Debt Payoff Planner Printable

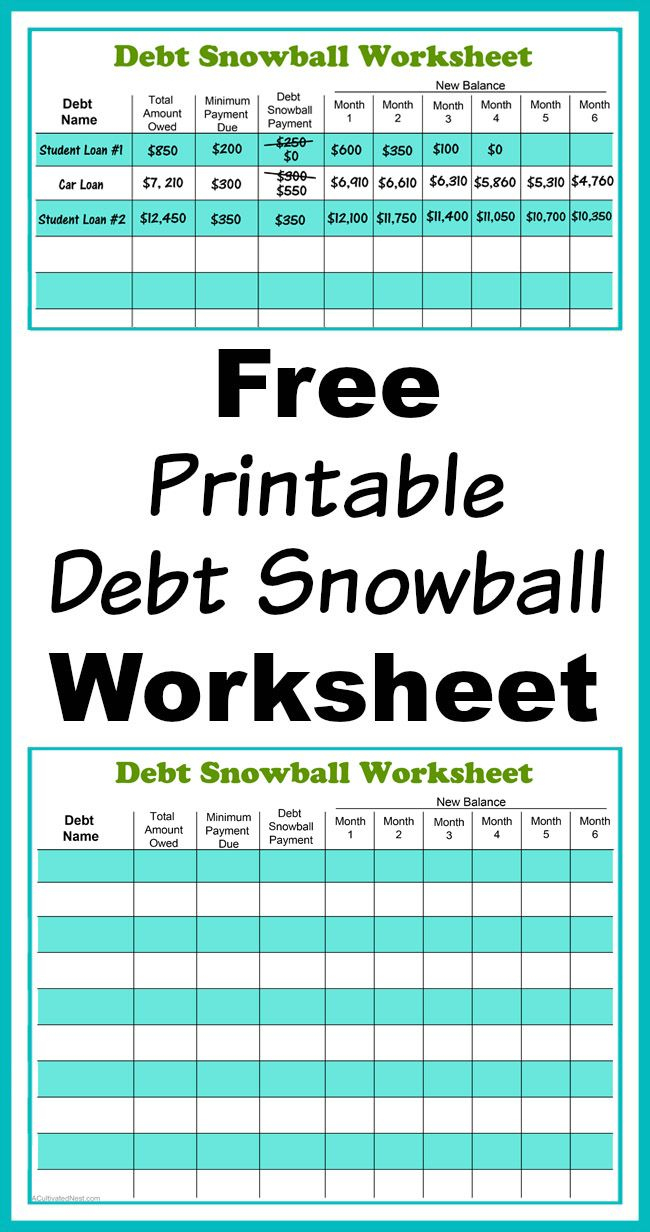

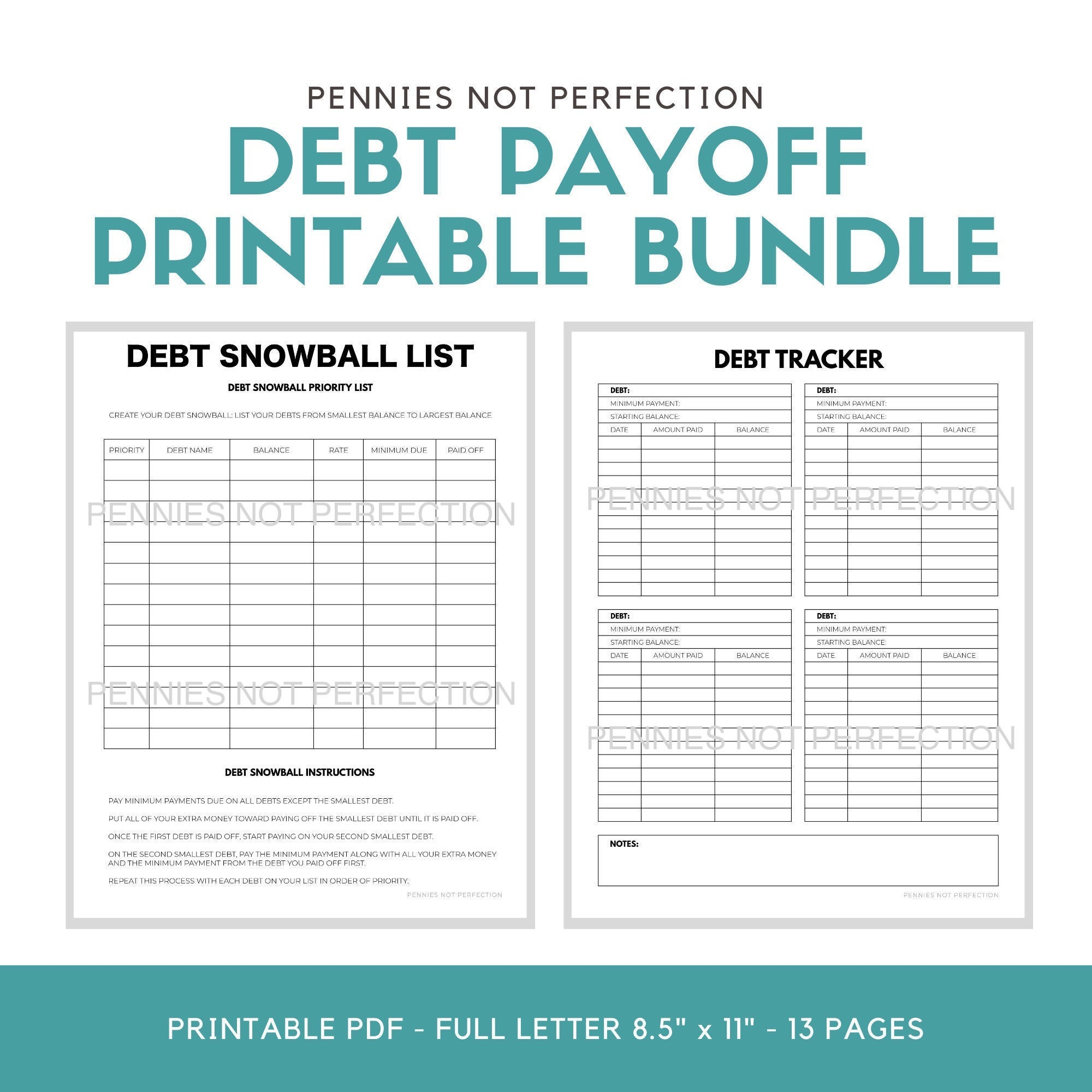

Debt Payoff Planner Printable - Need help repairing your credit? With just a few details. Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). You can also use this worksheet to add additional payments to debt each month. Month paid balance january february march april may june july august september october november december creditor: If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). Once you pay off one debt, move on to the. This is an aggressive way to pay off your debt. This printable is really nice to use for when you have. Web using the debt payoff planner. Write in the monthly payment followed by the due date. You can track the interest rate, balances and all payments that you make. Web debt payoff planner template simple planner sample planner basic planner printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. Once you pay off one debt, move on to. Once you pay off one debt, move on to the. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). Month paid balance january february march april may june july august september october november december creditor: Enter the. Web february 3, 2023 grab these free printable debt payoff planner pages to help you track as you pay down your debt so you always know where you stand with your finances. Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt fast, but don’t know where to start, bankrate’s debt calculator can help.. Many of us would like to pay down our debt. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). Then fill in the amount owed. This printable is really nice to use for when you have. It. Keep track of how much you owe and record the amount of money you're paying back with these handy sheets that you can download in a printable pdf format. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re. And it can feel debilitating if we have a lot of it. Enter the start debt, then print the worksheet. Write the debt you are trying to pay off in the “debt column.”. Two weeks ago we got our account balanced aligned with a personal cash flow statement. Web there are two debt payoff methods in the financial community that. If you don't know where to start on your debt free journey, start here. Web check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. Debt adds to the amount of money we need to come up with each month. Web there are two debt payoff methods. Debt adds to the amount of money we need to come up with each month. Web we are kicking off this year with a series of free printables to help you take control of your budget. Need help repairing your credit? Web progress markers 1st debt paid off halfway mark paid down debts 6+ months debt free! Web this spreadsheet. This debt snowball calculator is meant to gather information on all your debts. Sometimes, we need to write down every vital information to keep everything organized. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). Included is. Need help repairing your credit? And it can feel debilitating if we have a lot of it. Web we are kicking off this year with a series of free printables to help you take control of your budget. Web debt payoff planner template simple planner sample planner basic planner printable planner download this debt payoff planner template design in apple. Web this spreadsheet includes a printable payment schedule for easy reference. Web here is how it works: Sometimes, we need to write down every vital information to keep everything organized. Month paid balance january february march april may june july august september october november december creditor: Write the debt you are trying to pay off in the “debt column.”. You can track the interest rate, balances and all payments that you make. Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt fast, but don’t know where to start, bankrate’s debt calculator can help. Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. Monthly household income (optional) $ additional payment next, to snowball your debt, enter the additional amount you want to pay above the minimum required. Then fill in the amount owed. Web we are kicking off this year with a series of free printables to help you take control of your budget. And it can feel debilitating if we have a lot of it. Web get this free printable debt payoff tracker worksheet to keep up with all of your payments, track your progress, and have a one page glimpse at all of your debt payoff information. Web february 3, 2023 grab these free printable debt payoff planner pages to help you track as you pay down your debt so you always know where you stand with your finances. Month paid balance january february march april may june july august september october november december creditor: This grid uses 200 cells, so you'll have many opportunities to cross out, scratch out, or joyfully color in the amounts as you reach each goal. Many of us would like to pay down our debt. This process works, and you can see how effective it is on our printable guide. J f m a m j j a s o n d paid balance creditor: Web debt payoff planner creditor: Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Debt adds to the amount of money we need to come up with each month. Keep track of how much you owe and record the amount of money you're paying back with these handy sheets that you can download in a printable pdf format. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). This printable is really nice to use for when you have. Write the debt you are trying to pay off in the “debt column.”. You can track the interest rate, balances and all payments that you make. Web there are two debt payoff methods in the financial community that have been proven to work extremely effectively for hundreds of thousands of people. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. Two weeks ago we got our account balanced aligned with a personal cash flow statement. Web here is how it works: Included is the daily spending log, expense tracker, debt payoff tracker (this one), monthly bill worksheet and as a bonus, you can get the monthly goals and yearly goals trackers ! Web using the debt payoff planner. Once you pay off one debt, move on to the. How about 39 of them? Web the minimum payment represents the amount of cash flow you will free up by completely paying off the debt.Debt Snowball Tracker Printable Debt Payment Worksheet Etsy

debt repayment planner Paying off credit cards, Spreadsheet template

Free Printable Debt Payoff Worksheet Free Printable

Free Debt Repayment Printable Example Calendar Printable

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Canada

Budget Binder Printable How To Organize Your Finances Budget

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Debt Payoff Planner Free Printable Debt payoff, Budget planner

Debt Payoff Planner Worksheet A Mom's Take

Pin by Tiffany Bianchi on Organizing Debt payoff plan, Payoff, Debt

If You Don't Know Where To Start On Your Debt Free Journey, Start Here.

This Process Works, And You Can See How Effective It Is On Our Printable Guide.

Need Help Repairing Your Credit?

And It Can Feel Debilitating If We Have A Lot Of It.

Related Post: