Debt Repayment Budget Template

Debt Repayment Budget Template - Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying it. It’s available on instant download so you can access it anywhere, at anytime. Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom. If you live with a partner and you are not dealing with your debts together, contact us for advice about completing the budget. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. Divide your income among needs, wants, savings and debt repayment, using the 50/30/20 budget. Otherwise, your credit will suffer. Budgets should use monthly figures because most important bills are monthly. Before you can come up with a strategy, you need to be able to see all your debts in one place. Web create a plan of attack. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying it. If you have previously saved a budget, click the load button to see it. Ad easily manage employee expenses. Make a list. If you live with a partner and you are not dealing with your debts together, contact us for advice about completing the budget. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying. Try our free budget template (excel file or pdf ). This debt reduction spreadsheet 2021 is very helpful in planning repayment strategies. Save time on expense reports with everything in one place & approve with just one click. See where your money is going. Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to. Ad easily manage employee expenses. If you live with a partner and you are not dealing with your debts together, contact us for advice about completing the budget. Try our free budget template (excel file or pdf ). Web a properly created debt budget will help you save money that then goes towards repayment of your debts. He shared screenshots. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. See where your money is going. Excel templates range from debt repayment schedules to printable calendars to budgets and financial calculators. This template acts as a perfect guide for creating your own debt payment. Try our free budget template (excel file or pdf ). Before you can come up with a strategy, you need to be able to see all your debts in one place. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. Web a budget. Graphs will help you compare the two strategies side by side. Make a list of all your debts. Ad easily manage employee expenses. See where your money is going. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as. Include interest earned from your checking or money market bank account or any other interest that is yours to spend. When it comes to figuring out the best tactic, two popular debt repayment methods are the: If you live with a partner and you are not dealing with your debts together, contact us for advice about completing the budget. Your. Web debt reduction spreadsheet 2021. Excel templates range from debt repayment schedules to printable calendars to budgets and financial calculators. If you have previously saved a budget, click the load button to see it. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web if you have. This list should also include all of your debt, from. See where your money is going. Graphs will help you compare the two strategies side by side. Vertex 42 debt reduction snowball calculator and credit. Easily track your income, expenses, and debt payments, while gaining insights to optimize your financial strategy. Easily track your income, expenses, and debt payments, while gaining insights to optimize your financial strategy. The only thing you need to do is enter your debt details. Excel templates range from debt repayment schedules to printable calendars to budgets and financial calculators. Web a budget can help you: Budgets should use monthly figures because most important bills are monthly. If you live with a partner and you are not dealing with your debts together, contact us for advice about completing the budget. Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom. Otherwise, your credit will suffer. He shared screenshots of the budget template he created and explained how it. Ad easily manage employee expenses. Try our free budget template (excel file or pdf ). Graphs will help you compare the two strategies side by side. Web debt reduction spreadsheet 2021. Web a properly created debt budget will help you save money that then goes towards repayment of your debts. This list should also include all of your debt, from. Before you can come up with a strategy, you need to be able to see all your debts in one place. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. Fully integrated w/ employees, invoicing, project & more. Make a list of all your debts. Your list should include the minimum payment amount, the interest rate, and how much you owe total. Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom. It includes graph representation of your impending debts concerning the individual creditor. Your list should include the minimum payment amount, the interest rate, and how much you owe total. This debt reduction spreadsheet 2021 is very helpful in planning repayment strategies. This template acts as a perfect guide for creating your own debt payment plan. Make a list of all your debts. Ad licensed debt management service provider. Web ian group has paid down $190,000 in student loans. Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to pay each month, based on how much you owe and your interest rate. We are not a loan company, we do not lend money. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying it. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Excel templates range from debt repayment schedules to printable calendars to budgets and financial calculators. Save time on expense reports with everything in one place & approve with just one click. You can use this sheet to switch back and forth between the avalanche and debt snowball methods. Web for a good starting point, you can see how your current spending aligns with the 50/30/20 budget, which recommends spending 50% of your income on needs, 30% on wants and 20% on debt payments and.Debt Payment Plan Printable by aRodgersDesigns on Etsy Debt Free

How to Create A Budget Binder One Sweet Life

Free Excel Budget Template Collection for Business and Personal Use

Debt Repayment Plan Template Master of Documents

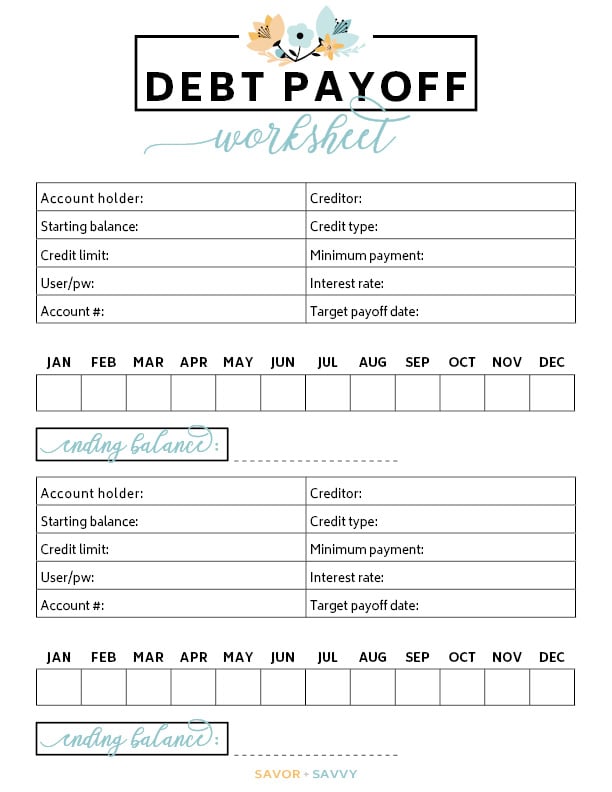

Free Debt Payoff Log Worksheet Printable Finances Savor + Savvy

Get A FREE Debt Payment Log Credit card payment tracker, Free budget

2021 Budget Binder Printables Budget binder printables, Debt

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Editable Paying Off Debt Worksheets Debt Repayment Budget Template

Pin by Connie Peterson on For the Home Simple budget, Budgeting, Debt

When It Comes To Figuring Out The Best Tactic, Two Popular Debt Repayment Methods Are The:

Vertex 42 Debt Reduction Snowball Calculator And Credit.

Graphs Will Help You Compare The Two Strategies Side By Side.

Easily Track Your Income, Expenses, And Debt Payments, While Gaining Insights To Optimize Your Financial Strategy.

Related Post: