1099 B Notice Template

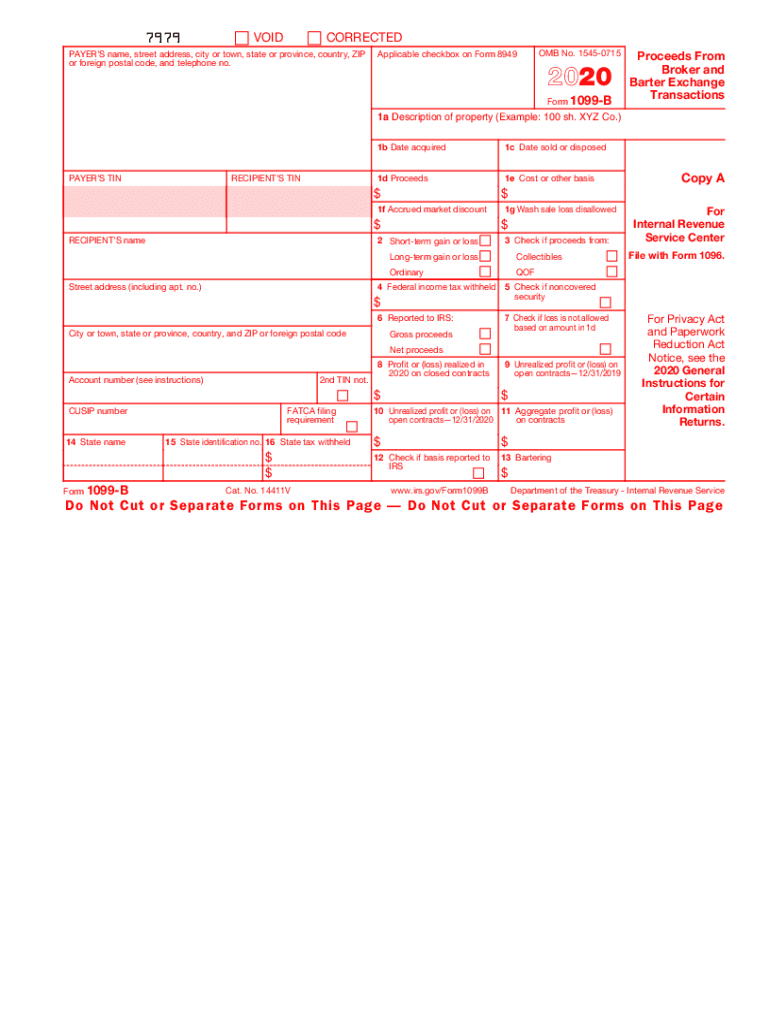

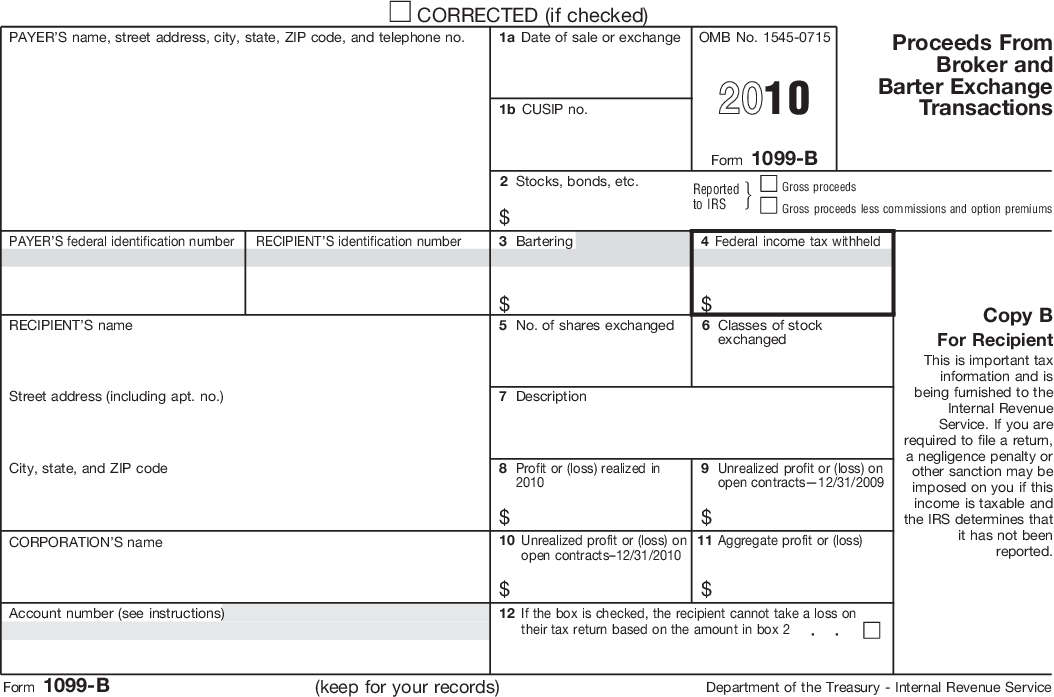

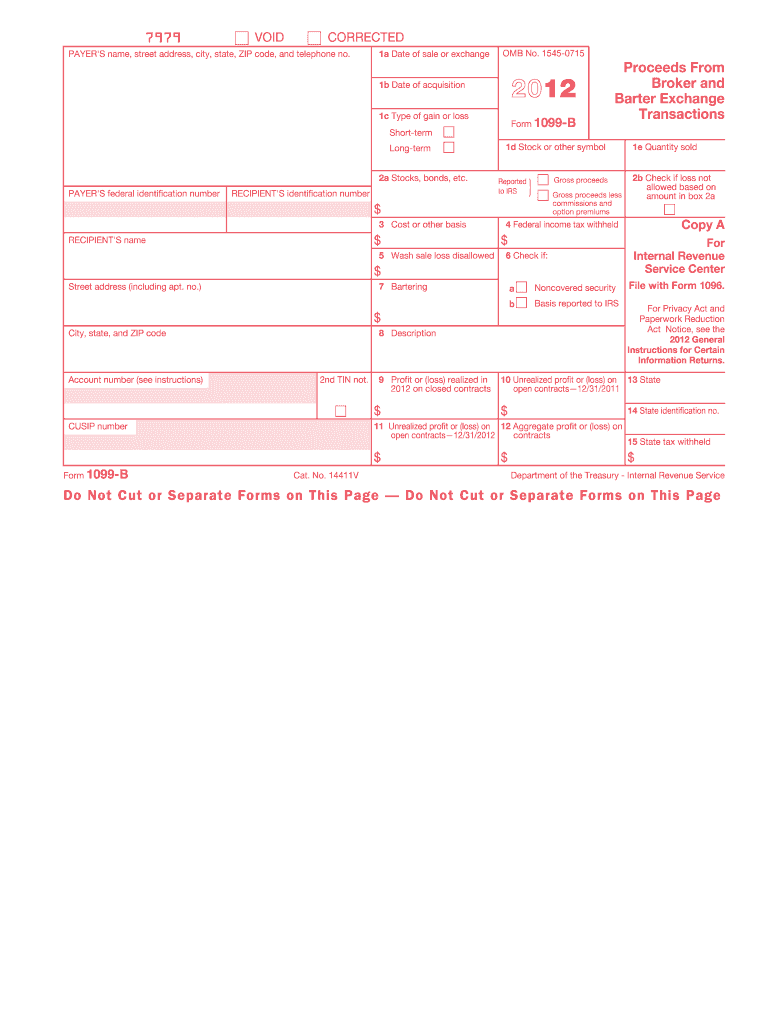

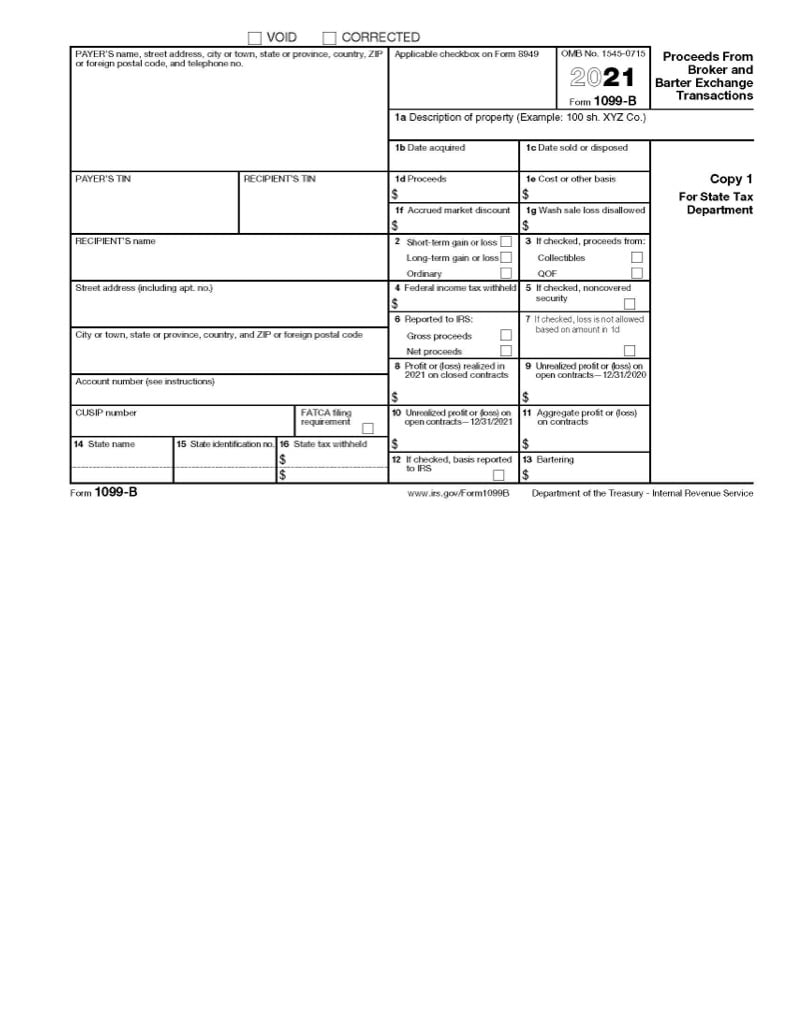

1099 B Notice Template - Ad download or email more irs fillable forms, try for free now! If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Show details this website is not affiliated with irs. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. For whom the broker has sold (including short sales) stocks, commodities,. You also may have a filing requirement. Reporting is also required when your. Web second “b” notice. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Web use a 1099 b 2021 template to make your document workflow more streamlined. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Reporting is also required when your. Web the notice. Reporting is also required when your. Show details this website is not affiliated with irs. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Reporting is also required when your. Web use a 1099 b 2021 template to make. A broker or barter exchange must file this form for each person: You also may have a filing requirement. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Reporting is also required when your. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email more irs fillable forms, try for free now! Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web use a 1099 b 2021. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. How it works browse for the 1099b. See the instructions for form. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers. For whom the broker has sold (including short sales) stocks, commodities,. Web second “b” notice. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Notifies individuals and organizations that the name and tax identification number submitted on irs form 1099 do. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Create an account with taxbandits. See the instructions for form. Web use a 1099 b 2021 template to make your document workflow more streamlined. Notifies individuals and organizations that the name and. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Web use a 1099 b 2021 template to make your document workflow more streamlined. A broker or barter exchange must file this form for each person: Proceeds from broker and barter exchange. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges. Ad download or email more irs fillable forms, try. Ad download or email more irs fillable forms, try for free now! A broker or barter exchange must file this form for each person: Show details this website is not affiliated with irs. Reporting is also required when your. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the. Web use a 1099 b 2021 template to make your document workflow more streamlined. Reporting is also required when your. How it works browse for the 1099b. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Get ready for tax season deadlines by completing any required tax forms today. Show details this website is not affiliated with irs. Complete, edit or print tax forms instantly. Web second “b” notice. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Ad download or email more irs fillable forms, try for free now! For whom, they sold stocks,. A broker or barter exchange must file this form for each person: Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Create an account with taxbandits. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges. Reporting is also required when your. For whom the broker has sold (including short sales) stocks, commodities,. You also may have a filing requirement. Get ready for tax season deadlines by completing any required tax forms today. Web second “b” notice. You also may have a filing requirement. Ad download or email more irs fillable forms, try for free now! Reporting is also required when your. How it works browse for the 1099b. For whom the broker has sold (including short sales) stocks, commodities,. Reporting is also required when your. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. See the instructions for form. Complete, edit or print tax forms instantly. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. A broker or barter exchange must file this form for each person: If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. For whom, they sold stocks,.Form 1099B Proceeds from Broker and Barter Exchange Transactions

Form 1099B Proceeds from Brokered and Bartered Transactions Jackson

How To Read A 1099b Form Armando Friend's Template

How To Read A 1099b Form Armando Friend's Template

Formulaire 1099B Définition du produit d'une bourse de courtage et

2020 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

1099 Products Page 2 Tax Form Depot

IRS Form 1099B.

1099 B Form Fill Out and Sign Printable PDF Template signNow

Irs First B Notice Fillable Form Printable Forms Free Online

Web Checked, The Payer Is Reporting On This Form 1099 To Satisfy Its Chapter 4 Account Reporting Requirement.

Notifies Individuals And Organizations That The Name And Tax Identification Number Submitted On Irs Form 1099 Do Not Match Irs Records.

Create An Account With Taxbandits.

Show Details This Website Is Not Affiliated With Irs.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png)