Acquisition Target Screening Template

Acquisition Target Screening Template - Quantitation, target screening, or unknown screening. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. This usually involves two steps: Web the business case should explain how the acquiring company plans to add value to the target or targets within a given m&a theme—for instance, the capital and. Select one of these options: Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. Web you want to capture six data points about each possible target: Valuing the target on a standalone. Web to start a new batch from a template in the navigation pane, click create a new batch. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. However, the criteria for screening are specific. Web to start a new batch from a template in the navigation pane, click create a new batch. Web the business case should explain how the acquiring company plans to. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. Web the business case should explain how the acquiring company plans to add value to the target or targets within a. Use our acquisition due diligence checklist to help make sure you get the. Web you want to capture six data points about each possible target: Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Web collect screening data from entire universe of potential targets, and. One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. This usually involves two steps: Web collect screening data from entire universe of potential. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Domontconsulting.com has been visited by 10k+ users in the past month Web you want to capture six data points about each possible target: Web one of the biggest steps in the m&a process is analyzing. Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. This usually involves two steps: Valuing the target on a standalone. Quantitation, target screening, or unknown screening. Use our acquisition due diligence checklist to help make sure you get the. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Valuing the target on a standalone. Web one of the biggest steps in the m&a process is analyzing and. Use our acquisition due diligence checklist to help make sure you get the. Select one of these options: Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition. One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. Use our acquisition due diligence checklist to help make sure you get the. Web one of the biggest steps in the m&a process. Web the business case should explain how the acquiring company plans to add value to the target or targets within a given m&a theme—for instance, the capital and. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Web the targets search is a clear definition of. Web you want to capture six data points about each possible target: 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web the business case should explain how the acquiring company plans to add value to the target or targets within a given m&a theme—for instance, the capital and. Domontconsulting.com has been visited by 10k+ users in the past month Web to start a new batch from a template in the navigation pane, click create a new batch. Valuing the target on a standalone. Select one of these options: Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. Use our acquisition due diligence checklist to help make sure you get the. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. However, the criteria for screening are specific. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. This usually involves two steps: Quantitation, target screening, or unknown screening. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. Use our acquisition due diligence checklist to help make sure you get the. Web you want to capture six data points about each possible target: Web the targets search is a clear definition of the basic principles and criteria for screening within the frame of a company's m&a strategy. Domontconsulting.com has been visited by 10k+ users in the past month Quantitation, target screening, or unknown screening. Web before fully committing to a transaction, you must first prepare an acquisition due diligence report. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web a reusable m&a playbook can be quickly deployed when an idea or opportunity arises, to ensure each m&a phase is comprehensive and thorough. Web identifying the right acquisition target and building the pipeline of potential target candidates is the critical initial phase of the acquisition process. This usually involves two steps: Web target screening involves thoroughly analyzing potential acquisition targets to determine whether they align with your company's strategic goals, financial. Target acquisition synonyms, target acquisition pronunciation, target acquisition translation, english dictionary definition of target acquisition. 1) name, 2) sales, 3) ownership, 4) competency enhancement, 5) asset value and 6) probability of success. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop. Web to start a new batch from a template in the navigation pane, click create a new batch. One of the cornerstones of a strong m&a capability is an ongoing and systematic search for acquisition targets as well as early.M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

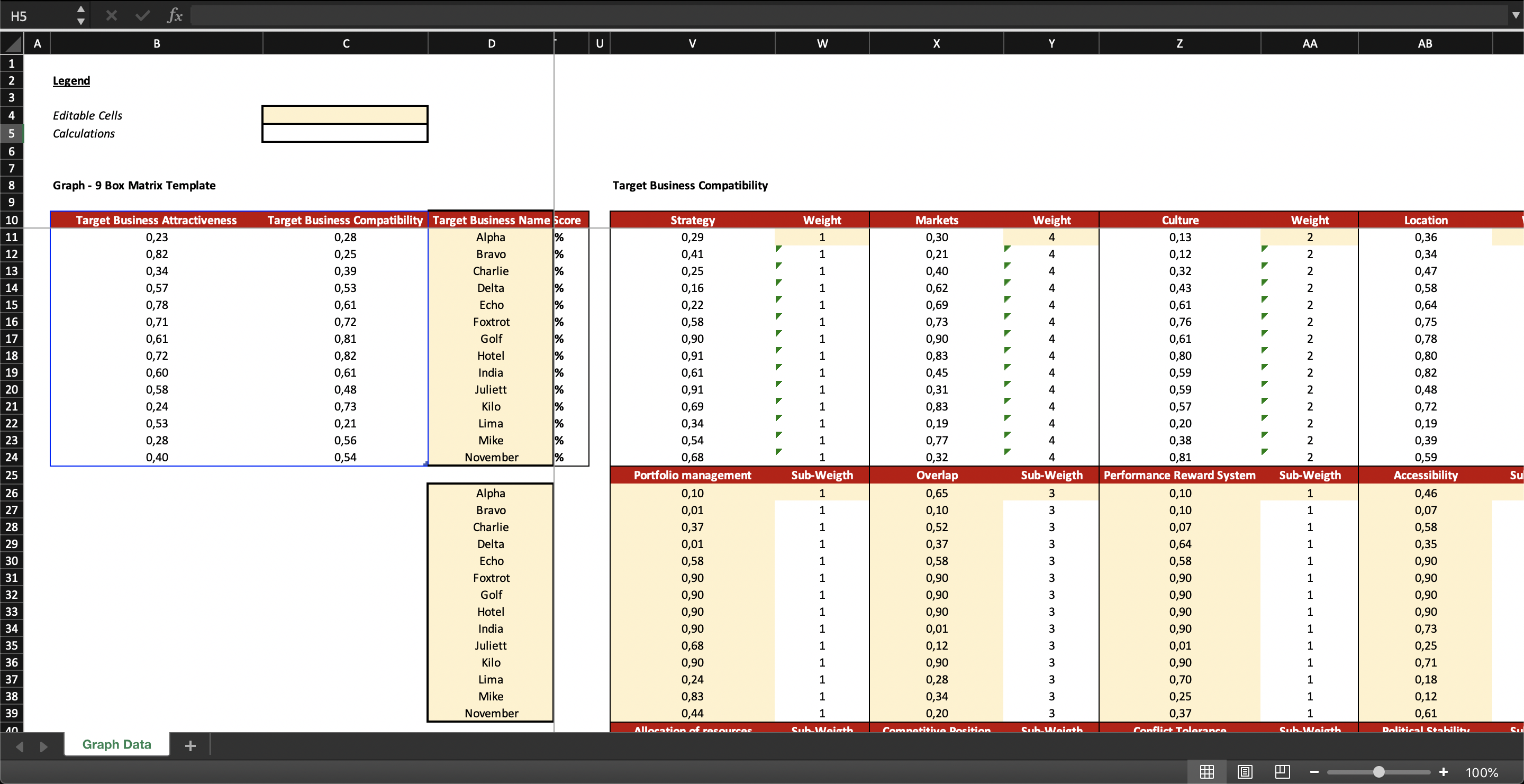

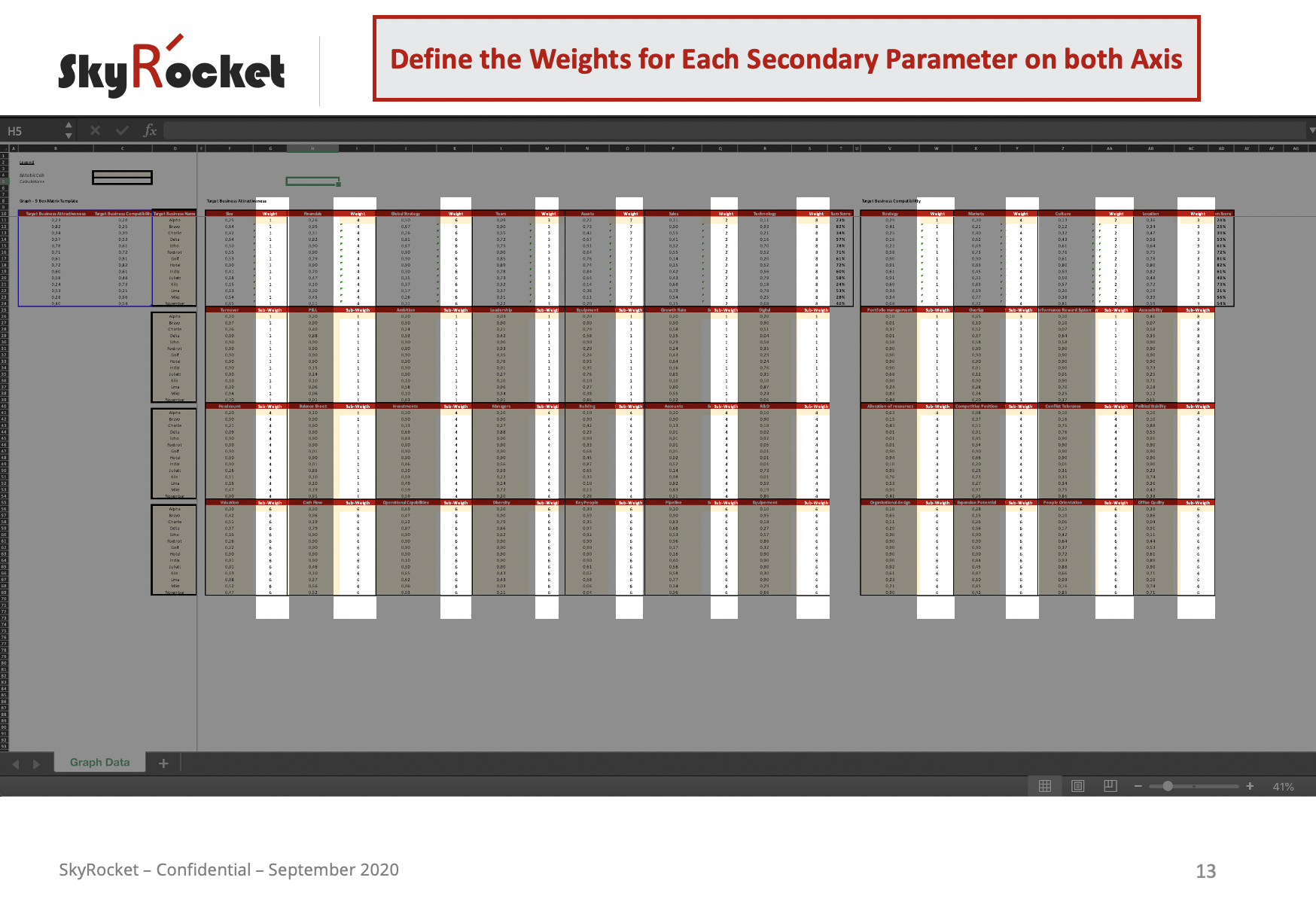

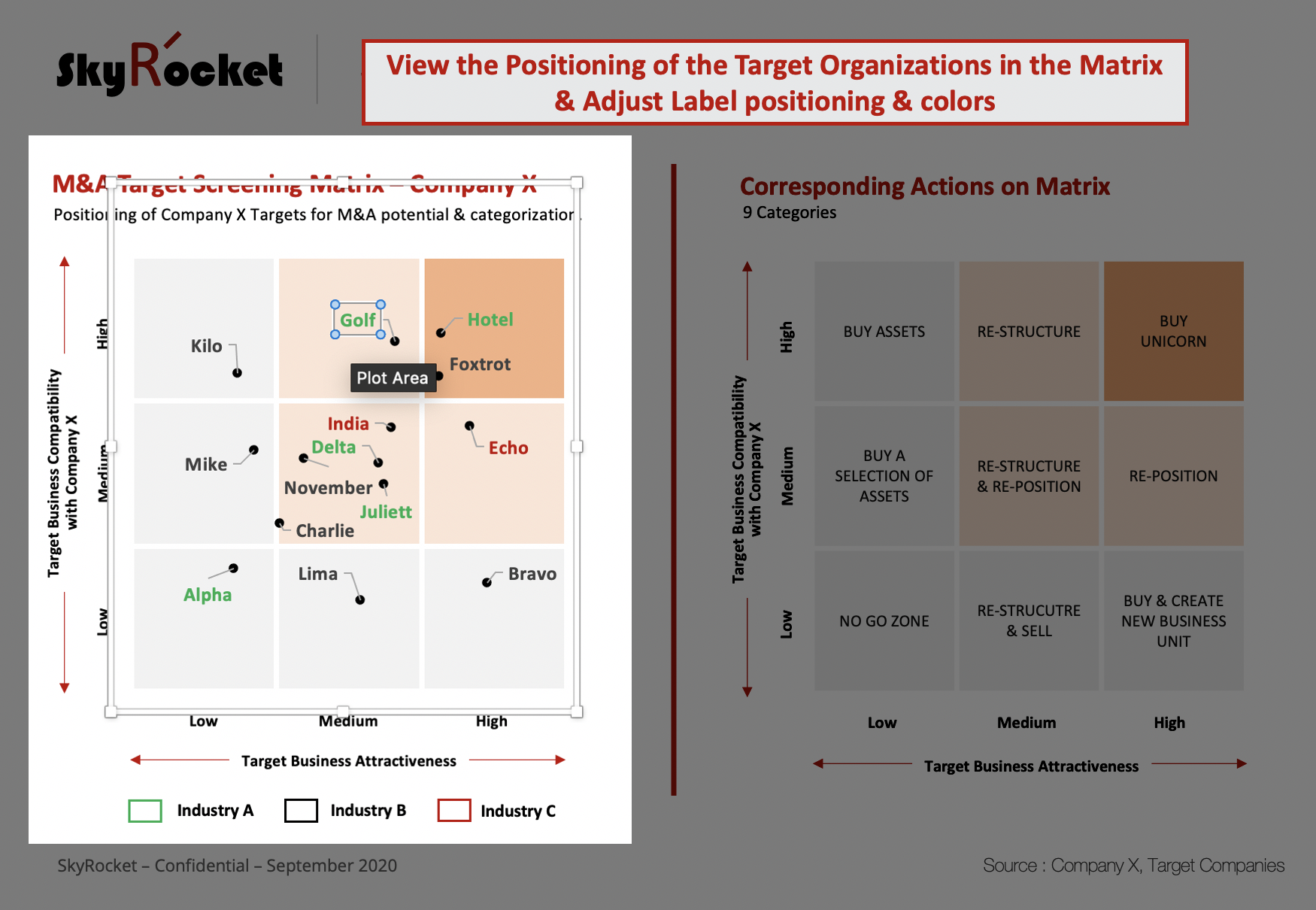

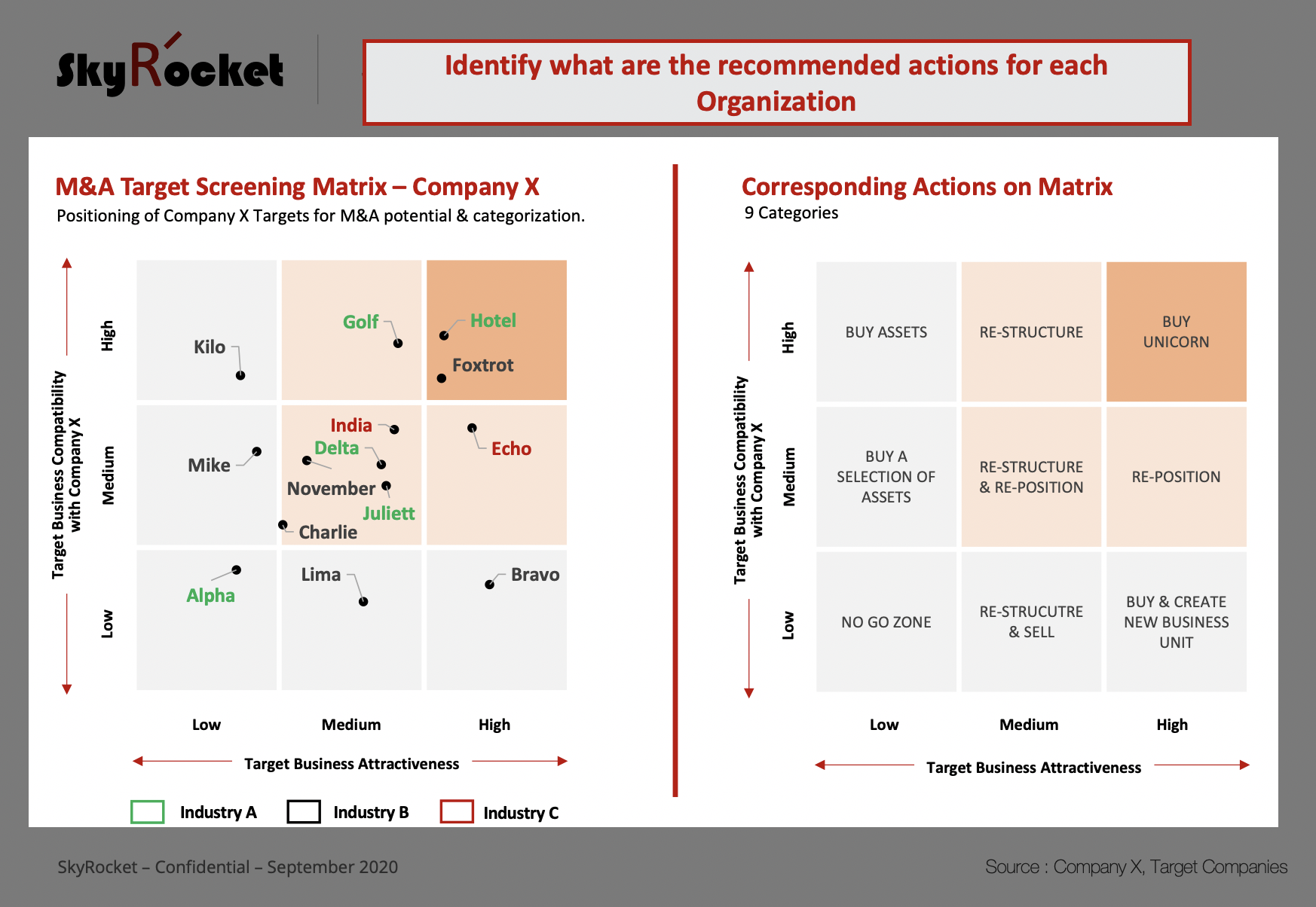

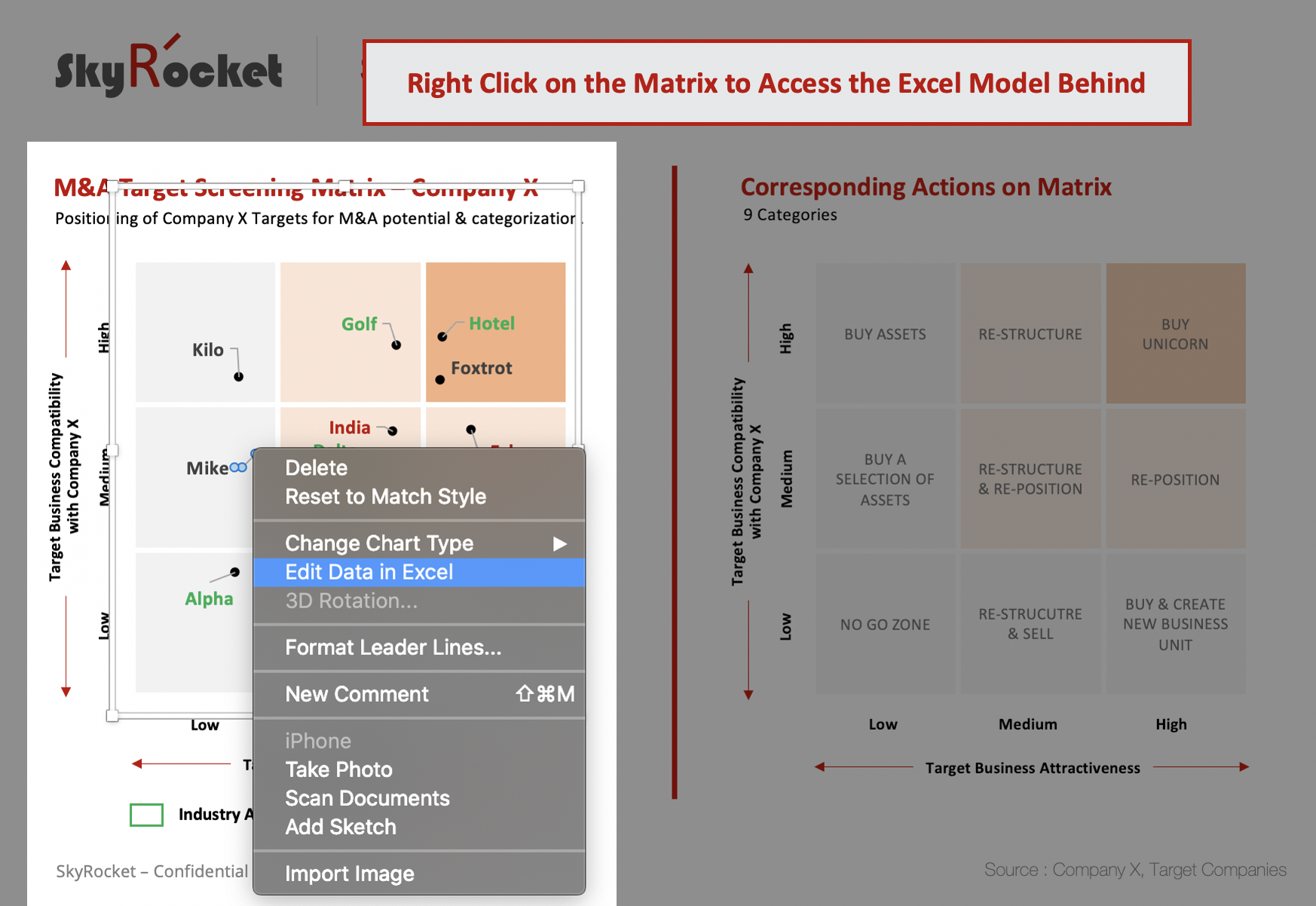

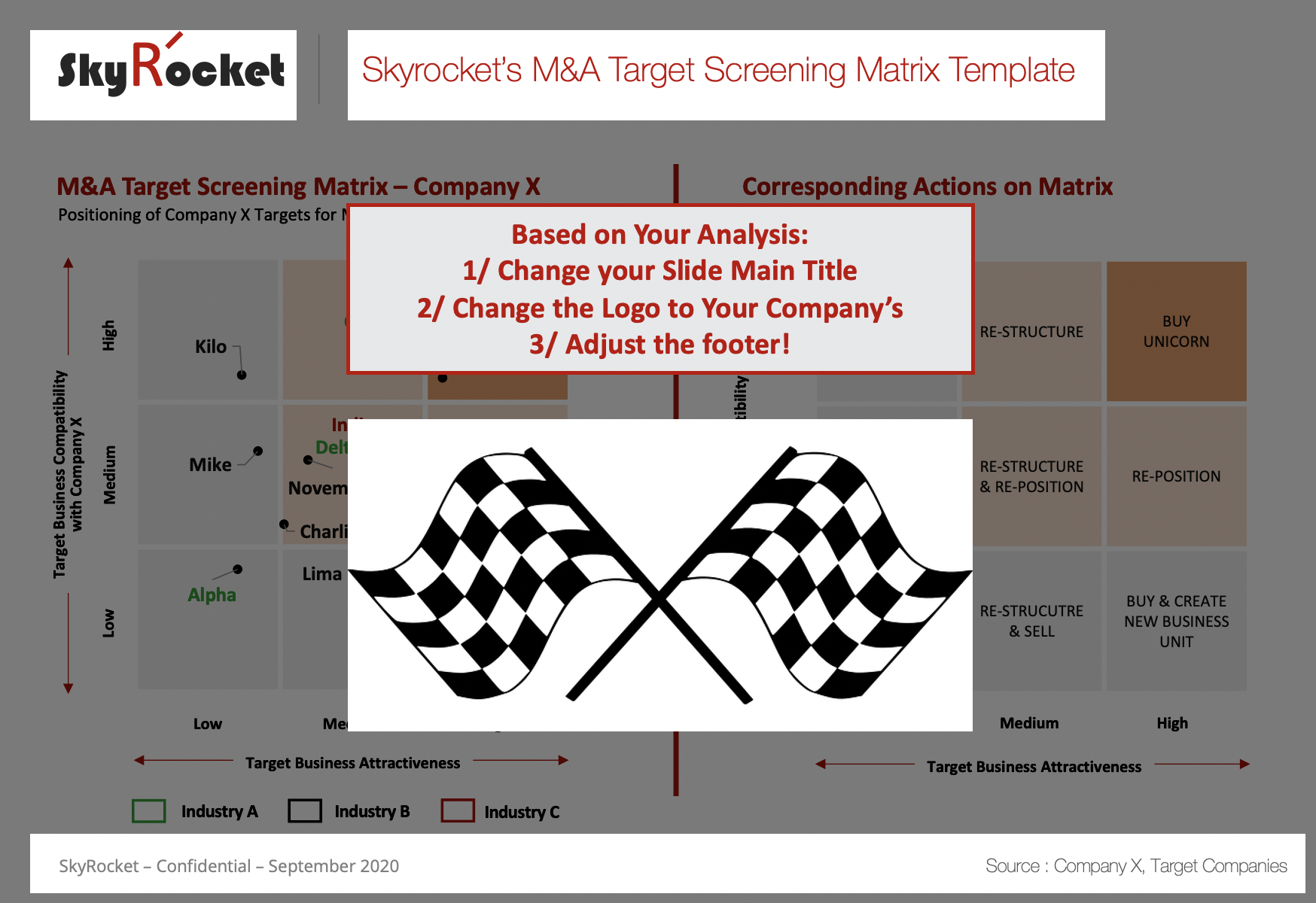

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Simple Strategic Plan Template

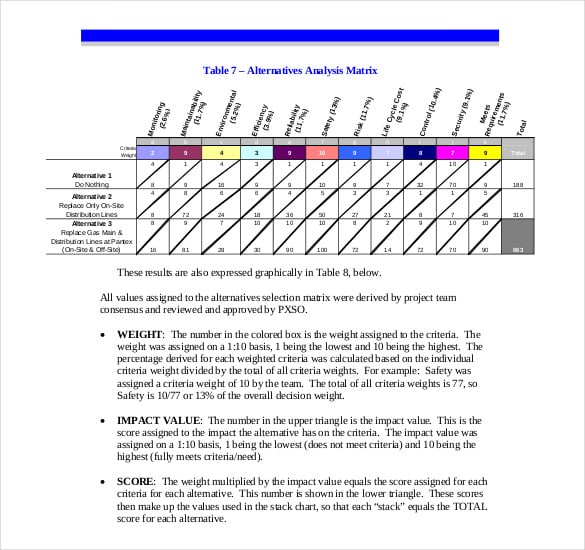

Pin on Business Analysis Tools Strategy Frameworks

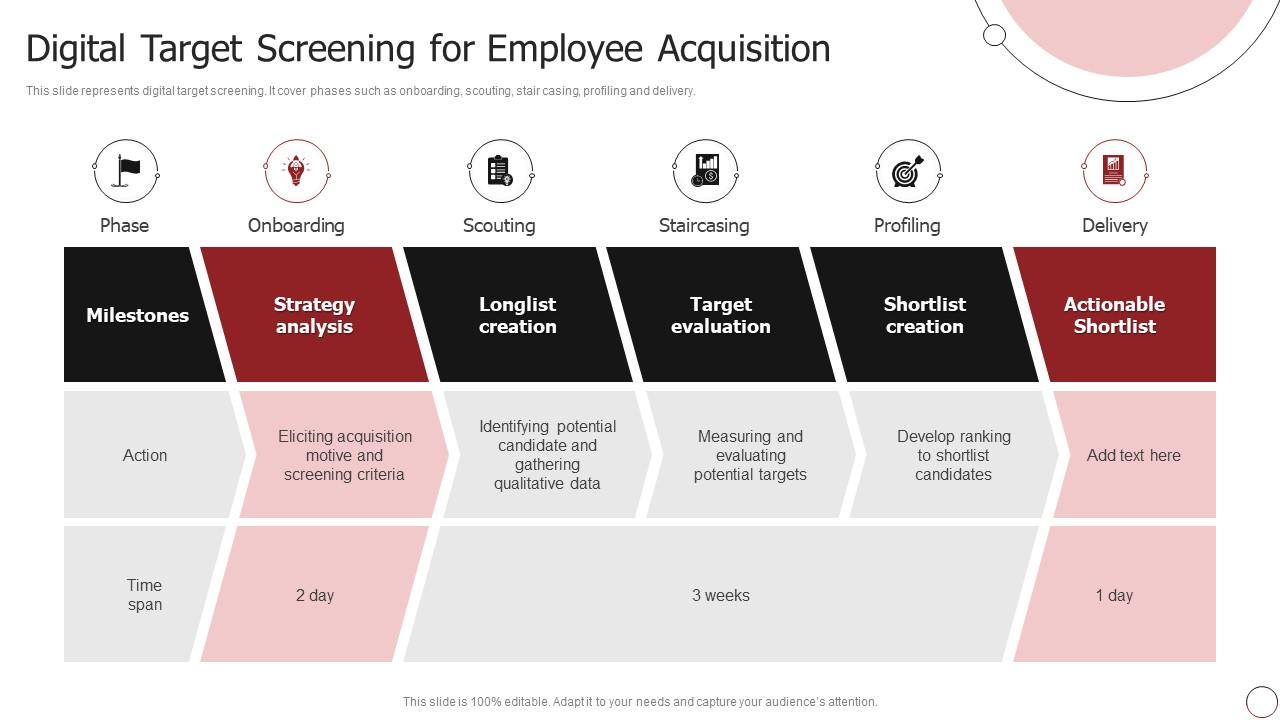

Digital Target Screening For Employee Acquisition

M&A Screening New Strategies Require a Wider View (2023)

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Valuing The Target On A Standalone.

Select One Of These Options:

Web The Business Case Should Explain How The Acquiring Company Plans To Add Value To The Target Or Targets Within A Given M&A Theme—For Instance, The Capital And.

However, The Criteria For Screening Are Specific.

Related Post: