. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Cfi = cash flow in the period i, so. Where, dcf = discounted cash flow. Web on this page, you’ll find the following: Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. Let’s say you look at your. Web period #1 (explicit forecast period): Web discount factor template. Where, cf = cash flow in year. It’s also used for calculating a company’s share price, the value of. Dcf analysis can be applied to value a. The discounted cash flow formula; Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web period #1 (explicit forecast period): Tips for doing a discounted cash flow analysis; Web the formula for dcf is: Web on this page, you’ll find the following: Web the dcf formula is given as follows: * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Web ppl corporation (ppl) dcf excel template main parts of the financial model: The dcf formula allows you to determine the. Web the dcf formula is given as follows: Dcf analysis can be applied to value a. Dcf = cf1/ (1+r)1 + cf2/ (1+r)2 +. In dcf analysis, essentially what you are doing is projecting the cash flows of a. Cf1 to cfn are the forecasted cash flows. Now that we know the dcf formula, let’s put it into practice with a hypothetical example. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web ppl corporation. This template allows you to build your own discounted cash flow. Now that we know the dcf formula, let’s put it into practice with a hypothetical example. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Cfi = cash flow in the period i, so. + cfn / (1 + r)^n) + tv / (1+r)^n where: Dcf analysis can be applied to value a. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Download wso's free discounted cash flow (dcf) model template below! Let’s say you look at your. Cf1 to cfn are the forecasted cash flows. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. The discounted cash flow formula; Web the dcf formula is given as follows: The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Web the discounted cash flow (dcf) method is one of the three main methods for calculating a company’s value. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Where, cf = cash flow in year. Web january 31, 2022. Where, dcf = discounted cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web the dcf formula is: The model is completely flexible, so that when you put in the. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors. Web period #1 (explicit forecast period): Dcf = cf1/ (1+r)1 + cf2/ (1+r)2 +. R is the discount rate. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Web january 31, 2022. Download wso's free discounted cash flow (dcf) model template below! Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Let’s say you look at your.Discounted Cash Flow DCF Valuation Model Template (Mining Company

Free Discounted Cash Flow Templates Smartsheet

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

Free Discounted Cash Flow Templates Smartsheet

xpressbasta Blog

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow Excel Template DCF Valuation Template

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

DCF Discounted Cash Flow Model Excel Template Eloquens

It’s Also Used For Calculating A Company’s Share Price, The Value Of.

Dcf Analysis Can Be Applied To Value A.

The Discounted Cash Flow (Dcf) Analysis Represents The Net Present Value (Npv) Of Projected Cash Flows Available To All Providers.

Tips For Doing A Discounted Cash Flow Analysis;

Related Post: