Asc 842 Lease Amortization Schedule Template

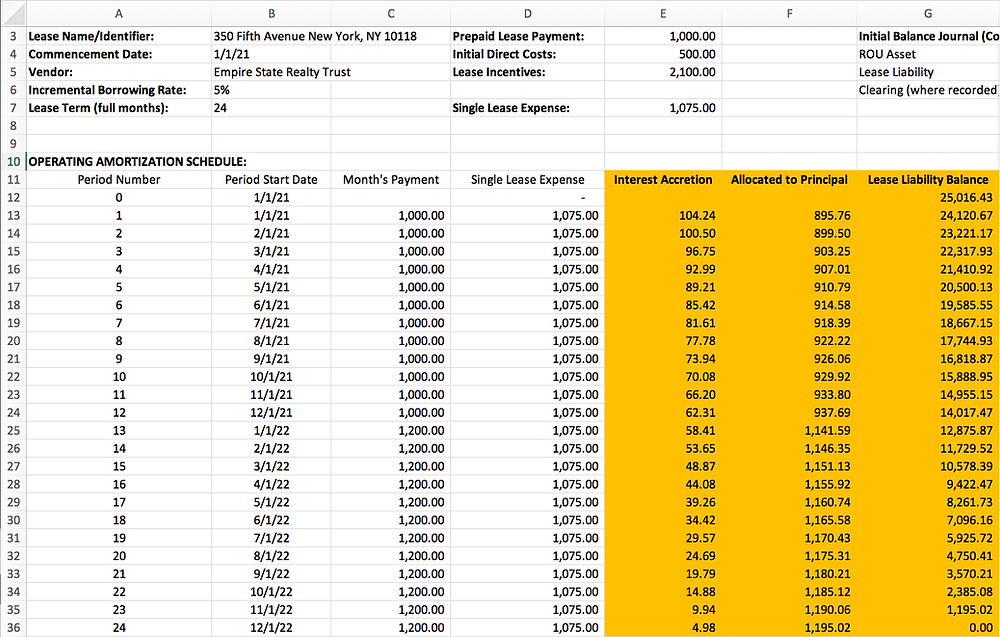

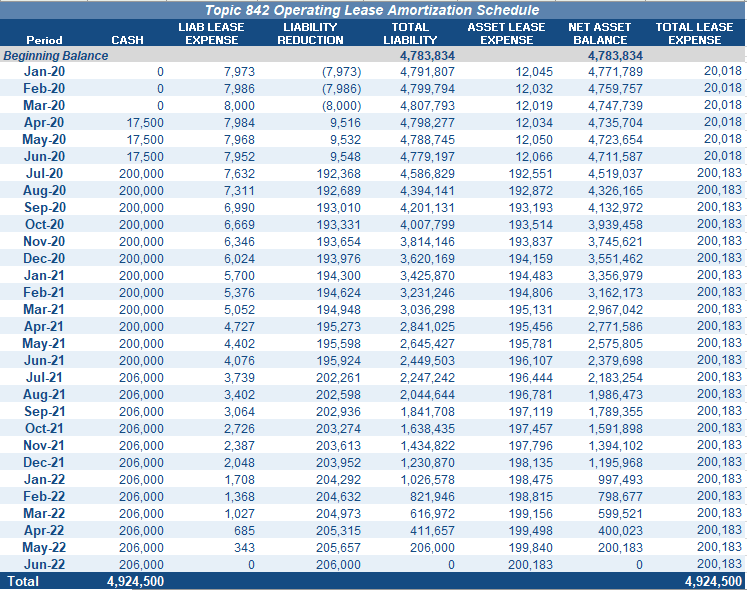

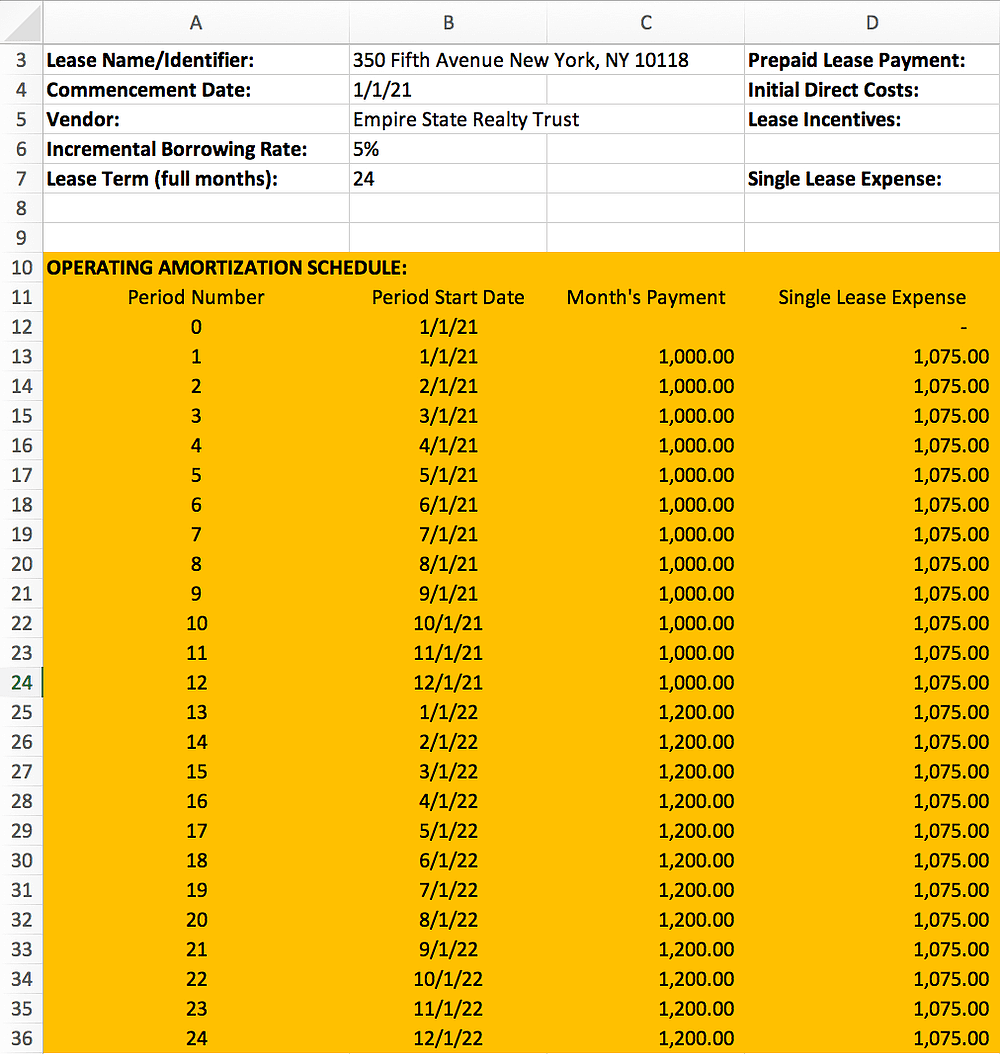

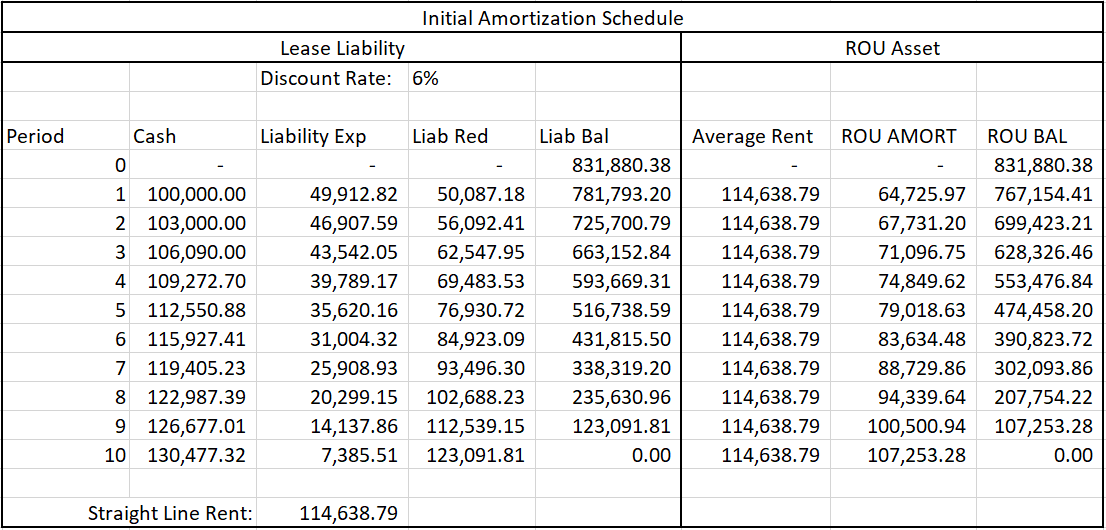

Asc 842 Lease Amortization Schedule Template - Capital lease criteria under asc 840 3. Web under fasb asc 842 the amortization period for leasehold improvements cannot be longer than the lease term for the leased asset (fasb asc 842 leasehold. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Under asc 842, operating leases and financial leases have different amortization calculations. Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. Web this guide discusses lessee and lessor accounting under asc 842. Web what is deferred rent? Web download the free guide now excel templates for operating and financing leases under asc 842. Web under asc 842, regardless of the classification of the lease, operating, or finance, a company must recognize a right of use asset for the majority of leases. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Accounting for leasehold improvements topic. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Web the amortization schedule for this lease is below. Web. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Deferred rent under asc 840 example #2: Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Web the amortization for a finance lease under. Web what is deferred rent? Deferred rent under asc 840 example #2: Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Capital lease criteria under asc 840 3. Web how to calculate your lease amortization. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web download the free guide now excel templates for operating and financing leases under asc 842. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Accounting for leasehold improvements. Under asc 842, operating leases and financial leases have different amortization calculations. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Web the amortization for a finance lease under asc 842 is very straightforward.. Web the amortization for a finance lease under asc 842 is very straightforward. Web under asc 842, regardless of the classification of the lease, operating, or finance, a company must recognize a right of use asset for the majority of leases. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. Deferred rent under asc 840 example #2: The first four chapters provide an introduction and guidance on determining whether an arrangement is (or.. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web download this asc 842 lease accounting spreadsheet template as we walk you through how. Web download the free guide now excel templates for operating and financing leases under asc 842. What is a capital/finance lease? Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Web download this asc 842 lease accounting spreadsheet template as we walk. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Web how to calculate your lease amortization. Web specifically, leases that commence or are modified after the adoption. Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web download the free guide now excel templates for operating and financing leases under asc 842. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. Web the amortization for a finance lease under asc 842 is very straightforward. Web under fasb asc 842 the amortization period for leasehold improvements cannot be longer than the lease term for the leased asset (fasb asc 842 leasehold. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Deferred rent examples under asc 840 and asc 842 example #1: Web the amortization schedule for this lease is below. Capital lease criteria under asc 840 3. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. What is a capital/finance lease? Under asc 842, operating leases and financial leases have different amortization calculations. Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Accounting for leasehold improvements topic. Web practice by entities within its scope when applying lease accounting requirements to common control arrangements. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Web how to calculate your lease amortization. Deferred rent under asc 840 example #2: Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Web the amortization for a finance lease under asc 842 is very straightforward. Web download the free guide now excel templates for operating and financing leases under asc 842. Web under fasb asc 842 the amortization period for leasehold improvements cannot be longer than the lease term for the leased asset (fasb asc 842 leasehold. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Web this guide discusses lessee and lessor accounting under asc 842. Web what is deferred rent? Web the asc 842 lease classification template for lessees is now available for download. Web practice by entities within its scope when applying lease accounting requirements to common control arrangements. Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. Under asc 842, operating leases and financial leases have different amortization calculations. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Web how to calculate your lease amortization. Deferred rent examples under asc 840 and asc 842 example #1:ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Rent Abatement & RentFree Period Accounting for US GAAP

Free Lease Amortization Schedule Excel Template

Puñado Ver a través de Decir calculo leasing excel Soldado Disponible genio

Sensational Asc 842 Excel Template Dashboard Download Free

ASC 842 Excel Template Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

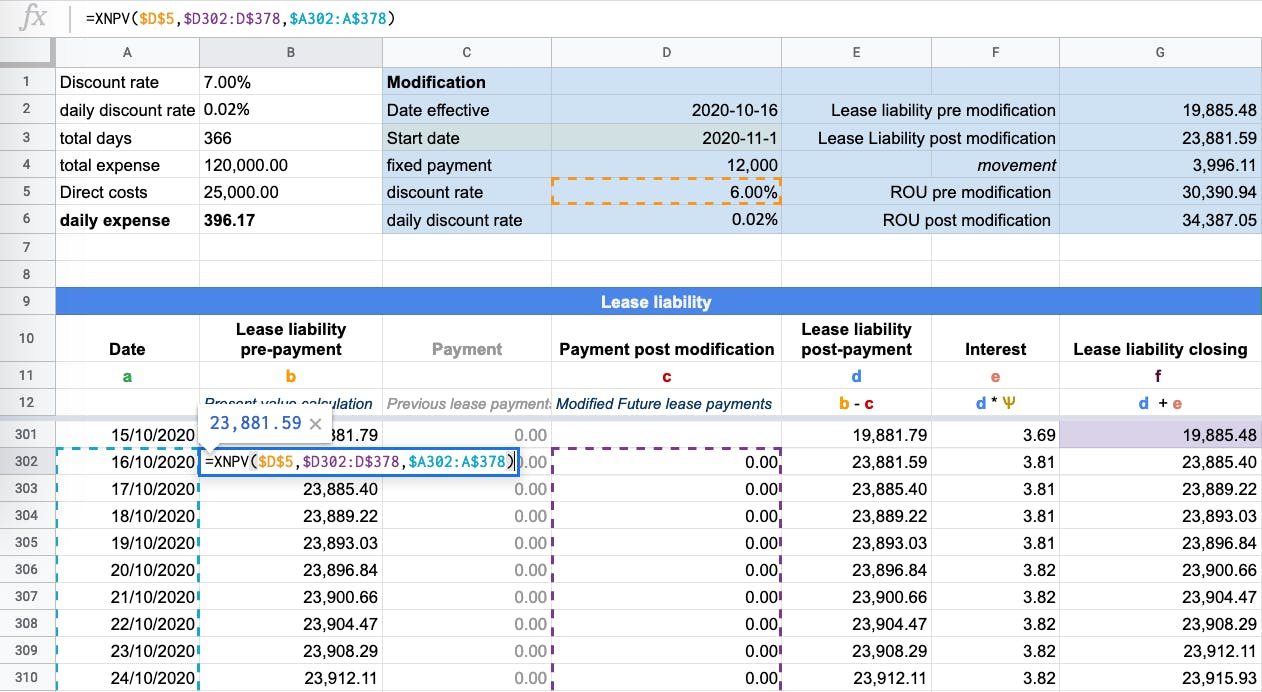

Lease Modification Accounting for ASC 842 Operating to Operating

Deferred Rent Under Asc 840 Example #2:

Accounting For Leasehold Improvements Topic.

The Entry To Record The Lease Upon Its Commencement Is A Debit To Rou Asset And A Credit To Lease Liability:.

Whether Financing Or Operating, You Can Easily Make An Operating Lease Schedule That Meets The Requirements Under Asc 842.

Related Post: