Biweekly Paycheck Budget Template

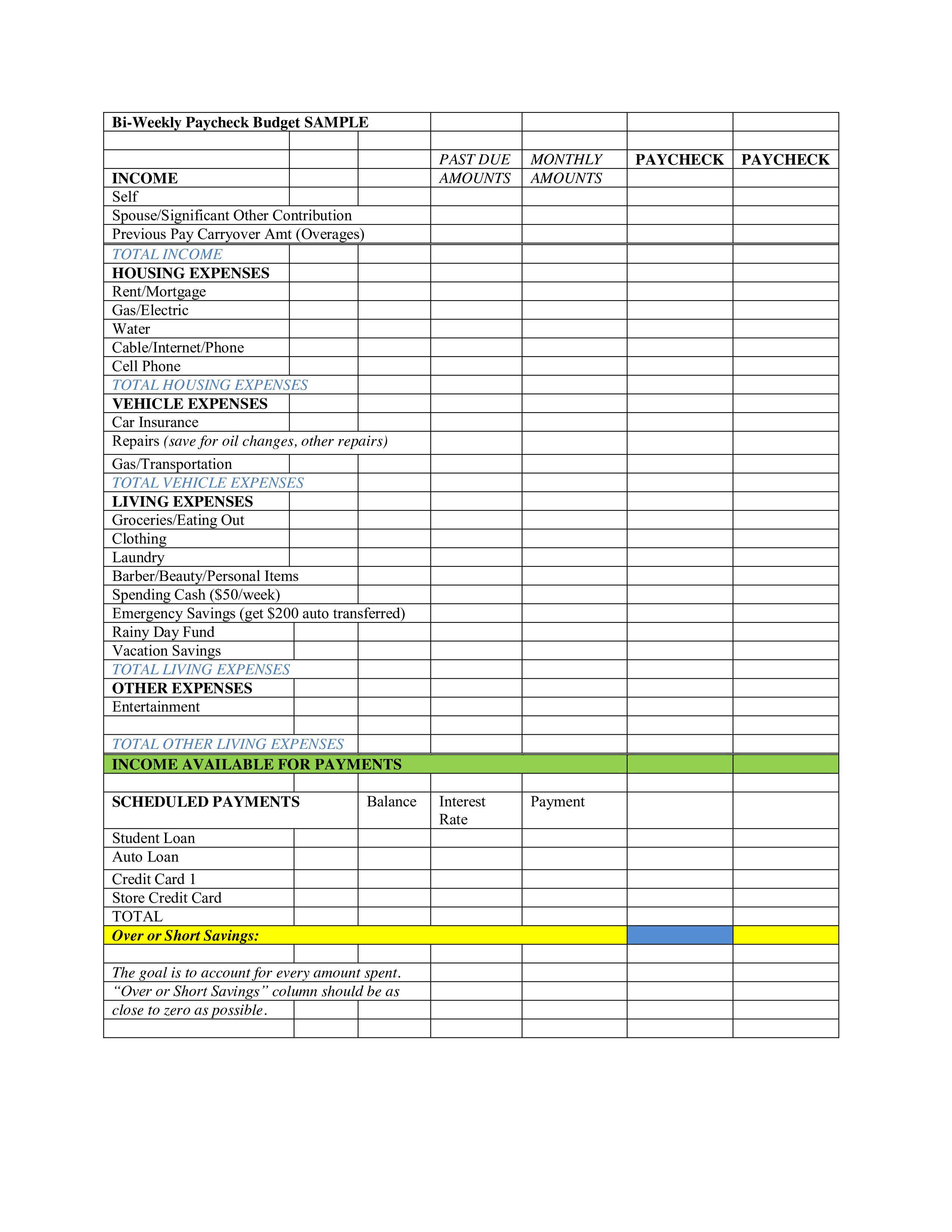

Biweekly Paycheck Budget Template - Adjust your budget as needed. Compare your regular expenses to your spending from the past month. Fill out a monthly budget calendar 3. 3.3 fund much needed rewards; The basic rule of thumb is 50% for needs, 30% for wants, and 20. Web here is how to budget biweekly: Be flexible when adjusting to this 2 week budget style. Set aside money for savings 4. Templates free biweekly budget templates. 2.2 get ahead on bills; 3.1 make an emergency fund; Set aside money for savings 4. Write your first biweekly budget. 101 planners free budget template. The basic rule of thumb is 50% for needs, 30% for wants, and 20. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. Want us to customize this template? Be flexible when adjusting to this 2 week budget style. Free download this bi weekly paycheck budget template design in word, google docs format. 3.3 fund much needed rewards; Want us to customize this template? 101 planners free budget template. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. List all your bills 2. Adjust your budget as needed. Set aside money for savings 4. How to budget biweekly paychecks in 7 easy steps: Create your monthly spending categories 5. Web free bi weekly paycheck budget template. 2.2 get ahead on bills; Web here is how to budget biweekly: Web biweekly budget planner from microsoft word. 2.2 get ahead on bills; Set aside money for savings 4. Free download this bi weekly paycheck budget template design in word, google docs format. 3.3 fund much needed rewards; We often get a paycheck and then spend it all without thinking about where it all goes. Now, here are the steps to creating a biweekly budget that works. How to budget biweekly paychecks in 7 easy steps: Adjust your budget as needed. Write your first biweekly budget. The first step is to track your spending and see where money is going. List all your bills 2. Fill out a monthly budget calendar 3. This way you can tell the money from each individual paycheck exactly where want it to go before it even arrives! 3.1 make an emergency fund; Adjust your budget as needed. Now, here are the steps to creating a biweekly budget that works. Compare your regular expenses to your spending from the past month. Web biweekly budget planner from microsoft word. Make sure you include every single purchase and expense within your ongoing budget. Fill out a monthly budget calendar 3. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. 101 planners free budget template. Now, here are the steps to creating a biweekly budget that works. You can use these templates and create a biweekly budget planner using a binder and make space for your bills, bank statements, and other financial documents too. Be sure to include your regular savings amount, which traditionally is 20 percent of your monthly. Web there are a few key things to keep in mind when creating a biweekly budget: Web. This way you can tell the money from each individual paycheck exactly where want it to go before it even arrives! Be sure to include your regular savings amount, which traditionally is 20 percent of your monthly. 101 planners free budget template. We often get a paycheck and then spend it all without thinking about where it all goes. How to budget biweekly paychecks in 7 easy steps: You can use these templates and create a biweekly budget planner using a binder and make space for your bills, bank statements, and other financial documents too. 3.3 fund much needed rewards; 2.2 get ahead on bills; Web here is how to budget biweekly: This is a great google sheet that follows the 50/30/20 rule to help you manage your money effectively and simply. Web free bi weekly paycheck budget template. Fill out a monthly budget calendar 3. 3.2 save for a big goal; Adjust your budget as needed. Web these budgeting worksheets will help you figure out how to budget biweekly, whether you get a paycheck once, twice, three or four times a month. Write your first biweekly budget. Create your monthly spending categories 5. Want us to customize this template? Free download this bi weekly paycheck budget template design in word, google docs format. Web there are a few key things to keep in mind when creating a biweekly budget: Set aside money for savings 4. Make sure you include every single purchase and expense within your ongoing budget. List all your bills 2. The basic rule of thumb is 50% for needs, 30% for wants, and 20. Be flexible when adjusting to this 2 week budget style. How to budget biweekly paychecks in 7 easy steps: Web these budgeting worksheets will help you figure out how to budget biweekly, whether you get a paycheck once, twice, three or four times a month. Web here is how to budget biweekly: Web biweekly budget planner from microsoft word. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. Adjust your budget as needed. 3.3 fund much needed rewards; 3.1 make an emergency fund; Fill out a monthly budget calendar 3. Be sure to include your regular savings amount, which traditionally is 20 percent of your monthly. Templates free biweekly budget templates.Pin on Payment Templates

Free Printable Biweekly Bill Planner Best Calendar Example

Bi Weekly Budget Template 2021 Etsy

Bi Weekly Paycheck Budget Templates at

Bi Weekly Paycheck Budget Template

How to Budget Monthly Bills with Biweekly Paychecks Weekly budget

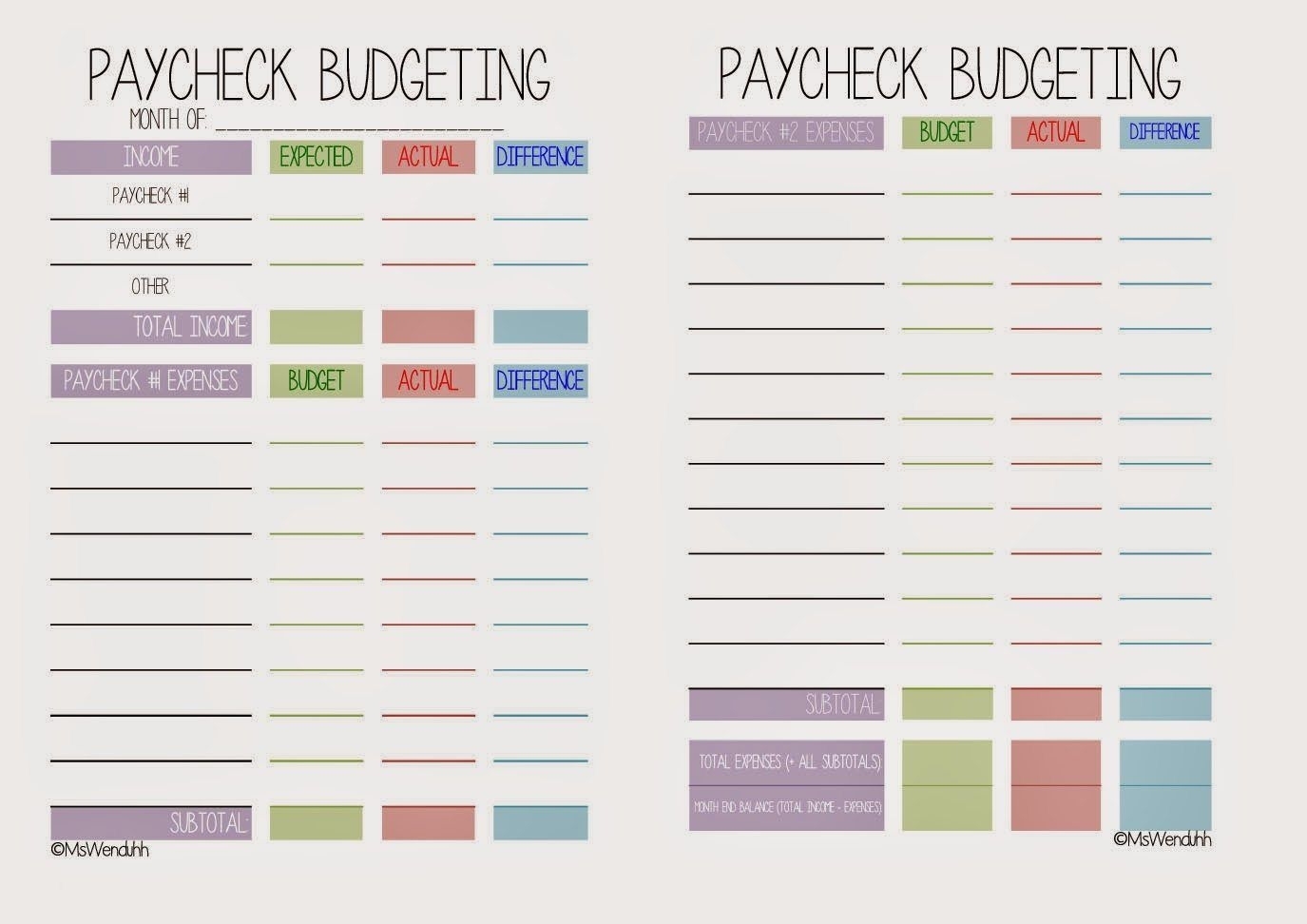

Bi Weekly Budget Planner Template Paycheck Budget Printable

Bi Weekly Budget Planner Template Paycheck Budget Printable Etsy Canada

Explore Our Sample of Biweekly Pay Budget Template Budget planner

Biweekly Budget Template (5+ Free Excel, PDF Documents)

2.2 Get Ahead On Bills;

3.2 Save For A Big Goal;

Now, Here Are The Steps To Creating A Biweekly Budget That Works.

You Can Use These Templates And Create A Biweekly Budget Planner Using A Binder And Make Space For Your Bills, Bank Statements, And Other Financial Documents Too.

Related Post: