1096 Template For Preprinted Forms

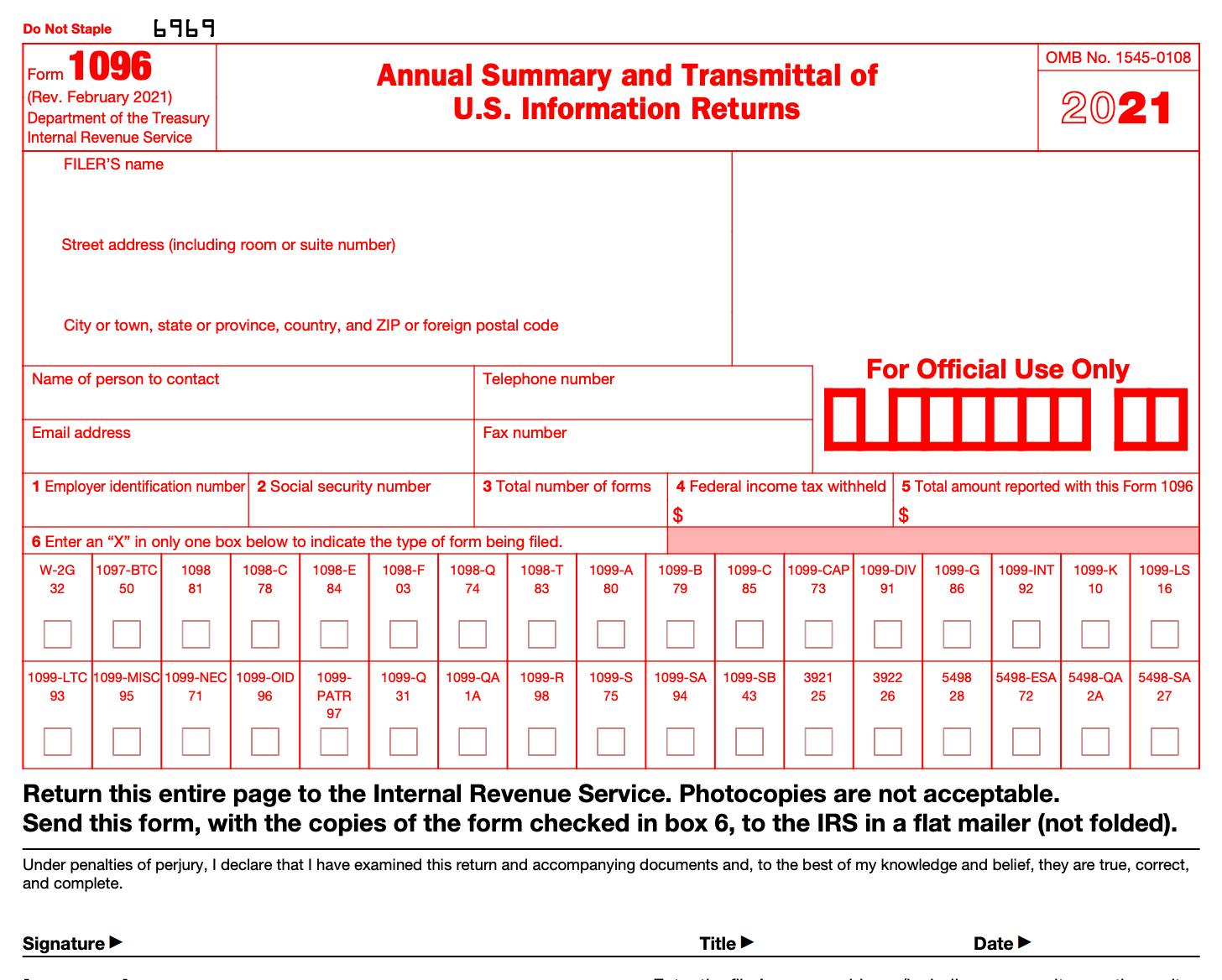

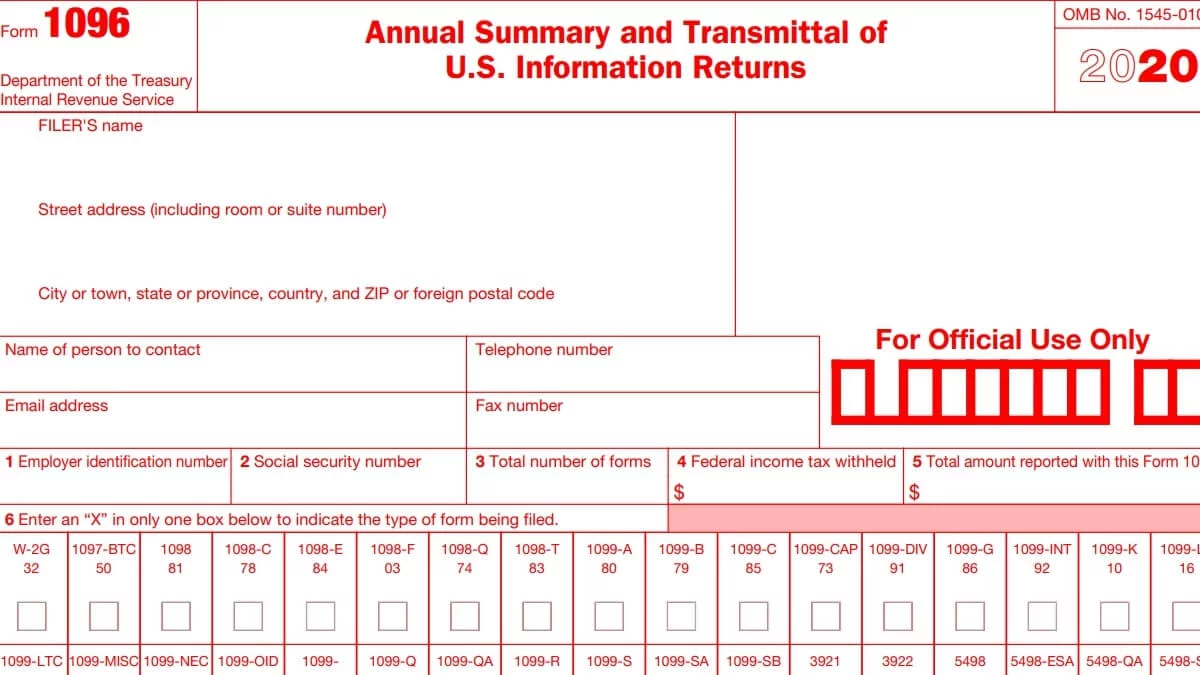

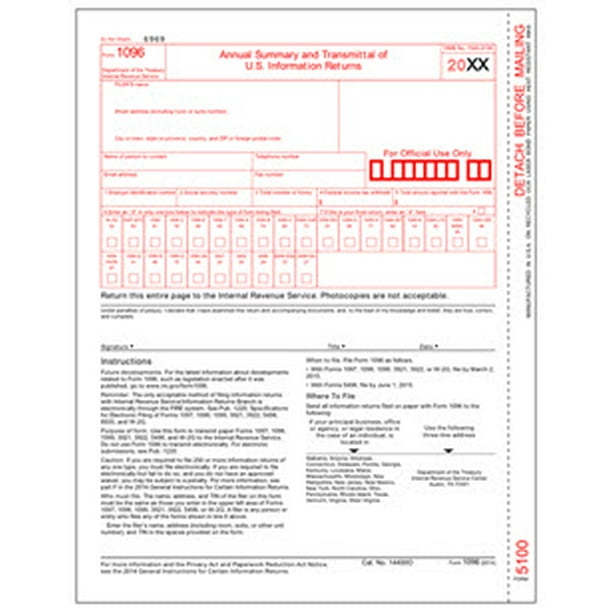

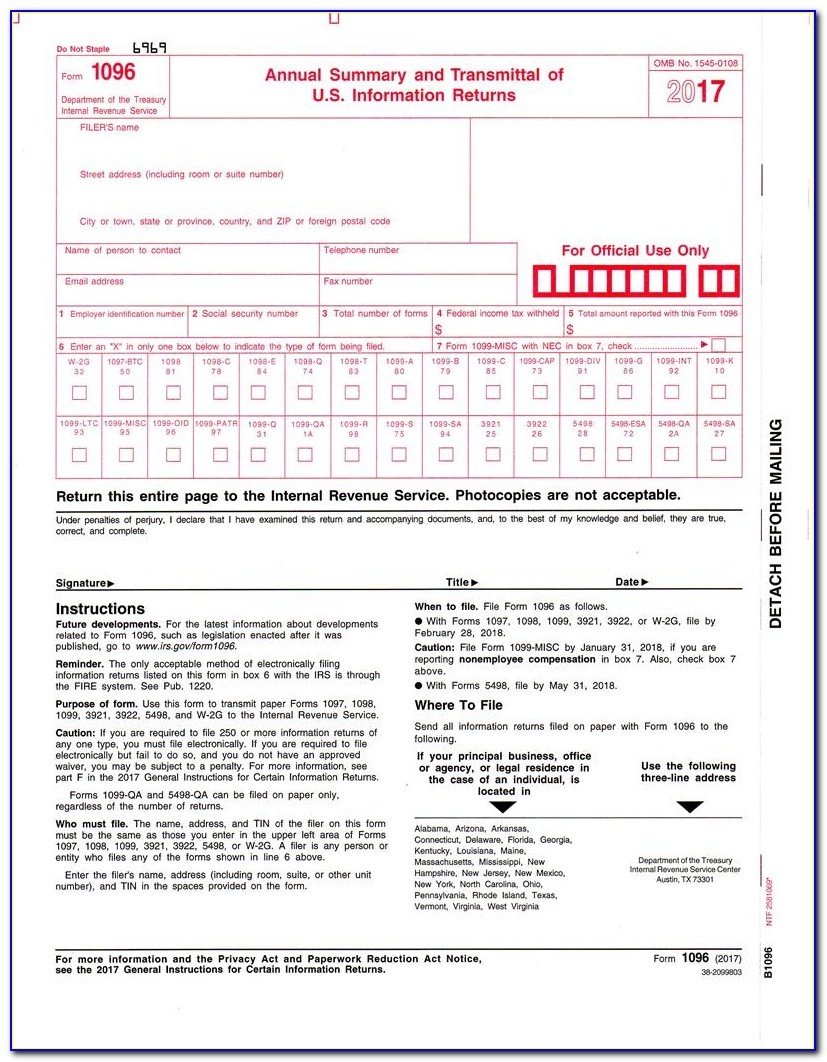

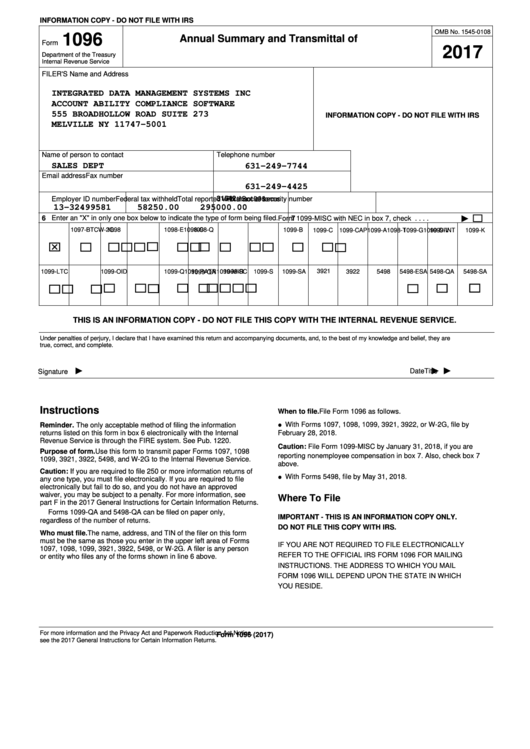

1096 Template For Preprinted Forms - Browse our selection of environmentally friendly forms & other custom printed products! Web form 1096, along with most types of 1099 forms, must be submitted to the irs no later than january 31 each year, for the previous calendar year, along with the applicable. Web any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Web 1099 and 1096. Click select type of 1099/1098 form to be filed 3. Click on employer and information. The official printed version of this irs. To calculate and print to irs 1099 forms with their unconventional spacing 1. There are essentially 2 options that you have when you are considering printing 1096 forms. Don't want to purchase a typewriter just to do a couple of tax forms. Web i am trying to find a template that will allow me to enter data for forms 1099 and 1096. You can print your form 1096 after going through the manual. Web any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Web word. Web i am trying to find a template that will allow me to enter data for forms 1099 and 1096. Ad download or email irs 1096 & more fillable forms, register and subscribe now! Important note on printing when. Ad download or email irs 1096 & more fillable forms, register and subscribe now! Select the type of 1099/1098 form. Enter the filer’s name, address (including room, suite,. Browse our selection of environmentally friendly forms & other custom printed products! This form is provided for informational purposes only. Web attention filers of form 1096: Web attention filers of form 1096: The official printed version of this irs. Download this 2022 excel template 2. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. The official printed version of this irs. This form is provided for informational purposes only. Click on the fillable fields and put the requested data. Web form 1096, along with most types of 1099 forms, must be submitted to the irs no later than january 31 each year, for the previous calendar year, along with the applicable. The official printed version of this irs. You can print your form 1096 after going through the manual.. This form is provided for informational purposes only. Click select type of 1099/1098 form to be filed 3. Web 1099 and 1096. Web form 1096, along with most types of 1099 forms, must be submitted to the irs no later than january 31 each year, for the previous calendar year, along with the applicable. The official printed version of this. Web open the template in our online editing tool. Web form 1096, along with most types of 1099 forms, must be submitted to the irs no later than january 31 each year, for the previous calendar year, along with the applicable. Web 1099 and 1096. Go through the recommendations to learn which information you must give. Download this 2022 excel. Web 1 2 next 33 comments jonpril moderator january 21, 2019 05:30 pm greetings, @natalie3! Web open the template in our online editing tool. The official printed version of this irs. Web any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Ad download. Click on the fillable fields and put the requested data. The official printed version of this irs. Web attention filers of form 1096: I have the preprinted forms but no typewriter to type the information in with. Web open the template in our online editing tool. You must file 1099s with the irs and in some cases. The official printed version of this irs. Click on the fillable fields and put the requested data. The first one is to opt for blank 1096 forms and. Web 1099 and 1096. Click on the fillable fields and put the requested data. Click select type of 1099/1098 form to be filed 3. Web any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Web the process of printing 1096 forms. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Web attention filers of form 1096: Web download over 7,000+ premium website templates, web templates, flash templates and more! Ad download or email irs 1096 & more fillable forms, register and subscribe now! The official printed version of this irs. This form is provided for informational purposes only. Web 1099 and 1096. Web form 1096, along with most types of 1099 forms, must be submitted to the irs no later than january 31 each year, for the previous calendar year, along with the applicable. Web 1 2 next 33 comments jonpril moderator january 21, 2019 05:30 pm greetings, @natalie3! Browse our selection of environmentally friendly forms & other custom printed products! I have the preprinted forms but no typewriter to type the information in with. Does anyone have a template they have. I am looking for either a word or excel template to complete irs form 1096. It appears in red, similar to the official irs form. Important note on printing when. Go through the recommendations to learn which information you must give. The first one is to opt for blank 1096 forms and. You must file 1099s with the irs and in some cases. To calculate and print to irs 1099 forms with their unconventional spacing 1. This form is provided for informational purposes only. I have the preprinted forms but no typewriter to type the information in with. Web download over 7,000+ premium website templates, web templates, flash templates and more! The official printed version of this irs. There are essentially 2 options that you have when you are considering printing 1096 forms. Web attention filers of form 1096: The official printed version of this irs. Don't want to purchase a typewriter just to do a couple of tax forms. Go through the recommendations to learn which information you must give. Web the process of printing 1096 forms. Web 1099 and 1096. I have the preprinted forms but no typewriter to type the information in with. It appears in red, similar to the official irs form.Free Printable 1096 Form Printable Templates

What is a 1096 Form? A Guide for US Employers Remote

Download Form 1096 Template retaillinoa

Printable Form 1096 1096 Tax Form Due Date Universal Network What

Printable Form 1096 Form 1096 (officially the annual summary and

Free Printable 1096 Form Printable Templates

Printable 1096 Form 2019 Fillable 1096 Form Fill Online & Download

1096 Form Editable Online Blank in PDF

Printable Form 1096 / 1096 Form 1096 Tax Form Printing in QuickBooks

Printable Form 1096 / 11 Printable form 1096 fillable Templates

Browse Our Selection Of Environmentally Friendly Forms & Other Custom Printed Products!

Web Open The Template In Our Online Editing Tool.

Select The Type Of 1099/1098 Form.

Ad Download Or Email Irs 1096 & More Fillable Forms, Register And Subscribe Now!

Related Post: