Business Debt Schedule Template

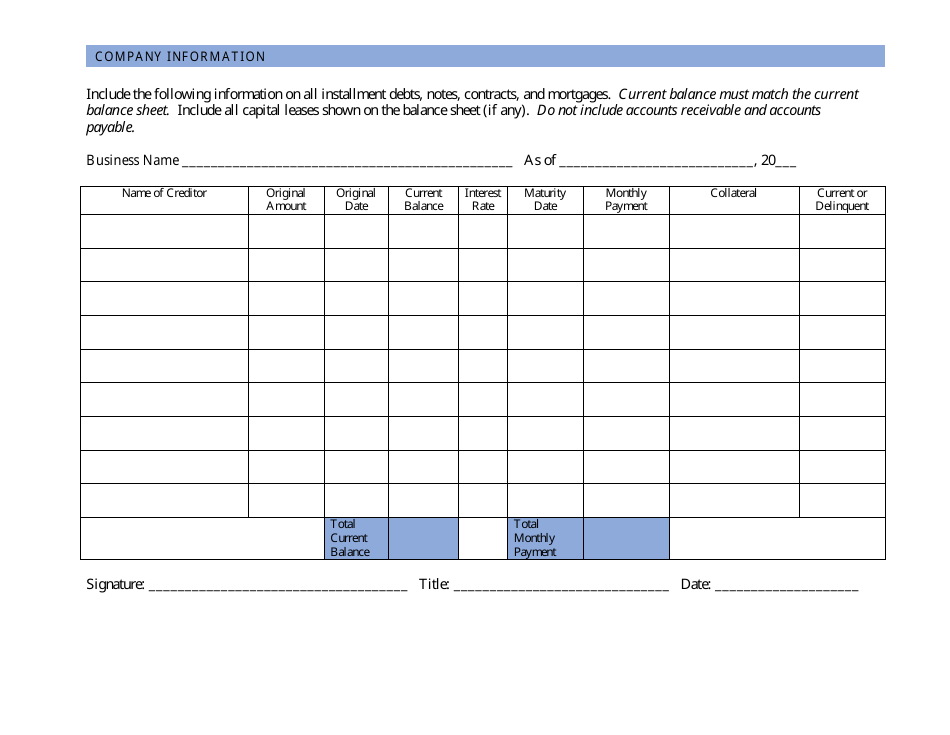

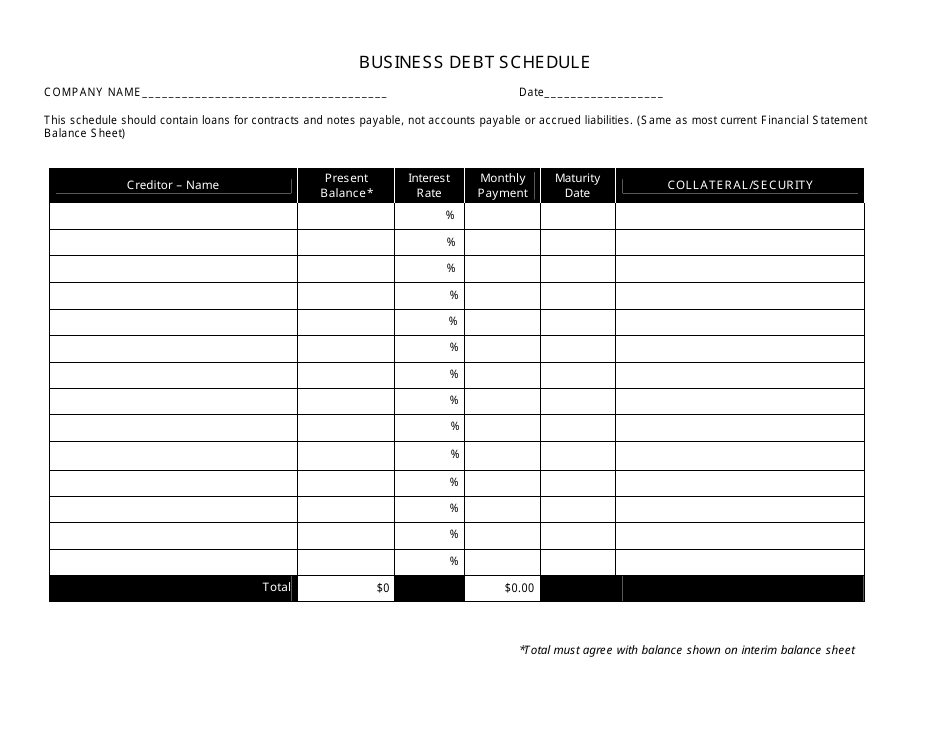

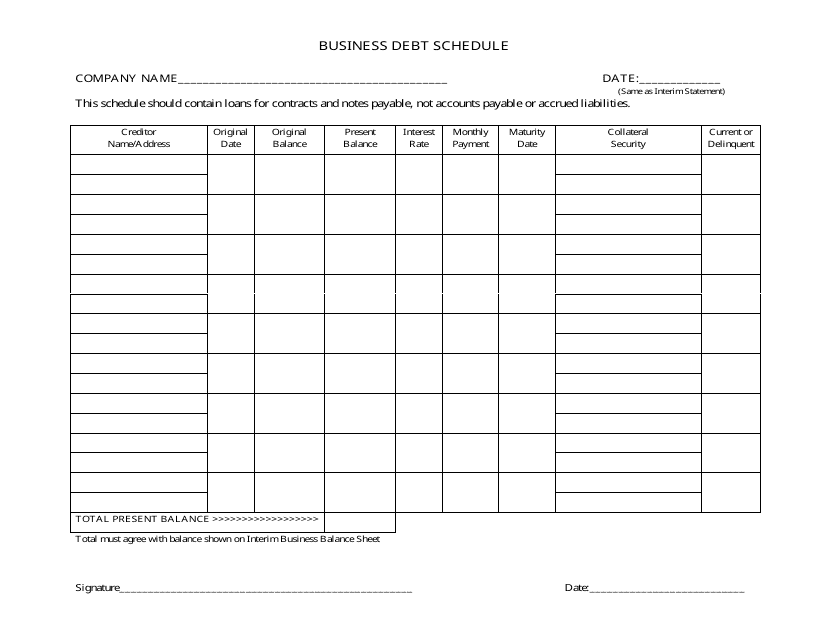

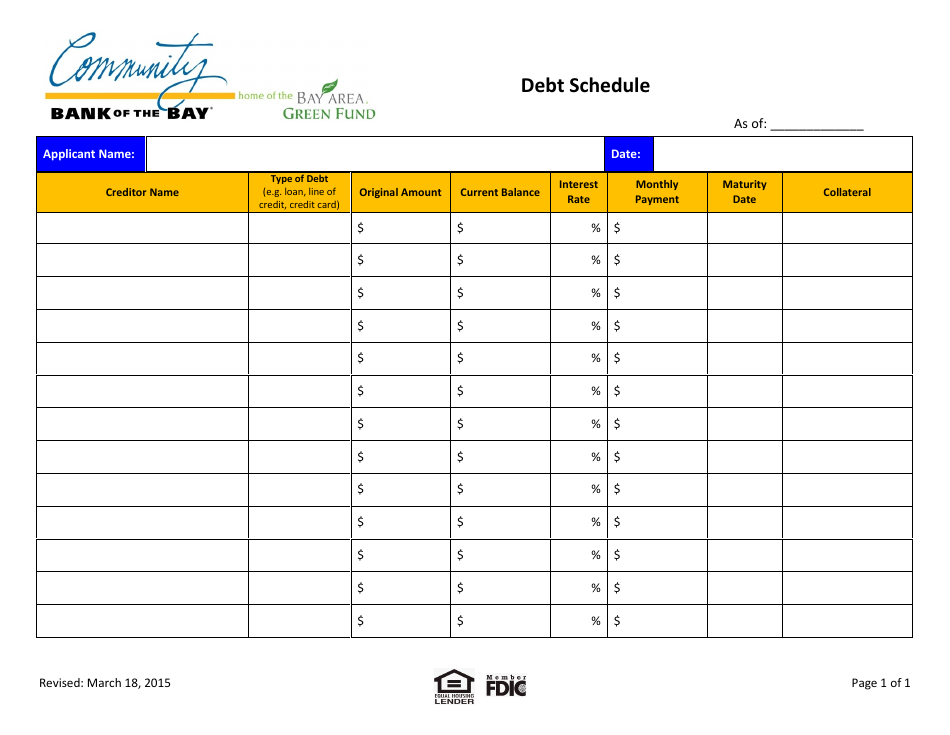

Business Debt Schedule Template - The more detail you include, the easier it. Simple & easy to use. That alone can feel like a lot to handle, but you can’t. Web debt schedule — excel model template now that we’ve listed out the steps to building out a debt schedule, we can move on to an example modeling exercise in excel. Monday.com has been visited by 100k+ users in the past month 21 taken directly from my reporter’s notebook: Web a business debt schedule lists the pertinent information with all your business’s outstanding debts. Web this schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. Web you may use your own form if you prefer. Learn more and download a template. To construct a debt schedule, analysts need to list all debt currently outstanding by the business. Web outstanding business debt form. Web business debt schedule template schedule excel business excel download this business debt schedule template design in excel, google sheets format. Web a business debt schedule lists the pertinent information about all your business’s outstanding debts. Web complete this. Web a business debt schedule lists the pertinent information with all your business’s outstanding debts. Web complete this form detailing all business debt (business credit cards,term loans/ notes payable, leases, lines of credit, shareholder loans, seller carry notes, irs tax. Web the information contained in this schedule is a supplement to your balance sheet and should balance to the liabilities. Club name amazon (amzn) gains market share versus. A business debt schedule, or schedule of debt, tracks the. Web the information contained in this schedule is a supplement to your balance sheet and should balance to the liabilities presented on that form. Web business debt schedule template schedule excel business excel download this business debt schedule template design in excel,. Web this schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. Web complete this form detailing all business debt (business credit cards,term loans/ notes payable, leases, lines of credit, shareholder loans, seller carry notes, irs tax. A business debt schedule, or schedule of debt, tracks the. Simple & easy to use. Web complete the table. Here are the types of debt to include in a business debt schedule: Web business debt schedule template schedule excel business excel download this business debt schedule template design in excel, google sheets format. Learn more and download a template. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new. Web you may use your own form if you prefer. Monday.com has been visited by 100k+ users in the past month A debt schedule for a business is a table that registers get debts according to the order of maturity. 21 taken directly from my reporter’s notebook: Simple & easy to use. This template allows you to record debt and interest payments over time. Web downloadable business debt schedule form. Creating your own schedule will give you the flexibility and customization you may need for your business. Web it allows you to structure and manage your company's debt obligations efficiently. The more detail you include, the easier it. Web examples of what categories to list when creating a business debt schedule include: 21 taken directly from my reporter’s notebook: Web a business debt schedule lists the pertinent information about all your business’s outstanding debts. Ad try any app for free and see what odoo can accomplish for you and your business. This template allows you to record debt. Learn more and download a template. Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Learn more and download a template. Web it allows you to structure and manage your company's debt obligations efficiently. Club name amazon (amzn) gains market share versus. Monday.com has been visited by 100k+ users in the past month Web complete this form detailing all business debt (business credit cards,term loans/ notes payable, leases, lines of credit, shareholder loans, seller carry notes, irs tax. Web a business debt schedule lists the pertinent information with all your business’s outstanding debts. Please use a separate form for each independent business. Stay on top of payment schedules, interest rates, and creditor information, empowering. Web 1 day agohere are some of the tickers on my radar for monday, aug. Web outstanding business debt form. Web debt schedule — excel model template now that we’ve listed out the steps to building out a debt schedule, we can move on to an example modeling exercise in excel. Crm, sales, mrp, accounting, inventory, invoicing & more. Simple & easy to use. A business debt schedule, or schedule of debt, tracks the. Web the information contained in this schedule is a supplement to your balance sheet and should balance to the liabilities presented on that form. Club name amazon (amzn) gains market share versus. Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Learn more and download a template. A debt schedule for a business is a table that registers get debts according to the order of maturity. Web complete the table below by identifying all business debt (excluding any personal debt). Web types of debt listed in a debt schedule. Web complete this form detailing all business debt (business credit cards,term loans/ notes payable, leases, lines of credit, shareholder loans, seller carry notes, irs tax. The information contained in this schedule is a supplement to your balance sheet and should balance to the liabilities. That alone can feel like a lot to handle, but you can’t. Web download our free business debt schedule template why do i need a business debt schedule template? Please use a separate form for each independent business entity. Here are the types of debt to include in a business debt schedule: Web outstanding business debt form. Creating your own schedule will give you the flexibility and customization you may need for your business. A debt schedule for a business is a table that registers get debts according to the order of maturity. Monday.com has been visited by 100k+ users in the past month Web we’ll review what a business debt schedule has, why you necessity one for your business additionally how go make a credit schedule of your own. A business debt schedule is a table that lists your monthly debt payments in order of maturity. Creditor name, original loan principal, term, secured or unsecured debt, maturity. Web complete this form detailing all business debt (business credit cards,term loans/ notes payable, leases, lines of credit, shareholder loans, seller carry notes, irs tax. To construct a debt schedule, analysts need to list all debt currently outstanding by the business. Stay on top of payment schedules, interest rates, and creditor information, empowering. Web this schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. Web 1 day agohere are some of the tickers on my radar for monday, aug. Web january 31, 2022 download wso's free debt schedule model template below! Web debt schedule — excel model template now that we’ve listed out the steps to building out a debt schedule, we can move on to an example modeling exercise in excel. Please use a separate form for each independent business entity. Web complete the table below by identifying all business debt (excluding any personal debt).Business Debt Schedule Form Ethel Hernandez's Templates

Company Debt Schedule Template Download Printable PDF Templateroller

Business Debt Schedule Template Excel Darrin Kenney's Templates

Debt Schedule Template Fill Online, Printable, Fillable, Blank

Free Debt Schedule Template Printable Templates

Business Debt Schedule Template Download Printable PDF Templateroller

Business Debt Schedule Template Excel Darrin Kenney's Templates

Debt Schedule Template Community Bank of the Bay Download Fillable

Free Debt Schedule Template

Business Debt Schedule Form Ethel Hernandez's Templates

Web The Information Contained In This Schedule Is A Supplement To Your Balance Sheet And Should Balance To The Liabilities Presented On That Form.

21 Taken Directly From My Reporter’s Notebook:

Web It Allows You To Structure And Manage Your Company's Debt Obligations Efficiently.

If No Debt, Fill Out.

Related Post: